The Dow Jones (US30, YM) index is the Dow Jones Industrial Average or DJIA index. It reflects the average price of 30 companies’ stocks from various sectors listed on the NYSE (New York Stock Exchange). Dow Jones comprises the largest US corporations, such as Apple, Walt Disney, Walmart, Nike, McDonald’s, Microsoft, Coca-Cola, and others.

This article delves into the prospects of the Dow Jones Index, analyzes its price movements and factors influencing the index value, and presents experts’ forecasts. Furthermore, it addresses the question of how to navigate challenging market conditions when making investment decisions.

The article covers the following subjects:

Highlights and Main Points

- Dow Jones is one of the key indices of the American stock market, founded in the late 19th century by Wall Street Journal editors Charles Dow and Edward Jones. The Dow Jones index includes stocks of the 30 largest corporations in the United States from various industries. The value of the index is tied to the price of these shares. The more expensive a stock is, the greater its weight in the index.

- The Dow Jones Index reflects the overall economic situation in the United States based on 30 companies from various sectors of the economy. The index directly affects financial markets, since the general mood of market participants depends on the dynamics of the DJIA rate.

- When trading the index, traders use scalping and day trading strategies to make a profit on price movements within the trading session. They also use swing trading to make money over several days, weeks, or months.

- The choice of time frame depends on the trading strategy. When trading intraday, it is better to use 3-minute to hourly time frames. When trading for a longer period, it is better to use hourly to weekly time frames.

- Stop loss settings depend on the chosen trading strategy and time frames used. Place stop orders behind liquid support and resistance levels, depending on the type of trade.

Dow Jones index price today

Currently, the Dow Jones index includes 30 companies from various sectors of the US economy.

The value of the index is calculated by adding the share prices of these companies and dividing the resulting amount by a specially calculated coefficient. This coefficient is used to avoid errors when splitting securities in the index structure. The capitalization of companies is not taken into account.

Index rebalancing occurs in the following cases:

- When a company’s capitalization sharply increases or decreases.

- When global economic changes occur.

The index is calculated at the end of the trading session.

The Dow Jones index price reached its historic high of $41,300.7 in July 2024. After that, the quotes slipped into correction due to uncertain Fed’s rhetoric and consumer inflation acceleration to 3.2% in the US in February.

Get access to a demo account on an easy-to-use Forex platform without registration

Dow Jones Price Forecast for 2024

Due to its long history, the Dow Jones index is very popular among investors and traders. This makes YM a liquid and quite volatile instrument.

Will the price reverse from current levels or reach new highs this year? Let us consider the forecasts of the world’s leading experts and analysts.

Bank of America

Experts are optimistic about the YM price in 2024. According to Capex experts, companies have successfully adapted to the Fed’s tight monetary policy and high inflation. Analysts expect the price of the Dow Jones index to be between $39,000 and $40,000 this year and consider that the market passed a period of economic uncertainty and geopolitical upheaval.

JPMorgan

According to Capex, JPMorgan experts predict a decline in index quotes to $33,000.

This scenario is based on several fundamental factors:

- Stocks of companies from different sectors of the US economy have reached above their all-time highs.

- Consumer demand has decreased.

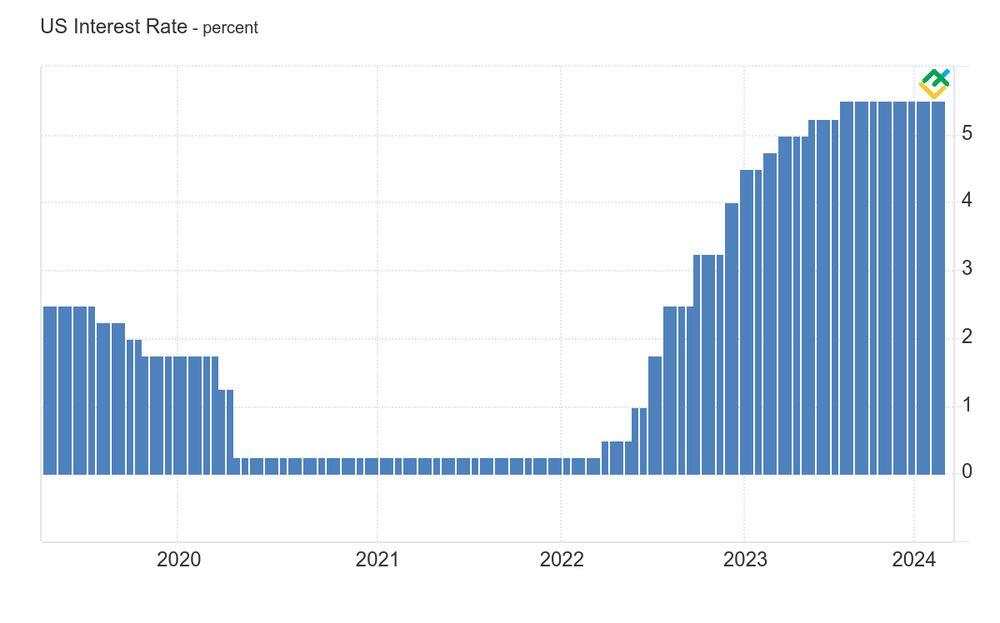

- The interest rate remains at a high level of 5.5% for a long time.

- Developed countries face the risk of recession.

- Geopolitical tensions are growing.

Deutsche Bank

The bank’s analysts give a positive forecast for the Dow Jones exchange rate in 2024.

In their opinion, index quotes will increase by 10% to $40,000 in 2024. If the US economy avoids recession, growth could reach up to 19%. This scenario is more likely due to cooling inflation and stable GDP growth.

Goldman Sachs

Goldman Sachs analysts’ forecast is neutral. In 2024, the Dow Jones rate is expected to trade between $37,000 and $38,000.

Bank experts predict that corporate income will remain at the same level, which will support stocks during a recession. In addition, earnings growth shortfalls and minimal equity risk premiums are the main constraints on the index’s growth.

Morgan Stanley

According to experts, the stock market may weaken in 2024, and index quotes may drop to $35,000. The leadership of large-cap tech companies is expected to last until early 2024. Analysts recommend that traders avoid expensive technology stocks and focus on procyclical securities and blue-chip stocks.

Societe Generale

French financial conglomerate Societe Generale forecasts that the Dow Jones Index will hit $37,500 in 2024, with a “buy the dips” recommendation. Experts anticipate a moderate recession in the middle of the year, a credit market sell-off in Q2, and a continuation of the Fed’s tight monetary policy. The US recession is expected to be short-lived and shallow.

Wells Fargo

Wells Fargo provides a neutral forecast, expecting the Dow Jones index to cost $36,000 in 2024. The Bank does not foresee high market volatility due to uncertainty about the key rate. Cracks in the economy are emerging and are likely to worsen as the Fed’s tight monetary policy remains in place.

CoinPriceForecast

Price range: $39 170 – $41 234 (as of July 25, 2024)

According to CoinPriceForecast, the Dow Jones price could reach $39,170 by mid-2024. By the end of the year, the quotes may rise to $41,234.

| Year | Mid-Year, $ | Year-End, $ |

|---|---|---|

| 2024 | 39 170 | 41 234 |

LongForecast

Price range: $36 422 – $44 041 (as of July 25, 2024)

According to LongForecast, the Dow Jones price is expected to show moderate volatility through the end of 2024, with a decline in November and a slight increase in December.

| Month | Open, $ | Min-Max, $ | Close, $ |

|---|---|---|---|

| August | 39 707 | 36 792-44 041 | 39 561 |

| September | 39 561 | 37 251-42 859 | 40 055 |

| October | 40 055 | 38 020-43 744 | 40 882 |

| November | 40 882 | 36 422-41 904 | 39 163 |

| December | 39 163 | 36 868-42 418 | 39 643 |

DJIA Technical analysis

Technical analysis of stocks included in the Dow Jones Industrial Average (DJIA) index helps identify trends and potential entry/exit points. It is better to use daily (D1), weekly (W1), and monthly (M1) time frames for analysis. Daily charts provide detailed information on short-term movements, while weekly and monthly time frames allow you to evaluate medium- and long-term trends.

Various technical tools should be used to conduct technical analysis. Moving averages help to identify trends and support/resistance levels. The RSI and MACD indicators are used to determine overbought and oversold conditions. Chart patterns such as “Head and shoulders” and “Double bottom” allow you to pinpoint potential trend reversals.

These technical tools help traders and investors make more informed decisions.

blog

Promo code

#YM Analysis For Next Three Months

Bullish scenario: the RSI at 59 indicates a neutral zone, signaling growth continuation. Moving averages (SMA and EMA) are close to each other at the current price level. It means that the price may consolidate and then break through the resistance. If the asset breaches the resistance of $41,000, the quotes may grow further.

Neutral scenario: if moving averages (SMA below EMA) and the RSI remain in the neutral zone, the index price will remain between $39 500 and $40 500. The price may consolidate or trade in a sideways trend in the coming months.

Bearish scenario: if the price starts to decline, you should pay attention to the key support of $38 000. Signals from moving averages, especially if the SMA continues to be below the EMA, may confirm the uptrend reversal.

Long-Term DJIA Technical Analysis for 2024

The weekly time frame for the Dow Jones Industrial Average (DJIA) shows several key signals. The SMA is below the EMA and the current asset price, which usually indicates a bullish trend. However, since the SMA is below the EMA, it could also signal a possible consolidation or correction soon.

The RSI is at 66, indicating a potential overbought condition. Thus, a short-term correction may unfold, or the price growth may slow down. The MACD is above 640. Both lines almost coincide, which may indicate the weakness of the current trend and a possible reversal.

Although the current technical data supports a bullish trend, high RSI values and the convergence of MACD lines indicate possible short-term price fluctuations and a correction. Monitor these indicators and be prepared for a potential trend reversal.

| Month | Dow Jones (#YM) Price Forecast | |

|---|---|---|

| Minimum, $ | Maximum, $ | |

| August | 38 157 | 42 030 |

| September | 39 627 | 42 593 |

| October | 40 446 | 42 534 |

| November | 38 745 | 42 577 |

| December | 39 220 | 43 124 |

Long-Term DJIA Trading Plan

Targets for 3 months:

- Current levels and trends assessment:

- Support: $38 000.

- Resistance: $40 000.

- Trading signals:

- If the index reaches above $41 000, the price may continue to grow. Bullish target – $42 000.

- If the index reaches below $39 000, a correction may start. Bearish target – $37 500.

- Indicators:

- RSI: values above 70 can indicate a possible overbought condition.

- MACD: crossing the signal line confirms the trend direction.

Targets for 12 months:

- Main targets:

- Optimistic outlook: if the index breaks through the current highs, the price may rise to $43 000.

- Negative scenario: if the US economy faces severe economic or geopolitical problems, the index rate may fall to $35 000.

- Indicators:

- The RSI values above 70 and below 30 can indicate an overbought or oversold asset condition.

- MACD: analyze signal lines to determine potential long-term changes.

Recommendations:

- Review your trading plan regularly and adjust your targets according to changing market conditions.

- Monitor macroeconomic indicators and geopolitical events that may affect the price.

Start trading with a trustworthy broker

Dow Jones Price Predictions for 2025

The Dow Jones forecast for a longer period involves certain risks due to the current geopolitical situation and global economic conditions. Therefore, the forecast may change.

Below, you can find expert forecasts for the Dow Jones index for 2025.

LongForecast

Price range: $37 411 – $57 346 (as of July 25, 2024)

According to LongForecast, the Dow Jones price will range between $37 411 and $57 346 in 2024. Experts expect an increase in August and September and a peak in October, followed by a decline in November. The price may slightly grow in December, ending the year at $49 842 – $57 346.

| Month | Open, $ | Min-Max, $ | Close, $ |

|---|---|---|---|

| January | 39 643 | 37 411-43 043 | 40 227 |

| February | 40 227 | 38 235-43 991 | 41 113 |

| March | 41 113 | 39 758-45 744 | 42 751 |

| April | 42 751 | 42 751-49 828 | 46 568 |

| May | 46 568 | 43 384-49 914 | 46 649 |

| June | 46 649 | 43 797-50 391 | 47 094 |

| July | 47 094 | 44 041-50 671 | 47 356 |

| August | 47 356 | 45 606-52 472 | 49 039 |

| September | 49 039 | 47 463-54 609 | 51 036 |

| October | 51 036 | 47 809-55 005 | 51 407 |

| November | 51 407 | 48 925-56 291 | 52 608 |

| December | 52 608 | 49 842-57 346 | 53 594 |

CoinPriceForecast

Price range: $41 693 – $42 826 (as of July 25, 2024)

CoinPriceForecast analysts expect the Dow Jones to reach $41 693 by mid-2025. By the end of the year, the price will rise to $42 826.

| Year | Mid-Year, $ | Year-End, $ |

|---|---|---|

| 2025 | 41 693 | 42 826 |

Predict-Price

Price range: $36 350 – $64 011 (as of July 25, 2024)

According to Predict-Price experts, DJIA will be trading in a neutral trend in 2025. However, the price may rise to $64 011. An alternative scenario implies a decline to the level of $36 350.

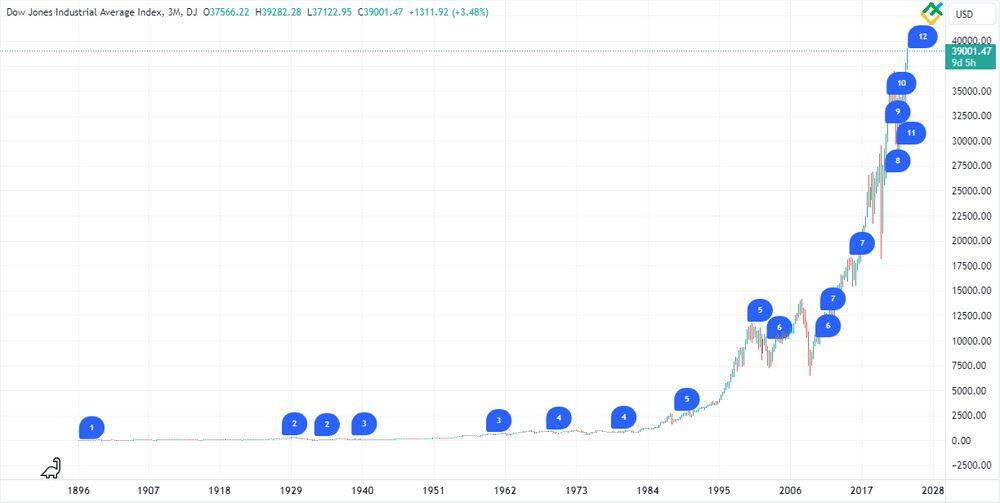

History of Dow Jones rate changes

To assess the DJIA rate’s moves and identify its patterns in the stock markets, let’s take a detailed look at the history of the price changes since the creation of the index.

- DJIA creation, 1896. The index was first published on 26 May 1896 and comprised 12 industrial companies.

- Great Depression, 1929–1933. The index fell by over 80% during the Great Depression, reaching a low in 1932.

- Post-war recovery, 1940–1960. After World War II, the index grew rapidly, reflecting the US economic recovery.

- Crises and corrections, 1970–1980. Significant crises occurred in 1973–1974 and 1987, leading to the DJIA’s decline.

- Internet boom, 1990–2000. In the late 1990s, the index grew along with high-tech companies.

- Profitability and recessions, 2000–2010. The Internet bubble burst in the early 2000s, and the 2008 financial crisis followed, pushing the Dow Jones down.

- Recovery period, 2010–2015. The exchange rate began to recover gradually after the crisis and reached some record levels by 2015.

- High-tech development, 2010–2020. Big tech stocks, such as Apple, Microsoft, and DJIA, became key growth drivers in the late 2010s.

- COVID-19 pandemic, 2020. At the beginning of 2020, the global financial market faced the COVID-19 pandemic. The DJIA declined in February–March 2020 but then began to recover quickly after the introduction of stimulus measures by federal agencies and the central bank.

- Record levels, 2020–2021. As of September 2021, the Dow Jones Industrial Average reached record levels, exceeding 35,000 pips. In 2021, investors expressed concerns over inflation and prospective Fed interest rate hikes, causing market fluctuations.

- Financial crisis, 2022. The DJIA showed a decline of 14.9% compared to 2021, closing at 30,273.96 pips amid the Fed’s attempts to handle inflation. That was the DJI’s worst year since 2008 when it fell by 33.8%.

- New record highs, 2023–2024. The Dow Jones price significantly grew and reached a new historic high of $39,282.28. The decrease occurred amid a steady decline in global inflation, positive rhetoric from the US Federal Reserve, and growth in corporate profits and capitalizations of companies in the index structure.

- The index reached its highest point at $41376.3 on 2024-07-18.

The chart below shows the events mentioned above that affected market conditions.

Source: TradingView.

Long-Term Dow Jones Predictions 2026–2030

Experts’ Dow Jones index long-term forecasts are quite similar. Many analysts believe that the current uptrend may soon experience a correction, and the price will grow after that. However, Dave Gilreath, Co-Founder and Managing Director of Sheaff Brock Investment Advisors, is sure of further economic growth over the next few years. He argues that companies normally increase profits over time. This may affect the further growth of YM quotes above $42 000 by 2025.

According to Brian Evans, chief investment officer and owner of Madrona Funds, LLC and Bauer Evans CPA, industry index quotes may reach $60 000 by 2030, based on a mathematical forecasting model.

CoinPriceForecast

CoinPriceForecast predicts that the Dow Jones Index will grow rapidly through 2030. In 2026, it may rise from $45 513 to $49 232. In 2027, the rate could reach $54 639. In 2028, the price is expected to climb to $55 472. In 2029, the asset will grow to $60 275. By the end of 2030, a significant increase from $64 017 to $68 201 is projected.

| Year | Mid-year, $ | Year-end, $ |

|---|---|---|

| 2026 | 45 513 | 49 232 |

| 2027 | 50 699 | 54 639 |

| 2028 | 54 814 | 55 472 |

| 2029 | 55 716 | 60 275 |

| 2030 | 64 017 | 68 201 |

Predict-Price

According to Predict-Price, the Dow Jones will rise to $72 326 in 2026. However, the price may fall to $35 408. You should be cautious when buying.

LongForecast

LongForecast analysts expect the Dow Jones Index to show steady growth from 2026 to 2028. In January 2026, the price will open at $53 594 and close around $51 344. By December 2026, it is expected to decline to $47 367. In 2027, the index may rise to $56 325 in December and reach $57 142 by August 2028.

| Year | Open, $ | Min-Max, $ | Close, $ |

|---|---|---|---|

| 2026 | |||

| January | 53 594 | 47 750-54 938 | 51 344 |

| December | 49 446 | 44 051-50 683 | 47 367 |

| 2027 | |||

| January | 47 367 | 44 592-51 304 | 47 948 |

| December | 55 039 | 52 382-60 268 | 56 325 |

| 2028 | |||

| January | 56 325 | 53 364-61 398 | 57 381 |

| August | 59 203 | 53 142-61 142 | 57 142 |

Note: The Dow Jones long-term forecast is based on assumptions and cannot be considered completely reliable.

Long-Term DJIA Predictions 2030–2040

The DJIA index consists of 30 large, publicly traded companies in the United States, representing various sectors of the economy. Their total capitalization exceeds $14 trillion.

Below are the top three companies by largest capitalization:

- Microsoft Corporation (MSFT) — $3.248 trillion.

The corporation’s capitalization grew as investors began to buy the company’s shares amid the development of AI technologies. Thus, the company invested about $13 billion in OpenAI’s ChatGPT. In addition, the companies signed a long-term contract allowing Microsoft to use AI in its products.

- Apple Inc. (AAPL) — $2.704 trillion.

The growth in Apple’s capitalization is due to the recovery in demand for the technology giant’s products against the backdrop of a favorable economic environment in this sector. The main sales segments are iPhone, Services, Mac, iPad, Wearables, Home & Accessories. The company also works closely with companies such as OpenAI, which helps to implement new technologies in their products.

- Amazon Inc. (AMZN) — $1.815 trillion.

The main reason for Amazon’s capitalization growth is the increase in revenue and operating profit to $7.7 billion. In addition, the corporation is actively optimizing its costs, making the rise in the cost of goods sold insignificant.

Long-term DJIA price prediction 2030

Although assessments differ, most analysts forecast a continuation of the bullish trend within the boundaries of the ascending channel until 2030. In 2024, the Dow Jones index corrections are possible due to uncertainty in the Fed’s policy, geopolitical tensions, and the upcoming US elections.

Unpredictable surges in geopolitical tensions and severe economic shocks could lead to a decline in the value of the Dow Jones index. However, technological breakthroughs, further growth in corporate profits, as well as global economic development will contribute to the DJIA rate growth.

When making long-term forecasts, it is important to consider the global economic situation, political news, inflation, interest rates, and the Fed’s rhetoric. The index is expected to trade in the $60 000 – $70 000 range in 2030, with a projected year-end close of $69 000.

Long-term DJIA price prediction 2040

In current geopolitical and economic realities, predicting the YM rate 16 years in advance is difficult. However, let’s look at the three most likely scenarios:

- An optimistic scenario suggests that with stable economic and technological development, the price of the Dow Jones index may continue to grow at a steady pace of 10–20% per year.

- According to the neutral scenario, the index will grow moderately under favorable economic conditions and a stable rise in corporate profits.

- The negative scenario implies increased geopolitical tensions, disruption of supply chains, rising inflation, and falling global demand.

Experts predict that by 2040, the lowest price may reach $75,000 and the highest one – $200,000, closing at $125,000. It should be emphasized that long-term forecasts may differ significantly from the actual data due to various factors.

About the Dow Jones Stock Index

The Dow Jones index (Dow Jones) is an American stock index with a leading market position. It was created in 1896 by Charles Dow and Edward Jones, the founders of the famous financial media agency Dow Jones & Company and the first publishers of the Wall Street Journal.

Originally, the Dow Jones index consisted only of industrial companies, but this is no longer true. Of the original 12 companies, only General Electric still exists, but it was also removed in 2018. Procter & Gamble, included in the Dow since 1932, is the oldest company on the Dow Jones index.

The index’s initial cost was $40.94, the average of the prices of 12 shares at the time. In 1916, the index was expanded to 20 stocks. Since 1928, the Dow has included 30 publicly listed companies, which is why it is also called “Dow 30.”

You can buy the Dow Jones from S&P Dow Jones Indices LLC, just like other popular indexes, including the S&P 500. The Dow Jones Index’s product code is #YM on the CME stock exchange.

It’s worth noting that the Dow Jones is a price-weighted index, in contrast to, for example, the AEX. That means that an expensive stock can greatly impact the index’s overall movement. In other words, not every company is equally important and counts equally for the stand of the fair, which provides a good picture of the financial situation in America.

The calculation of the final price of the index is quite complicated, given stock splits and dividends. The average is divided by the Dow Divisor, which maintains the index’s accuracy. The Dow Divisor is regularly updated, affecting the Dow Jones forecast.

Factors That Can Impact the Dow Jones Stock Price

A stock index is a difficult instrument for forecasting as it comprises various stocks. The price of stocks is subject to specific factors inherent in specific economic sectors. However, we can single out a few factors that affect the index as a whole.

1. Current news

The price of the Dow Jones in the stock market is based on information from the companies included. That is why it is important to keep a close eye on all the major news and financial performance of the companies that weigh the most in this reference index.

2. US Economic Data

Economic data published by US officials also play an important role in the index’s price formation. These figures include the unemployment rate, trade balance, GDP growth rate, inflation data, retail sales, durable goods, industrial orders, business sentiment, and consumer confidence.

3. US Dollar Exchange Rate

The value of the US dollar against other currencies affects the export or import profitability of US-listed companies, so it also affects the Dow Jones index. If the US dollar goes down, the stock index’s cost can drop, too.

4. US Federal Reserve Communications

The US Federal Reserve’s rate decisions and press conferences also impact the value of the Dow Jones index stocks.

Today, the Dow Jones Industrial Average (#YM) is traded at $40 349.1.

What’s the future of the Dow Jones? Is investing in Dow Jones still a good option?

Over the past 25 years, the Dow Jones index has broken several price records.

Below are the historical highs for the Dow Jones Industrial Average price from 2000 to 2024:

- $11,750 in 2000;

- $14,198 in 2007;

- $18,351 in 2015;

- $26,951 in 2018;

- $29,568 in 2020;

- $36,952 in 2022;

- $37,649 in 2023

- $41,376 in July 2024.

The Dow Jones index’s value has increased by a record 234% over the past 25 years. On average, the DJIA grows 10% per year and up to 20% during a bullish trend.

The rising value of the industrial index makes it more volatile. The price during a trading session can fluctuate by hundreds and sometimes thousands of pips.

The Dow Jones Industrial Average remains an attractive and popular trading instrument. YM’s historical value contributes to investors’ and traders’ high confidence in the index.

Shares of international multinational corporations included in the Dow Jones attract the attention of many market participants.

If you are interested in index investing and want to learn more about it, open a free demo account with LiteFinance. A wide range of trading instruments and analysis tools will help you increase your profits.

Dow Jones Price Prediction FAQ

The current DJIA price as of 25.07.2024 is $40 349.1.

According to expert forecasts, the Dow Jones price may reach $41 978 – $44 978 in 2024. In 2025, it is expected to rise to $57 346. By the 2030s, the index is projected to range between $60 000 and $70 000.

The Dow Jones price target is projected to range from $33 000 to $44 978 in 2024, depending on market conditions and economic factors.

The Dow Jones Index is expected to soar to $42 826 – $57 346 in 2025.

In 2030, the Dow Jones Index price is expected to range between $60 000 and $70 000.

Companies with the highest stock prices have a greater proportionate weight in the structure of the Dow Jones Industrial Average. The index is calculated by adding up the stock prices of all 30 component companies and dividing the total by adivisor.

The Dow Jones Index can be a good investment due to the diversification and stability of large companies. However, potential risks such as economic volatility and geopolitical factors should be considered.

The Dow Jones reached a historic high in July 2024, which may subsequently trigger a downward correction. However, the growth of corporate indicators and partial recovery of consumer demand may support the index and boost its further growth. Current economic trends indicate potential stability and even strengthening of the DJIA in the future.

Since 2024, the Dow Jones index has gained more than 9%. Wall Street experts forecast that its return will be 11% this year. Positive economic indicators and corporate earnings are expected to support the growth.

The Dow Jones price is trading in an uptrend, so investing in the index looks reasonable. Moreover, the companies included in the Dow Jones are quite stable. The index’s diversified structure will allow traders to avoid high risk since it includes 30 companies from various sectors of the US economy.

Price chart of YM in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.