The Trump trade, American exceptionalism, and the Fed’s slow pace have restored the U.S. dollar’s dominance. If this continues, the U.S. currency may become the year’s top performer. Let’s discuss it and make a trading plan for the EURUSD.

The article covers the following subjects:

Highlights and key points

- The EURUSD wouldn’t have fallen so low if not for the Trump trade.

- The IMF raised its forecast for US GDP and lowered it for the eurozone GDP.

- The Fed may pause in November or December.

- The euro’s decline towards $1.071 and $1.06 is gaining momentum.

Weekly fundamental forecast for dollar

Although Donald Trump has repeatedly said he wants to weaken the dollar, his policies will likely do the opposite. EURUSD collapsed below 1.08 amid a resurgence of American exceptionalism, the Fed’s cautious stance, and bets on a stronger greenback as a Republican win becomes more likely. And there’s more to come.

Goldman Sachs believes the euro will collapse below parity to $0.97 if Donald Trump keeps his promises to raise import tariffs. The main currency pair was last seen at that level at the end of 2022. However, this is not a baseline scenario. The banking company still hopes that EURUSD will rally to 1.1 by the end of 2024 and to 1.15 in 12 months. Does it believe in Kamala Harris’ victory?

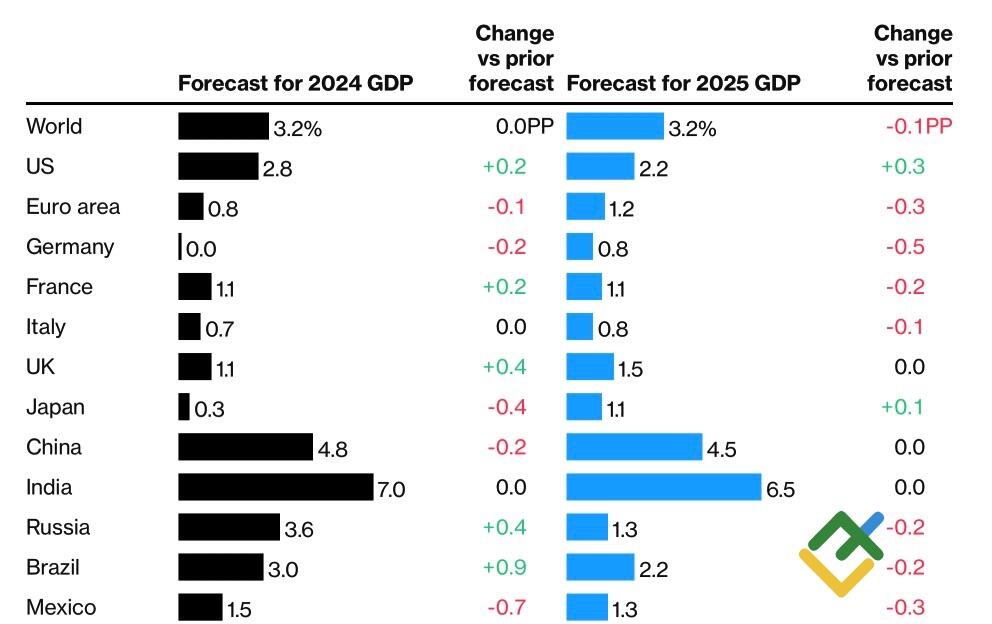

The IMF’s baseline scenario is US GDP growth of 2.8% in 2024 and 2.2% in 2025. Both forecasts were increased by 0.2 p.p. and 0.3 p.p., respectively. If Donald Trump’s protectionism starts to work, the final figures will decline to 1.8% and 1.2%. The International Monetary Fund believes that trade wars are a negative driver for both the global and American economies.

IMF forecasts

Source: Bloomberg.

Conversely, Eurozone GDP estimates were lowered to 0.8% this year and 1.2% for next year due to the weakness of the German economy and weak external demand for exports. The final result may be even worse, as France’s attempt to balance its budget threatens to slow down the gross domestic product. The French economy looks as weak as the government, but it helps somewhat balance Germany’s weakness.

Thus, the IMF highlights the divergence in economic growth between the U.S. and the eurozone, allowing us to talk about American exceptionalism and pushing EURUSD quotes lower.

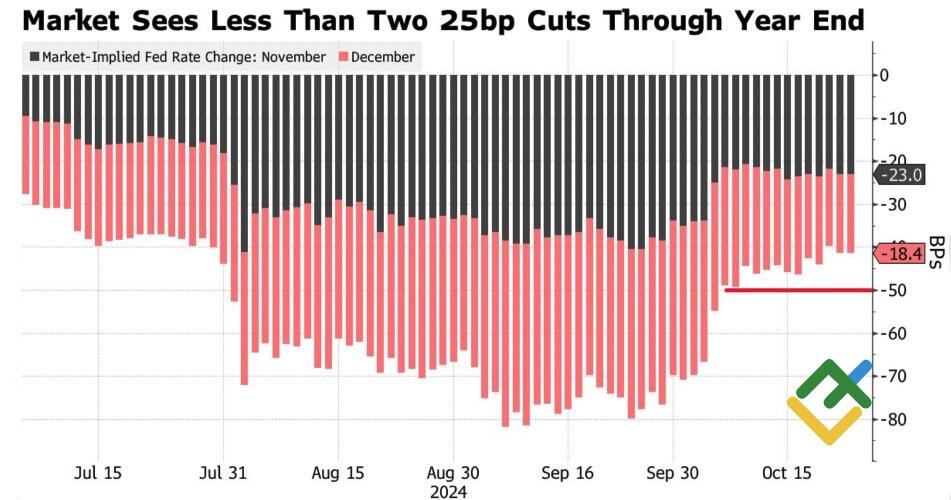

A strong economy is never associated with weak inflation. The risks of its revival in the U.S. have prodded investors into revising the future trajectory of the fed funds rate. At the end of September, the derivatives market expected a cut of 80 bp at November and December meetings. At one of these meetings, the Fed was supposed to make a big 50 bp cut.

Expectations for Fed rates

Source: Bloomberg.

However, forecasts changed at the end of October. Derivatives currently project a 41.4 bps decline in borrowing costs by year-end. There is a certain risk that the Fed will pause at one of its two meetings in 2024. Such expectations are no less supportive of the U.S. dollar than the Trump trade and American exceptionalism.

Weekly trading plan for EURUSD

EURUSD still has room for falling, so hold shorts opened above 1.12 and ramped up at 1.1045 and 1.0865, and build them up on pullbacks. Levels of 1.071 and 1.06 remain our price targets.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.