Markets may be deluded about the speed of the Fed’s monetary expansion. But what if the US economy starts to cool sharply? Will the Fed have to act aggressively, and how will this affect the EURUSD? Let’s discuss it and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Other central banks are easing monetary policy.

- The Fed is maintaining its current stance, which supports the strength of the US dollar.

- July labor market report is as a crucial indicator for the EURUSD currency pair.

- The pair faces the risk of declining towards 1.07 or rebounding above 1.083.

Fundamental forecast for dollar for today

The Federal Reserve will cut rates in September, which poses a downside risk for the US dollar. However, the United States is not the only player in the global economy, and the dollar is not the sole currency of interest. Other central banks are also easing their monetary policies, and they are doing so at a faster pace than the Fed. This dynamic allows the EURUSD pair to plummet sharply on any negative news while experiencing only modest gains on positive developments.

Following the Bank of Canada, the Bank of England lowered borrowing costs, which caused the “loonie” to depreciate, and then the pound followed. The slowdown in Australian inflation ruined market expectations of monetary tightening by the Reserve Bank of Australia (RBA) and sank the “Aussie.” The decline in long-term inflation expectations in Europe to an 18-month low indicates that the European Central Bank has managed to tame inflation, and it is likely to resume soon its monetary expansion cycle – a negative development for the euro.

Market expectations of inflation in Europe

Source: Bloomberg.

The US dollar is strengthening against its competitors not because the Federal Reserve is abandoning the idea of lowering the federal funds rate. The thing is, the American central bank is hesitating, making its currency the best choice. Unless we consider the yen. The divergence between Bank of Japan’s monetary policy and other regulators has turned the yen from an apparent outsider to a favorite in the Forex market.

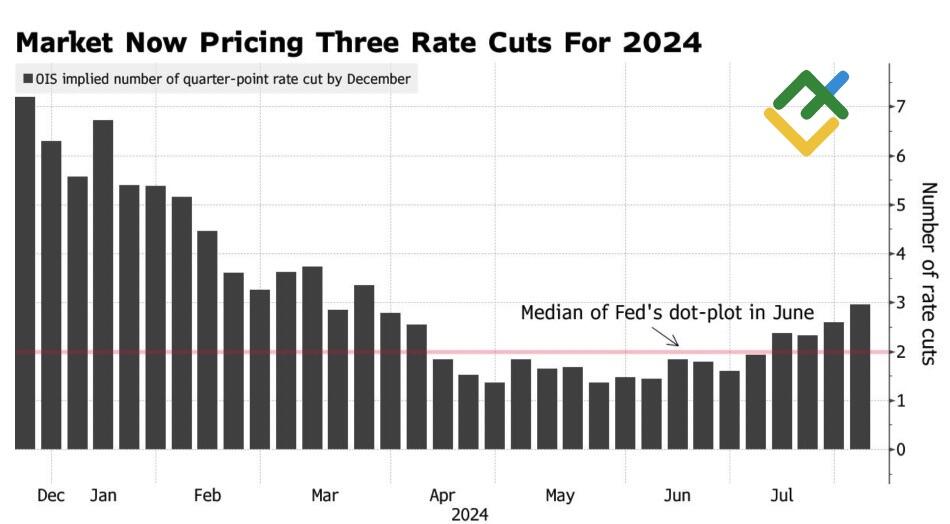

Markets are demanding that the Federal Reserve implement three acts of monetary expansion this year. CME derivatives indicate a 74% probability of such an outcome, while interest rate swaps estimate the scale of monetary policy easing in 2024 at 84 basis points. At first glance, these forecasts seem overly optimistic, and the EURUSD pair is falling because it is experiencing a sense of déjà vu.

Expected scale of the Fed’s policy expansion

Source: Bloomberg.

Similarly, at the end of 2023, investors were pressuring the Federal Reserve to lower interest rates at six FOMC meetings in 2024. However, as soon as those hopes faded, the USD index rose.

Now, let’s consider an alternative scenario. The economy begins to cool rapidly, and the Federal Reserve has only three meetings to ensure a soft landing – in September, November, and December. With no meetings scheduled in August and October, a swift slowdown in employment and inflation would require a 50-basis point cut in the federal funds rate. In this scenario, the Federal Reserve would be ahead of the curve, and the US dollar risks weakening. Unless, of course, recession expectations prompt investors to buy the greenback as a safe-haven asset.

Trading plan for EURUSD for today

July US labor market report may become decisive. Unemployment is expected to remain at 4.1%, wages – to slow to 3.7%, and employment – to fall from +206 thousand to +175 thousand. Such or stronger statistics will allow the Fed to take its time, and the EURUSD may continue its slide towards 1.07. Consider short positions in this context. Weaker stats will be a reason for the pair to rebound above 1.083. As noted earlier, this level serves as a sort of red line. As long as the euro trades below, bears prevail in the market.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.