Investors anticipated signals regarding a federal funds rate cut in September, but not to this extent. Even Jerome Powell’s references to the Fed’s apolitical stance can be interpreted as a clue. Let’s discuss it and make a trading plan for the EURUSD.

The article covers the following subjects:

Highlights and key points

- The Federal Reserve discussed a rate cut in July.

- It will most likely do that in September.

- Markets were nervous, but the central bank reassured them.

- Employment data in the US will be a reason for building up positions in the EURUSD.

Weekly fundamental forecast for dollar

The Federal Reserve stays out of politics, and that is further evidence that the federal funds rate will be cut in September. Jerome Powell has vigorously defended the central bank’s independence, asserting that its decisions are data-driven rather than influenced by the political agenda. According to Donald Trump, easing monetary policy before the elections is precisely what the Fed knows it should avoid. Economists from his former administration believe policy easing can wait until November. However, the Fed is not waiting, and this is good news for the EURUSD.

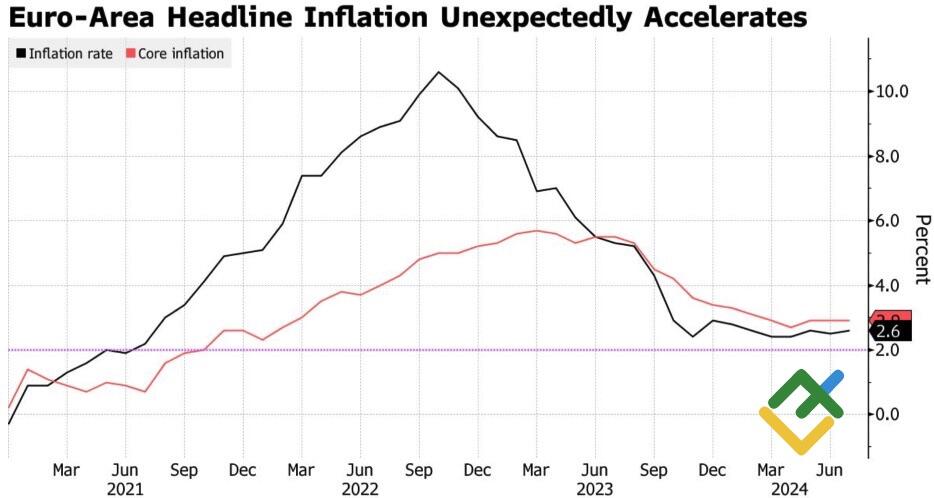

The last day of July proved to be very tense. First, the main currency pair was buoyed by an unexpected acceleration in European inflation, disappointing ADP employment statistics, and a decline in labor costs. The euro returned to the trading range of $1.083-1.09, but the bulls’ celebrations did not last long. What seemed like an insignificant report on the rise in pending home sales in the US drove up Treasury yields and pushed the EURUSD down to a critical support level of 1.079-1.08. Then, it was Jerome Powell’s time to act.

European inflation trends

Source: Bloomberg.

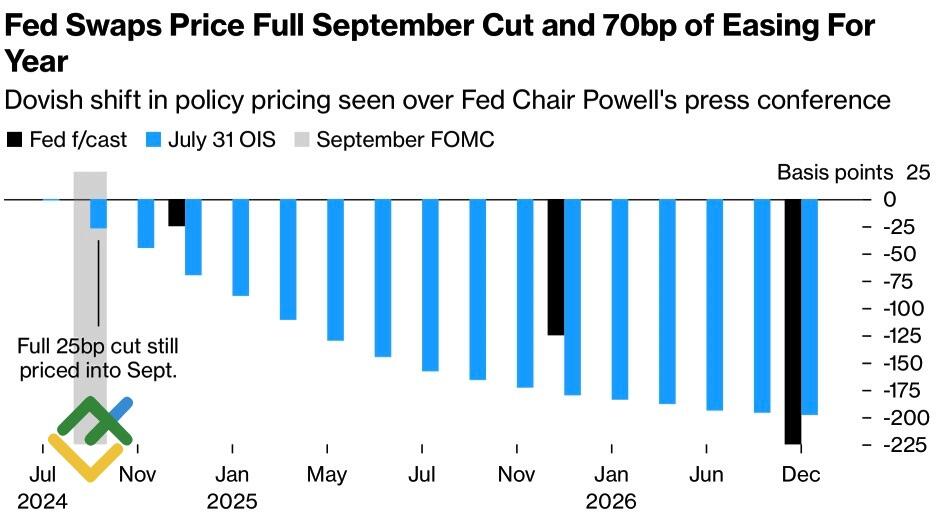

Investors were anticipating signals, but certainly not to this extent. The Federal Reserve Chair emphasized three times that a rate cut in September would be “on the table.” He indicated that there was a real discussion about this in July and that progress had been made regarding inflation. The FOMC’s accompanying statement included a reference to being attentive to risks on both sides of the Fed’s mandate. While data dependence remains a key principle, the numerous clues suggest that the start of a monetary expansion cycle in September is a settled matter, barring any unforeseen events, JP Morgan says.

The derivatives market is 100% confident in this, raising expectations for the scale of monetary easing in 2024 from 64% to 72%.

Market expectations of Fed rate

Source: Bloomberg.

So, why was the market so nervous? And how can we explain the rapid rally in US stock indices on news that was known from the start? The S&P 500 skyrocketed once the Fed’s provided a signal.

I attribute this to a lack of confidence. Unexpectedly strong GDP data, business activity, and the real estate market may have deterred the Federal Reserve from giving clues. On the other hand, there were calls for rate cuts as early as July, which would have been perceived by stock indices as the central bank’s fear of an impending recession.

Weekly trading plan for EURUSD

Anyway, the FOMC meeting results have reassured investors. The market is waiting for US employment data to understand future fed funds rate trends. Hold longs on the EURUSD opened at 1.079-1.08, and be prepared to build them up on good news.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.