By Chuck Mikolajczak

NEW YORK (Reuters) – The dollar climbed on Monday, buoyed by a rise in U.S. bond yields, as solid U.S. economic data suggested the Federal Reserve can afford to be patient in cutting rates while investors positioned for the Nov. 5 presidential election.

The greenback has risen for three straight weeks as a run of positive economic data led investors to scale back expectations about the size and speed of rate cuts from the Fed.

Markets are pricing in a 91.7% chance for a cut of 25 basis points (bps) at the Fed’s November meeting, with an 8.3% chance of the central bank holding rates steady, according to CME’s FedWatch Tool. The market was completely pricing in a cut of at least 25 bps a month ago, with a 50.4% chance of a 50 bps cut.

“It’s not so much about the Fed as the market correcting itself and once again converging with the Fed,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

“The economic data has been robust and we’ll see that next week when we get the GDP figure.”

The yield on benchmark U.S. 10-year notes rose 8.3 basis points to 4.158% after hitting a 3-month high of 4.172%.

Last week the Atlanta Fed raised its estimate for third quarter GDP growth to 3.4%.

Federal Reserve Bank of Dallas President Lorie Logan said on Monday she sees more gradual rate cuts ahead for the central bank and suggested she sees no reasons why the Fed can’t also press forward with shrinking its balance sheet.

The dollar index, which measures the greenback against a basket of currencies, rose 0.32% to 103.79, with the euro down 0.28% at $1.0835. Sterling weakened 0.41% to $1.2995.

The European Central Bank (ECB) last week cut rates for the third time this year. On Monday, Slovak central bank chief Peter Kazimir said euro zone inflation is increasingly likely to return to target next year but a bit more evidence is needed before the European Central Bank can declare victory.

Data on Monday showed German producer prices fell more than expected in September, declining 1.4% year-on-year, mainly due to a drop in energy costs.

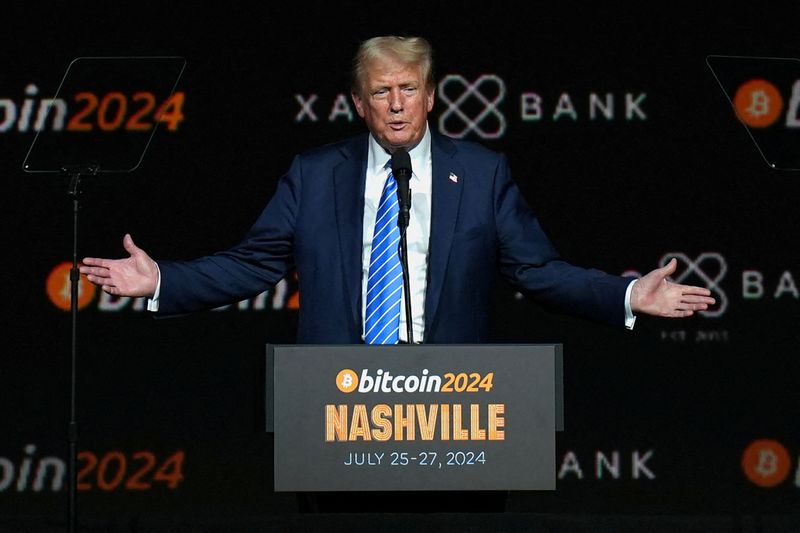

Investors were also positioning as the U.S. election on Nov. 5 grew closer. Chandler said a Trump victory is likely to bring about tariffs that would affect those that are closest and most exposed to the U.S. in trade partner terms, such as Canada, Mexico, China and Japan.

Against the Japanese yen, the dollar strengthened 0.51% to 150.27. Japan will hold a general election on Sunday, Oct. 27. While opinion polls vary on how many seats the ruling Liberal Democratic Party (LDP) will win, markets have been optimistic that the LDP along with junior coalition partner Komeito will prevail.

The Mexican peso < MXN=> was 0.43% weaker versus the dollar at 19.992. The Canadian dollar weakened 0.28% versus the greenback to 1.38 per dollar and the Chinese yuan weakened 0.18% to 7.131 per dollar.

In cryptocurrencies, bitcoin fell 2.47% to $67,048.00.

This post is originally published on INVESTING.