Disney stocks have been a favorite among investors for decades. After all, The Walt Disney Company is a steady member of major US indices, such as the S&P 500 (it’s not included in the Nasdaq 100 index, however).

The company’s financial statements for the first and second quarters of the fiscal year showed a positive shift, with its EPS of $1.21 exceeding analyst expectations. However, the company’s revenue of $22.08 billion came in below market consensus expectations.

At the same time, Disney is actively investing in its streaming service Disney+ to strengthen its competitiveness in the entertainment market, competing with platforms such as Netflix and HBO. These strategic moves aim to meet the growing demand for digital content and increase customer loyalty.

The article covers the following subjects:

Highlights and Key Points: Disney Stock Forecast 2024-2030

- Today, on 16.07.2024, Disney stocks are trading at $96.82 per share.

- Financial Performance: Disnaey showed a decline, not living up to Q1 profit expectations and higher turnover.

- 2024 Stock Price Prediction: Analysts rate Disney stock as a “Strong Buy,” with price targets suggesting modest to substantial growth.

- Technical Analysis indicates a stable bullish trend, with potential for price growth before any corrections.

- Future Forecasts: Predictions for 2024 show a price range between $97 and $101. Long-term forecasts up to 2030 suggest potential growth to $232.

- Influencing Factors: Key drivers include global media demand, gaming sector growth, competition, and piracy challenges.

- Investment Viability: Disney’s strategic focus and market position make it a potentially solid long-term investment, though market conditions should be monitored.

DIS Stock Price Today, Coming Days and Week

When forecasting Disney’s stock price, focus on company updates, entertainment sector trends, and broader market sentiment. Key areas include earnings reports, content release success, and theme park operations. Regulatory news, especially related to media and entertainment, is also crucial. Use technical analysis tools like Moving Averages and RSI for short-term trends.

Additionally, monitor global economic indicators and major events, as they can influence investor behavior and market dynamics, providing a well-rounded perspective on Disney’s stock in the upcoming days and weeks.

Disney Price Forecast 2024 – Expert Forecasts

The 2024 forecast for Disney’s stock (DIS) from StockAnalysis reflects a consensus “Strong Buy” rating based on analysis by 23 Wall Street experts. An average price target of $127.08 is posited, with a high estimate of $145.00, suggesting substantial growth potential. On the lower end, a target of $93.00 indicates caution amidst market uncertainties. The forecasted modest upside of 31.19% from the last recorded price points to cautiously optimistic market sentiment towards Walt Disney’s stock as a potential buy in the stock market arena.

LongForecast

Price range for 2024: $68.59 – $101.42 (as of July 16, 2024)

LongForecast projects Disney stock to start the second half of 2024 at $94.64, reaching highs of up to $101.42 and concluding the year around $92.44, which marks a decline. This forecast portrays a bearish stance on Disney’s stock, acknowledging the likelihood of fluctuating prices and the overall downtrend.

| Month | Opening, $ | Min.-Max.,$ | Closing, $ |

|---|---|---|---|

| August | 94.64 | 84.47-101.42 | 92.44 |

| September | 92.44 | 80.22-94.18 | 87.20 |

| October | 87.20 | 75.45-88.57 | 82.01 |

| November | 82.01 | 68.59-82.01 | 74.55 |

| December | 74.55 | 74.46-87.40 | 80.93 |

CoinPriceForecast

CoinPriceForecast expects Disney stock to reach $98.02 by mid-2024 and drop to $96.97 by year-end. This outlook highlights the market’s negative sentiment towards the company’s stock, indicating pessimism regarding its market performance and predicting a bearish price movement.

| Year | Mid-Year, $ | Year-end, $ |

|---|---|---|

| 2024 | 98.02 | 96.97 |

Disney Stock Technical Analysis

Technical analysis of Disney shares examines price trends and trading volumes on various time frames. It is recommended to use a variety of time frames for this instrument, ranging from short (one day) to long-term periods (weekly and monthly charts) to get a complete idea of the price movement.

The basic technical analysis tools helpful in analyzing Disney stock include:

- Indicators. For instance, moving averages (SMA, EMA) help determine the trend direction. The RSI (Relative Strength Index) shows if the stock is overbought or oversold. The MACD (Moving Average Convergence Divergence) helps identify changes in price momentum.

- Chart patterns, such as Heads and Shoulders, triangles, flags, and pennants, help determine possible reversal or trend continuation points.

Investors can also check trading volumes to confirm the current trend’s strength.

Technical analysis of Disney stock is instrumental in the rapidly changing media and entertainment market, where understanding technical patterns and indicators can help make informed investment decisions.

Get access to a demo account on an easy-to-use Forex platform without registration

#DIS Stock Forecast for Next Three Months

Disney (#DIS) stock has shown mixed performance over the past six months, reflecting complex trends in the media and entertainment market. Since February, DIS’s share price has held steady at around $107-$123, indicating investor support. In May, there was a slight decline to $105 in response to general market factors and corrective movements.

Technical analysis based on moving averages shows that DIS shares remain below the key level of the MA-200, which may signal support for a downtrend in the long term. However, in daily charts, Stochastic signals an oversold state, warning of a forthcoming correction to the upside.

In the coming months, it will be important to monitor trading volumes and market reactions to key events, such as financial reports and news about the company’s strategic initiatives. Positive factors include efforts to expand the Disney+ streaming service and recovering demand across various business segments, while negative drivers could be related to economic uncertainty or changes in consumer preferences.

Thus, the long-term outlook for Disney stock remains favorable, but careful monitoring of current trends and market environment analysis is required.

Long-Term Disney Shares Technical Analysis for 2024

Disney stock’s technical analysis unveils interesting trends amid current technical indicator readings. The RSI value of 43 indicates a relatively oversold nature of Disney’s shares, signaling a potential reversal or a temporary pause in the ongoing downward movement.

The MACD shows a crossover followed by a drastic price decline but remains in the positive zone, confirming bearish market sentiment towards Disney’s shares. This may mean that the current downtrend will continue in the near time.

Disney’s shares remain above key support levels, which could signal potential price stabilization or the start of a new upward move if the company’s fundamentals strengthen, for example, amid successful digital and content strategies.

Long-term investors may view the current situation as an opportunity to buy Disney shares in the long term, based on the company’s potential growth and solid position in the media and entertainment market.

However, to make informed investment decisions, you should be wary of corrections and closely monitor the dynamics of key technical indicators.

| Month | Walt Disney Co (#DIS) projected values | |

|---|---|---|

| Minimum, $ | Maximum, $ | |

| August 2024 | 86 | 104 |

| September 2024 | 81 | 95 |

| October 2024 | 76 | 89 |

| November 2024 | 69 | 83 |

| December 2024 | 75 | 88 |

Long-term trading plan for Walt Disney Co (#DIS)

A three-month and one-year long-term trading plan for Walt Disney Co (#DIS) stock includes several recommendations.

Three-month targets:

- Long positions can be opened at $79-89 if the price hits these levels after a correction or consolidation.

- Sell positions can be opened at market price with Take Profit at $89 and Stop Loss at $107.

One-year targets:

- Consider long-term buy positions on lower levels, for example, $67-71, in case of significant corrections or macroeconomic instability.

- Long-term selling is highly risky. Enter at market price with TP at $53 and SL at $110.

The plan is based on technical analysis and involves the strategy of buying on dips and selling on rises, taking into account potential support and resistance levels. It is important to regularly monitor market conditions and adjust the plan to changes in technical indicator readings and the company’s fundamentals.

Disney Stock Price Prediction 2025

In this section, we will provide you with insights on the Disney Stock Price Prediction for 2025, where industry analysts unravel expectations for Disney’s financial journey and market positioning.

LongForecast

Price range for 2025: $80.93 – $137.28 (as of July 16, 2024)

LongForecast projects positive momentum for Disney stock for the whole year 2025. The forecast suggests a significant rise in April, peaking at $124.16, with volatility expected in October with prices rising sharply, increasing to $122.54. The year will end on a high note, with December closing at 127.11.

| Month | Opening, $ | Min.-Max.,$ | Closing, $ |

|---|---|---|---|

| January | 80.93 | 80.93-100.52 | 93.07 |

| February | 93.07 | 92.05-108.05 | 100.05 |

| March | 100.05 | 92.62-108.72 | 100.67 |

| April | 100.67 | 100.67-124.16 | 114.96 |

| May | 114.96 | 105.79-124.19 | 114.99 |

| June | 114.99 | 105.98-124.42 | 115.20 |

| July | 115.20 | 108.18-127.00 | 117.59 |

| August | 117.59 | 108.26-127.08 | 117.67 |

| September | 117.67 | 109.10-128.08 | 118.59 |

| October | 118.59 | 112.74-132.34 | 122.54 |

| November | 122.54 | 115.08-135.10 | 125.09 |

| December | 125.09 | 116.94-137.28 | 127.11 |

CoinPriceForecast

Price range for 2025: $104.00 – $130.22 (as of July 16, 2024)

According to CoinPriceForecast, Disney’s share price will rise to $104.00 by mid-2025 and reach $130.22 by the end of the year. This positive outlook points to continued growth until the end of 2025, driven by hopes of Disney’s steady investor appeal in entertainment and its ability to adapt and thrive in a changing environment.

| Year | Mid-Year, $ | Year-end, $ |

|---|---|---|

| 2025 | 104.00 | 130.22 |

Long Term Disney Stock Forecast 2026-2030

Let’s dive into an expert analysis of the long-term Disney Stock Forecast for 2026-2030, with finance professionals offering deep insights into anticipated market trends and potential shifts in Disney’s stock performance.

CoinPriceForecast

Analysts at CoinPriceForecast predict a promising future for Disney stock from 2026 to 2030. With the starting price of $130.22, shares will rise to $136.52 in mid-2026 and reach an impressive $232.19 by the end of 2030. This strong growth trajectory is supported by key milestones such as an increase to $163.74 by the end of 2027, showcasing Disney’s strong position in the market. The company’s shares are expected to continue growing steadily, reaching $205.65 by the end of 2029.

| Year | Mid-Year, $ | Year-end, $ |

|---|---|---|

| 2026 | 136.52 | 155.94 |

| 2027 | 162.93 | 163.74 |

| 2028 | 173.18 | 180.51 |

| 2029 | 196.76 | 205.65 |

| 2030 | 217.16 | 232.19 |

LongForecast

LongForecast expects mixed yet promising trajectories for Disney’s stock in 2026-2030. In 2026, the company’s shares will start at $127.11, fall to $114.50 in February, and rally to $121.28 in June. A noticeable peak may be recorded in March when the price will hit $131.68. The forecast anticipates growth until mid-2027, with a gradual decline from the beginning of the second half of the year. By July 2028, the price will drop to $111.99. Despite volatility, significant highs and lows suggest a dynamic period ahead for Disney.

| Month | Opening, $ | Min.-Max.,$ | Closing, $ |

|---|---|---|---|

| 2026 | |||

| January | 127.11 | 105.34-127.11 | 114.50 |

| February | 114.50 | 114.50-142.21 | 131.68 |

| March | 131.68 | 106.76-131.68 | 116.04 |

| April | 116.04 | 99.30-116.56 | 107.93 |

| May | 107.93 | 107.93-130.98 | 121.28 |

| June | 121.28 | 94.84-121.28 | 103.09 |

| July | 103.09 | 100.47-117.95 | 109.21 |

| August | 109.21 | 109.21-130.31 | 120.66 |

| September | 120.66 | 108.88-127.82 | 118.35 |

| October | 118.35 | 102.71-120.57 | 111.64 |

| November | 111.64 | 96.60-113.40 | 105.00 |

| December | 105.00 | 87.81-105.00 | 95.45 |

| 2027 | |||

| January | 95.45 | 95.33-111.91 | 103.62 |

| February | 103.62 | 103.62-128.69 | 119.16 |

| March | 119.16 | 117.84-138.34 | 128.09 |

| April | 128.09 | 114.93-134.91 | 124.92 |

| May | 124.92 | 124.92-154.07 | 142.66 |

| June | 142.66 | 131.28-154.12 | 142.70 |

| July | 142.70 | 130.34-153.00 | 141.67 |

| August | 141.67 | 119.52-141.67 | 129.91 |

| September | 129.91 | 119.19-139.91 | 129.55 |

| October | 129.55 | 120.12-141.00 | 130.56 |

| November | 130.56 | 104.11-130.56 | 113.16 |

| December | 113.16 | 106.27-124.75 | 115.51 |

| 2028 | |||

| January | 115.51 | 107.98-126.76 | 117.37 |

| February | 117.37 | 97.27-117.37 | 105.73 |

| March | 105.73 | 105.73-131.32 | 121.59 |

| April | 121.59 | 98.58-121.59 | 107.15 |

| May | 107.15 | 91.69-107.63 | 99.66 |

| June | 99.66 | 99.66-120.95 | 111.99 |

| July | 111.99 | 87.57-111.99 | 95.19 |

| August | 95.19 | 92.77-108.91 | 100.84 |

A Recent History of the Disney (DIS) Stock Price

Tracing the recent history of Disney (DIS) stock price reveals a journey marked by significant milestones and strategic shifts. Here’s an overview of the key events:

- Founded in 1923, more than 100 years later Disney is valued at $122.18 billion.

- In 2018, Disney acquired 21st Century Fox for $71 billion, expanding its content and gaining a majority in Hulu.

- At the end of 2019, Disney’s share price reached just above $150.

- The company owns TV channels and a cruise line and launched the streaming service Disney+.

- Launched in 2019, Disney+ saw rapid growth from 28 million subscribers in February 2020 to 73.7 million by September 2020.

- March 2020: Price plummeted to $79 due to the pandemic, impacting amusement parks and film releases.

- Focused on streaming, Disney faced criticism for premiering “Mulan” on Disney+ in 2020.

- First half of 2021: Disney announced 32,000 layoffs due to financial strain.

- In November 2022, Bob Iger returned as Disney CEO, replacing the previous head of the company.

- In early 2023, Disney announced plans to cut about 7,000 jobs as part of a major restructuring to reduce costs by $5.5 billion.

- In 2023, Disney restructured its media divisions and resumed dividend payments after a long pause.

- Despite the challenges posed by the pandemic, Disney+ continues to grow. By the end of 2023, the platform attracted over 150 million subscribers, confirming the success of its strategic focus on streaming.

- Disney aims to expand its streaming platforms. It already hosts over 100 million customers across Disney+, Hulu, and ESPN+.

Factors that Can Affect the Disney Stock Price

Various factors influence the DIS stock price, essential for traders and investors to consider:

- Demand for Media: Global demand for television and video-on-demand is growing, with Disney positioning itself as a leader in online video content.

- Growth of Gaming: The gaming sector, particularly online games, is expanding, and Disney has invested significantly in this area.

- Piracy: Disney, like other media companies, faces challenges from piracy, impacting DVD sales and video-on-demand revenue.

- Competition: Despite its leadership, Disney competes in a highly competitive and aggressive entertainment industry.

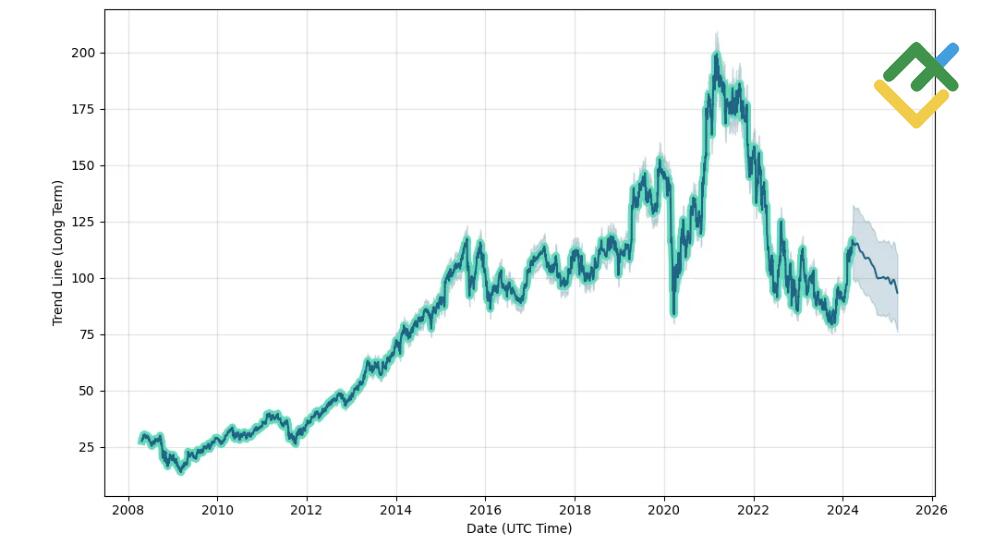

How Did the #DIS Share Price Change Over Time?

We can’t predict with certainty what the price of one DIS stock will be in the next 10 years, but we can look back at the price history. This can help us make more reliable predictions. Below is a historical timeline that shows how the price of the DIS stock changed over the past 10 years:

What is the Future Price of Disney Stocks? Are Disney Stocks a Good Investment?

Disney stock attracts investor attention due to its solid brand, robust intellectual property portfolio, and strategic investments in media and entertainment.

The return of Bob Iger as CEO in 2022 emphasized the company’s commitment to stability and innovation. Disney continues to advance its strategy, including the expansion of Disney+ service and modernization of its theme parks, creating the potential for long-term growth and a stronger position in the entertainment market.

However, investors should consider market volatility and the company’s challenges, such as legal disputes and the need for internal reforms. These factors may give rise to temporary fluctuations in stock price and require close monitoring.

FAQs on Disney Stock Price Prediction

Currently, Disney stocks are trading at 96.82 US Dollars, as of today, 16.07.2024.

Analysts foresee a steady rise in Disney stock in the long term. The price is expected to reach around $130.22 by the end of 2025. Market sentiment remains optimistic, given Disney’s strategic moves in the entertainment sector.

According to analyst forecasts, Disney’s share price is expected to drop to $80.93 in 2024. The forecasts indicate possible challenges and risks the company may face shortly, including internal strategic changes and external economic factors affecting the entertainment market.

Disney stock could rise significantly, doubling its current price if the ongoing growth continues. Experts predict that DIS’s share price could reach $232 by 2030. This outlook is based on the company’s strong fundamentals, including successful development strategies in the media industry, growth of the Disney+ service, and innovative approaches to parks and content development.

Disney shares can be an attractive long-term investment due to its strong brand, diversity of intellectual property, and strategic investments in digitalization and entertainment content. However, investors must consider market volatility and the company’s challenges.

The true value of Disney stock reflects the company’s robust market position, future growth potential, and the strength of its diversified entertainment portfolio. Current estimates do not suggest Disney stock is overvalued, emphasizing its long-term investor appeal.

Price chart of DIS in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.