The European stock market started on a strong note. Investors took advantage of cheap valuations, expectations of ECB rate cuts, rumors of an end to the war in Ukraine, and other factors to buy the DAX 40. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Europe has seen its best start compared to the U.S. since 2000.

- The decline of the U.S. dollar has supported Old World stock indices.

- Cheap valuations of European stocks have fueled the rally.

- The DAX 40 could reach 24,000 by early April.

Monthly Fundamental Forecast for DAX 40

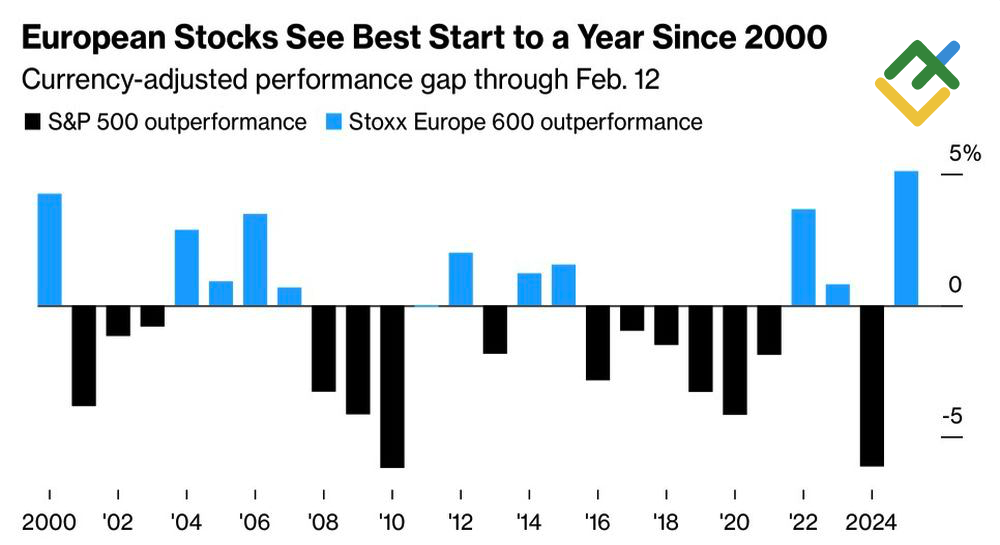

The European stock market rose from the ashes like a phoenix after its biggest defeat by the Americans since the pandemic, based on the results of 2024. Cheap valuations, Donald Trump’s hesitation in imposing tariffs, the ECB’s monetary expansion, and rumors of peace in Ukraine have allowed the EuroStoxx 600 to mark its best start compared to the S&P 500 since 2000. The main driver of the rally has been the German DAX 40, which has surged nearly 14% since the beginning of the year.

Dynamics of the EuroStoxx 600 to S&P 500 Ratio

Source: Bloomberg.

What doesn’t kill you makes you stronger. Europe’s lag behind the U.S. in 2024 was not only due to a weak economy but also fears that Donald Trump’s tariffs would further worsen the situation. The Republican had promised to impose universal duties of 10-20% on imports, and the largest U.S. trade deficit with the EU suggested that Brussels would be the first to bear the brunt.

In reality, the White House started with Canada, Mexico, and China and decided to replace universal tariffs with reciprocal ones. Moreover, they are not expected to be implemented before April 1. Europe still has time, and the front-loading of American imports has already begun. This is boosting the Eurozone PMI and is one of the drivers in the DAX 40 rally.

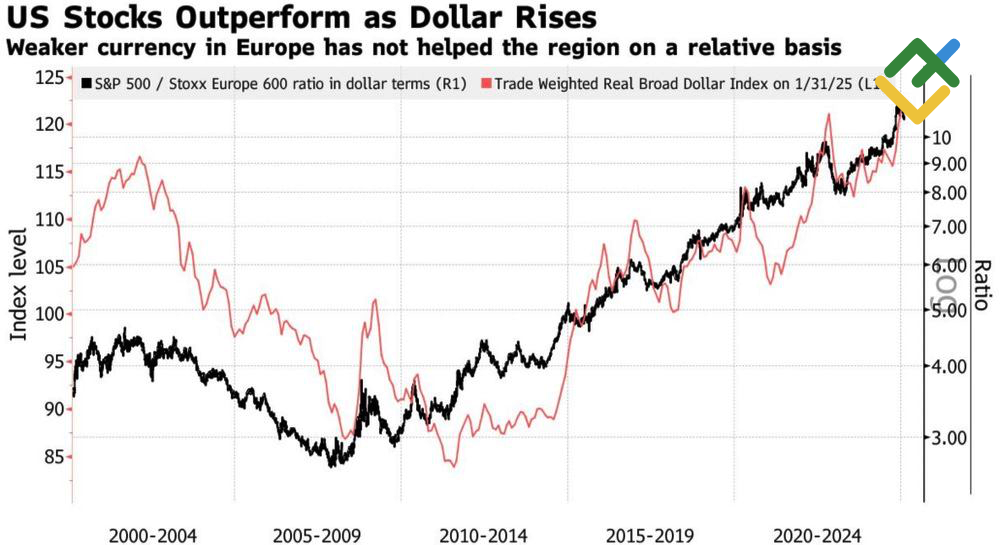

The retreat of Trump trade is putting pressure on the U.S. dollar, and when the USD index falls, U.S. stocks tend to lag European ones.

Dynamics of the Dollar and the Ratio of U.S. to European Stock Indices

Source: Bloomberg.

The DAX 40 rally is further fueled by expectations of easier fiscal policy following the conservatives’ victory in the German parliamentary elections on February 23, China’s massive stimulus measures favorable to German exports, market forecasts of 3-4 rounds of ECB monetary expansion, cheap stock valuations, and the DeepSeek story.

Dynamics of European and U.S. Stock Valuations

Source: Bloomberg.

After the emergence of the Chinese competitor, investors have reconsidered their views on the Magnificent Seven and started looking for alternatives, including those outside the U.S. Moreover, Brussels plans to invest €200 billion in artificial intelligence technologies.

Will the European stock rally continue? Skeptics believe that divergence in economic growth will prevent it. According to ECB forecasts, Eurozone GDP will expand by a modest 1.1% in 2025, while the Fed expects U.S. growth of 2.1%. Optimists, on the other hand, are confident that the FOMO (fear of missing out) strategy regarding the DAX 40 will remain relevant, especially as the end of the war in Ukraine is expected to have a favorable impact on Europe’s economy.

Monthly Trading Plan for DAX 40

The DAX 40 has not yet exhausted its potential. Before the introduction of reciprocal tariffs in early April, the index could rise toward 24,000. The recommendation is to buy on pullbacks.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of FDAX in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.