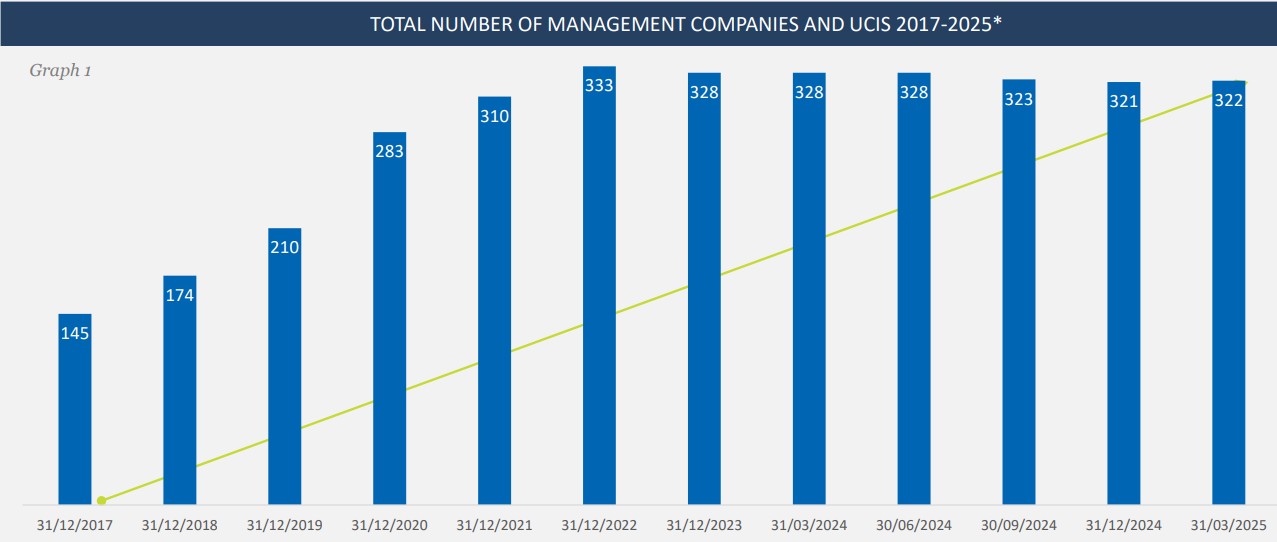

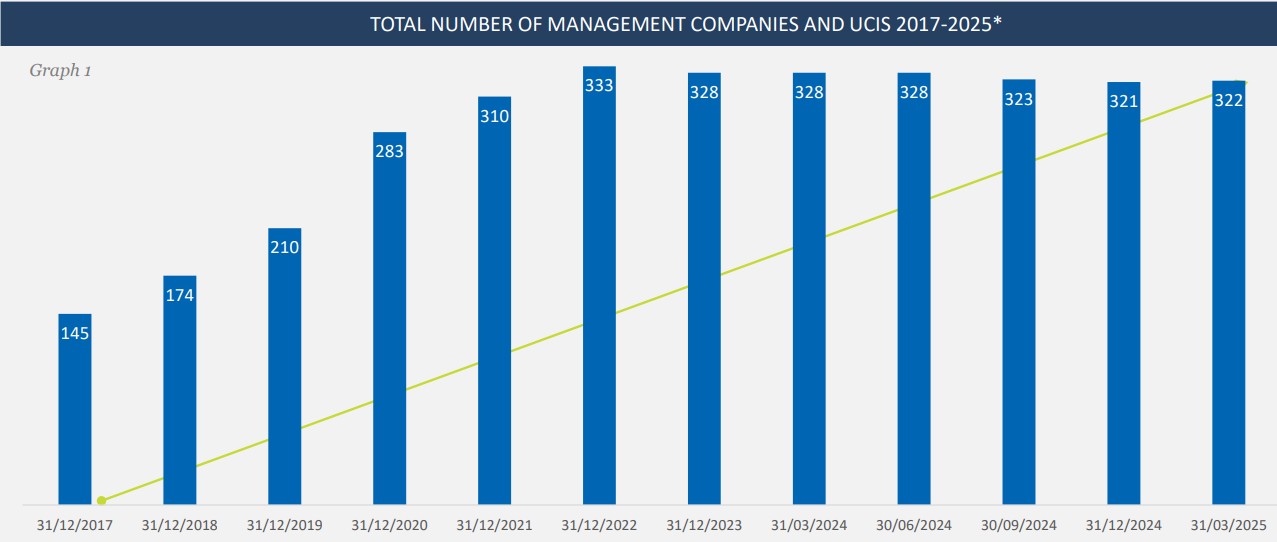

While the number of fund management entities in Cyprus

edged down in early 2025, total assets under management rose sharply, highlighting

a shift in capital concentration and investment preference across the country’s

financial sector.

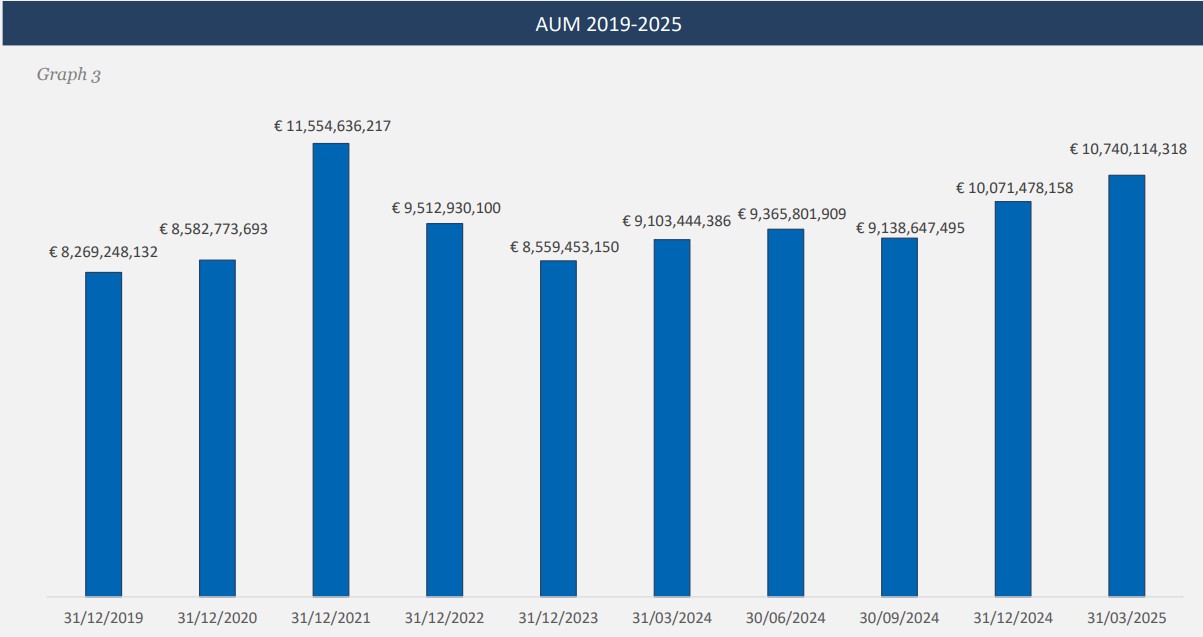

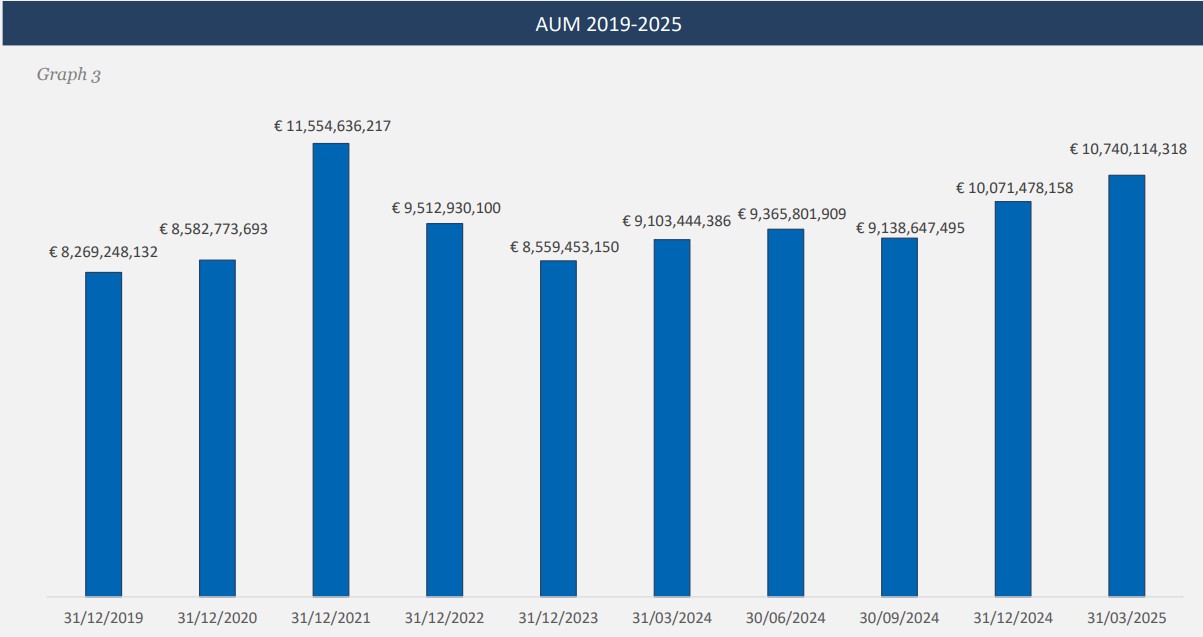

The Cyprus Securities and Exchange Commission (CySEC )

reported that the collective investments sector reached €10.7 billion in total

assets under management (AUM) during the first quarter of 2025, up 6.64% from

the previous quarter.

This growth occurred despite a 1.8% annual drop in the

number of supervised Management Companies and Undertakings of Collective

Investments (UCIs), now standing at 322.

Private Equity Investment

Allocations

CySEC‘s latest bulletin revealed changing allocation

patterns among Cyprus-based UCIs. Alternative Investment Fund Managers (AIFMs)

continue to dominate the market, managing 63% of all assets. UCITS Management

Companies account for 10%, while Sub-threshold AIFMs manage 9%. Only 1% of

assets are overseen by foreign fund managers.

Private equity emerged as the largest investment

category, representing 31% of total AUM among Alternative Investment Funds

(AIFs), Limited Number Persons AIFs (AIFLNPs), and Reserved AIFs (RAIFs).

Real estate made up 16.6%, while hedge funds and funds

of funds held shares of 12.5% and 12.3% respectively. A new breakdown offered

for the first time shows that within private equity, 36.2% was allocated to

growth capital and 34.2% to multi-strategy investments.

Local Investments and Investor Types

Out of the 224 UCIs with active operations, 198 are

domiciled in Cyprus, collectively holding 72.4% of total AUM. Notably, 162 of

these entities direct some or all of their investments locally.

You may also find interesting: Hong Kong’s Assets Under Management Grow by Double Digits on 81% Rise in Fund Inflows – SFC Survey

These domestic allocations total €2.9 billion, or just

over 27% of Cyprus’ overall fund assets. Private equity leads the way in local

deployment, representing more than 70% of these Cyprus-based investments.

Retail investors dominate the UCITS space, comprising

99.1% of its 8,831 investors. In contrast, the investor base for AIFs, AIFLNPs,

and RAIFs skews toward professionals and well-informed individuals. Only 12.1%

of these investors are classified as retail, with 63.4% deemed well-informed

and 24.5% professional.

UCITS Focus on Transferable Securities

Within the UCITS framework, a significant

majority—86.7%—of funds are invested in transferable securities. A further 9%

of assets go into other UCITS and collective investment schemes, while 3.3% is

kept in bank deposits.

The more diverse “Other” category of investment

includes 32.2% in equity capital and 16.8% in fixed income, alongside smaller

shares in cash, commodities, and infrastructure.

While the number of fund management entities in Cyprus

edged down in early 2025, total assets under management rose sharply, highlighting

a shift in capital concentration and investment preference across the country’s

financial sector.

The Cyprus Securities and Exchange Commission (CySEC )

reported that the collective investments sector reached €10.7 billion in total

assets under management (AUM) during the first quarter of 2025, up 6.64% from

the previous quarter.

This growth occurred despite a 1.8% annual drop in the

number of supervised Management Companies and Undertakings of Collective

Investments (UCIs), now standing at 322.

Private Equity Investment

Allocations

CySEC‘s latest bulletin revealed changing allocation

patterns among Cyprus-based UCIs. Alternative Investment Fund Managers (AIFMs)

continue to dominate the market, managing 63% of all assets. UCITS Management

Companies account for 10%, while Sub-threshold AIFMs manage 9%. Only 1% of

assets are overseen by foreign fund managers.

Private equity emerged as the largest investment

category, representing 31% of total AUM among Alternative Investment Funds

(AIFs), Limited Number Persons AIFs (AIFLNPs), and Reserved AIFs (RAIFs).

Real estate made up 16.6%, while hedge funds and funds

of funds held shares of 12.5% and 12.3% respectively. A new breakdown offered

for the first time shows that within private equity, 36.2% was allocated to

growth capital and 34.2% to multi-strategy investments.

Local Investments and Investor Types

Out of the 224 UCIs with active operations, 198 are

domiciled in Cyprus, collectively holding 72.4% of total AUM. Notably, 162 of

these entities direct some or all of their investments locally.

You may also find interesting: Hong Kong’s Assets Under Management Grow by Double Digits on 81% Rise in Fund Inflows – SFC Survey

These domestic allocations total €2.9 billion, or just

over 27% of Cyprus’ overall fund assets. Private equity leads the way in local

deployment, representing more than 70% of these Cyprus-based investments.

Retail investors dominate the UCITS space, comprising

99.1% of its 8,831 investors. In contrast, the investor base for AIFs, AIFLNPs,

and RAIFs skews toward professionals and well-informed individuals. Only 12.1%

of these investors are classified as retail, with 63.4% deemed well-informed

and 24.5% professional.

UCITS Focus on Transferable Securities

Within the UCITS framework, a significant

majority—86.7%—of funds are invested in transferable securities. A further 9%

of assets go into other UCITS and collective investment schemes, while 3.3% is

kept in bank deposits.

The more diverse “Other” category of investment

includes 32.2% in equity capital and 16.8% in fixed income, alongside smaller

shares in cash, commodities, and infrastructure.

This post is originally published on FINANCEMAGNATES.