Forex trendlines are powerful tools every trader should master. They simplify complex markets by identifying trends and potential price reversals. By learning how to draw trendlines in forex, you can anticipate market movements with precision. Using trendlines for forex trading provides clarity in dynamic markets, helping traders make informed decisions. In this article, we’ll explore actionable strategies to leverage forex trendlines and maximize your trading success.

What Are Forex Trendlines and Why Are They Essential?

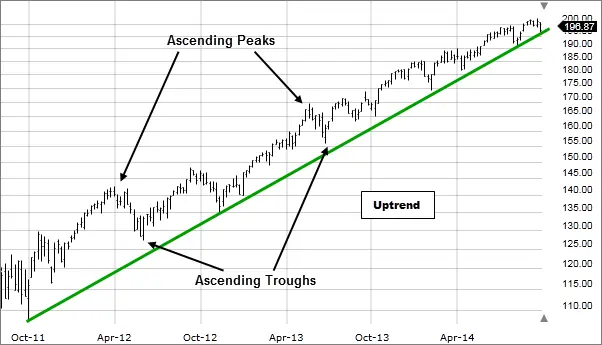

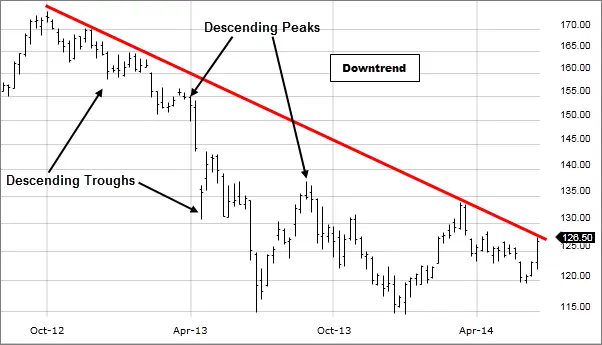

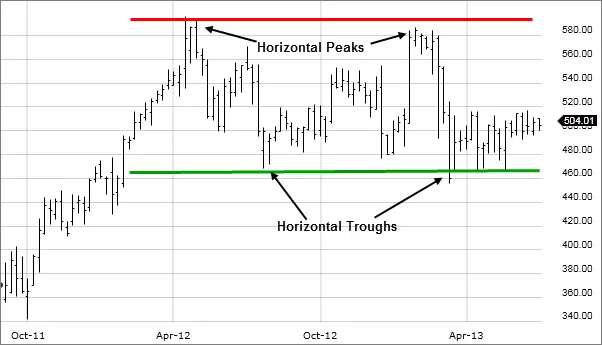

Forex trendlines are lines connecting significant highs and lows on a chart. These lines visually represent market trends, making it easier to identify opportunities. There are three types of trendlines you should understand:

- Uptrend: Connects higher lows in a bullish market.

- Downtrend: Connects lower highs in a bearish market.

- Horizontal: Indicates support or resistance levels.

Forex trendlines act as a visual guide to market direction. For example, in an uptrend, the price respects the line as support, signaling potential entry points. In a downtrend, the price tests the line as resistance, hinting at selling opportunities. Trendline analysis for forex markets simplifies decision-making, especially when combined with other tools.

Example:

Imagine EUR/USD forming higher lows. Connecting these lows creates an uptrend line. Each time the price bounces off the trendline, it signals a potential buy opportunity.

How to Draw Trendlines in Forex?

Drawing forex trendlines accurately requires practice and precision. Follow these steps to master the process:

Step 1: Identify Swing Highs and Lows

Start by spotting key highs and lows on the chart. These points form the foundation of your trendline. For example, in a bullish market, connect the higher lows.

Step 2: Connect at Least Two Points

Ensure the trendline touches at least two swing points. This validates its reliability. Extend the line to project future interactions.

Step 3: Focus on Key Market Structures

Avoid forcing trendlines. They should fit naturally with the price movement. Forcing lines leads to misleading signals.

Common Mistakes to Avoid:

- Ignoring candlestick wicks when drawing lines.

- Adjusting trendlines too frequently without justification.

- Relying solely on trendlines without additional analysis.

By mastering how to draw trendlines in forex, traders can make smarter decisions. Combining this with forex trading strategies with trendlines ensures accurate and actionable insights.

Using Forex Trendlines Effectively

Forex trendlines serve as dynamic support and resistance zones. Let’s explore their practical applications:

Trendline Rebounds

When the price bounces off a trendline, it creates trading opportunities. Traders can place buy or sell orders based on the rebound.

Example:

In an uptrend, the price respects the trendline. When it touches the line and forms a bullish candle, it signals a potential buy. Stop-loss can be placed just below the trendline.

Trendline Breakouts

Breakouts occur when the price breaches a trendline. This signals a potential reversal or continuation of the trend.

Example:

In a downtrend, the price breaks above the trendline and closes higher. This indicates a bullish reversal, offering a chance to go long.

Multiple Timeframe Analysis

Analyzing forex trendlines across different timeframes enhances accuracy. Use higher timeframes to identify major trends and lower timeframes for precise entries.

Example:

On a daily chart, an uptrend is visible. On a 4-hour chart, the price tests the trendline. Combining these perspectives confirms a strong buy signal.

Using trendlines for forex trading is more effective when combined with other tools. This ensures a holistic approach to market analysis.

Advanced Forex Trendline Strategies

Channel Trading

Channels involve drawing parallel trendlines to define a range. Traders buy at the lower trendline and sell at the upper one.

Example:

In a sideways market, GBP/USD forms a channel. Buying near the lower trendline and exiting near the upper one captures profits efficiently.

Dynamic Trendlines

Adjust trendlines as the market evolves. This keeps your analysis relevant and aligns with changing conditions.

Example:

If EUR/USD breaks above an initial trendline, adjust it to connect newer swing points. This reflects the updated market trend.

Trendline Confluence

Combine trendlines with other technical tools for stronger signals. Look for intersections with moving averages, Fibonacci levels, or RSI divergences.

Example:

USD/JPY’s trendline aligns with the 50-day moving average. This confluence strengthens the buy signal, providing a high-probability setup.

Trendline analysis for forex markets becomes highly effective when advanced strategies are employed. Practice these techniques to refine your skills.

Avoiding Common Pitfalls

While forex trendlines are simple to use, traders often make avoidable mistakes. Let’s address these pitfalls:

- Forcing Trendlines: Avoid drawing lines to fit pre-existing biases. Let the market guide your analysis.

- Ignoring Wicks: Candlestick wicks are important for accurate trendline placement. Skipping them leads to false signals.

- Over-reliance on Trendlines: Trendlines should be combined with indicators like RSI or MACD for confirmation.

- Frequent Adjustments: Adjusting trendlines too often creates confusion. Stick to clear and justified changes.

By steering clear of these mistakes, you can enhance the effectiveness of forex trendlines. They remain one of the simplest yet most powerful tools in technical analysis.

Practical Example: Trendline Analysis for USD/CAD

The chart above is taken from the discord server of Edge Forex, it provides a real-world example of forex trendlines applied to analyze USD/CAD. This image showcases key technical elements like trendlines, chart patterns, and the RSI indicator to provide actionable insights. Here’s a breakdown of the analysis:

- Trendline Resistance and Breakout:

- The price forms a clear upward-sloping trendline acting as resistance. The eventual breakout above the trendline signals bullish momentum. Traders can use such breakouts to identify potential entry points for long trades.

- Inverse Head and Shoulders Pattern:

- The chart highlights an inverse head and shoulders pattern, a strong bullish reversal signal. This aligns with the breakout above the trendline, increasing the probability of further upward movement.

- Horizontal Support Zone:

- A horizontal blue line marks a key support level. The price respects this zone, consolidating before the breakout. This confluence of horizontal support and the trendline makes the breakout more reliable.

- RSI Confirmation:

- The RSI indicator below the chart shows overbought conditions after the breakout. While this suggests caution, it also confirms the strength of the bullish move. Traders could wait for a pullback to the trendline for a safer entry.

- Strategic Entry and Exit Points:

- Entry: After the breakout above the trendline or confirmation of the inverse head and shoulders pattern.

- Exit: Near the next resistance level or when RSI signals overbought exhaustion.

Key Takeaway:

This chart showcases how forex trendlines combine with chart patterns and indicators to create a complete trading strategy. The breakout, supported by an inverse head and shoulders pattern and RSI confirmation, demonstrates a high-probability bullish setup. By integrating trendline analysis with such patterns, traders can make informed decisions in the USD/CAD market.

Conclusion

Forex trendlines are invaluable for understanding market dynamics. They simplify complex movements and provide actionable insights. By mastering how to draw trendlines in forex, traders can identify trends, reversals, and optimal entry points. Using trendlines for forex trading alongside indicators like RSI ensures a comprehensive strategy.

Recap the key takeaways:

- Trendlines simplify market analysis.

- Use rebounds, breakouts, and advanced strategies effectively.

- Avoid common pitfalls and combine trendlines with other tools.

Practice drawing forex trendlines on demo accounts to build confidence. Explore more tutorials and strategies to excel in trading. With consistent effort, you’ll make smarter decisions and achieve success in the forex markets.

FAQs

What’s the ideal timeframe for drawing forex trendlines?

It depends on your trading style. Higher timeframes reveal trends, while lower timeframes provide precise entries.

Can forex trendlines be used in scalping?

Yes, trendlines work well on shorter timeframes for quick trade setups.

What indicators complement forex trendlines?

RSI, MACD, and moving averages are excellent complements for trendline analysis.

Click here to read our latest article Gold and Forex: The Duo Every Trader Should Know About

This post is originally published on EDGE-FOREX.