Donald Trump’s threat to impose 50% tariffs on copper imports widened spreads on COMEX and LME futures to 25%. Copper continues to flow from Europe to the US. Let’s discuss this topic and make a trading plan for the XCUUSD.

The article covers the following subjects:

Major Takeaways

- The US intends to impose 50% tariffs on copper.

- The metal saw a record daily rally.

- The flow of copper from Europe to the US is widening the spread.

- Copper can be bought on a rebound from $9,350–$9,410 and $9,195 per metric ton.

Monthly Copper Fundamental Analysis

Copper has long been considered an indicator of the global economy’s health. The metal is a key component in the production of a wide range of goods, including cars, mobile phones, and computer chips. Its growth indicates an increase in demand, which is beneficial for global GDP. In this regard, the surge in COMEX futures to record highs contradicts the view that Donald Trump’s tariffs will slow economic growth. In fact, there are more factors to consider.

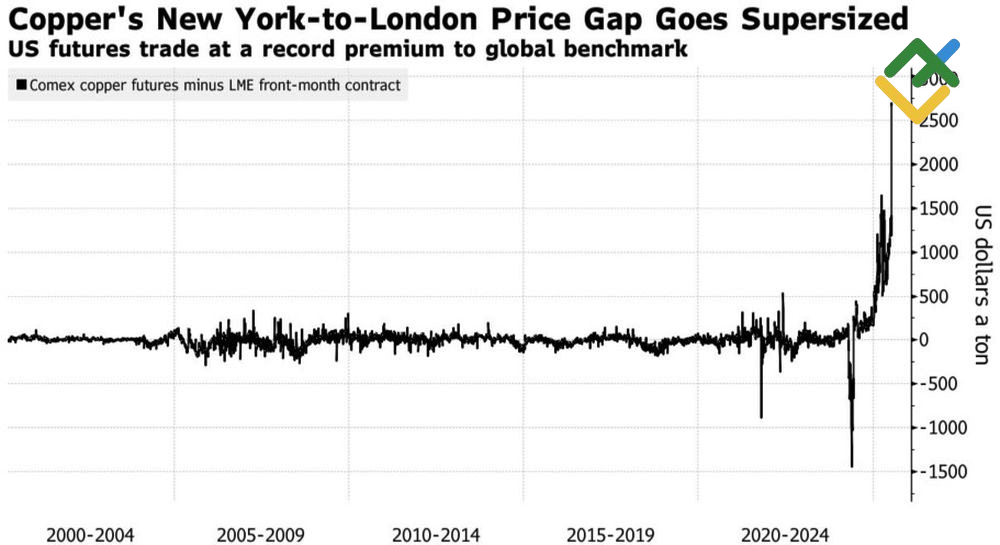

In February, the US administration initiated an investigation into copper supplies that were reported to potentially compromise US national security. As a result, Washington had the authority to impose tariffs, similar to those previously implemented on aluminum and steel. Copper stocks on COMEX began to rise rapidly, and the price spread with LME futures widened. Donald Trump’s recent proposal of 50% import duties has led to a significant increase in metal prices, reaching a record high of 13% in a single day. The price differential between New York and London widened to an impressive 25%.

Copper’s New York-to-London Price Gap

Source: Bloomberg.

The US administration is confident that US copper reserves can meet domestic demand. However, this will require increased production, which will take many years. In 2024, the US consumed 1.6 million tons of refined copper, while production reached 850,000 tons, meaning that almost half of the required volume had to be imported. The primary suppliers were Chile, Canada, and Mexico, accounting for 38%, 28%, and 7% of the total, respectively.

National security considerations are influenced by China’s increasing presence in the global market. According to Wood Mackenzie, between 2019 and 2024, China’s share of global investment in copper mines was approximately 50%. Notably, the total global investment amounted to $55 billion. From 2000 to 2024, the country was responsible for approximately 75% of the global increase in copper smelter capacity. Therefore, Washington’s concerns are both valid and understandable.

Commerce Secretary Howard Lutnick stressed that tariffs would be implemented on August 1 or at the end of July. As a result, copper stocks on COMEX are expected to expand further. The significant increase in metal stocks in the US is likely to result in a substantial rally in futures markets, which have already experienced growth of over 40% since the beginning of the year. At the same time, prices on the LME are likely to continue declining. The same holds true for XCUUSD quotes.

However, the implementation of these tariffs is not a foregone conclusion. The imposition of additional duties on copper imports will result in increased costs for US producers and will spur inflation in the US. Moreover, the discontent among companies and the general public could prompt Donald Trump to soften his stance. Such a scenario would likely result in a fall in COMEX futures and a rise in XCUUSD quotes.

Monthly XCUUSD Trading Plan

Therefore, the outlook for European copper appears bearish in the near term and bullish in the long term. At present, the XCUUSD can be sold. After that, long positions can be opened on a rebound from support levels of $9,350–$9,410 and $9,195.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XCUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.