Cardano (ADA) has kept investor interest alive for several years, thanks to its regular innovations that enhance the network’s operations. A significant milestone in the blockchain platform’s development in 2024 was the Chang upgrade, aimed at bolstering decentralization and refining its governance structure. Such changes positively impact market sentiment as they give the platform additional benefits and allow the community to be more involved in project management. However, overall market trends remain uncertain, making short-term forecasting challenging.

Like many cryptocurrencies, Cardano constantly faces challenges related to the regulatory environment and competition in the blockchain market. Moreover, the coin’s success depends not only on the quality of technological advancements but also on the overall state of the industry. Strengthening decentralized governance and active community engagement can play a key role in the future development of the network.

The article covers the following subjects:

Major Takeaways

|

Current price |

The current ADA price stands at $0.42670 as of 08.11.2024. |

|

Minimum and maximum prices |

The ADA price reached its high of $3.09 on 2021-09-02, and the historical low of $0.01925 was set on 2020-03-13. |

|

Forecast for 2024 |

|

|

Long-term predictions for 2025–2030 |

|

ADA Real-Time Market Status

The ADA price is trading at $0.42670 as of 08.11.2024.

When analyzing Cardano (ADA), it is crucial to consider key market indicators. Factors such as market sentiment, trading volume, and market capitalization significantly influence the price. Additionally, circulating and maximum supply are vital in making long-term assessments. This data helps traders make more informed trading decisions.

- The market sentiment reflects the general investor and trader mood regarding ADA. Sentiment indicators are useful for forecasting short-term fluctuations.

- Trading volume indicates the amount of ADA bought and sold over the past 24 hours. High volume may signal increased market activity and possible price changes.

- The price change over the last year helps to assess the long-term trends and volatility of the asset.

- Market capitalization is ADA’s current price multiplied by its circulating supply. High capitalization shows the cryptocurrency’s stability and credibility.

- Circulating supply refers to the number of ADA coins in circulation. This metric is crucial for determining the real value of the asset.

- Maximum supply is the total number of coins that can be issued. A limited maximum supply often affects long-term price growth due to scarcity.

|

Metric |

Value |

|

Market cap |

$12.35B |

|

Trading volume over the last 24 hours |

$302B |

|

Volume to market cap ratio |

0.024 |

|

All-time high |

$3.09 |

|

Price change over the last year |

-10.3% |

|

Circulating supply |

34.98B ADA |

|

Maximum supply |

45B ADA |

ADA Price Forecast for 2024–2025 Based on Technical Analysis

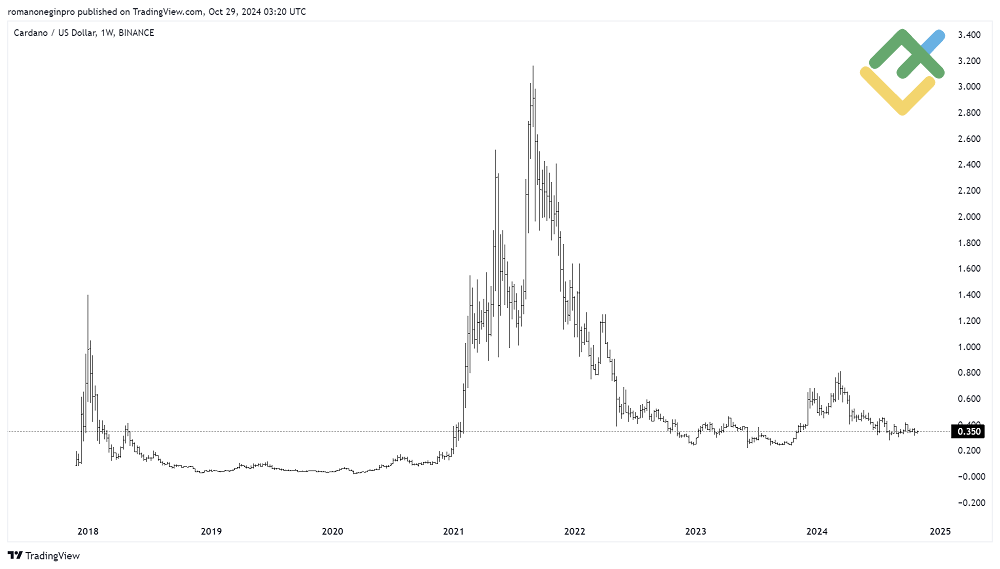

Let’s analyze the weekly time frame, showing the history of the ADAUSD quotes since 2017.

The chart displays a global complex corrective trend with two main parts already completed. Currently, the ADAUSD pair is forming the third part of the corrective pattern, likely the final one.

It is effective to utilize a daily time frame to conduct long-term Cardano technical analysis. The use of the following additional tools and indicators will also be helpful:

- The Elliott Wave theory can help identify emerging patterns and predict future price movements.

- Trend lines offer insight into the prevailing price direction.

- Fibonacci retracement levels can determine potential pivot points.

- Candlestick patterns are useful in assessing market behavior and psychology, as well as in identifying potential price targets.

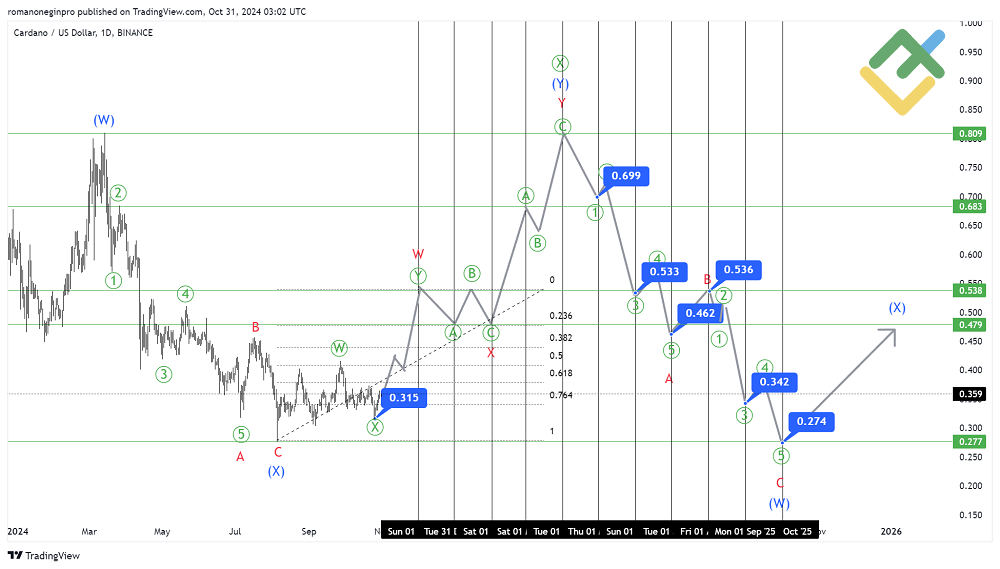

Let’s examine the markup of the most recent chart section on the daily time frame.

The ADAUSD pair is forming a global corrective trend, taking the shape of a double zigzag [W]-[X]-[Y]. The wave [W] is finished, although it is not visible on the current chart. The linking wave [X] is in progress.

The linking wave [X] will likely end as a double three (W)-(X)-(Y). The first motive sub-wave (W) completed at 0.80. Afterward, the price fell in a zigzag sub-wave (X), marking a new low of 0.27.

After hitting the 0.27 level, the price reversed, and the final motive sub-wave (Y) started to develop as a double zigzag W-X-Y. The first sub-wave W is expected to end near the high of 0.53. After that, a horizontal linking wave X may form, retracing 23.6% of the wave W, according to the Fibonacci indicator. Thus, the price will drop to 0.47.

From February to April 2025, the price may rise in the zigzag wave Y, which will highly likely equal the wave (W). Therefore, the asset may grow again to the high of 0.80, where the large wave [X] is expected to end.

The quotes may plunge in April as a new bearish trend is expected to start. According to the Elliott wave theory, the large motive wave [Y] may develop as a double zigzag (W)-(X)-(Y).

Thus, during the next six months, Cardano may depreciate within the motive wave (W), approximately to the low of 0.27, marked by the sub-wave (X) in August. The approximate scheme of possible future price movement is represented on the chart using trend lines.

|

Month |

ADAUSD projected values |

|

|

Minimum, $ |

Maximum, $ |

|

|

November 2024 |

0.35 |

0.53 |

|

December 2024 |

0.47 |

0.53 |

|

January 2025 |

0.47 |

0.53 |

|

February 2025 |

0.47 |

0.68 |

|

March 2025 |

0.65 |

0.80 |

|

April 2025 |

0.69 |

0.80 |

|

May 2025 |

0.53 |

0.69 |

|

June 2025 |

0.46 |

0.53 |

|

July 2025 |

0.46 |

0.53 |

|

August 2025 |

0.34 |

0.53 |

|

September 2025 |

0.27 |

0.34 |

|

October 2025 |

0.27 |

0.35 |

Long-Term Trading Plan for ADAUSD

The following trading plan can be developed based on the scenario created using the Elliott wave analysis.

Assuming that the price is trading at the beginning of a large motive wave (Y), which is expected to end near the high of 0.80, one may consider long trades at the current level with the profit target at the mentioned high.

The price growth will likely end in April 2025. Thus, consider short trades around that time. The asset may fall within the zigzag wave (W) with the target at the low of 0.27. Therefore, Cardano is not the best investment at the moment. However, one may use the asset to diversify the portfolio.

Making long-term forecasts can be challenging, especially in the current market conditions. Do not neglect to conduct technical and fundamental analyses before making any trading decision.

Analysts’ ADA Price Projections for 2024–2025

Let’s take a closer look at the leading analysts’ projections for Cardano (ADA) prices in 2024 and 2025. Experts consider both potential growth prospects and risks associated with the asset. Their assessments take into account key network upgrades, market trends, and the development of the Cardano ecosystem, which helps to shed light on anticipated price movements.

Changelly

Price range in 2024–2025: $0.323–$0.486 (as of 27.10.2024).

According to Changelly, the Cardano (ADA) price will range from $0.323 to $0.365 for the remainder of 2024. The average price may reach $0.351. Overall, the market is expected to remain relatively stable, with only moderate fluctuations anticipated near the end of the year.

Changelly forecasts more substantial growth for 2025. The lowest price will not fall below $0.323, while the highest price may climb to $0.486.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

November 2024 |

0.323 |

0.338 |

0.353 |

|

December 2024 |

0.336 |

0.351 |

0.365 |

|

January 2025 |

0.323 |

0.389 |

0.356 |

|

February 2025 |

0.323 |

0.412 |

0.368 |

|

March 2025 |

0.323 |

0.436 |

0.380 |

|

April 2025 |

0.323 |

0.459 |

0.391 |

|

May 2025 |

0.323 |

0.483 |

0.403 |

|

June 2025 |

0.323 |

0.507 |

0.415 |

|

July 2025 |

0.323 |

0.530 |

0.427 |

|

August 2025 |

0.323 |

0.554 |

0.439 |

|

September 2025 |

0.323 |

0.577 |

0.451 |

|

October 2025 |

0.323 |

0.601 |

0.462 |

|

November 2025 |

0.323 |

0.624 |

0.474 |

|

December 2025 |

0.323 |

0.648 |

0.486 |

CoinCodex

Price range in 2024–2025: $0.331–$1.847 (as of 27.10.2024).

According to CoinCodex, in November 2024, the Cardano (ADA) price will fluctuate between $0.331 and $0.417, with the average price reaching $0.367. In December, the lowest, average, and highest prices will likely rise to $0.440, $0.711, and $0.906, respectively.

In 2025, the ADA price is expected to range between $0.763 and $1.847. The most optimistic forecast points to July as a peak month, when ADA may reach its highest level due to positive market conditions and increased activity in the ecosystem.

The table below provides an overview of Cardano’s projected prices for November and December 2024, along with forecasts for each month of 2025.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

November 2024 |

0.331 |

0.367 |

0.417 |

|

December 2024 |

0.440 |

0.711 |

0.906 |

|

January 2025 |

0.763 |

0.832 |

0.923 |

|

February 2025 |

0.793 |

0.891 |

0.996 |

|

March 2025 |

0.923 |

1.112 |

1.447 |

|

April 2025 |

0.828 |

1.010 |

1.187 |

|

May 2025 |

0.787 |

0.894 |

0.976 |

|

June 2025 |

0.892 |

1.233 |

1.775 |

|

July 2025 |

1.358 |

1.611 |

1.847 |

|

August 2025 |

1.343 |

1.402 |

1.468 |

|

September 2025 |

1.199 |

1.300 |

1.430 |

|

October 2025 |

0.869 |

0.976 |

1.179 |

|

November 2025 |

0.819 |

0.925 |

1.028 |

|

December 2025 |

0.757 |

0.793 |

0.941 |

CoinPedia

Price range in 2024–2025: $0.27–$2.42 (as of 27.10.2024).

CoinPedia forecasts a price increase for Cardano (ADA) in 2024. The lowest price will trade at $0.27, and the highest price will hit $1.00. Meanwhile, the average price is expected to reach $0.63. Network upgrades, an increase in major transactions, and the DeFi ecosystem development will likely fuel the growth.

In 2025, the price is projected to range between $1.81 and $2.42, averaging at $2.11. The anticipated growth is driven by positive market trends and further network expansion.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2024 |

0.27 |

0.63 |

1.00 |

|

2025 |

1.81 |

2.11 |

2.42 |

Analysts are optimistic about Cardano’s future, citing ongoing technology development and a growing DeFi ecosystem, which suggests long-term stability for ADA. However, short-term predictions vary due to market volatility and macroeconomic factors.

Analysts’ ADA Price Projections for 2026

Let’s review experts’ forecasts for Cardano (ADA) in 2026. Analysts assess both growth opportunities and potential risks by examining the impact of network upgrades and market conditions. The predictions help outline possible price scenarios and highlight key factors influencing ADA’s future.

Changelly

Price range in 2026: $0.359–$0.928 (as of 27.10.2024).

Changelly experts anticipate a steady growth for the ADA price in 2026. According to the forecast, quotes will range from $0.359 to $0.928.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.359 |

0.659 |

0.523 |

|

February |

0.395 |

0.671 |

0.560 |

|

March |

0.432 |

0.682 |

0.597 |

|

April |

0.468 |

0.694 |

0.633 |

|

May |

0.504 |

0.705 |

0.670 |

|

June |

0.540 |

0.717 |

0.707 |

|

July |

0.577 |

0.728 |

0.744 |

|

August |

0.613 |

0.740 |

0.781 |

|

September |

0.649 |

0.751 |

0.818 |

|

October |

0.685 |

0.763 |

0.855 |

|

November |

0.721 |

0.774 |

0.892 |

|

December |

0.758 |

0.786 |

0.928 |

CoinCodex

Price range in 2026: $0.312–$0.849 (as of 27.10.2024).

Analysts at CoinCodex project that ADA will rise in 2026, reaching a high of $0.849 in February and a low of $0.311 in November, with an average price remaining below $0.779.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.621 |

0.661 |

0.742 |

|

February |

0.673 |

0.779 |

0.849 |

|

March |

0.457 |

0.622 |

0.708 |

|

April |

0.433 |

0.484 |

0.535 |

|

May |

0.422 |

0.440 |

0.457 |

|

June |

0.414 |

0.451 |

0.474 |

|

July |

0.422 |

0.449 |

0.498 |

|

August |

0.413 |

0.431 |

0.462 |

|

September |

0.368 |

0.391 |

0.414 |

|

October |

0.346 |

0.362 |

0.412 |

|

November |

0.311 |

0.330 |

0.355 |

|

December |

0.317 |

0.364 |

0.392 |

CoinPedia

Price range in 2026: $2.76–$3.30 (as of 27.10.2024).

According to CoinPedia, the ADA price will continue to move higher in 2026, ranging from $2.76 to $3.30, with an average price of around $3.03.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

2.76 |

3.03 |

3.30 |

Analysts are generally upbeat about Cardano’s (ADA) outlook for 2026, highlighting the potential for growth driven by network enhancements and increased activity in the ecosystem. However, the wide range of projected prices reflects the uncertainties posed by market volatility and macroeconomic factors. CoinPedia stands out with the most ambitious forecast, assuming significant price gains, while Changelly and CoinCodex take a more cautious stance, suggesting moderate growth.

Analysts’ ADA Price Projections for 2027

Experts provide forecasts for Cardano’s price in 2027, considering various factors that could influence the cryptocurrency’s performance. The analysis takes into account possible network upgrades, market trends, and the current state of the ecosystem, helping to predict the future of ADA and understand what scenarios could materialize in 2027.

Changelly

Price range in 2027: $0.78–$1.32 (as of 27.10.2024).

Changelly experts predict that the ADA price will range from $0.78 to $1.32 in 2027, with the average price climbing to $1.14 by December.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.78 |

0.81 |

0.96 |

|

February |

0.81 |

0.84 |

0.99 |

|

March |

0.84 |

0.87 |

1.03 |

|

April |

0.87 |

0.90 |

1.06 |

|

May |

0.90 |

0.93 |

1.09 |

|

June |

0.92 |

0.96 |

1.12 |

|

July |

0.95 |

0.99 |

1.16 |

|

August |

0.98 |

1.02 |

1.19 |

|

September |

1.01 |

1.05 |

1.22 |

|

October |

1.04 |

1.08 |

1.25 |

|

November |

1.07 |

1.11 |

1.29 |

|

December |

1.10 |

1.14 |

1.32 |

CoinCodex

Price range in 2027: $0.311–$0.533 (as of 27.10.2024).

According to CoinCodex, the ADA price will appreciate in 2027, with a low of $0.311 in September and a high of $0.533 in November, averaging around $0.500 by year’s end.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.370 |

0.389 |

0.402 |

|

February |

0.348 |

0.366 |

0.388 |

|

March |

0.387 |

0.401 |

0.427 |

|

April |

0.376 |

0.385 |

0.402 |

|

May |

0.320 |

0.351 |

0.388 |

|

June |

0.328 |

0.342 |

0.365 |

|

July |

0.320 |

0.339 |

0.351 |

|

August |

0.312 |

0.318 |

0.324 |

|

September |

0.311 |

0.315 |

0.323 |

|

October |

0.315 |

0.356 |

0.390 |

|

November |

0.384 |

0.430 |

0.533 |

|

December |

0.460 |

0.500 |

0.530 |

CoinPedia

Price range in 2027: $4.56–$5.03 (as of 27.10.2024).

CoinPedia experts predict a significant uptick in the ADA price in 2027, with a range from $4.56 to $5.03 and an average price of around $4.79.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

4.56 |

4.79 |

5.03 |

Forecasts for 2027 vary widely, reflecting the uncertainty in the market. Differences in estimates may stem from expectations regarding the Cardano ecosystem’s development and the DeFi sector’s potential growth. CoinPedia takes a more optimistic stance, highlighting expected network improvements, while Changelly and CoinCodex adopt a more cautious viewpoint in their price analyses.

Analysts’ ADA Price Projections for 2028

Analysts offer their forecasts for Cardano (ADA) in 2028, taking into account key factors that could affect the price. Experts analyze network upgrades, the state of the ecosystem, and general market trends in their estimates, providing insights into potential scenarios for ADA in 2028 and assessing its growth prospects.

Changelly

Price range in 2028: $1.14–$1.89 (as of 27.10.2024).

Changelly predicts that the ADA price will range from $1.14 to $1.89, with the average price growing to $1.61 by the end of 2028.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

1.14 |

1.18 |

1.37 |

|

February |

1.18 |

1.22 |

1.42 |

|

March |

1.21 |

1.26 |

1.46 |

|

April |

1.25 |

1.30 |

1.51 |

|

May |

1.29 |

1.34 |

1.56 |

|

June |

1.33 |

1.38 |

1.61 |

|

July |

1.36 |

1.41 |

1.65 |

|

August |

1.40 |

1.45 |

1.70 |

|

September |

1.44 |

1.49 |

1.75 |

|

October |

1.48 |

1.53 |

1.80 |

|

November |

1.51 |

1.57 |

1.84 |

|

December |

1.55 |

1.61 |

1.89 |

CoinCodex

Price range in 2028: $0.323 –$1.512 (as of 27.10.2024).

CoinCodex experts predict a continuation of the uptrend for ADA in 2028. The price will range from $0.323 in November to $1.512 in December, with the average value not exceeding $1.155.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.438 |

0.461 |

0.487 |

|

February |

0.497 |

0.546 |

0.599 |

|

March |

0.497 |

0.532 |

0.600 |

|

April |

0.422 |

0.439 |

0.493 |

|

May |

0.418 |

0.432 |

0.452 |

|

June |

0.372 |

0.398 |

0.423 |

|

July |

0.350 |

0.401 |

0.424 |

|

August |

0.356 |

0.370 |

0.394 |

|

September |

0.355 |

0.374 |

0.401 |

|

October |

0.346 |

0.370 |

0.378 |

|

November |

0.323 |

0.412 |

0.621 |

|

December |

0.703 |

1.155 |

1.512 |

CoinPedia

Price range in 2028: $5.29 –$5.73 (as of 27.10.2024).

Analysts at CoinPedia anticipate that the ADA price will range between $5.29 and $5.73 in 2028, averaging around $5.51.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

5.29 |

5.51 |

5.73 |

The difference in forecasts for 2028 underlines the market’s uncertainty. Changelly and CoinCodex forecasts demonstrate a cautious approach, pointing to possible volatile swings between $1 and $2. CoinPedia, on the other hand, remains confident of significant growth due to expected major network upgrades and the increasing use of DeFi and NFTs on the Cardano platform. The varying predictions highlight the need to carefully analyze macroeconomic conditions and network changes.

Analysts’ ADA Price Projections for 2029

Let’s examine expert forecasts for Cardano in 2029. Analysts study possible trends in the cryptocurrency market and the impact of key factors such as network upgrades, the state of the ecosystem, and the macroeconomic situation. These predictions help assess the growth prospects and possible risks for ADA in 2029.

Changelly

Price range in 2029: $1.62–$2.74 (as of 27.10.2024).

Changelly predicts that in 2029, the ADA price will range from $1.62 in January to $2.74 in December, with the average price climbing to $2.41.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

1.62 |

1.68 |

1.96 |

|

February |

1.68 |

1.74 |

2.03 |

|

March |

1.75 |

1.81 |

2.10 |

|

April |

1.81 |

1.88 |

2.17 |

|

May |

1.88 |

1.94 |

2.24 |

|

June |

1.94 |

2.01 |

2.32 |

|

July |

2.01 |

2.08 |

2.39 |

|

August |

2.07 |

2.14 |

2.46 |

|

September |

2.14 |

2.21 |

2.53 |

|

October |

2.20 |

2.28 |

2.60 |

|

November |

2.27 |

2.34 |

2.67 |

|

December |

2.33 |

2.41 |

2.74 |

CoinCodex

Price range in 2029: $1.172–$3.46 (as of 27.10.2024).

According to CoinCodex, the ADA price will skyrocket in 2029. The price is expected to reach its high near $3.46 in July. However, the quotes may retreat to $1.172 in December. The average price will likely rally to $2.93 in July, indicating an optimistic outlook for the market during this period.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

1.216 |

1.367 |

1.547 |

|

February |

1.277 |

1.490 |

1.697 |

|

March |

1.547 |

1.967 |

2.63 |

|

April |

1.351 |

1.695 |

2.09 |

|

May |

1.266 |

1.483 |

1.655 |

|

June |

1.524 |

2.30 |

3.31 |

|

July |

2.45 |

2.93 |

3.46 |

|

August |

2.42 |

2.53 |

2.63 |

|

September |

1.992 |

2.29 |

2.60 |

|

October |

1.435 |

1.627 |

1.946 |

|

November |

1.332 |

1.546 |

1.764 |

|

December |

1.172 |

1.256 |

1.381 |

CoinPedia

Price range in 2029: $6.68–$7.79 (as of 27.10.2024).

CoinPedia analysts predict that in 2029, the ADA price will range between $6.68 and $7.79, averaging around $7.235.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

6.68 |

7.235 |

7.79 |

Experts share their forecasts for Cardano (ADA) in 2029, analyzing market trends and the impact of various factors. Special attention is paid to network upgrades, ecosystem development, and macroeconomic conditions. These forecasts assess the potential growth opportunities and risks that ADA may face in 2029, painting a clearer picture of the cryptocurrency’s future.

Analysts’ ADA Price Projections for 2030

Analysts forecast the Cardano (ADA) price in 2030 by examining ecosystem development, technological innovations, and global economic conditions. These aspects aid in predicting ADA’s price change and its impact on the cryptocurrency market. The predictions offer insights into the currency’s prospects for investors.

Changelly

Price range in 2030: $2.42–$4.15 (as of 27.10.2024).

Changelly forecasts a steady growth of the coin in 2030. The lowest price is expected to reach $2.42 in January. By the end of the year, the quotes will likely soar to $4.15.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

2.42 |

2.50 |

2.86 |

|

February |

2.51 |

2.60 |

2.98 |

|

March |

2.60 |

2.69 |

3.09 |

|

April |

2.69 |

2.79 |

3.21 |

|

May |

2.78 |

2.88 |

3.33 |

|

June |

2.88 |

2.98 |

3.45 |

|

July |

2.97 |

3.07 |

3.56 |

|

August |

3.06 |

3.16 |

3.68 |

|

September |

3.15 |

3.26 |

3.80 |

|

October |

3.24 |

3.35 |

3.92 |

|

November |

3.33 |

3.45 |

4.03 |

|

December |

3.42 |

3.54 |

4.15 |

CoinCodex

Price range in 2030: $0.282–$1.393 (as of 27.10.2024).

According to CoinCodex, in 2030, the ADA price may reach a high of $1.393 in February. However, the quotes are predicted to rebound to a low of $0.282 in November. The average price will likely jump to $1.255.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.923 |

0.997 |

1.111 |

|

February |

1.096 |

1.255 |

1.393 |

|

March |

0.583 |

0.895 |

1.096 |

|

April |

0.533 |

0.633 |

0.744 |

|

May |

0.494 |

0.544 |

0.584 |

|

June |

0.504 |

0.579 |

0.624 |

|

July |

0.511 |

0.563 |

0.667 |

|

August |

0.488 |

0.524 |

0.594 |

|

September |

0.398 |

0.447 |

0.494 |

|

October |

0.355 |

0.379 |

0.453 |

|

November |

0.282 |

0.317 |

0.363 |

|

December |

0.309 |

0.401 |

0.459 |

CoinPedia

Price range in 2030: $9.12–$10.32 (as of 27.10.2024).

CoinPedia experts predict that in 2030, the ADA price will range between $9.12 and $10.32, with an average price of around $9.72.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

9.12 |

9.72 |

10.32 |

Forecasts for 2030 reflect uncertainty in the cryptocurrency market. Changelly and CoinCodex emphasize the possibility of moderate growth and volatility, while CoinPedia points to considerably higher increase potential, possibly based on expectations of major technological upgrades and further Cardano ecosystem development. These varying assessments highlight the importance of considering external economic factors and technical innovations when analyzing the cryptocurrency’s prospects.

Analysts’ ADA Price Projections for 2050

Experts provide forecasts for Cardano (ADA) up to 2050. However, such long-term predictions are highly approximate. Actual changes in the market will depend on many factors, including technological advances, the macroeconomic situation, cryptocurrency regulation, the state of the Cardano ecosystem, and global financial trends. These forecasts provide only a rough picture of potential scenarios for Cardano’s development, helping investors grasp potential price directions and risks in the long term.

Changelly predicts that the ADA price may soar to a high of $330.08 in 2050, with the lowest price standing at $286.16. The average price is projected to be $302.95, reflecting a strong belief in the cryptocurrency’s potential for long-term growth.

According to CoinPriceForecast, Cardano’s price will rise from current levels, reaching a $0.66–$0.98 range by 2050. In 2031, ADA may start the year at $0.66, dropping slightly to $0.64 in the first half, and close the year at $0.68, marking an increase of about 96% from today’s levels.

CoinCodex analysts predict significant growth for Cardano (ADA) by 2050. They have compared the projections with the historical returns of the S&P 500 and Bitcoin’s performance over the last three years. A hypothetical $1,000 investment in 2024 could grow to $15,546 based on the ROI of the S&P 500 index or to $47,734 based on Bitcoin’s average annual return. However, such projections are only approximate and do not guarantee an accurate forecast over such a long time frame.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2035 |

1.20 |

1.50 |

1.75 |

|

2040 |

2.00 |

2.35 |

2.70 |

|

2045 |

2.80 |

3.20 |

3.65 |

|

2050 |

286.16 |

302.95 |

330.08 |

Projections for the ADA price in 2050 reflect experts’ optimistic expectations. Changelly anticipates significant growth, anticipating the highest price of $330.08 in 2050, with a steady average price of around $302.95. CoinPriceForecast is more cautious, predicting a price range between $0.66 and $0.98, indicating stable but less pronounced growth. CoinCodex uses the historical performance of the S&P 500 index and Bitcoin, suggesting that long-term investment could significantly increase returns, though recognizing the uncertainty of such predictions.

Predicting the market over such an extended period carries significant uncertainty, as the cryptocurrency market is affected by numerous factors. While analysts generally agree that ADA has the potential for an increase, the differing forecasts emphasize the importance of considering macroeconomic and technological changes that may significantly alter the outlook for the next decades.

Market Sentiment for ADA (Cardano) On Social Media

Media sentiment is an indicator that reflects social media users’ attitudes towards a particular asset. The indicator is crucial for analysts, providing insights into the community’s perception of the cryptocurrency and helping spot potential trends. For example, Social Volume measures the number of unique mentions of an asset on social media. If interest in an asset picks up, it can enhance its liquidity and predictability for trading.

When analyzing the current sentiment on ADA, the following trends can be observed:

- Social Engagement. In October 2024, Cardano (ADA) captured significant attention in the cryptocurrency landscape due to statements made by its founder, Charles Hoskinson. The surge in followers and activity on the X platform (formerly Twitter) emphasizes the growing interest in ADA. While the number of Cardano subscribers had declined since March, it began to climb again at the beginning of October, which may indicate a potential bullish trend.

- Social Sentiment. According to analytics companies, Cardano exhibits a higher optimism level than other major cryptocurrencies, such as Bitcoin and XRP. The Weighted Sentiment indicator, which factors in the balance of positive and negative messages along with social volume, suggests that investors are feeling bullish about Cardano despite market volatility this year.

Recent posts on Twitter demonstrate differing sentiments among traders about the future of Cardano (ADA). Analysts note that ADA may repeat the 2020 scenario and anticipate a price surge by around 18 November, two weeks after the US election, and a possible market peak in September 2025. This optimistic forecast is based on the idea of historical repetition and similarities with past market behavior.

Nevertheless, some users express skepticism regarding ADA’s future prospects, pointing to recent declines and suggesting a possible further drop in the token’s price. This pessimistic outlook is illustrated in the chart, where ADA is marked by a series of dips, hinting at a potential downtrend continuation.

These contrasting perspectives reflect the uncertainty among traders and investors. While some see upside potential based on historical data, others continue to spot signs of the ADA price weakening.

ADA Price History

Cardano (ADA) reached the highest price of $3.09 on 2021-09-02. The lowest price of $0.01925 was recorded on 2020-03-13.

The chart below shows the ADAUSD performance over the last ten years. It is crucial to assess historical data to make the forecasts as accurate as possible.

Cardano (ADA) is one of the most volatile tokens in the cryptocurrency market. Since its launch in 2017, the ADA price has experienced numerous ups and downs due to various market and technological factors.

- 2018–2021. In 2018, the ADA price opened at $0.03, rising to around $1.40 by 2021 amid a surge of interest in cryptocurrencies and blockchain innovations. This growth is attributed to the implementation of Cardano network upgrades and the increased use of smart contracts, as well as the overall bullish sentiment in the crypto market.

- 2022. ADA faced a severe correction in 2022, plunging to $0.31. This slump was driven by a general bearish trend in the cryptocurrency market, which affected many digital assets. Increased regulatory pressure and macroeconomic uncertainty also contributed to the price drop.

- 2023. ADA showed signs of recovery amid new technical upgrades and the development of the Cardano-based DeFi ecosystem. The growing interest in decentralized applications (dApps) and the introduction of new solutions, such as the Vasil Hard Fork, contributed to a partial price recovery.

- 2024. The ADA price experienced significant changes. In the first half of the year, the token price fluctuated amid market volatility. However, in October 2024, social engagement in the asset spiked due to Charles Hoskinson’s statements about Cardano’s prospects, attracting investors and triggering a slight uptick in the ADA price. Additionally, an increase in transaction activity on the Cardano blockchain, along with the renewed interest of major investors, often referred to as crypto whales, became drivers of the positive trend.

The ADA price continues to be affected by regulatory changes, technological advances, market sentiment and major investors’ activity. High volatility remains a crucial factor in trading the asset. Thus, long-term forecasts require careful analysis of the macroeconomic environment and technological upgrades in the Cardano network.

ADA Fundamental Analysis

Fundamental analysis of the ADA exchange rate involves assessing the key factors affecting the long-term value of the cryptocurrency. These factors include technological advancements, the adoption of decentralized applications, regulatory changes, and developers’ activity. Additionally, macroeconomic conditions and market sentiment play a significant role in this analysis. Understanding these aspects helps to better predict future fluctuations in Cardano’s price and its stability in the cryptocurrency market.

What Factors Affect the ADA Price?

The following factors influence the ADAUSD quotes:

- Traders’ sentiment. Short-term changes in the ADA price directly depend on the market sentiment. Bulls’ enthusiasm may lead to a price rise, while negative attitudes may result in a price slide.

- Market capitalization. Cardano maintains a strong market position due to its significant market capitalization, exceeding $11 billion as of October 2024. This figure indicates a high level of investor confidence and potential for further growth.

- Ranking and prospects. Cardano holds a strong position within the top 10 cryptocurrencies by market capitalization, currently ranked seventh. Forecasts regarding its further development and technological advances keep investors interested in the asset.

- Global economic conditions. Changes in the world economy, such as inflation or financial crises, may affect investors’ behavior in cryptocurrency markets, including ADA. Digital assets may serve as safe havens during economic instability.

- Regulatory changes. Legislative innovations can significantly affect the ADA rate. Positive regulatory decisions may strengthen investors’ confidence, while tight measures may lead to a price depreciation.

- Cardano ecosystem development. Improvements in the Cardano ecosystem, including the launch of new projects and partnerships, can positively impact the token’s value. Technical updates, such as the Vasil Hard Fork, boost the network’s functionality, attracting new users.

- Community support. Cardano has an active community of developers and investors that helps promote the network. The growing use of ADA in decentralized applications and payments generates additional demand and keeps the price high.

More Facts About ADA

Cardano (ADA) is an open-source, decentralized blockchain platform launched in 2017 by Charles Hoskinson, a co-founder of Ethereum. Cardano was founded by Input Output Hong Kong (IOHK) to tackle the scalability, security, and resilience challenges older blockchains face. One of Cardano’s key features is its use of a Proof-of-Stake (PoS) algorithm called Ouroboros, which makes it more energy efficient than other blockchains, including Bitcoin.

ADA’s price growth started when the network expanded its functionality and introduced smart contract support in 2021. This advancement opened new opportunities for creating decentralized applications (dApps), capturing the interest of developers and investors. Cardano is used in various sectors, including decentralized finance (DeFi), non-fungible tokens (NFTs), and supply chain management.

The growing popularity of ADA among traders is driven by the network’s reliability, sustainable development of the ecosystem, and support from an active community. Cardano attracts both long-term investors and speculators due to the asset’s high volatility and long-term growth prospects fueled by network improvements and technological innovations.

Advantages and Disadvantages of Investing In ADA

The advantages of investing in Cardano (ADA) token include the following characteristics:

- Technological innovations. Cardano employs a scientific approach to development based on research and peer reviews. This method bolsters the network’s reliability and reduces the likelihood of errors in the code. Furthermore, using the Ouroboros algorithm enhances the network’s energy efficiency compared to Proof-of-Work (PoW) based blockchains such as Bitcoin.

- Active developers’ community. Cardano has an engaged community that fosters the ecosystem and promotes new projects, increasing investors’ confidence and supporting demand for ADA.

- Long-term growth prospects. Network improvements such as the Vasil Hard Fork and smart contract integration create potential for long-term growth. Increased use of decentralized applications (dApps) and DeFi makes Cardano appealing to developers.

- Transparency and decentralization. Cardano’s governance system is based on decentralized principles, which allow ADA holders to participate in decision-making on the network’s development, creating an additional incentive for investors.

However, as with any other asset, investing in Cardano (ADA) carries certain risks:

- High volatility. Like most cryptocurrencies, ADA is subject to significant price fluctuations, which may pose a risk to short-term investors. Sudden changes in market sentiment can trigger sharp price drops.

- Competition with other blockchains. Cardano faces competition from other blockchain platforms such as Ethereum, Polkadot, and Solana. This may limit the influx of new users and slow down the growth of ADA’s value.

- Dependence on the global economy and regulation. Economic and regulatory changes may affect the ADA price. Increased regulation of the crypto market may hinder access to Cardano and cause a decline in institutional investors’ interest.

- Slow development process. A scientific approach to development sometimes leads to the slow introduction of new features compared to competitors. Investors who prefer faster progress may reject this approach.

Investing in ADA requires careful analysis and understanding of the benefits and risks involved, which is essential for making informed decisions in a volatile cryptocurrency market.

How We Make Forecasts

To forecast the price of Cardano (ADA), a comprehensive approach involving the analysis of various factors is employed:

- Short-term forecasts are based on technical analysis involving the evaluation of market indicators, charts, and trends, allowing you to spot short-term price fluctuations and assess traders’ sentiment.

- Medium-term forecasts take into account fundamental factors such as technological network upgrades, ecosystem development, as well as news and regulatory developments. The economic situation and social activity are also considered.

- Long-term forecasts rely on macroeconomic tendencies, global financial trends, and blockchain technology adoption pace. Technological developments and the influence of major market participants are also taken into account.

This approach helps cover all aspects affecting the ADA price and make more accurate predictions for different periods.

Conclusion: Is ADA a Good Investment?

Cardano (ADA) remains one of the most popular assets in the cryptocurrency market. The token has solidified its position in the industry thanks to its stable ecosystem, active development, and community support. Analysts note that ADA’s prospects depend on the success of technological innovations, such as the introduction of smart contracts and network upgrades that strengthen the platform’s position in DeFi and decentralized applications.

ADA’s long-term potential stems from its science-based development approach, sustainable technology, and emphasis on energy efficiency through its Proof-of-Stake algorithm. This makes Cardano attractive to cleantech-oriented investors. However, high volatility and competition with other blockchains require a cautious approach.

In general, ADA can be a good long-term investment for those who are willing to follow technological developments and consider all risk factors. Understanding fundamental and macroeconomic changes will help investors better assess the asset’s future prospects.

ADA Price Prediction FAQ

Cardano stands out for its science-based approach to development and the use of the Proof-of-Stake (PoS) algorithm, which enhances the network’s energy efficiency. This reduces the cost of mining and makes the blockchain more environmentally friendly.

Cardano is widely used in DeFi, supply chain management, and education. Its blockchain supports decentralized applications (dApps) and smart contracts, attracting developers from various industries.

The current ADA price is $0.42670 as of 08.11.2024.

The main risks stem from high volatility, competition with other blockchains, and possible regulatory changes. Investors should consider all these factors before buying an asset.

Upgrades such as the Vasil Hard Fork and smart contracts support implementation enhance the network’s functionality, spurring investors’ interest and ecosystem development.

ADA has the potential for long-term growth due to its scientific approach to network development and focus on energy efficiency. However, high volatility requires careful market analysis and risk assessment.

Active community and growing interest in the project may boost confidence in Cardano and attract new investors, creating additional demand, which may positively influence the price.

Price chart of ADAUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.