If the FOMC meeting is an unambiguously upbeat event for the EURUSD pair, then the BoJ verdict can potentially impact global financial markets significantly. How might the return of capital to Japan by Japanese investors affect the euro? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Bank of Japan’s unexpected move could send the EURUSD pair down.

- The euro is weak because of the German economy and the Trump trade.

- The Fed may weaken the US dollar.

- The EURUSD pair can be bought once it returns to 1.083-1.09.

Weekly fundamental forecast for euro

It is always challenging to descend a mountain. Such challenges are particularly tough when they involve a group. Several of the world’s leading central banks have already reduced interest rates. The Fed is keen to avoid a repeat of the inflationary pressures seen at the beginning of the year, while the Bank of Japan’s final decision remains unclear. The BoJ’s actions could significantly impact financial markets, as evidenced by the collapse of the EURUSD.

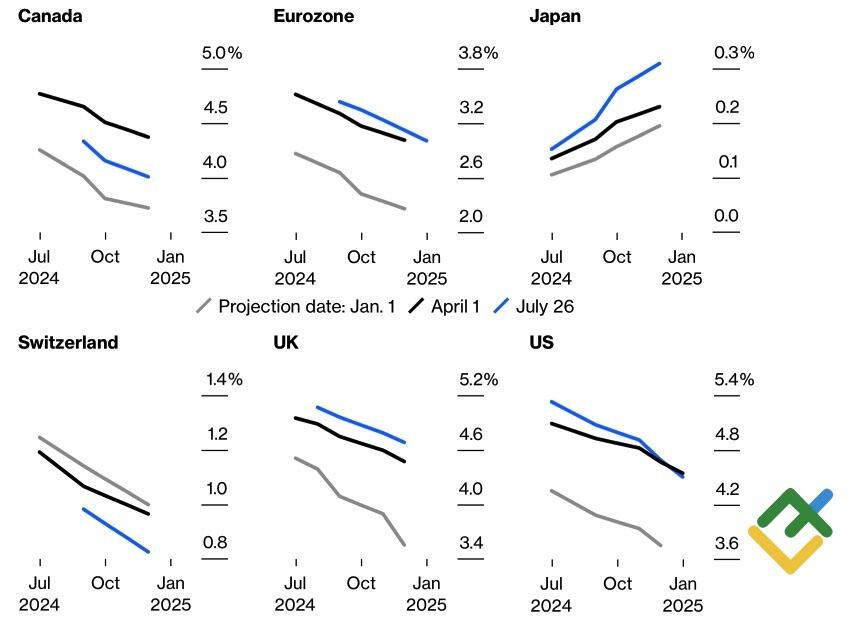

Market forecasts for central bank rates

Source: Bloomberg.

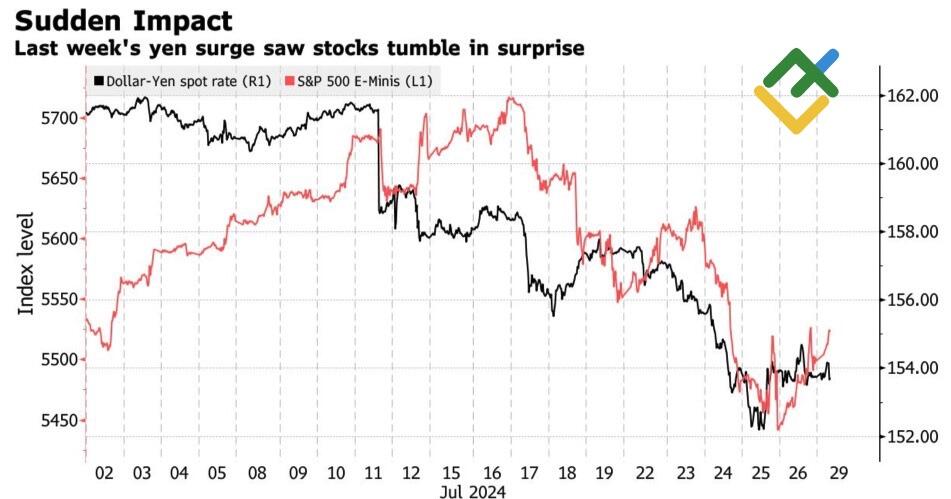

The divergence in monetary policy between the Fed and the Bank of Japan has resulted in the strengthening of the yen and a spillover of capital from other regions to Asia. Large investors in Japan have been allocating capital to US equities. When capital flows were redirected back to Japan, the S&P 500 index saw a decline. Consequently, global risk appetite is deteriorating, and the US dollar is strengthening against major world currencies, including the euro.

Japanese yen and S&P 500 performance

Source: Bloomberg.

The situation is further complicated by investor concerns regarding the underwhelming corporate reports from the Magnificent Seven companies. It is possible that other companies may experience similar difficulties to those encountered by Tesla and Alphabet. Investors are concerned that the tech giants are required to generate profits that do not mirror their high stock prices. If this does not occur, the S&P 500 will continue to decline, dragging the EURUSD pair down.

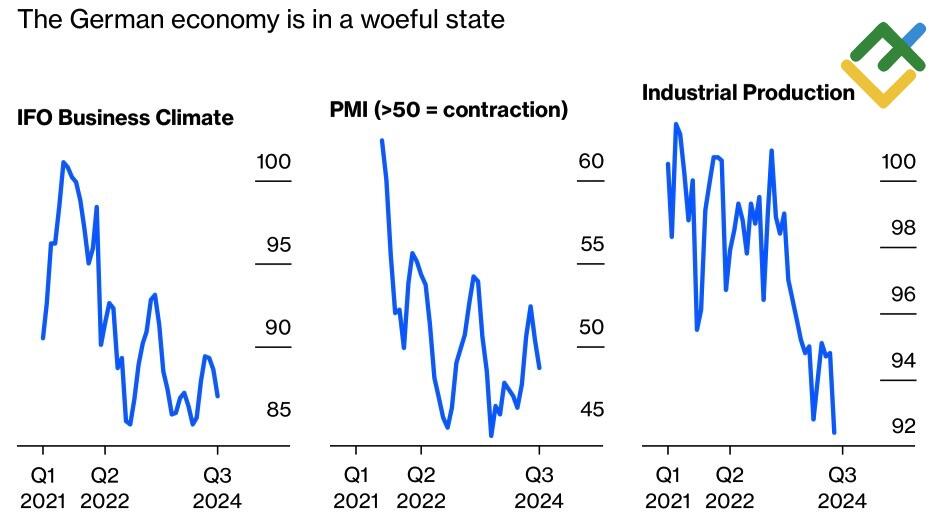

The principle of fundamental analysis, “strong economy, strong currency,” also favors bears. Leading indicators suggest that Germany, the eurozone’s leading economy, is experiencing challenges. This increases the risk of more aggressive monetary expansion by the ECB and puts pressure on the euro. Reuters experts predict that the Fed and the Bank of England will cut rates at two meetings in 2024, and the European Central Bank will make three rate cuts.

Germany’s economic indicators

Source: Bloomberg.

Meanwhile, one cannot rule out the Trump factor. The protectionist policies of the presidential candidate and his “America First!” approach could significantly slow global economic growth. This will adversely affect pro-cyclical currencies such as the euro and the pound.

However, suppose the BoJ decisions do not cause significant disruption in the financial markets. In that case, the EURUSD pair will have the potential to increase on the expectation of a reduction in the federal funds rate. The Fed is aware that it is employing an appropriate strategy to combat inflation, and based on the latest data, it should provide a hint of monetary policy easing in the near future.

Weekly trading plan for EURUSD

Against this backdrop, one can buy the EURUSD pair if it returns to the range of 1.083-1.09, climbing above 1.085. At the same time, long trades can also be opened on a rebound from the support level of 1.079-1.08.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.