Despite trade deficits, capital flowed into the US, entering the stock and bond markets. However, US President Donald Trump’s trade policies have sparked a global trade war, which has become a significant game-changer. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- European stocks look more attractive than US stocks.

- German bonds have taken away the safe-haven status from US Treasuries.

- Capital outflows from the US are weighing on the US dollar.

- Long trades on the EURUSD pair can be opened on pullbacks with targets at 1.16 and 1.195.

Weekly US Dollar Fundamental Forecast

Donald Trump made the bold claim that other countries were taking advantage of America, draining its wealth. However, it was revealed that the United States was, in fact, absorbing money from the rest of the world, selling its stocks and bonds. This trend has now shifted, leading to a decline in the US dollar. The US has adjusted its tariff policy in response to these developments, but it remains to be seen whether these changes will be sufficient. Meanwhile, EURUSD bears lack the strength to push the quotes lower.

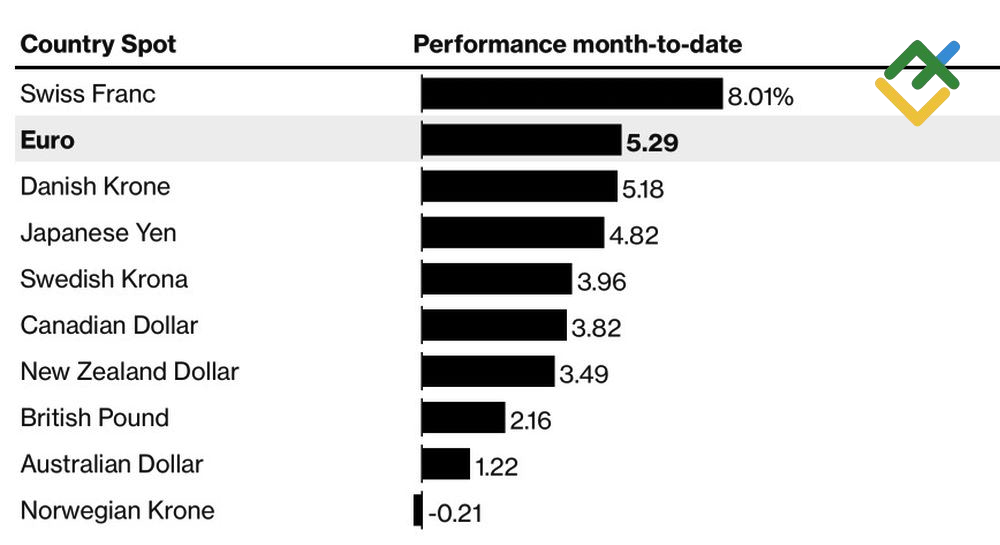

Major Currencies’ Performance Against US Dollar

Source: Bloomberg.

The current geopolitical climate makes it clear that the tariffs were imposed to make other countries negotiate with the United States, with the primary objective of isolating China. According to the Wall Street Journal, the White House’s primary demand for the tariffs to be lifted is to prevent China from entering its area of influence. This strategy involves discouraging the purchase of goods and preventing the establishment of cost-effective factories.

At the same time, Donald Trump has asserted that it is Beijing that needs to make a deal with Washington, not the other way around, and has invited China to the negotiating table.

On paper, a slowdown in China’s economy to 4% or less due to a trade war with the US would be detrimental to the eurozone, which is heavily reliant on exports. This is particularly concerning given that the US is not planning to remove the 10% tariffs on EU goods, as well as the 25% levy on imports of cars, steel, and aluminum. This context raises questions about the euro’s appreciation against such a backdrop.

While Brussels is poised to lose the trade war, it is evident that it is gaining ground in the investment arena. Despite the recent decline due to tariffs, European stock indices are outperforming their US counterparts, German bonds have surpassed Treasuries in terms of safety, and the euro is capitalizing on the shift of funds from the US to the currency bloc countries. Concurrent sell-offs of the US dollar and Treasuries suggest a potential crisis in the US.

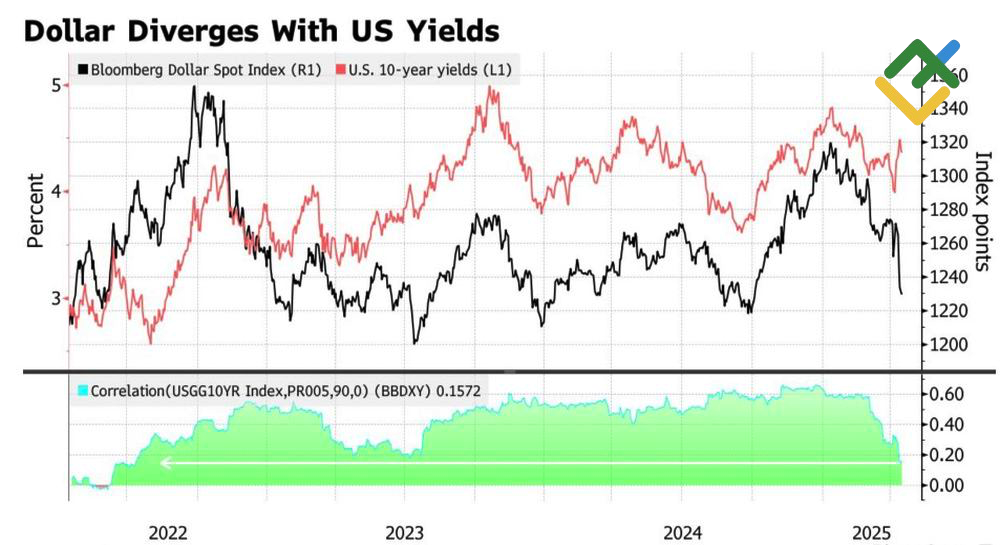

US Dollar Index and US Treasury Yields

Source: Bloomberg.

Danske Bank has observed that in 2025, the US dollar declined at the third fastest pace in history during periods when 10-year debt rates increased by 25 basis points or more. The first occurred in 1985 in the aftermath of the Plaza Accord, while the second was observed in May 2009. Both instances were subsequently followed by an extended period of heightened performance for the USD index.

This underscores the importance of recognizing that a victory in a trade war does not guarantee prosperity for a nation’s currency. On the contrary, the US policy of undermining the foundations of international trade has led to a decline in investor confidence in US assets, triggering capital outflows from the US and a weakening of the US dollar.

Weekly EURUSD Trading Plan

Should bears fail to keep the EURUSD pair’s quotes below 1.129, it will confirm their weakness, allowing traders to open long positions on pullbacks with the targets of 1.16 and 1.195.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.