Australia is between a rock and a hard place: the US is its most important military partner, while China remains the largest consumer market. A trading war between the two will not benefit the AUDUSD. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Trump’s trade retreat provides a boost to the Australian dollar.

- A potential trade war may be less severe than anticipated.

- Divergence in monetary policy supports the Australian dollar.

- If AUD/USD falls below 0.662, it signals a selling opportunity.

Weekly Fundamental Forecast for Australian Dollar

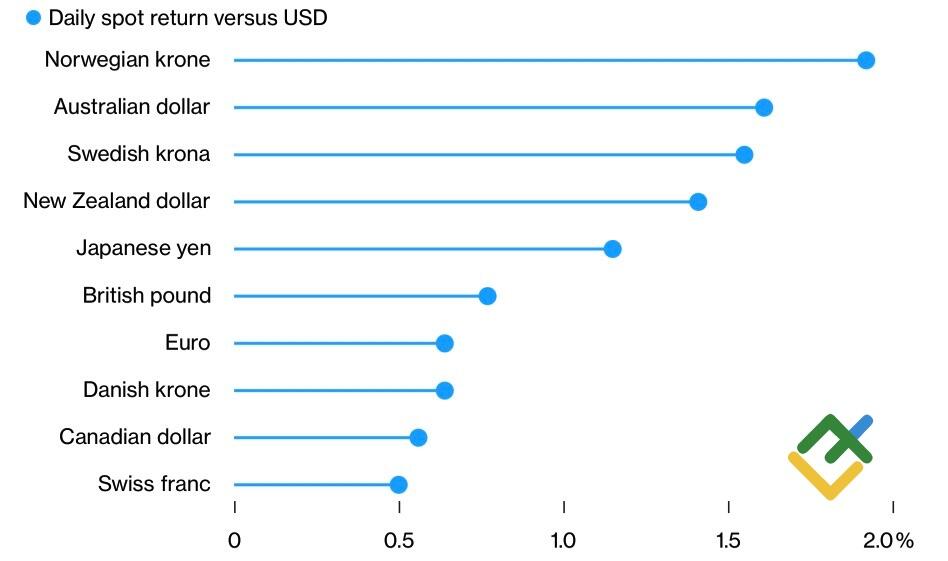

“Buy the rumor, sell the fact.” This age-old principle has poured cold water on the high expectations of Trump Trade advocates. While Donald Trump has won the presidential election, he has not yet returned to the White House, and there’s no certainty he will fulfill all his campaign promises. The affected currencies have stabilized and even rebounded. One of the primary beneficiaries has been the Australian dollar: AUDUSD has marked its best daily performance in a year.

Reaction to Trump trade hangover

Source: Bloomberg.

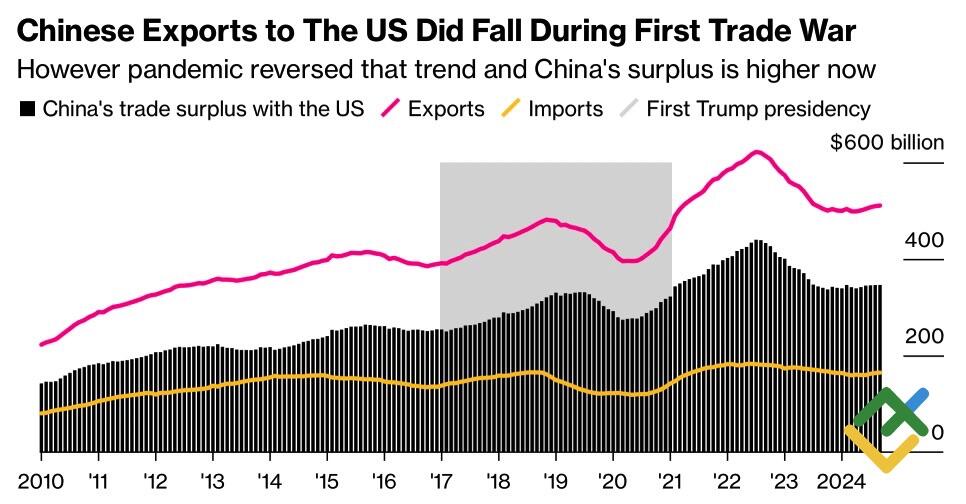

Donald Trump talked about 60% tariffs on imports from China and 20% import tariffs for the rest of the world. This would raise the average tariff to over 20%, a level not seen since World War II. However, during his previous term, the Republican often exploited a carrot-and-stick policy, using tariff concerns to force countries to revise trade agreements in the US’s favor. Will he take that path now? If so, the AUDUSD drop by 6% from its September high to its November bottom looks excessive.

The response from China is greatly important. Beijing is much more prepared for a trade war than six years ago. Back then, China’s trade balance did worsen significantly, but the surplus has grown since then. A partial list of China’s countermeasures could include control over the export of critical raw materials, retaliatory tariffs on agricultural imports, and pressure on American companies.

Foreign trade trends in China

Source: Bloomberg.

Like six years ago, Australia will be a hostage to the situation. The United States is its largest military partner, while China is its largest trade partner. Trying to sit on two chairs at once may end badly.

According to the Reserve Bank, the resumption of the trade war will be extremely negative for the Green Continent. The RBA suggests that Beijing does not rush to implement fiscal stimulus measures, hoping to figure out which of Donald Trump’s pre-election promises are lies and which are not. According to a Reuters insider, information about economic support of $1.4 trillion will be confirmed in the coming days, and Australia will likely get a portion of this pie.

Support for AUDUSD comes not only from the Trump trade retreat and the understanding that the trade war may not be as frightening as expected but also from the divergence in monetary policy between the RBA and other central banks. At its November meeting, the Reserve Bank of Australia kept the key rate at 4.35% and did not rule out either a cut or a hike in the future. Amid a 25-basis point cut in borrowing costs by the Fed and the Bank of England and a 50-basis point cut by the Riksbank, the RBA is the odd one out, which finally begins to strengthen the Aussie.

Weekly Trading Plan for AUDUSD

AUDUSD could grow to 0.671 and 0.6735, but retreating from these levels of a decline below support at 0.662 should be used for selling.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.