Brent quotes slide as markets fear a recession in the US, trade wars, and increased production. However, data shows the US economy is not falling into a recession. Let’s discuss this topic and make a trading plan for Brent.

The article covers the following subjects:

Major Takeaways

- Trade wars will slow oil demand.

- Lifting sanctions on Russia will increase supply.

- OPEC+ intends to increase production.

- Brent can be sold on a pullback from $72.2 and $73.5 or a drop below $70.15.

Weekly Fundamental Forecast for Brent

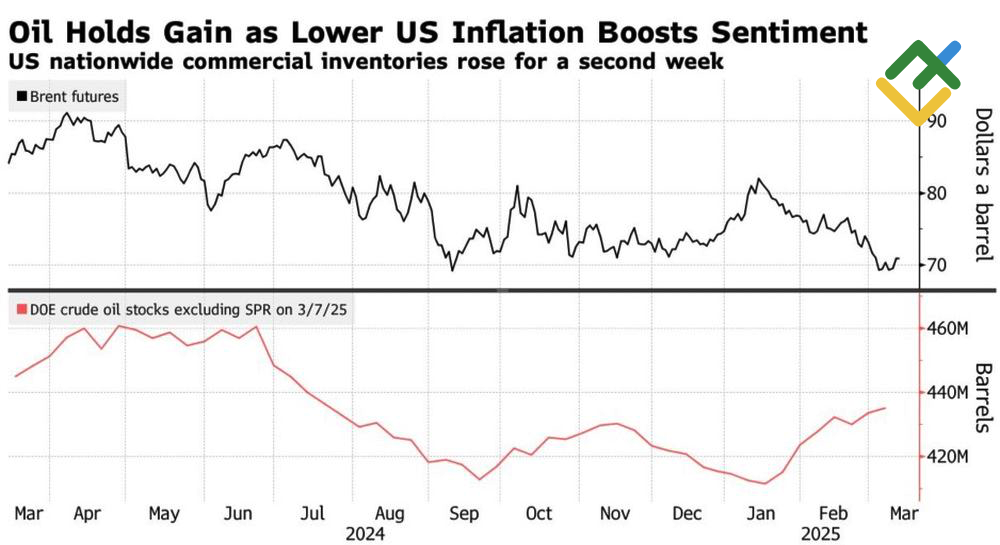

Donald Trump’s recent statement that the US economy is in a transition period has led to speculation about the potential for a recession. However, the US labor market remains robust, inflation is decelerating, which supports the likelihood of a soft landing, and the significant drop in gasoline inventories during the first week of March points to sustained domestic demand. As a result, the Brent crude oil price, which had been falling, rebounded against the news.

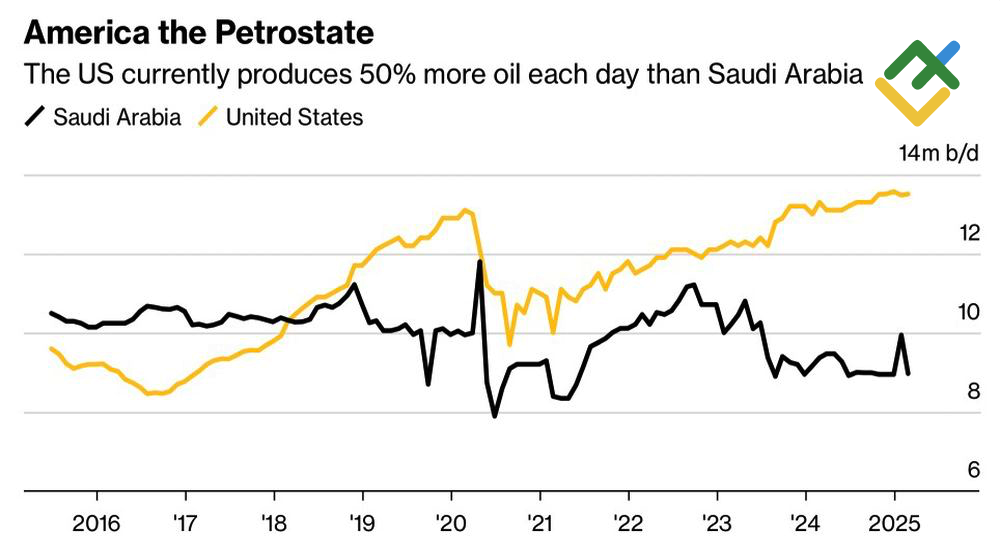

Brent dropped from its January peaks amid OPEC’s intention to follow the US and increase production, the thaw in relations between the US and Russia, which implies the lifting of sanctions against one of the largest oil producers. Tariffs and trade tensions, which are likely to cool the global economy, have also contributed to this decline.

US and Saudi Arabia Oil Production

Source: Bloomberg.

Brent rebounded from a six-month low due to speculation regarding a potential shift in German fiscal policy from restraint to spending, as well as China’s ambitious 5% GDP target for 2025, which suggests the possibility of further economic stimulus.

According to JP Morgan estimates, global demand as of March 11 stood at 102.2 million bpd, up 1.7 million bpd y/y and exceeding the expected monthly gain of 60,000 bpd. This outperformance is further validated by a significant decrease in US gasoline inventories, which fell by 5.7 million barrels over the past week. Gasoline demand reached 9.2 million bpd, marking the highest level since November. Conversely, crude oil inventories rose by 1.5 million barrels, falling short of the projected increase of 4.2 million barrels.

Crude Oil Stocks and Brent Price Performance

Source: Bloomberg.

The thaw in US-Russian relations and expectations of the lifting of sanctions against Moscow have led to an increase in crude oil flows from Russian ports by 300,000 in four weeks, the largest increase since January 2023. According to JP Morgan, Donald Trump could loosen the stranglehold on Iran and Venezuela, which would lead to an increase in supply.

Meanwhile, OPEC+ is following the US. In early spring, the alliance caught investors off guard with its intention to gradually cut production, reporting a 363,000 bpd increase in output to 41 million bpd. The main culprit was Kazakhstan, whose oil production jumped to 1.767 million bpd, at least 300,000 bpd above the ceiling.

Trade wars and China’s first deflation in 13 months, pointing to weak domestic demand, complete the bearish picture for the oil market.

Weekly Trading Plan for Brent

Brent will unlikely reverse the downtrend. While the bearish trend remains intact, you can open short trades on pullbacks from the resistance levels of $72.2 and $73.5. In addition, short positions can be opened if Brent’s quotes break through the support level of $70.15.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of UKBRENT in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.