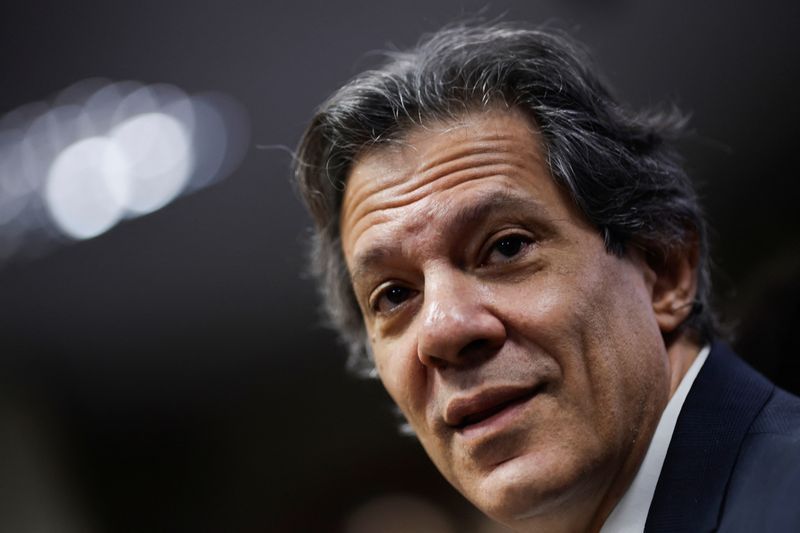

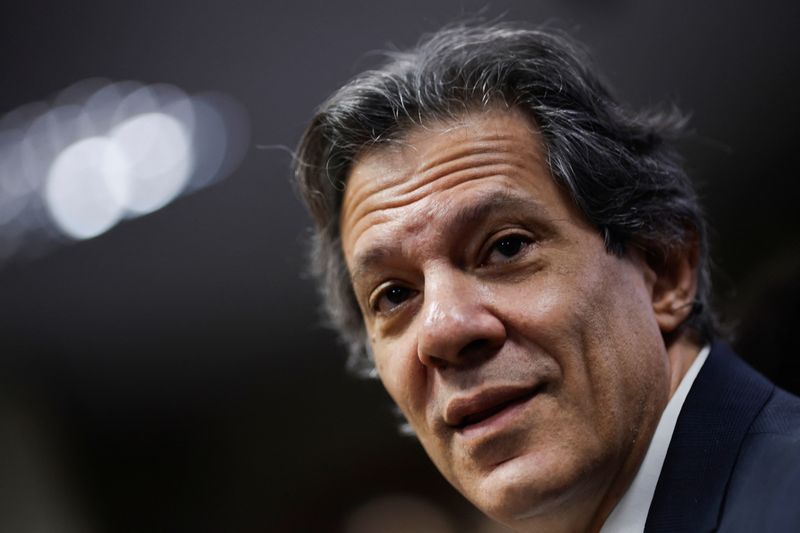

BRASILIA (Reuters) – Brazil’s Finance Minister Fernando Haddad said on Monday that the government has no plans to raise the financial transactions tax, known as IOF, to address U.S. dollar outflow following the sharp depreciation of the Brazilian currency last year.

“There is no discussion about changing the exchange rate regime in Brazil or increasing taxes for this purpose,” Haddad told reporters.

He described the U.S. dollar’s recent movements as part of “a natural accommodation process” following stresses caused by both external and domestic factors.

The Brazilian real depreciated by more than 20% last year, ranking among the worst-performing emerging market currencies.

The decline was driven by the global strengthening of the U.S. dollar following policy promises by President-elect Donald Trump, coupled with a steep increase in risk premiums on Brazilian assets after the government unveiled a fiscal containment package that disappointed investors.

After meeting with President Luiz Inacio Lula da Silva earlier on Monday, Haddad said the discussions focused on planning for the year, with the priority being the approval of the 2025 budget proposal.

This post is originally published on INVESTING.