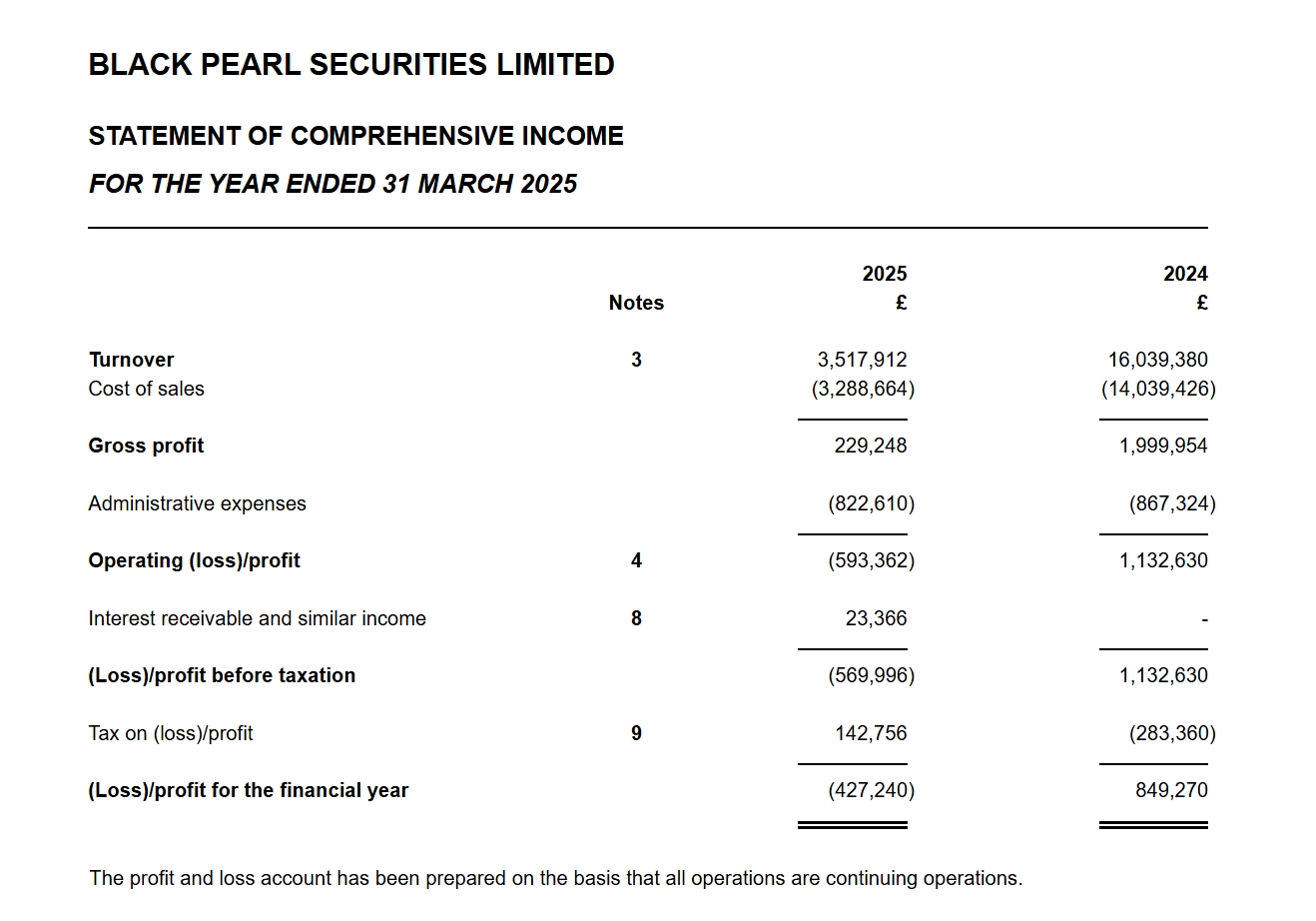

Black Pearl Securities Limited, operating as BP Prime, has

released its financial results for the fiscal year ended 31 March 2025. The

company reported a net loss of £427,240, marking a significant downturn

compared to the net profit of £849,270 recorded in the previous financial year.

Turnover Drops, Operating Losses Increase

The statement of comprehensive income reveals that total

turnover declined substantially to £3,517,912, down from £16,039,380 in the

preceding year. This decrease in revenue had a considerable impact on the

company’s overall financial performance.

Gross profit for the year fell sharply to £229,248, down

from £1,999,954 in the prior year. The reduction in gross profit was

accompanied by an increase in cost of sales and administrative expenses

relative to the lower revenue base.

Operating results reflected these trends, with the company

posting an operating loss of £593,362, in contrast to an operating profit of

£1,132,630 achieved in the year before. The downturn in operating performance

was a key factor in the overall loss reported.

You may find it interesting at FinanceMagnates.com: BP

Prime’s Professional Clients Push FY24 Revenue 7x: Boosting China Retail

Offerings.

BP Prime Notes New Interest Income

BP Prime recorded interest receivable of £23,366, an item

not present in the previous year’s accounts. Tax charges for the year stood at

£142,756, reflecting adjustments related to the loss. This compares to a tax

expense of £283,360 reported in the prior year.

“The company’s financial risk management objectives are

therefore to minimise the key financial risks through having clearly defining

terms of business with counterparties and stringent market control over

transactions with them and regular monitoring of cash flow and management

accounts to ensure regulatory capital requirements are not breached and the

company maintains adequate working capital,” the company stated in its filing.

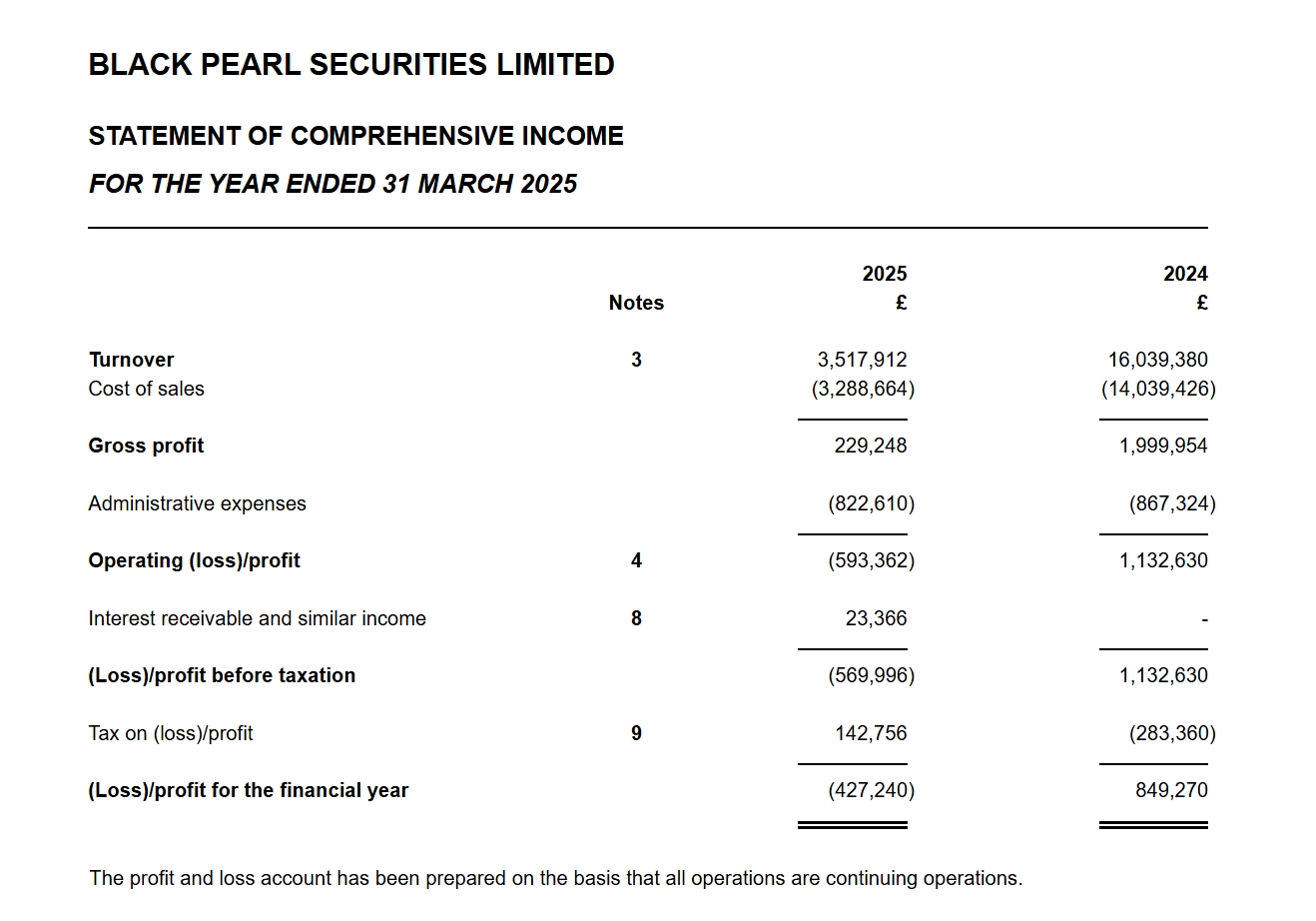

Black Pearl Securities Limited, operating as BP Prime, has

released its financial results for the fiscal year ended 31 March 2025. The

company reported a net loss of £427,240, marking a significant downturn

compared to the net profit of £849,270 recorded in the previous financial year.

Turnover Drops, Operating Losses Increase

The statement of comprehensive income reveals that total

turnover declined substantially to £3,517,912, down from £16,039,380 in the

preceding year. This decrease in revenue had a considerable impact on the

company’s overall financial performance.

Gross profit for the year fell sharply to £229,248, down

from £1,999,954 in the prior year. The reduction in gross profit was

accompanied by an increase in cost of sales and administrative expenses

relative to the lower revenue base.

Operating results reflected these trends, with the company

posting an operating loss of £593,362, in contrast to an operating profit of

£1,132,630 achieved in the year before. The downturn in operating performance

was a key factor in the overall loss reported.

You may find it interesting at FinanceMagnates.com: BP

Prime’s Professional Clients Push FY24 Revenue 7x: Boosting China Retail

Offerings.

BP Prime Notes New Interest Income

BP Prime recorded interest receivable of £23,366, an item

not present in the previous year’s accounts. Tax charges for the year stood at

£142,756, reflecting adjustments related to the loss. This compares to a tax

expense of £283,360 reported in the prior year.

“The company’s financial risk management objectives are

therefore to minimise the key financial risks through having clearly defining

terms of business with counterparties and stringent market control over

transactions with them and regular monitoring of cash flow and management

accounts to ensure regulatory capital requirements are not breached and the

company maintains adequate working capital,” the company stated in its filing.

This post is originally published on FINANCEMAGNATES.