Bitcoin has suffered losses due to token sell-offs in the US and Germany, as well as debt payments by the bankrupt Mt Gox exchange. When the crypto winter was approaching, Trump came to the aid of BTCUSD bulls. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Bitcoin soared 22% thanks to the Trump trade.

- The Republican promises to support the crypto industry.

- Trump’s policies are wreaking havoc, which is favorable for gold and the BTCUSD.

- Bitcoin may skyrocket to $78000.

Monthly Bitcoin fundamental forecast

In 2019, Donald Trump said he was not a fan of Bitcoin because its value is based on nothing, and digital assets can facilitate drug trafficking and other crimes. The 2024 Republican has accepted millions of dollars in cryptocurrency donations to his presidential campaign and met with executives from mining companies. His party claims to end the Democrats’ illegal oppression and opposes the Fed’s creation of a digital dollar. Should we be surprised by BTCUSD‘s rapid recovery?

After the assassination attempt on the 45th president of the United States, the Trump trade is gaining momentum. The Republican’s promises of deregulation, tax cuts, and import tariffs are creating a tailwind for stocks, gold, and bitcoin. These policies are pro-inflationary, and the presence of pressure on the Fed and the Republican’s eccentric antics are wreaking havoc in the markets and causing investors to flee to safe-haven assets. No wonder gold has set a new record, and the S&P 500 has done so for the 38th time in 2024.

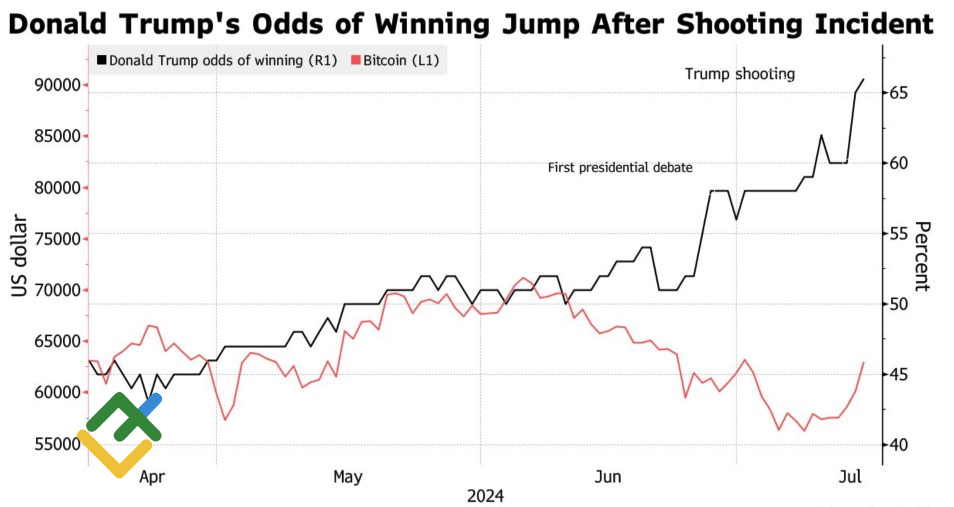

Bitcoin is one of the main beneficiaries of the Trump trade. Not only is the Republican showing himself to be a supporter of the crypto industry, but he is promising to rid it of such a formidable competitor as the Fed’s digital dollar. Notably, the BTCUSD pair is soaring amidst the growing popularity of the former head of the White House.

Donald Trump odds of winning the elections and BTC performance

Source: Bloomberg.

Before the assassination attempt on Donald Trump, BTC had posted red figures. The overflow of capital from this cryptocurrency into Ethereum, on the basis of which ETFs were supposed to start functioning, the outflow of money from Bitcoin-ETFs, large-scale sales of confiscated tokens by the governments of Germany and the United States, as well as the repayment of debts of the bankrupt Mt. Gox exchange for $8.9 billion created an oversupply and pushed the BTCUSD pair to the lows since February.

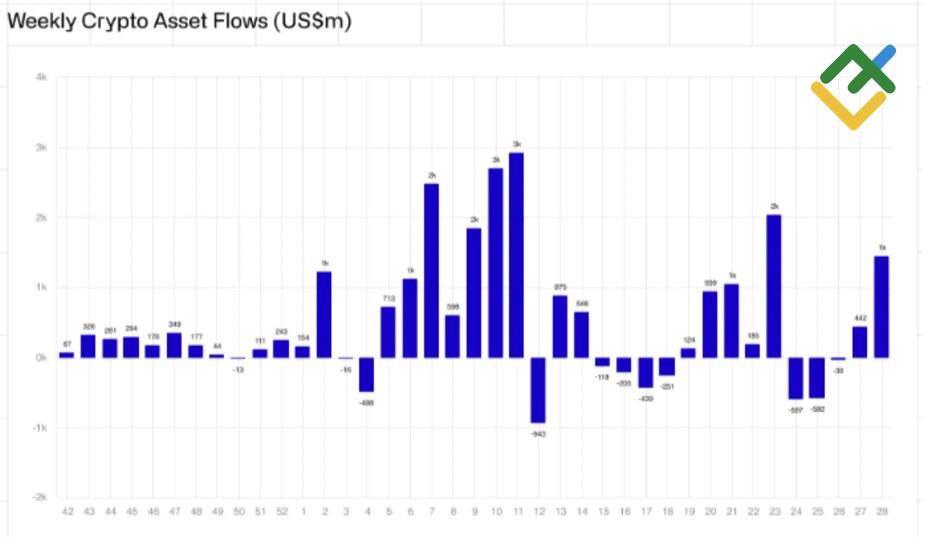

Shots fired at the 45th president of the United States prevented Bitcoin from slipping into another crypto winter. The rise in Trump’s ratings after the debate with Joe Biden and the assassination attempt reversed flows into ETFs. In the five-day period ending July 12, specialized ETFs attracted $1.35 billion, the highest in five weeks.

Crypto-ETF capital inflows

Source: Bloomberg.

Monthly BTCUSD trading plan

Some say the Trump trade has exhausted, but it is just starting to gain momentum. Weakening regulation of the crypto industry, Republicans setting roadblocks on the Fed’s road to the creation of the digital dollar, and accelerating the economy with the help of fiscal stimulus in the context of weakening monetary policy of the Fed will trigger a severe turmoil in the market, undermine confidence in the greenback, and accelerate the growth of BTCUSD quotes. In such a situation, one may buy Bitcoin with targets of $70000 and $78000.

Price chart of BTCUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.