Small-cap shares can sometimes outperform blue chips regarding growth dynamics, but large-cap stocks are more stable and suit best long-term investment strategies. Conversely, small caps tend to be associated with higher volatility and lower liquidity. However, the growth potential of small cap stocks may be a few times bigger than blue chips’ when it comes to periods from several weeks to several months.

In this article, you will learn about the distinctive features of small cap stocks, the best strategies to apply to small cap, and their choice criteria for online trading. Also, be prepared to explore the most promising shares with big growth potential for the next year.

The article covers the following subjects:

Major Takeaways

- Small-cap companies have a small market capitalization of $300 million to $2 billion.

- The main small cap stock indices are the S&P 600 and Russell 2000.

- In the long term, the S&P 600 is less performing than the blue-chip index S&P 500.

- However, in the short and medium term, individual small cap stocks can yield over 50-70% in a few months.

- The main risks of investing in small cap stocks are greater volatility and instability during recessions.

What Are Small-Cap Stocks?

A company’s market capitalization is its value estimated by investors and expressed by its share market price. This is the value of all its issued shares calculated as follows:

Capitalization = price of one share * number of issued shares

The level of capitalization depends on the market value of shares, which reflects investor interest. Market capitalization does not reflect the real, intrinsic value of the company.

Example: GameStop shares rose sharply due to a short squeeze in January 2021.

The company’s capitalization grew more than 10 times. However, that demand was created artificially, so a rollback to the equilibrium price occurred later.

Based on capitalization levels, companies are conventionally divided into four categories:

- Large caps – over $ 10 billion.

- Mid cap stocks – $ 2 billion – $ 10 billion.

- Small cap companies – $ 300 million – $ 2 billion.

- Micro cap companies – up to $ 300 million.

Small cap equities can be found in almost all industries, from retail and services to technology and industrial sectors.

This division primarily applies to the capitalization of the U.S. stock market and international companies. A similar division exists in other countries and regions, but the criteria may differ because those companies typically have smaller total capitalizations than the U.S. market.

Comparison with Other Stocks Types

Each type of stock has its advantages and disadvantages. These categories are not strictly defined—companies with a $6-7 billion capitalization are still considered small, while businesses worth $8-9 billion continue to be considered large. That is, the growth of capitalization from $2 billion to $6 billion does not fundamentally change the price dynamics. Therefore, the advantages/disadvantages are somewhat blurred, and much depends on the industry, fundamental factors, and the company’s management.

Small-Cap Stocks Versus Large-Cap Stock

Large-cap companies are predominantly blue chips, often included in the well-known indices NASDAQ, S&P 500, or Dow Jones. Large-cap company stocks represent well-established, diversified businesses operating both domestically and internationally, often serving as a barometer for the overall U.S. economy.

|

Small cap stocks |

Large cap stocks |

|

|

Market capitalization |

$300 million – $2 billion |

Over $10 billion |

|

Volatility |

Relatively high |

Relatively low |

|

Liquidity |

Relatively low |

High |

|

Risk |

Comparatively high |

Comparatively low |

|

Growth potential |

Relatively high |

Moderate |

|

Resilience to recession |

Usually unstable due to operating in a single niche segment |

Stable thanks to business diversification, operations in international markets, and access to external borrowing |

|

Dividends |

Usually, there are no dividends, as part of the profit is directed towards company development |

Regular payouts |

Small-Cap Stock vs. Mid-Cap Stock

Mid-cap companies are the “golden mean” between large and small companies.

Investors consider these stocks ‘second-tier,’ yet they inspire high confidence and demonstrate significant growth potential.

Mid-cap and small-cap companies are very similar. Thus, a small organization can sharply increase its value due to financial success and move into another category.

|

Small-cap stocks |

Mid-cap stocks |

|

|

Market capitalization |

$300 million – $ 2 billion |

$2-10 billion |

|

Volatility |

Relatively high |

Moderate, subject to a sector |

|

Liquidity |

Relatively low |

Medium. It may grow due to fundamental factors |

|

Risk |

Comparatively high; eventual downturns |

Moderate; a deeper drawdown may occur compared to large cap stocks |

|

Growth potential |

Relatively high |

Moderate: a chance to upgrade to blue chips. |

|

Resilience to recession |

Relatively weak |

Relatively stable |

|

Dividends |

Often allocated for a company’s development |

Regular payouts |

Small Cap Stock vs. Penny Stock

Penny stocks are stocks that cost less than $5 (according to the SEC classifier). Most often, these shares cost less than $1, so in slang, they are also called “junk.” They are issued by small companies operating in a regional niche and focused on a narrow circle of buyers.

|

Small cap stocks |

Penny stocks |

|

|

Market capitalization |

$300 million – $ 2 billion |

Less than $300 million; a share price may be less than $5 |

|

Volatility |

Relatively high |

Extremely high; often used in short-term trades |

|

Liquidity |

Relatively low |

Extremely low; spreads may skyrocket during a recession |

|

Risk |

Relatively high; however, these stocks are subject to regulatory control as they are traded on stock exchanges. |

Extremely high; OTC trading |

|

Growth potential |

Relatively high |

Moderately high; the release of a new product is likely to attract investor attention, but the company lacks the resources to offer something unique and capture a significant market share |

|

Resilience to recession |

Relatively weak |

High instability, partly due to a lack of interest from institutional investors such as banks and investment funds, and a high dependence on regional counterparties. |

Small Cap Stock Indexes

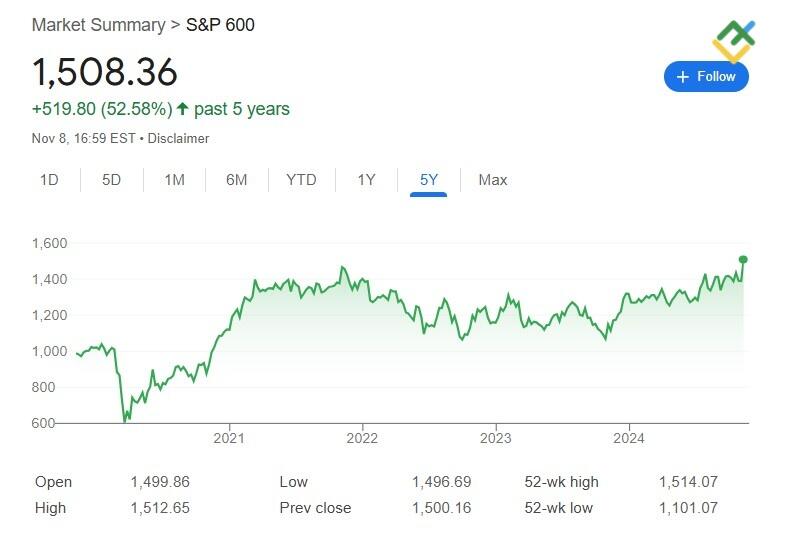

The best-known small-cap indices are the S&P 600 and the Russell 2000. The first index is managed by the U.S., while the second — by the UK. Most of such indices overlap: for example, the S&P 600 is part of the S&P 1500 index.

S&P 600

S&P 600 (Standard & Poor’s 600) is a stock index that includes 600 shares of small American companies. It is used as a benchmark for mutual funds and management companies that invest in small-cap stocks and is considered one of the best indicators of the health of U.S. small businesses. Selection criteria: profitability, liquidity, and market capitalization. Capitalization requirements: $1-7 billion.

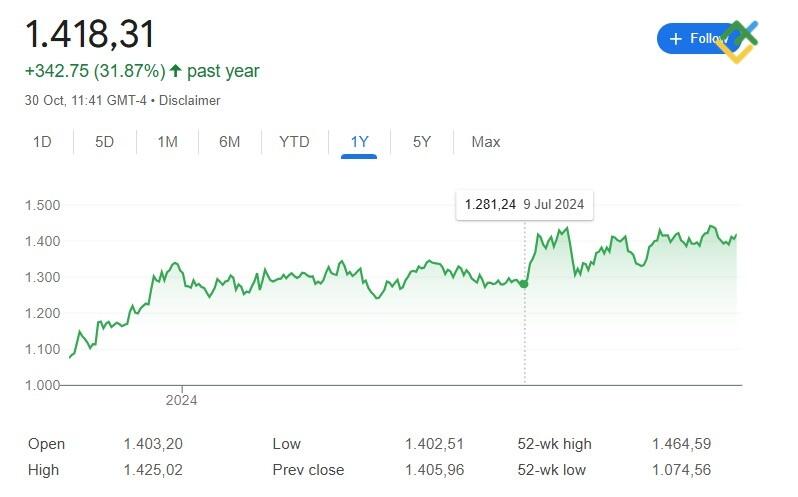

The one-year chart above demonstrates an uptrend for the S&P 600, indicating relatively moderate risks of positional trading: +31.87% since the beginning of 2024 and +44.65% over 5 years. However, the chart also highlights high volatility.

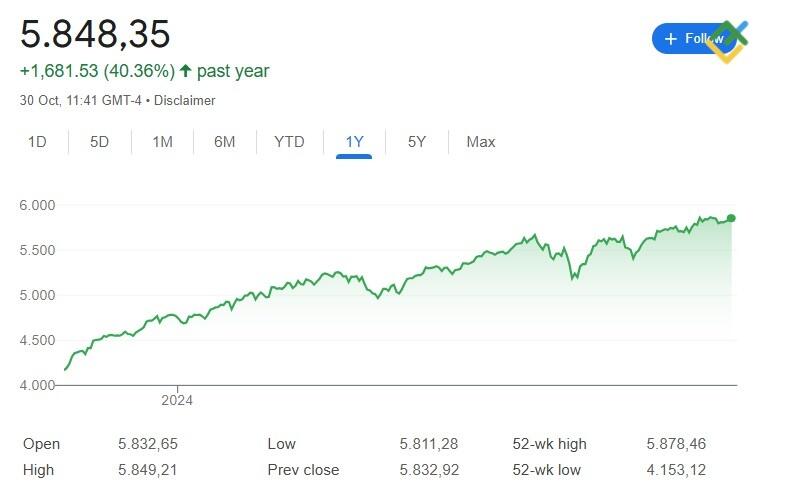

For comparison, let’s take the S&P 500 chart for the same period:

Yearly yield +40.36%, 5 years: +90.70%.

The picture is even worse on the monthly time frame. The S&P 500 grew by 1.50% in October 2024, while the S&P 600 declined by 0.29%.

The S&P 600 can be considered a long-term investment diversification tool. However, it is more suitable for two strategies: trading on local volatility and seeking individual undervalued small cap companies that may become blue chips.

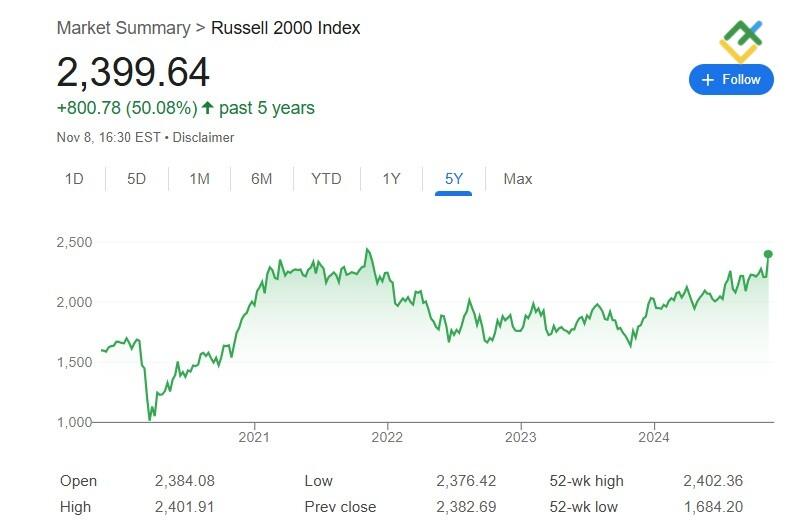

The Russell 2000

The Russell 2000 is a stock index that includes 2,000 small cap American companies. It is part of the Russell 3000 index, covering about 98% of the overall U.S. stock market cap. The Russell 2000 was created to track and evaluate small companies with a capitalization of $100 million – $4 billion. It is managed by the London-based FTSE Russell Group.

Compared to the S&P 600, the Russell 2000 index is considered more objective. Firstly, it includes a larger number of companies. Secondly, it encompasses companies with a capitalization of less than $1 billion, that is, more volatile and with a greater risk. However, the growth trends of these two indices are almost the same on 1-year and 5-year time frames.

Russell 2000:

S&P 600:

Top Small-Cap Stocks

In this section, you will learn about the best small cap stocks that can be held for more than 1 year. These are mainly U.S. companies. Their upside has not yet been exhausted, and while volatility remains moderately high, there are still prospects for growth.

Axon Enterprise Inc (NASDAQ: AXON)

Axon Enterprise Inc. is an American company specializing in developing technologies for ensuring public safety and law enforcement. It was founded in 1993 and is known for producing TASER stun guns used by law enforcement agencies and private individuals.

The company also provides integrated data management systems for police and emergency services, including body cameras, software for collecting and analyzing evidence, and analytical tools like Axon Evidence and Axon Records.

Over the past 2.5 years, the company’s stock has increased fivefold, driven by strong financial results and the implementation of innovative technologies. The company has recently started adopting cloud technologies and artificial intelligence, and these innovations have enabled it to secure government contracts.

The example of Axon Enterprise stock shows well that categorization by market cap is relative. It’s not just about the frequency of index revisions. As of the time of writing, the company’s market capitalization stands at $33.15 billion, well above the typical $2 billion threshold. Back in 2019, the company’s market cap was $4.35 billion. As of the end of 2024, Axon Enterprise shares are part of the S&P 600 Small Cap and S&P 500 (large-cap).

Qualys Inc (NASDAQ: QLYS)

Qualys, Inc. is an American company specializing in cloud cybersecurity solutions. It was founded in 1999, and its primary focus is on providing services for automating vulnerability management processes, securing cloud environments, and monitoring and assessing IT infrastructure security.

With a market capitalization of $5.71 billion, Qualys is included in the S&P 600 index. Over the past decade, 2022 was the company’s worst-performing year, with a decline of 19.97%. 2024 has also been challenging, with the stock down by over 21%. However, in previous years, the company demonstrated capitalization growth: +69.35% in 2023 and +12.04% and +45.7% in 2021 and 2020, respectively.

In the long term, the trend remains upward. The current price pullback from historical highs could be an excellent investment opportunity to consider long positions.

Dorman Products Inc (NASDAQ: DORM)

Dorman Products, Inc. is an American automotive company founded in 1908. It specializes in developing, manufacturing, and distributing auto parts and accessories for post-sale maintenance. Dorman’s product line includes over 118,000 items— components for passenger cars, trucks, and commercial vehicles. The company produces nearly all types of consumables, from engine parts, cooling systems, and braking components to electrical components and interior accessories.

The company’s competitive advantage lies in its wide array of products, which includes unique, innovative developments not available from original equipment manufacturers (OEMs). This makes it easier and cheaper for car owners to find enhanced parts at Dorman’s than to buy OEM parts.

At the time of writing, the company’s market capitalization is $4.04 billion, and its stock is included in the S&P 600 index. However, Dorman faced losses in five out of the last ten years, highlighting high-risk factors. The maximum drawdown of 28.9% occurred in 2022. Despite this, annual growth often compensates for the losses (2016: +52.8%, 2021: +27.49%). In 2024, the company demonstrated over 55% growth in 10 months.

According to analysts, stock prices are currently at an all-time high and are likely to surpass it further.

City Holding Company (NASDAQ: CHCO)

City Holding Company is an American holding company whose shares are included in the S&P 600 index. It provides banking and financial services through its primary subsidiary, City National Bank of West Virginia. Founded in 1982 in Charleston, the company operates in several U.S. states, including West Virginia, Kentucky, and Virginia.

Like any financial company, City Holding Company is highly sensitive to the U.S. financial situation. This is reflected in relatively deep drawdowns on the chart, which can be used for short- and medium-term strategies, such as swing trading (trading on corrections). An additional advantage is the company’s consistent payment of quarterly dividends, with periodic increases.

The long-term trend remains upward. The secret to this success lies in the company’s focus on lending to legal entities in key sectors, such as industry and real estate, and its support for regional businesses. The company’s market capitalization is approximately $1.71 billion, gradually approaching the upper limit for small cap equities. The average annual growth rate of its market capitalization is 15-20%.

Centrus Energy (NYSE: LEU)

Centrus Energy Corp. is a U.S.-based company specializing in uranium enrichment and supplying nuclear fuel for the energy industry. Centrus Energy participates in government projects, including collaborations with the U.S. Department of Energy.

Its market capitalization is $1.38 billion, with a highly volatile performance record. In 2015, the company’s market cap declined by a record 69.15%, followed by drops of 36% and 32% in 2017 and 2022, respectively. However, 2020 saw a remarkable increase of 317.4%, and 2023 brought an 84% gain, resulting in a fiftyfold rise in value since 2019.

Centrus is the only publicly traded company in the U.S. engaged in uranium enrichment that employs American technology and labor. Its stock price is directly influenced by financial results.

Several factors work in the company’s favor:

- Industry giants like Microsoft, Google, and Amazon are investing in nuclear projects.

- Nuclear energy has a strong potential to replace petroleum-based energy sources. While safety and waste storage remain challenging, oil will become increasingly expensive due to resource limitations.

- Centrus plans to sign contracts to supply High-Assay Low-Enriched Uranium (HALEU). The company’s HALEU-class facility, launched in 2023, is the only one in the U.S.

The contracts are predominantly short-term, and market prices remain volatile, which explains the fluctuations in the stock price. Nevertheless, reaching new historic highs is quite plausible, given that the company holds contracts with the U.S. Department of Energy.

Hypoport AG (XETRA: HYQ)

Hypoport AG is a leading provider of digital solutions for Germany’s financial and insurance sectors. The company operates in three main segments: Real Estate & Mortgage Platforms, Insurance Platforms, and Financing Platforms.

Key Products:

- Europace. The largest B2B platform for mortgage lending in Germany. Europace integrates banks, insurance companies, and brokers into a unified cloud-based environment for processing and managing loan applications.

- SMART INSUR. A centralized database with tools for insurance policy management and claims processing.

- Dr. Klein Wowi. A platform designed to optimize financial and operational processes in the real estate sector. It supports property managers and owners in accounting, expense control, document management, and financing, including loans.

The company’s financial results depend highly on consumer prosperity, which tends to decline significantly during crises, reducing demand for credit and insurance products. The sharpest downturns occurred in 2008 (financial crisis) and 2021 (COVID-19 pandemic).

At its historical peak in September 2021, the company’s market capitalization reached $4.66 billion. By 2024, the company had shifted to the small-cap category with a market capitalization of $560 million. However, the chart shows a rising trend toward historical highs, suggesting potential for long-term investment on a 1–2-year horizon.

Algoma Steel Inc. (NASDAQ: ASTL)

Algoma Steel Inc. is one of Canada’s largest steel manufacturers, founded in 1901. The company produces various steel plate products used in automotive manufacturing, shipbuilding, construction, pipelines, and heavy industry.

Algoma Steel is gradually transitioning to electric arc furnaces, which will reduce its carbon emissions by 70%.

The company has several key advantages:

- It went public relatively recently, and it has done so quite confidently. While many young companies demonstrate an initial surge followed by a drop below their IPO price, ASTL has shown stability. The stock chart is volatile, with ups and downs, but there is potential for further growth.

- Algoma Steel is the only Canadian producer of heavy plate mill products used in the construction, mining, mechanical engineering, and defense industries.

- In 2024, the company upgraded its production facilities, expanding its product range and increasing plate mill output by 50%.

Additionally, the company pays dividends. Considering the potential for exports, rising global steel prices, and the gradual increase in ASTL’s stock price, it may be worth considering this company’s shares.

Digi International (NASDAQ: DGII)

Digi International is a U.S.-based company specializing in Internet of Things (IoT) and wireless communication solutions. Products: Routers, network gateways, modules, and software for device connectivity and remote management. Applications: Used in healthcare, agriculture, banking, transportation, and industrial sectors.

The company’s market cap is $1.06 billion as of this writing. At its historical peak, it approached $1.5 billion. The fact that the stock price has retreated from its highs but is now attempting to reach them again makes it a compelling investment for 1-2 years, with a target price of $42-45.

Established in 1985, Digi International remains in the “small-cap” category due to its niche focus. The IoT sector is still relatively unfamiliar to many, and adopting IoT technologies continues to raise questions. However, progress is evident, and the price of DGII shares could surpass its historical highs over the next 5-10 years.

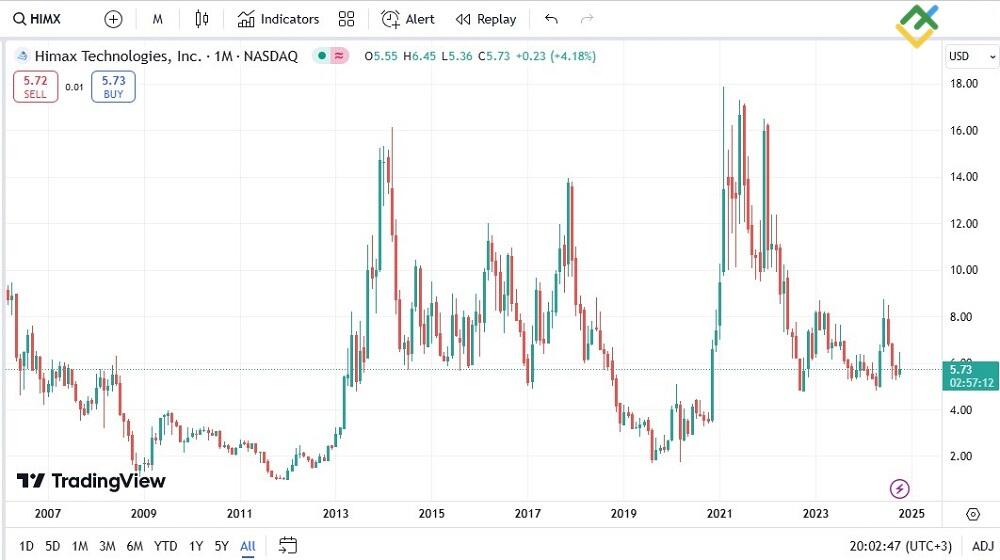

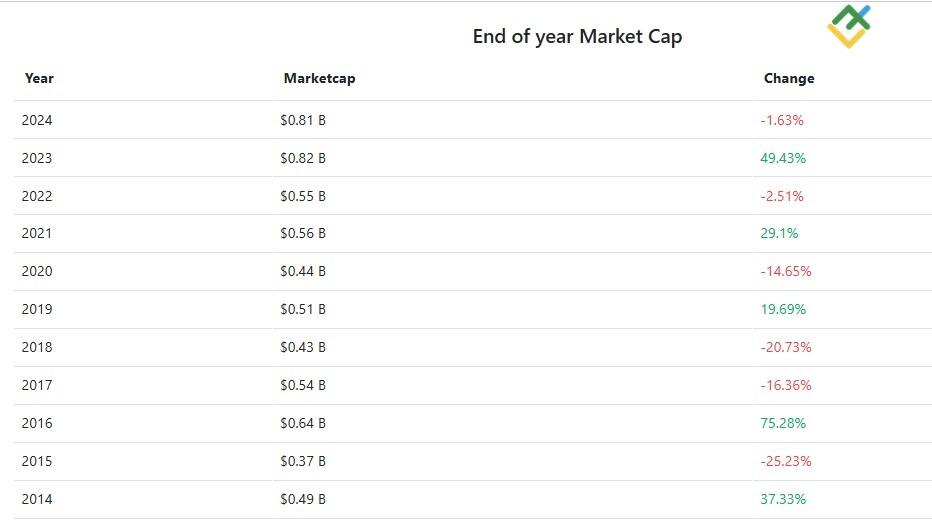

Himax Technologies Inc (NASDAQ: HIMX)

Himax Technologies Inc. is a Taiwanese company with a market capitalization of $1.04 billion, founded in 2001. Specialization: Development and production of semiconductor solutions for displays and optical technologies. It is a leading supplier of Display Driver Integrated Circuits (DDIC), Touch and Display Driver Integration (TDDI) technologies, and 3D sensing solutions, widely used in smartphones, tablets, TVs, and virtual/augmented reality devices.

Over the past 12 years, the stock has experienced multiple fivefold surges and similar declines. While it may not be ideal for long-term investment, buying at lows and selling near historical highs, which the stock has failed to surpass three times, could be effective.

A key factor here is the company’s segment: semiconductors remain one of the hottest topics, unlikely to lose interest in the next 3-5 years. Thus, the price range of $4.7-$5.2 appears to be one of the best entry points for a long position on a 6–12-month horizon, with a take-profit target of $10.5-$11.

Marex Group PLC (NASDAQ: MRX)

Marex Group is a global commodities broker and one of the largest dealers on the London Metal Exchange. Founded in 2005 in the United Kingdom, the company operates in over 20 countries. Core Business: Commodity market brokerage services, trade execution support, clearing, and tailored hedging and investment solutions for corporate clients and institutional investors.

Although not a young company, Marex went public in the U.S. only in May 2024, with an initial market capitalization of approximately $1.3 billion. Its stock price has risen by 55% in the six months since. This strong performance is backed by robust financial results, with revenue growth of 75% in 2023 and a 43.5% profit increase. The company’s shares are worth considering for medium-term investment.

How to Invest in Small-Cap Stocks

Determination and desire to figure small-cap out are all you need. If you truly want to understand the specifics of stock markets, are prepared to be patient, and are willing to dedicate time to learning, then you’ve already completed 50% of the task. The general technical algorithm of investing is analyzed further.

Start trading with a trustworthy broker

Here’s the algorithm for spotting top small cap stocks:

- Review stock charts. Pick companies from the S&P 600 or Russell 2000 indices. Another option is to sort stocks by capitalization on an analytical resource like Companiesmarketcap or another and look through all the charts of companies worth from $100 million to $6 billion.

- Pay attention to the following data:

- Dynamics of cost. Avoid companies that show negative dynamics on a 5- or 10-year time frame. Additionally, if the price has sharply soared in the last 2-3 years and updated the maximums, it may be overvalued, and the prospects for growth may be exhausted.

- When was the IPO? If a company went public 3-5 years ago and is not trending down in the long term, take a closer look at this company. If the IPO was long ago, consider how often the price updates historical maximums. Is there a price range that could be used in channel strategies?

- Check the sector, the main counterparties (suppliers, entrepreneurs), sales markets, etc. The more diversification, the better.

- Financial results and their dynamics: Check out the ROA, ROI, EBITDA, price-to-earnings ratio, P/S ratio, and debt load. The company’s large dependence on borrowed funds is a negative signal.

And do not forget about diversification. Forming a diversified portfolio, including companies from the financial, industrial, technological, and retail sectors, makes sense.

What to Look for When Investing in Small-Cap Shares

When analyzing potentially promising stocks, pay attention to the key points:

-

Industry specifics. Large companies often have diversified businesses, while small companies focus on a specific niche. What matters here is the segment.

For instance, the financial results of a small biotech company will be directly influenced by the outcome of testing a flagship drug. The company’s capitalization can grow or fall by two times or more in a day. A small technology startup working in AR/VR technologies or AI has a better upside. A segment with a significant upside and a future startup may be absorbed by a larger company or receive support from an investment fund.

-

Dynamics of capitalization changes. Evaluate the market cap dynamics over the past ten years for long-term investing. If seven or eight years out of ten have closed with profits, that’s a good signal. It is also important to measure how much stocks declined during crises, such as pandemics or local developments (U.S. elections, the beginning of geopolitical conflicts, etc.)

Be skeptical of stocks growing and breaking all-time highs over the past 2-3 years. Small companies are not giants like Nvidia or MicroStrategy, so a sharp rise can be followed by an equally sharp decline.

Example :

Plug Power Inc. (PLUG) develops innovative technologies for the energy market, specializing in environmentally friendly hydrogen fuel cells that emit only water and air. In 2020, the stock soared amid growing interest in renewable energy sources. In 2022, a deal with Amazon resulted in 14% growth. However, the chart above shows the final result.

Subjective observation: a small-cap company is either young, or its stocks experience strong price “swings.” With a market cap of $1 billion and an average growth of 15% per year, the stock price will surpass the $2 billion value in 5-6 years. If a company has operated for a longer time, it means that either its yield is less than 15% per year, unlikely to draw investor interest, or its shares are highly volatile.

Example. REX American Resources (NYSE: REX)

This biofuel (ethanol and related products) producer was founded in 1980. The chart looks relatively attractive, but only for a long-term investor. This is what the capitalization dynamics look like:

Each positive year alternates with a loss-making year, with more than a 20% drawdown. Although such a company is a high risk for a long-term investor, the uptrend has continued. Capitalizing on the high intra-range volatility for short- and medium-term strategies could make sense.

Advantages and Disadvantages of Small-Cap Stocks

The key point described in many theoretical articles states that large companies are already at the peak of their development, so their shares grow slowly. Nevertheless, such large-cap companies as Nvidia or MicroStrategy refute this statement. In theory, small companies are in the market expansion phase, which makes them more promising. However, practice shows that not all of them succeed. Therefore, the advantages and disadvantages are somewhat subjective and depend on the specific business model of each company.

Advantages

- Potential for growth. If the company is relatively young and has recently gone public, it is supposed to have upside. The “youth” phase is different for each industry, but it generally varies from 3 to 5 years.

For example, a company that has operated since 2000 has only now decided to attract investors’ money. Going public gives the company additional attention, offering investors the opportunity to invest. This creates extra demand for shares. Small companies can grow 30-50% per year, while the growth of large companies will be 15-20%.

- Undervaluation and diversity. There are more small companies than large ones. Since there is less information about them, they are less likely to draw large investor interest, so they remain undervalued. There is still a chance that an investment fund will take notice of such a company, and its shares will surge.

- Flexibility. These are most often niche companies with a relatively simple organizational structure. It is easier for them to restructure and adapt to changes during a recession.

- Affordable entry threshold. Most small companies have relatively low share prices. Large companies are sometimes forced to split their shares due to constant growth.

However, all these advantages mostly refer to individual companies since much depends on the management and the business sector. Some shares lose value after an IPO, while others stabilize within a certain range. Therefore, success depends on choosing the right asset.

Disadvantages

- Weak business diversification. Small companies are most often niche-focused, producing auxiliary products for large corporations. For example, ACM Research produces cleaning equipment for semiconductor manufacturers. InfuSystem Holdings Inc. assembles infusion pumps for hospitals, surgical centers, and oncology clinics. If such companies lose their key customer or a serious competitor appears, their income will reduce drastically.

- High Volatility. Small-cap shares are sensitive to various failures and crises. If such companies report poor financial results or lose their sales markets, investors will likely sell their shares at the earliest opportunity.

- Low liquidity. Smaller size companies have smaller trading volumes than larger companies. Consequently, they are less liquid and have a bigger difference between the buy and sell prices (larger spreads).

- Lack of stable growth. If small-cap shares were constantly growing, they would all have transitioned to the large-cap category. While there are still a few examples, they are rare, making long-term investments in small-cap stocks over a 5–10-year horizon impractical.

- Lack of publicly available information. News aggregators and analytical platforms pay more attention to large companies. Lack of information leads to problems with the objectivity of analysis.

- Limited access to capital. Small companies have fewer resources than large ones and may have difficulty raising capital. This limits their ability to grow on a large scale and makes them more vulnerable during recessions.

The key disadvantage is high risk. If a recession occurs, small companies are more likely to go bankrupt due to the lack of business diversification and investor fear.

Are Small-Cap Stocks a Good Investment?

Let’s analyze the following hypothetical situation:

Among 100 large companies:

- 65 will achieve an annual profit of 15%.

- 10 will incur a loss by year-end.

- 25 will experience modest growth of 3-5% per year.

Among 100 small companies:

- 30 will achieve an annual profit of 40%.

- 30 will incur a loss.

- 40 will experience modest growth of 3-5% per year.

Although the example is hypothetical and the numbers are made up, the idea is that large-cap shares grow more slowly but steadily. Small-cap shares are less stable, but some can show a greater increase in profitability.

Thus, the answer comes down to two points:

- Much depends on the ability to analyze. Your goal is achieved if you buy shares of exactly those 30 small companies that will grow the most. However, the risk of error when analyzing small cap companies is higher.

- Much depends on your goals and attitude to risk. A conservative strategy would consist in investing in the S&P 500 or NASDAQ. A higher-risk strategy would be buying shares of individual small companies.

The most appropriate tactic would be diversifying the investment portfolio by investing 50% in blue chip indices and another 50% — in higher-risk small-cap stocks.

How to Trade Small-Cap Stocks

- Invest in CFDs on shares. Disadvantage: Most Forex brokers mainly offer large cap stocks, and there are swap costs.

- Buy stocks on the exchange via stock brokers. Advantage: Access to thousands of companies’ stocks, including penny stocks. Disadvantage: High commission costs (depository fees, exchange fees, taxes, etc.).

- Invest in ETFs focused on small cap stock. Advantage: Diversification and no need to search for individual stocks.

Strategies for trading small cap stock:

- Trading short-term volatility. Goal: Identify companies whose stock prices move within a defined range, hitting new highs and strong support levels 1-3 times a year. Buy and sell during these fluctuations.

- Long-term investing with risk amortization. Small-cap stocks are highly volatile in the short term, but volatility smooths out over longer periods. Over 5-10 years, small companies may significantly grow, strengthen market positions, and expand product lines, potentially transitioning to medium or large cap and doubling or tripling their stock value.

- Fundamental analysis-based trading. Identify promising sectors, explore companies’ unique products, and forecast factors likely to drive future stock growth.

Example: The shares of Verona Pharma (LSE: VRNA), a small company, tripled in value within three months after the FDA approved their medicine Ohtuvayre (ensifentrine) for treating chronic obstructive pulmonary disease (COPD).

While the major growth phase is likely over, investors tracking the company’s developments tripled their investments.

Conclusion

Let’s sum it up:

- Small cap companies have a total value of $300 million to $2 billion.

- Advantages: the potential to deliver significant growth, i.e., potentially high capital gains.

- Disadvantages: high volatility and greater risk of bankruptcy during recessions.

The optimal strategy is a combination of conservative instruments with riskier ones. For example, investing in major stock indices and small-cap shares. You determine the ratio yourself.

Small-Cap Stocks FAQs

Search for companies included in the Russell 2000 and S&P 600 indices. Or, you can sort companies by capitalization on Finviz or Companiesmarketcap’s analytical platforms and consider those with a capitalization below $6 billion.

Both positive and negative scenarios may play out. Investors tend to trust large companies, considering them more stable, so they will withdraw money primarily from small companies during high inflation, accelerating the fall in their prices. On the other hand, small companies can adapt more quickly to changing market conditions and show better financial results. Much depends on business specifics and competent management.

Yes, they are. These companies are often regional, less liquid, and more volatile. They are at earlier stages of their development and may have fewer resources to maintain stability during a crisis, which makes them more vulnerable to market fluctuations.

From several weeks to several months. Or for more than 10 years. You can capitalize on medium-term volatility or let the company reveal its potential.

Any technical analysis indicator works well on small- and large-cap stock charts. The question is in the settings. Since stocks of small companies are more volatile, it makes sense to take shorter periods to spot faster the beginning of strong impulses. Trend lines, resistance and support levels, and reversal patterns also work well.

The share price of small-cap companies depends mainly on the financial result and investor expectations. Both are influenced by fundamental macro factors and the company’s earnings and performance: optimized management, cost reduction, and sales growth. If the overall market stagnates or some of the company’s financial figures do not show positive dynamics, its shares fall in price.

The ideal candidate is a company that has gone public within the last 12 months, operates in a promising industry, and demonstrates a strong track record of financial performance. A company that can introduce a new searched-for product also has large growth potential. This applies to technology and biotechnology companies.

Small cap companies are less resilient during a crisis, posing greater risks. While it is better to choose blue chips for conservative, long-term investing, small cap companies can have greater growth potential. However, unlike blue chips, shares of small companies can remain unnoticed and undervalued.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.