Will the Reserve Bank of Australia follow the path of its New Zealand counterpart? Will there be a dovish reversal? The markets do not believe in a dovish turn, but could the situation change? Let’s discuss this topic and make a trading plan for the AUDUSD pair.

The article covers the following subjects:

Highlights and key points

- Australia has been slower in raising rates than New Zealand.

- Inflation expectations in Australia are unanchored. This factor makes it possible to count on a cash rate hike.

- Strong employment and inflation will help the AUDUSD pair to soar to 0.69.

Weekly Australian dollar fundamental forecast

In the second quarter of 2024, the Australian and New Zealand dollars were the best performers among the G10 currencies, thanks to the central banks that left the door open for the resumption of the monetary restriction cycle. However, the RBNZ abandoned this idea in July and signaled a rate cut. As a result, the kiwi collapsed. Will the RBA follow this path or remain silent to allow the aussie to compete with the British pound for leadership in the race?

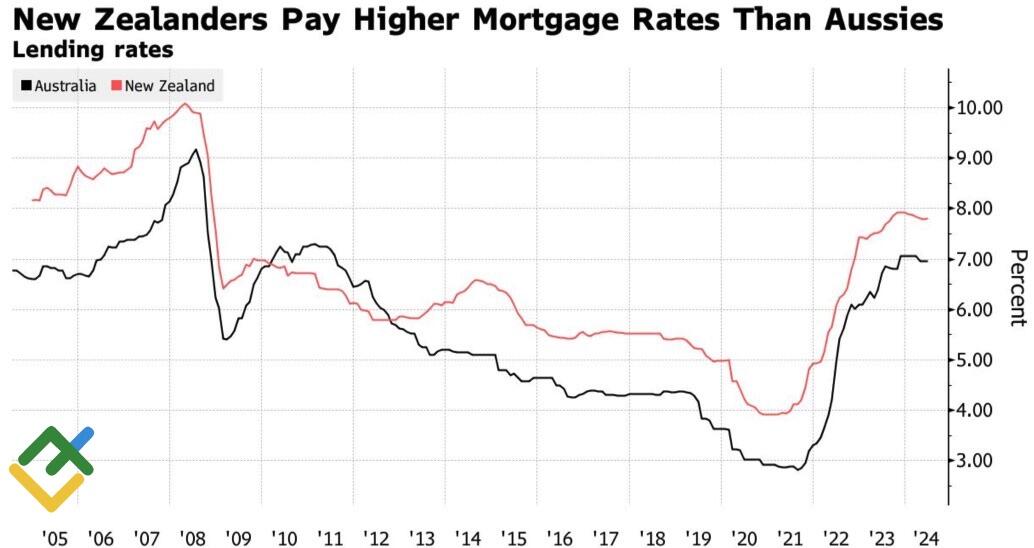

The Reserve Bank of Australia has moved extremely slowly in its monetary tightening cycle. Starting in 2022, it had raised the cash rate from 0.1% to 4.35%, equivalent to 425bp, by October 2023. Wellington stepped faster and more aggressively. Since the beginning of the cycle, the RBNZ key rate has jumped by 525 bp.

RBA and RBNZ interest rates

Source: Bloomberg.

On the one hand, the RBA’s caution helped the Australian economy avoid a recession and helped the labor market maintain its strength. New Zealand failed to dodge a recession. In April-July, its economy likely contracted for the fifth time in the last seven quarters. On the other hand, Australia has failed to anchor inflation expectations, which poses high risks of a return of high prices and keeps the Reserve Bank and investors on edge.

Inflation expectations change

Source: Bloomberg.

The futures market gives a 65% probability that Michele Bullock and her colleagues will raise the cash rate to 4.6% from 4.35% as early as August, although Bloomberg experts predict that the key rate will remain unchanged until the end of the year. When the Fed is set to reduce the cost of borrowing, and the RBA does not exclude a rate hike, the divergence in monetary policy creates a tailwind for the AUDUSD pair.

Even bad news from China, Australia’s main trading partner, cannot cancel it. In June, China’s imports slid by 2.3%, indicating weakness in domestic demand, while GDP grew by only 4.7% in the second quarter. Bloomberg experts expected the indicator to expand by 5.1%. The AUDUSD pair disregarded this data. Most likely, bulls expect that the disappointing statistics are a strong argument in favor of additional fiscal stimulus.

Australia can afford them. According to Treasurer Jim Chalmers, the country is on the verge of the largest surplus in history. This factor may support economic growth and mitigate the effects of monetary policy tightening.

Weekly AUDUSD trading plan

If the Australian labor market data confirms its strength and inflation slows less than expected in the second quarter, the country’s regulator will likely raise the benchmark interest rate. The rate hike will allow the AUDUSD pair to reach the second of the two targets of 0.675 and 0.69 set for long trades. These trades can be kept open. Meanwhile, the growing influence of US politics on the markets is the main risk for this scenario.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.