Bearish drivers that triggered a decline of over 9% in the AUDUSD pair in 2024 continue to exert increasing downward pressure, contributing to a sustained downtrend. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The aussie lost over 9% of its value in 2024.

- The start of the RBA’s monetary expansion cycle is approaching.

- Trade wars will not allow the Australian currency to recover.

- The AUDUSD pair may slip below 0.6.

Weekly Fundamental Forecast for Australian Dollar

Deteriorating global risk appetite, growing fears of a US trade war with China, and the approaching start of the Reserve Bank of Australia’s monetary expansion cycle drove a collapse in AUDUSD quotes by more than 9% in 2024, notching the pair’s worst performance in six years. This decline occurred primarily in the fourth quarter, coinciding with Donald Trump’s victory in the US presidential election. The approach of his inauguration has created a sense of uncertainty, preventing the Australian dollar from strengthening.

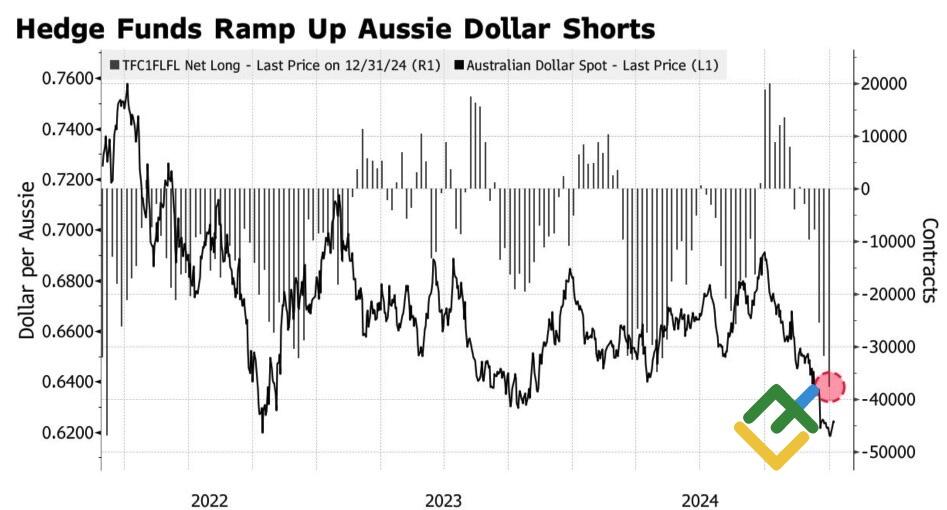

According to Macquarie Bank, if US stock indices continue to fall due to tariff concerns, China’s fiscal and monetary stimulus may be insufficient to stimulate the economy, potentially prompting the RBA to cut interest rates more aggressively. In this case, the AUDUSD pair may collapse to 0.6. Hedge funds align with the bank’s perspective and have rapidly increased net short positions on the Australian dollar to their highest levels since March 2022.

AUDUSD Performance and Speculative Positions on Aussie

Source: Bloomberg.

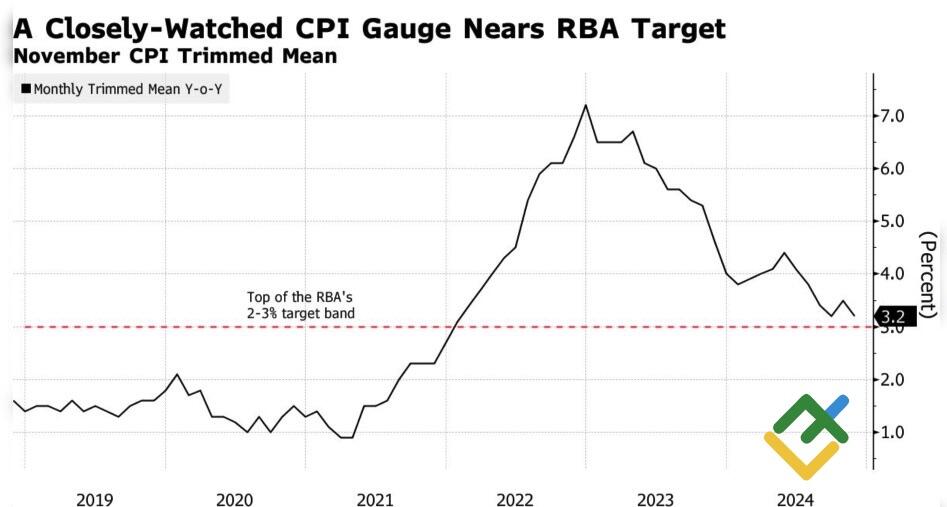

Westpac believes that the minutes of the RBA’s latest meeting, released just before Christmas, indicate that the regulator may cut the cash rate, starting from 4.35%. Following the slowdown in average core inflation from 3.5% to 3.2% in December, the derivatives market has increased the likelihood of this outcome to 70% and is confident in the start of a monetary expansion cycle before April. Capital Economics has revised its forecast of a cash rate cut in May to an earlier date.

Australian Inflation Rate

Source: Bloomberg.

The aussie exhibited a notable shift in value in response to speculative reports regarding tariffs on critical imports, as reported by the Washington Post. The currency gained significantly along with the euro and the pound sterling. However, these gains were erased following Donald Trump’s denial of the reports, coupled with the release of robust US jobs and business activity statistics, which increased the likelihood of a single rate cut by the Fed in 2025. Against this backdrop, the AUDUSD pair embarked on a downward trajectory again.

Suppose the US Federal Reserve remains committed to a single reduction in the federal funds rate this year, and the Reserve Bank of Australia assumes the role of a stabilizing force in an economy grappling with the repercussions of trade wars. In that case, the Australian dollar will likely decline below 0.60. In light of Donald Trump’s criticism of the Washington Post, investors are increasingly opting for a scenario involving substantial tariffs and trade wars, which has revived demand for the US dollar.

Weekly Trading Plan for AUDUSD

The recent decline in US stock indices has exacerbated the situation. These indices exhibit high sensitivity to the rally in US Treasury yields on the back of robust US macroeconomic data. Against this backdrop, the Fed may pause its cycle for a longer period. At the same time, the strong US labor market data will likely drag AUDUSD quotes to the previously announced bearish target of 0.615 or lower. Therefore, the recommendation is to sell.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.