While traders sought to capitalize on the divergence in monetary policy between the RBA and other central banks, AUDUSD bulls saw another avenue for potential gain: rising global risk appetite. Let’s discuss this topic further and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The AUDUSD pair is sensitive to the US stock indices.

- The Reserve Bank of Australia is not planning to cut rates in the near term.

- The US dollar may recover thanks to the FOMC forecasts.

- One can open positions on the AUDUSD pair within the consolidation range of 0.66-0.68.

Weekly Australian dollar fundamental forecast

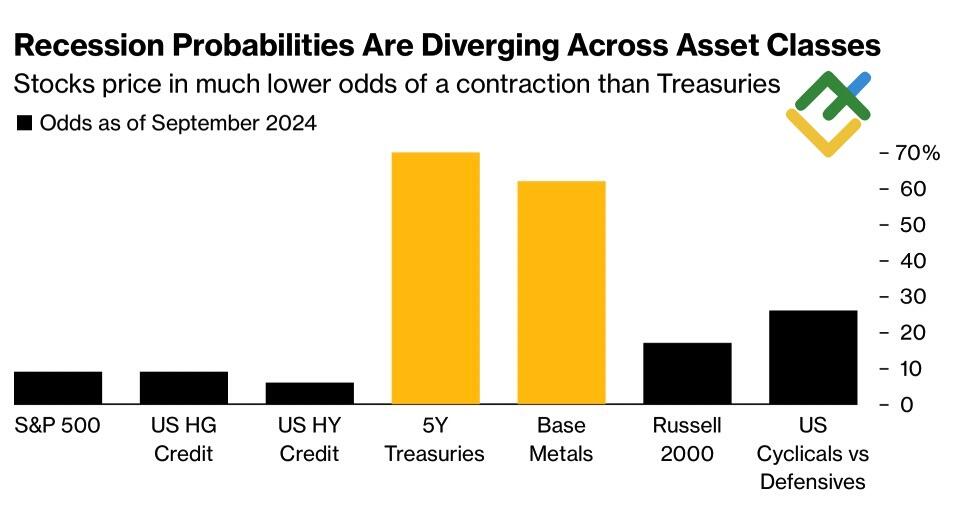

The question on many people’s minds is whether the US economy will slip into a recession. Investors are awaiting the Fed’s decision to cut the federal funds rate by 25 or 50 basis points in September. This has prompted a range of reactions across different asset classes. While there is a sense of caution in commodities and debt markets, equities are more optimistic. The Australian dollar has shown particular confidence in US stock indices, with the AUDUSD pair soaring by almost 6% from its low following Black Monday.

Financial markets and recession probabilities

Source: Bloomberg.

The Australian dollar is a yield currency. Therefore, its value is sensitive to the performance of the S&P 500 and the associated change in global risk appetite. Goldman Sachs has stated that a pullback in the broad stock index by 20% or more is unlikely. Such major shifts have become less common since the 1990s due to an extended business cycle, increased central bank support, and declining volatility. If Goldman Sachs’ assessment proves accurate, the AUDUSD is unlikely to return to its August lows in the near term.

S&P 500 performance and Australian dollar rate

Source: Trading Economics.

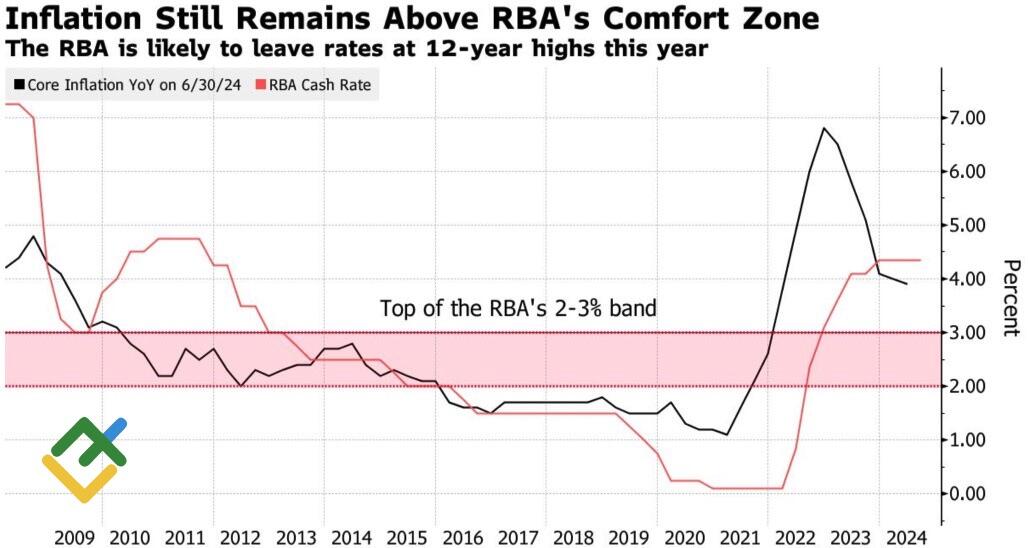

Notably, the Australian dollar has the potential to surprise with an unexpected move. In contrast to the majority of G10 central bankers, the RBA does not plan to reduce the key rate from 4.35% until at least the first half of 2025. RBA head Michele Bullock stated that monetary policy should remain accommodative until inflation reaches the targeted 2-3% range. If the Australian economy continues to grow in line with the RBA’s projections, investors will not see a cut in cash rates in the near term.

Australia’s cash rate and inflation change

Source: Bloomberg.

At the same time, the AUDUSD pair’s rally looks limited. The market is overestimating the scale of the Fed’s monetary expansion in 2024. Once investors recognize that the Fed is not inclined to act hastily, they will likely turn to the US dollar. It would be sufficient for the September FOMC projections to include figures of 50-75 bps rather than the 100 bps that is currently expected by the derivatives market.

The US dollar is likely to receive support from the US presidential election. As November draws closer, uncertainty and volatility will increase, which will benefit safe-haven assets and have a negative impact on the AUDUSD pair. China, Australia’s main trading partner, is unlikely to experience rapid economic growth, and new drivers are needed to achieve new records for the S&P 500 index, which are still difficult to find.

Weekly AUDUSD trading plan

The AUDUSD currency pair will likely undergo a period of consolidation in the range of 0.66-0.68 over the medium term. Therefore, one can sell the pair when it reaches the range’s upper boundary or buy it when it declines to its lower boundary.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.