The slower reduction of the RBA rate compared to the Fed allows AUDUSD bulls to dominate the market. Nevertheless, Canberra’s sluggishness has been well-known. However, Washington may act in a surprising way. Let us consider the potential outcomes and develop a trading plan.

The article covers the following subjects:

Major Takeaways

- The slowing economy forces the RBA to cut rates.

- US trade duties threaten to slow Australia’s GDP further.

- The aussie cannot take advantage of the monetary policy pace.

- The AUDUSD pair continues to plummet toward 0.635 and 0.615.

Weekly Fundamental Forecast for Australian Dollar

When a currency does not strengthen on positive economic news and depreciates against unfavorable news, it offers a clear indication of underlying market trends. The downtrend in the AUDUSD pair remains intact despite the Reserve Bank’s reluctance to cut rates. The disappointing Australian GDP statistics have hit aussie bulls so severely that even strong retail sales figures could not provide enough support to them.

The economy grew by 0.3% q/q and 0.8% y/y in the third quarter, which fell short of the forecasts made by experts at Bloomberg. In addition, government spending was the primary driver of the index’s growth, while consumer spending remained relatively cautious. The data indicate that the Reserve Bank’s GDP forecast of +1.5% for 2024 may be at risk, prompting the derivatives market to increase the likelihood of a cut in the cash rate in April 2025 from 73% to 96%. The estimated scope of RBA monetary expansion by May rose from 28 bps to 35 bps, which dragged the AUDUSD pair lower.

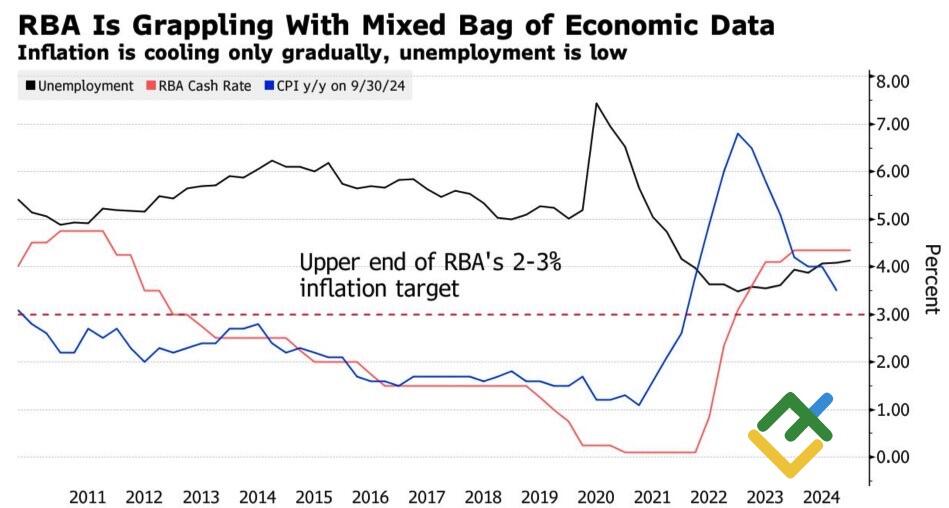

Unemployment, Inflation, and RBA Cash Rate

Source: Bloomberg.

The fresh figures show a 0.6% m/m increase in retail sales in October, which suggests a promising start to the fourth quarter for the economy. However, when the market is dominated by a pessimistic outlook, positive developments are often overlooked.

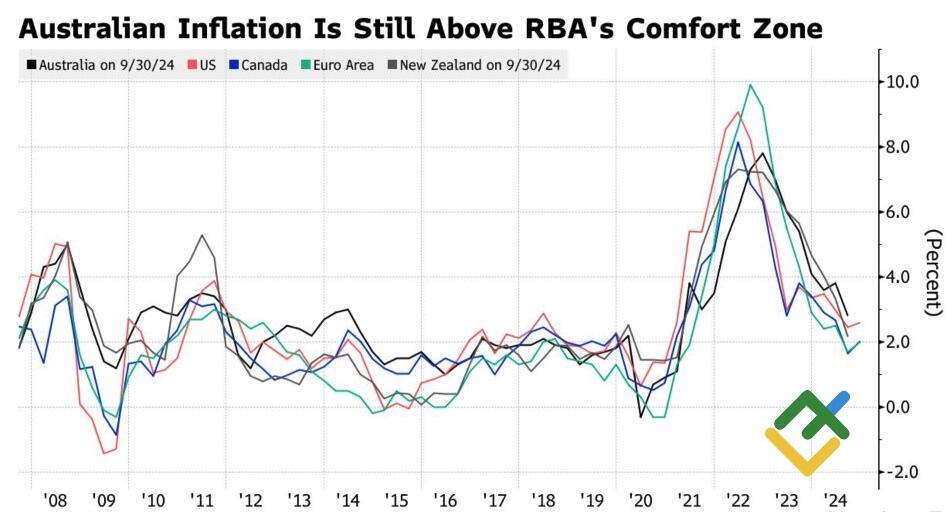

Michele Bullock believes that, in the short term, there is little likelihood of a key rate cut. The Reserve Bank governor acknowledges the continued strength of the Australian labor market, high inflation, and increased government spending. Despite consumer prices slowing from 2.3% to 2.1% in October, average inflation accelerated from 3.2% to 3.5%. The RBA forecasts that inflation will return to the 2-3% target range by the end of 2025, anchoring near 2.5% at the end of 2026. It appears that Canberra will require additional time to achieve its inflation targets.

Inflation Rate in Australia and Other Countries

Source: Bloomberg.

The hawkish rhetoric of the Reserve Bank prompted ANZ to revise its forecasts. The bank anticipates a reduction in the cash rate in April, not in February as previously expected. In addition, the estimated scale of monetary expansion in 2025 has been revised from three to two acts. The slower pace of RBA monetary policy easing in comparison to the Fed, which is expected to cut borrowing costs by 75 bps, should provide support for the AUDUSD exchange rate.

In reality, investors are looking beyond immediate circumstances. The introduction of trade tariffs by Donald Trump against China will slow the Australian economy while also spurring inflation in the US. This will result in a change of trajectory for interest rates, which will favor the Fed and continue to put downward pressure on the AUDUSD exchange rate. Consequently, Goldman Sachs has revised its forecast for Australia’s GDP growth in 2025 from 2% to 1.8%, citing the potential for negative spillover effects from the expected increase in duties on imports from China.

Weekly Trading Plan for AUDUSD

In such conditions, the optimal strategy for AUDUSD traders is to open short trades on upward pullbacks with the targets at 0.635 and 0.615.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.