Altria Group, Inc. is facing declining cigarette sales and significant regulatory pressure, forcing the company to aggressively develop smoke-free products. The company’s revenue grew 1.3% to $5.34 billion in the third quarter of 2024, with earnings per share of $1.38, beating analysts’ expectations. Demand for smokeless products such as NJOY and nicotine pouches on! continues to increase, and the recent FDA approval to sell menthol NJOY has strengthened Altria’s position in this segment.

Despite the high dividend yield, investors should consider the risks associated with further declines in traditional cigarette sales and potential regulatory changes. This article will discuss the key factors that could affect the #MO stock price.

The article covers the following subjects:

Major Takeaways

- The current price of MO is $54.68 as of 13.11.2024.

- The MO price reached its all-time high of $89.4 on 2007-01-11. The stock’s all-time low of $0.3 was recorded on 1970-05-25.

- Altria Group, Inc. continues to confront the challenges of declining cigarette sales and tighter regulation in the tobacco industry. Despite the high dividend yield, analysts remain cautiously optimistic about MO’s potential growth.

- Forecasts for late 2024 vary, with some analysts expecting the MO rate in the $44–$45 range. More optimistic estimates suggest growth to $60 by 2025 and even to $265 by 2029.

- Altria is actively promoting its smokeless products, such as tobacco heating systems and nicotine pouches, to stimulate revenues. However, bans on menthol additives, high excise taxes, and legal risks limit the company’s long-term prospects.

- Given the ongoing hurdles in the tobacco industry, experts recommend investors consider regulatory restrictions and other risks when evaluating the potential of Altria Group shares, despite the attractiveness of dividends the company pays out.

#MO Real-Time Market Status

The MO stock is trading at $54.68 as of 13.11.2024.

Key indicators investors should monitor to keep track of the MO market:

Price change over 12 months.

- Description: The percentage change in share price over the last 12 months

- Purpose: It helps to assess the company’s long-term performance and trends.

Trading volume.

- Description: The number of shares sold and bought during a given period.

- Purpose: High volume indicates increased interest and volatility; low volume indicates weak trading activity.

Market capitalization.

- Description: The total value of all shares of the company in the market.

- Purpose: It reflects the company’s size in the market and affects the attractiveness of the stock among investors.

Price-to-earnings (P/E) ratio.

- Description: The ratio of the current share price to earnings per share.

- Purpose: It helps to evaluate whether a stock is overvalued; a low P/E ratio may point to undervaluation.

Dividend yield.

- Description: The percentage ratio of annual dividends divided by the stock’s current price.

- Purpose: It is important for dividend-focused investors.

Market sentiment.

- Description: Investors’ general perceptions and expectations about the stock.

- Purpose: It affects the supply and demand of stocks. Positive market sentiment can drive prices higher.

News and company-related events.

- Description: Important announcements, financial reports, senior executives changes, and other events.

- Purpose: These events can influence the stock price and perception of the company.

It is important to monitor these indicators to make informed investment decisions and respond to market changes in a timely manner.

Altria Stock Price Forecast for 2024–2025 Based on Technical Analysis

The long-term technical analysis of MO shares for 2024–2025 is performed on the daily chart employing the RSI and MACD indicators.

Support levels:

- Upper support at $49.59: this level has already acted as support, and it is the key level for the short-term trend.

- Medium support level at $44.45: as price history shows, the stock has remained above this level for a long time. If this support is breached, the stock will likely fall further.

- Lower support level at $40.00: this level offers long-term support, and it can be reached in case of a stronger decline.

Resistance levels:

- Current resistance level at $46.35: this level represents a short-term resistance.

- Major resistance level at $54.80: the price has tested this level several times but failed to settle above it.

- Next resistance level at $56.50: this level will act as a strong resistance if the price consolidates above $54.80.

Historically, the company’s stock has posted gains after testing the support area. However, each time the price has approached the resistance level, it has failed to break through it without a significant increase in trading volume or positive news. This suggests that the stock price may breach the resistance against more robust fundamental data.

The RSI (Relative Strength Index):

- The RSI value is around 69.4, which is close to the overbought zone. Usually, the overbought zone starts at 70.

- The RSI is moving towards 70, indicating that the asset is overheated and a correction may occur in the near future. This does not always lead to a trend reversal but warns of a potential slowdown in growth.

MACD (Moving Average Convergence Divergence):

-

The MACD histogram shows a positive value in the green zone, which suggests an upward momentum. The MACD line has crossed the signal line from below, giving a bullish signal.

A positive histogram and crossing lines point to a strong uptrend at the moment.

|

Month |

Altria Group, Inc. (#MO) Projected Values |

|

|

Minimum, $ |

Maximum, $ |

|

|

November 2024 |

48.50 |

56.50 |

|

December 2024 |

48.00 |

56.00 |

|

January 2025 |

49.00 |

54.50 |

|

February 2025 |

48.50 |

54.80 |

|

March 2025 |

47.50 |

55.00 |

|

April 2025 |

46.00 |

55.50 |

|

May 2025 |

46.50 |

56.00 |

|

June 2025 |

47.00 |

56.50 |

|

July 2025 |

48.00 |

57.00 |

|

August 2025 |

49.00 |

57.50 |

|

September 2025 |

50.00 |

58.00 |

|

October 2025 |

49.50 |

57.50 |

|

November 2025 |

48.50 |

56.50 |

|

December 2025 |

48.00 |

56.00 |

The price range is determined based on current support and resistance levels.

Seasonal fluctuations are taken into account. As a rule, the stock will show weak trading activity in early 2025 and become more intense by the summer due to broad market trends.

Upper resistance levels may be tested in mid-2025. However, if the price breaks through them, the stock will likely continue soaring above $57.5.

The projected lows suggest that current support areas will remain intact. The stock may demonstrate a short-term decline if negative market factors emerge.

Long-Term Trading Plan for Altria Group Inc. (#MO)

Let’s build a trading plan for the next three months and a year.

Short-term trading plan

- Buy Limit: $49.50.

- Take Profit: $54.50.

- Stop Loss: $47.00.

These key levels should be taken into account when making trading decisions. They can act as targets for profit taking and areas where signals to open positions may emerge.

Trading plan for 2025

When trading over the long term, it is also advantageous to open long positions:

- Buy on a breakout of the $54.80 level;

- Buy on correction to the support of $44.50;

- Buy on correction to the support of $40.00.

This #MO stock trading plan for 2025 assumes several levels for opening trades. Adhere to the established take-profit and stop-loss levels, as well as take into account the fundamental factors to timely adjust the plan when the market situation changes.

Analysts’ Altria Shares Price Projections for 2024–2025

Analysts are cautiously optimistic about the company’s prospects. Altria’s high dividend yield and ongoing challenges such as reduced demand for cigarettes and stricter regulation are factored into the outlook.

TradingView

Price range in 2024–2025: $45.75–$52.25 (as of 01.11.2024).

According to TradingView, shares of Altria Group (MO) will range between $45.75 and $52.25 in 2024 and 2025. Analysts rate the current situation as neutral and recommend a “hold” on the stock. The company’s EPS is expected to continue to grow and could reach $1.35 by the end of the first quarter of 2025.

|

Month |

Average price, $ |

Minimum, $ |

Maximum, $ |

|

November 2024 |

50.75 |

49.00 |

52.00 |

|

December 2024 |

50.50 |

48.75 |

52.25 |

|

January 2025 |

50.25 |

48.50 |

52.00 |

|

February 2025 |

50.00 |

48.25 |

51.75 |

|

March 2025 |

49.75 |

48.00 |

51.50 |

|

April 2025 |

49.50 |

47.75 |

51.25 |

|

May 2025 |

49.25 |

47.50 |

51.00 |

|

June 2025 |

49.00 |

47.25 |

50.75 |

|

July 2025 |

48.75 |

47.00 |

50.50 |

|

August 2025 |

48.50 |

46.75 |

50.25 |

|

September 2025 |

48.25 |

46.50 |

50.00 |

|

October 2025 |

48.00 |

46.25 |

49.75 |

|

November 2025 |

47.75 |

46.00 |

49.50 |

|

December 2025 |

47.50 |

45.75 |

49.25 |

MarketBeat

Price range in 2024–2025: $50.00–$55.25 (as of 01.11.2024).

MarketBeat estimates that Altria will trade between a low of $50.00 and a high of $55.25. Analysts’ recommendations range from “hold” to “sell,” reflecting a cautious approach to the company’s prospects.

|

Month |

Average price, $ |

Minimum, $ |

Maximum, $ |

|

November 2024 |

51.00 |

50.00 |

52.00 |

|

December 2024 |

51.25 |

50.25 |

52.25 |

|

January 2025 |

51.50 |

50.50 |

52.50 |

|

February 2025 |

51.75 |

50.75 |

52.75 |

|

March 2025 |

52.00 |

51.00 |

53.00 |

|

April 2025 |

52.25 |

51.25 |

53.25 |

|

May 2025 |

52.50 |

51.50 |

53.50 |

|

June 2025 |

52.75 |

51.75 |

53.75 |

|

July 2025 |

53.00 |

52.00 |

54.00 |

|

August 2025 |

53.25 |

52.25 |

54.25 |

|

September 2025 |

53.50 |

52.50 |

54.50 |

|

October 2025 |

53.75 |

52.75 |

54.75 |

|

November 2025 |

54.00 |

53.00 |

55.00 |

|

December 2025 |

54.25 |

53.25 |

55.25 |

CoinCodex

Price range in 2024–2025: $52.00 – $57.25 (as of 01.11.2024).

CoinCodex expects Altria Group shares to trade in the range of $52.00–$57.25 between November 2024 and December 2025. Technical indicators point to a bullish trend.

|

Month |

Average price, $ |

Minimum, $ |

Maximum, $ |

|

November 2024 |

53.00 |

52.00 |

54.00 |

|

December 2024 |

53.25 |

52.25 |

54.25 |

|

January 2025 |

53.50 |

52.50 |

54.50 |

|

February 2025 |

53.75 |

52.75 |

54.75 |

|

March 2025 |

54.00 |

53.00 |

55.00 |

|

April 2025 |

54.25 |

53.25 |

55.25 |

|

May 2025 |

54.50 |

53.50 |

55.50 |

|

June 2025 |

54.75 |

53.75 |

55.75 |

|

July 2025 |

55.00 |

54.00 |

56.00 |

|

August 2025 |

55.25 |

54.25 |

56.25 |

|

September 2025 |

55.50 |

54.50 |

56.50 |

|

October 2025 |

55.75 |

54.75 |

56.75 |

|

November 2025 |

56.00 |

55.00 |

57.00 |

|

December 2025 |

56.25 |

55.25 |

57.25 |

StockAnalysis

Price range in 2024–2025: $48.00–$55.25 (as of 01.11.2024).

According to StockAnalysis, shares of Altria Group (MO) will trade in the range of $48.00 – $55.25. Analysts assess the current market situation as neutral, with a “hold” recommendation on the stock. Forecasts for 2025 indicate possible EPS growth to $1.35.

|

Month |

Average price, $ |

Minimum, $ |

Maximum, $ |

|

November 2024 |

50.00 |

48.00 |

52.00 |

|

December 2024 |

50.25 |

48.25 |

52.25 |

|

January 2025 |

50.50 |

48.50 |

52.50 |

|

February 2025 |

50.75 |

48.75 |

52.75 |

|

March 2025 |

51.00 |

49.00 |

53.00 |

|

April 2025 |

51.25 |

49.25 |

53.25 |

|

May 2025 |

51.50 |

49.50 |

53.50 |

|

June 2025 |

51.75 |

49.75 |

53.75 |

|

July 2025 |

52.00 |

50.00 |

54.00 |

|

August 2025 |

52.25 |

50.25 |

54.25 |

|

September 2025 |

52.50 |

50.50 |

54.50 |

|

October 2025 |

52.75 |

50.75 |

54.75 |

|

November 2025 |

53.00 |

51.00 |

55.00 |

|

December 2025 |

53.25 |

51.25 |

55.25 |

Analysts rate Altria Group (MO) shares as moderately stable, with a projected price range of $45.75 to $57.25 through the end of 2025. Recommendations range from “hold” to “sell,” reflecting the analysts’ cautious outlook. CoinCodex gives the most optimistic forecast, suggesting a bullish market sentiment. However, TradingView and StockAnalysis give more conservative estimates. The average price is estimated to be around $50.75, with a slight upside potential.

For investors focused on sustainable income, Altria stock remains an attractive choice due to the dividend payments. However, given risks such as potential regulatory changes and reduced demand for traditional cigarettes, the stock is unlikely to post significant gains. Given these headwinds, the Altria stock is suitable for long-term investments but less attractive for those expecting rapid growth.

Analysts’ Altria Shares Price Projections for 2026

Analysts are optimistic about Altria stock’s outlook for 2026 while remaining reasonably cautious given current market conditions and the company’s strategic initiatives.

StockScan

Price range in 2026: $28.34–$44.90 (as of 01.11.2024).

StockScan projects that MO will have an average price of $36.62 in 2026. The price will vary between $28.34 and $44.90, suggesting a possible decline in the rate.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2026 |

44.90 |

28.34 |

36.62 |

PandaForecast

Price range in 2026: $36.50–$56.00 (as of 01.11.2024).

According to PandaForecast, the Altria stock is expected to trade between $36.50 and $56.00 in 2026. The average projected price target is $45.28 and a moderate upside is expected.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2026 |

56.00 |

36.50 |

45.28 |

Investing.com

Price range in 2026: $40.50–$57.00 (as of 01.11.2024).

Investing.com analysts anticipate that Altria’s share price will move between $40.50 and $57.00 in 2026. Experts predict a sustainable price trend with insignificant volatility.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2026 |

57.00 |

40.50 |

48.75 |

Analysts expect moderately stable performance for Altria Group (MO) shares in 2026, with a projected price target range of $28.34–$57.00. The average price will fluctuate between $36.62 and $48.75. A stable price trend is expected, but upside potential will likely be limited. The company’s prospects will depend on its ability to adapt to changes in consumer demand.

The high dividend yield makes Altria stock attractive to conservative investors focused on consistent profits. However, the company’s growth will be capped by regulatory risks and evolving consumer behavior. Thus, Altria remains a solid choice for long-term investments.

Analysts’ Altria Shares Price Projections for 2027

Analysts remain conservative on the future of Altria stock given various fundamental factors.

StockScan

Price range in 2027: $30.00–$46.00 (as of 01.11.2024).

According to StockScan‘s forecast, Altria’s average share price in 2027 will be around $38.10. The projected price range is between $30.00 and $46.00, indicating moderate year-over-year growth. However, there remain significant risks associated with tobacco product regulation.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2027 |

46.00 |

30.00 |

38.10 |

PandaForecast

Price range in 2027: $37.00–$58.00 (as of 01.11.2024).

PandaForecast predicts that Altria’s stock price will range from $37.00 to $58.00 in 2027. The average price stands near $47.30. At the same time, analysts expect the company to diversify its business and develop nicotine-free products.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2027 |

58.00 |

37.00 |

47.30 |

MacroTrends

Price range in 2027: $41.00–$60.50 (as of 01.11.2024).

MacroTrends analysts anticipate Altria’s stock to trade in the range of $41.00–$60.50 in 2027, with an average price of $50.25. The projected growth stems from steady demand for the dividend stock and the company’s expanding product portfolio.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2027 |

60.50 |

41.00 |

50.25 |

The outlook for the Altria stock in 2027 remains upbeat, with an expected price range of $30.00 to $60.50. The average price will likely range between $38.10 and $50.25, suggesting moderate growth. Experts believe that the company’s success depends on its alternative products and its ability to attract dividend-oriented investors.

Analysts forecast moderate growth of Altria shares. High dividend yields will continue to attract conservative investors, while business diversification may help mitigate risks associated with regulatory changes and falling demand for traditional tobacco products.

Analysts’ Altria Shares Price Projections for 2028

This section contains Altria Group’s stock outlook for 2028. Most analysts expect a modest increase in the MO rate.

StockScan

Price range in 2028: $32.50–$48.30 (as of 01.11.2024).

According to StockScan, Altria’s average share price in 2028 is expected to be around $39.80. The projected range will be between $32.50 and $48.30. The stock will likely post marginal gains driven by demand for the company’s new products.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2028 |

48.30 |

32.50 |

39.80 |

WalletInvestor

Price range in 2028: $40.00–$59.00 (as of 01.11.2024).

WalletInvestor forecasts that the stock will trade in the range of $40.00–$59.00, with an average price expected to fluctuate near $49.50. The forecast is based on expectations that the company will develop alternative tobacco products and maintain a stable dividend policy.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2028 |

59.00 |

40.00 |

49.50 |

MarketBeat

Price range in 2028: $45.00–$65.00 (as of 01.11.2024).

MarketBeat estimates that Altria’s stock price will trade between $45.00 and $65.00 in 2028, with an average price of $53.00. The projected growth will be driven by conservative investors interested in a stable dividend and nicotine-free product expansion.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2028 |

65.00 |

45.00 |

53.00 |

The outlook for Altria stock in 2028 remains positive, with a price range of $32.50 to $65.00. The average price is expected between $39.80 and $53.00, indicating modest year-over-year growth. Experts emphasize that the company’s success will depend on expanding its range of alternative products and maintaining its dividend policy.

Analysts’ Altria Shares Price Projections for 2029

This section presents Altria Group’s stock outlook for 2029. Analysts offer moderately optimistic estimates.

StockScan

Price range in 2029: $40.00–$58.00 (as of 01.11.2024).

According to StockScan, Altria’s share price is anticipated to range from $40.00 to $58.00 in 2029, with an average price of $49.00. Experts assume sustained growth due to the popularity of Altria shares among dividend-focused investors and further development of the company.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2029 |

58.00 |

40.00 |

49.00 |

TipRanks

Price range in 2029: $38.00–$57.00 (as of 01.11.2024).

TipRanks suggests that the Altria stock price will oscillate between $38.00 and $57.00 in 2029. The average price is projected at $47.50. Analysts expect the company to continue broadening its product range and adjusting to shifts in the market, focusing on tobacco-free products.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2029 |

57.00 |

38.00 |

47.50 |

CoinCodex

Price range in 2029: $42.00–$62.00 (as of 01.11.2024).

CoinCodex estimates that Altria shares will trade in a range of $42.00 to $62.00 in 2029, with an average projected price of $52.00. Analysts expect steady investor demand and business diversification to support MO’s share price.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2029 |

62.00 |

42.00 |

52.00 |

In 2029, the Altria stock will remain a promising investment opportunity, with an expected price range of $38.00–$62.00. The average price will vary within the range of $47.50 to $52.00, indicating stable growth compared to previous years. Experts emphasize that the company should focus on developing alternative products and keeping its dividend policy appealing for investors.

Analysts expect stability and moderate growth for Altria stock through 2029. The high dividend yield will remain attractive for conservative investors, and efforts to diversify the business will help the company cope with regulatory headwinds and shifts in demand.

Analysts’ Altria Shares Price Projections for 2030

In this section, you will find forecasts for Altria Group shares for 2030. Analysts assume modest gains, but risks will persist.

WalletInvestor

Price range in 2030: $44.00–$63.00 (as of 01.11.2024).

Analysts at WalletInvestor anticipate Altria’s stock price will settle at a range of $44.00 to $63.00 by 2030, with an average estimated price of $53.50. Analysts predict that the company will maintain its appeal to investors due to its high dividend yield and efforts to diversify its product line.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2030 |

63.00 |

44.00 |

53.50 |

Panda Forecast

Price range in 2030: $46.00–$66.00 (as of 01.11.2024).

According to Panda Forecast, Altria’s stock price will range from $46.00 to $66.00 in 2030, trading near the average price of $56.00. The forecast is based on expectations of successful alternative product offerings.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2030 |

66.00 |

46.00 |

56.00 |

Stock Raven

Price range in 2030: $45.00–$68.00 (as of 01.11.2024).

Stock Raven estimates that Altria’s stock will trade within a range of $45.00 to $68.00 in 2030. The average price will be about $57.00. The expected growth will be driven by continued investor interest in dividend stocks and the company’s business expansion prospects.

|

Year |

Maximum, $ |

Minimum, $ |

Average, $ |

|

2030 |

68.00 |

45.00 |

57.00 |

The outlook for 2030 remains optimistic, with Altria’s stock price projected to range between $44.00 and $68.00. The average price is expected to be between $53.50 and $57.00, indicating a promising growth trajectory. The company’s success will be driven by its capacity to diversify its business and maintain its market appeal among investors seeking dividend income.

Analysts’ Altria Shares Price Projections until 2050

Long-term forecasts to 2050 are extremely approximate. Altria’s performance will depend on many fundamental factors, including economic conditions, regulatory changes, and technological breakthroughs.

StockScan

Price range: $14.50–$27.47 (as of 01.11.2024).

StockScan predicts a gradual decline in Altria’s share price. According to analysts, the company may face pressure amid a decline in sales of traditional tobacco products. The MO price will decline between 2035 and 2050, with a minimum value of $13.65 by 2045.

MarketTalkz

Price range: $227.01–$1,700.00 (as of 01.11.2024).

Conversely, MarketTalkz analysts expect Altria’s stock price to rise by 2050 due to the company’s efforts aimed at diversifying its products and potential business transformation. The projected compound annual growth rate is estimated to be about 17.44% between 2040 and 2050, with a projected price target of over $1,700 by the end of the period.

CoinPriceForecast

Price range: $50.00–$125.00 (as of 01.11.2024).

CoinPriceForecast holds a more moderate stance, forecasting a steady growth of Altria shares. The company is expected to successfully navigate market changes and expand its product portfolio. The projected average share price by 2050 is $125, which suggests gradual but sustainable appreciation.

|

Year |

StockScan ($) |

MarketTalkz ($) |

CoinPriceForecast ($) |

|

2035 |

27.47 |

227.01 |

50.00 |

|

2040 |

26.06 |

318.93 |

75.00 |

|

2045 |

13.65 |

1,591.95 |

100.00 |

|

2050 |

14.50 |

1,700.00 |

125.00 |

Forecasts for Altria shares extending to 2050 indicate a divergence of opinion, with estimates ranging from rapid growth to significant declines. The actual values will depend on the company’s ability to adapt to market changes and successfully diversify its business operations.

The company’s outlook remains uncertain due to shifts in consumer preferences, regulatory decisions, and the emergence of alternative products. The high dividend yield continues to be an attractive proposition for investors. However, the company will need to undergo a successful transformation and adapt to new market conditions in order to achieve significant market growth.

Market Sentiment for MO (Altria) on Social Media

Media sentiment, or social media sentiment, in trading refers to the analysis of public perception and general mood about the company gathered from social media, news websites, and forums. Analysts use this tool to gauge public perception of a company and predict possible shifts in its share price.

Key metrics of media sentiment:

- Social Volume. The indicator reflects the number of unique mentions of an asset in social media.

- Social Engagement. A metric that shows the community’s activity related to a particular asset. It is calculated based on the number of posts on various platforms, excluding spam. Increased interest indicates greater liquidity of the asset.

- Net Social Media Sentiment. It measures the overall market sentiment, i.e. how positive or negative the social posts about the company are.

Social media mentions about MO (Altria):

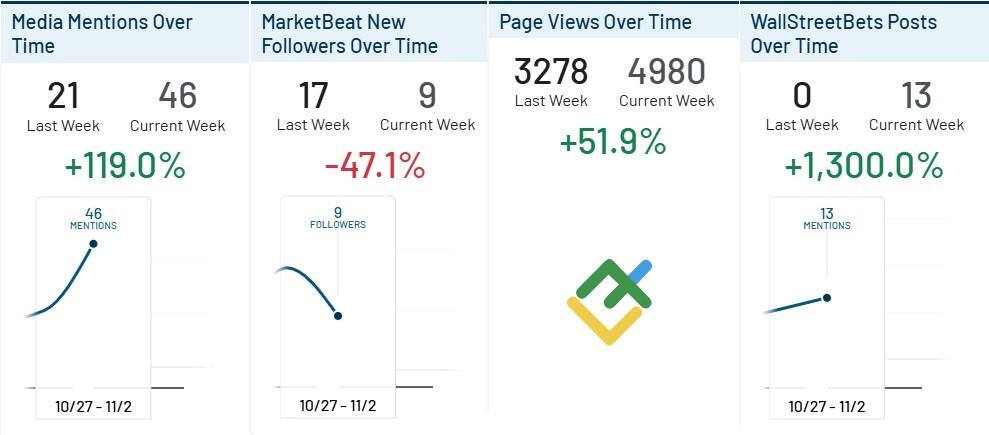

According to MarketBeat, Altria Group (MO)’s social media mentions increased to 46 or by 119% on a weekly basis. Meanwhile, the number of posts on the WallStreetBets platform increased by 1,300% to 13 posts. However, the number of new followers decreased by 47.1%. The company’s total page views increased by 51.9% to 4,980 views.

The data indicates a notable increase in interest in Altria on social media, which may suggest that investors and traders are becoming increasingly engaged with the company. However, the decline in the number of new followers may suggest that the interest is transient or linked to specific occurrences.

There is a marked increase in the number of posts and reactions to Altria shares on the X platform, particularly in light of the MO rate hike at the end of October 2024. Based on the mentions, the following key perspectives can be identified:

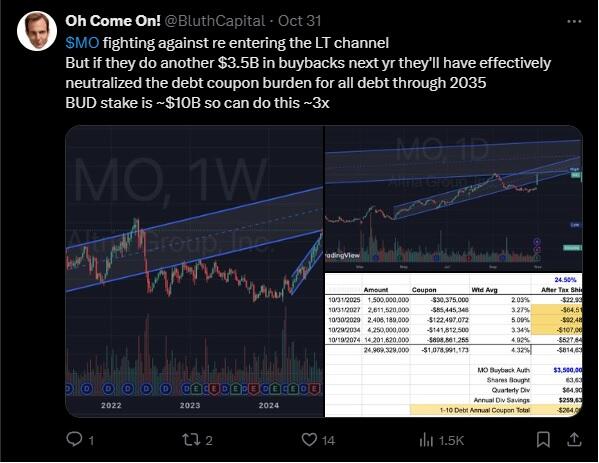

-

There is a prevailing sense of optimism and anticipation for continued growth. Many X users have noted Altria’s positive outlook, citing the company’s share repurchase program as a key factor. The company has announced plans to invest a further $3.5 billion in buybacks, which is expected to improve its financial position. Such financial maneuvers enhance confidence in the company.

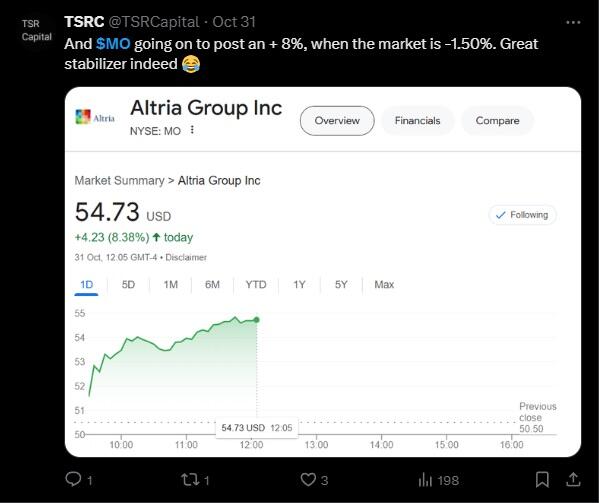

-

Despite the overall market decline, Altria Group has demonstrated a notable growth of 8%. This reinforces its position as a “stabilizer” in investors’ portfolios during periods of market turbulence.

The positive sentiment on social media, particularly in light of the company’s robust performance during market turbulence, indicates that investors have considerable confidence in Altria. The stock may attract short-term traders, which could potentially lead to increased volatility. However, the key factors that will drive long-term growth are the continued implementation of the buyback program and the perception of Altria as a stable company offering a high dividend yield. If the current enthusiasm persists, the growth will be supported in the short term as well.

MO Price History

Altria(MO) reached its all-time high of $89.4 on 2007-01-11.

The lowest price of Altria(MO) was recorded on 1970-05-25 when the stock declined to $0.3.

It is essential to evaluate historical data to make our predictions as accurate as possible.

Shares of Altria Group (ticker MO) have seen significant fluctuations over the past few years, driven by both corporate decisions and external factors.

In 2008, the MO stock declined sharply after Kraft Foods and Philip Morris International separated from Altria.

In June 2017, the stock price reached $77.78 but dropped after the US Food and Drug Administration announced new regulations on tobacco and nicotine products.

In 2018, the MO stock slumped below $50 due to difficulties with product diversification as well as losses after investments in Cronos Group and JUUL.

In 2019, the downtrend continued despite a temporary uptick following the report on increased quarterly earnings.

In 2020, the COVID-19 pandemic affected the company’s performance negatively.

In 2021, the MO stock showcased stability, with the price reaching the $52 mark. However, analysts were cautious about forecasting significant growth, citing regulatory pressures and high competition as potential obstacles.

In 2022, the company adapted to a challenging regulatory environment but faced significant industry challenges, including reduced demand for nicotine products.

In 2023, Altria continued its diversification efforts, but structural challenges in the tobacco industry persisted.

In 2024, the company reported net income per share of $1.21 for Q1 2024, exceeding analysts’ expectations. In Q2 2024, Altria posted revenue growth of 1.3%, reaching a total of $5.34 billion, beating analysts’ forecasts.

In October 2024, the company announced a 4.1% increase in its quarterly dividend to $1.02, marking the 55th consecutive annual increase.

These developments have reinforced Altria’s market position and attracted a significant number of investors.

It is crucial for Altria Group to maintain stability by continuing to adjust its business strategy and expand its product range. Analysts have indicated that structural challenges in the tobacco industry are likely to persist and that Altria’s future results will depend on the company’s ability to respond effectively to these challenges.

MO Shares Fundamental Analysis

Investors should consider many fundamental factors affecting Altria’s stock value before purchasing it. MO’s value depends not only on the company’s financial performance and corporate strategies, but also on external factors such as regulatory changes, economic conditions, and technology advances.

What Factors Affect the MO Stock?

- Compliance with legislation. The tobacco industry, where Altria Group is a leader, is highly regulated. New regulatory measures, advertising restrictions, and health and wellness initiatives could adversely affect the company’s revenues and share price. Changes in this area may both limit and open new opportunities for Altria’s operations.

- Market trends and changing consumer behavior. Growing interest in healthy lifestyles poses challenges for Altria as demand for traditional tobacco products gradually declines. To maintain stability, the company is actively developing nicotine-free products and reduced-risk nicotine delivery systems. Success in this area will influence the long-term sustainability of the business and the attractiveness of Altria’s stock.

- Economic conditions. Household income figures, tax policies, and international trade agreements can directly affect a company’s sales and profitability. Economic downturns can reduce Altria’s revenues, while favorable economic conditions generally have a positive impact on its business.

- Technological advances and innovation. Technological advances are playing an increasingly important role in the tobacco industry. Altria’s investments in research and development, particularly in e-cigarettes and other technology, may provide the company with access to new markets and revenue streams. Success in innovations such as smokeless and e-cigarette devices could be critical to MO’s future share price appreciation.

- Financial performance and dividend policy. A company’s financial strength and ability to pay dividends are important criteria for yield-oriented investors. Altria is known for its high dividend yield, and deviation from this policy could negatively affect MO’s price.

More Facts About Altria

Altria Group, Inc. is one of the largest tobacco companies in the US. It was founded in 1985. The company traces its origins to Philip Morris Companies Inc. which was renamed Altria in 2003. Altria is primarily known for its production of cigarettes under the Marlboro brand, which remains one of the best-selling cigarettes in the world. However, the company has diversified its assets to go beyond traditional tobacco products.

Altria has a diversified business portfolio that encompasses a range of industries, including tobacco, cigars, and smokeless nicotine products. In recent years, the company has made substantial investments in new technologies and products in Cronos Group and JUUL Labs. These investments enable the company to navigate changing consumer preferences and facilitate growth.

Altria’s reputation among traders is based on its consistent dividend policy and attractive yield. The company is renowned for its generous dividends, which make it an attractive addition to any investment portfolio. Furthermore, its capacity to evolve in response to market shifts and sustain high profitability despite regulatory constraints is a key draw for new investors.

Advantages and Disadvantages of Investing in MO

Advantages:

- High dividend yield. Altria is renowned for its consistent and generous dividend policy. The company has a proven track record of increasing dividends over decades, providing its shareholders with a reliable source of passive income.

- Industry leader. Altria is a prominent heavyweight in the tobacco industry, with its Marlboro brand remaining one of the most popular in the world. This enables the company to maintain its market dominance despite intensifying competition and evolving consumer preferences.

- Diversification and adaptation. Altria is pursuing a strategy of expansion through the introduction of alternative nicotine products and smokeless devices. This initiative is designed to offset the decline in demand for traditional cigarettes.

- Hedge against inflation. As a rule, tobacco companies raise product prices to offset rising costs. This helps Altria maintain profitability despite rising inflation.

Disadvantages:

- Regulatory risks. The tobacco industry is subject to extensive regulation, and the introduction of new restrictions could have a detrimental impact on Altria’s revenue streams. For instance, the regulation of flavored cigarettes or restrictions on advertising could harm demand for the company’s products.

- Decreased demand for tobacco products. As consumers increasingly prioritize healthy lifestyles, the demand for traditional cigarettes is gradually declining. This is prompting Altria to pursue new avenues for growth, though there is no guarantee of success.

- High debt load. Altria has significant debt obligations, partly related to its recent investments. The company’s high debt load may restrict its flexibility and future investment capacity.

- Uncertain market response to new products. While the company is actively investing in alternative products, there is no guarantee that these new products will succeed in a highly competitive market. Should they fail to meet expectations, the company will suffer losses.

How We Make Forecasts

We employ a blend of fundamental and technical analysis to build our forecasts for Altria (MO) stock, examining short-, medium-, and long-term estimates from prominent analytical agencies.

Short-term forecasts:

We analyze current market sentiment and macroeconomic data, including changes in demand, social media sentiment, and the company’s financial reports for recent quarters. Technical analysis plays a key role at this stage.

Medium-term forecasts:

For medium-term forecasts, we focus on more consistent economic and industry trends such as regulatory changes and consumer preferences. The company’s past performance and macroeconomic conditions such as inflation and interest rates are considered.

Long-term forecasts:

Long-term forecasts are based on Altria’s strategic plans, including business diversification and investments in alternative products. We also consider global economic trends and growth prospects in the industry. Although these forecasts are only approximate due to many unpredictable factors, they provide insights into the company’s direction in the face of market changes.

Conclusion: Is Altria (MO) a Good Investment?

Altria (MO) allures investors with its stable dividend yield and strong position in the tobacco market. Altria has shown resilience to market and economic changes, making it attractive to conservative investors. However, a potential investment in this asset also requires consideration of certain risks, such as strict regulatory hurdles and reduced demand for traditional tobacco products.

Altria seeks to tailor itself to new trends and is developing alternative directions to support its long-term prospects. Investments in alternative technologies allow the company to remain competitive despite challenges in the industry.

Altria represents an attractive long-term investment opportunity for those prepared to navigate potential fluctuations related to regulatory changes and seeking a stable source of income in the form of dividends.

Altaria Price Prediction FAQ

Creating a forecast can take from a few days to several weeks. Analysts study company reports, economic indicators, and market trends to draw informed conclusions.

The main factors are regulatory changes, demand for tobacco and alternative products, and economic stability affecting consumer spending and company investments.

Long-term forecasts are less accurate because they depend on many factors, including changes in consumer behavior and regulatory conditions, as well as global economic trends.

As of November 1, 2024, Altria has a market capitalization of approximately $95.7 billion.

Price chart of MO in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.