Alibaba is one of the largest companies in the e-commerce and cloud technology sectors. However, its shares remain under pressure amid stricter regulations, technology export restrictions, and economic turbulence in China. Despite these external challenges, the company continues to develop strategic business areas and invest in cloud infrastructure, AI technologies, and international projects.

Although Alibaba shares have declined, analysts remain moderately positive about the long-term outlook. Fundamental factors such as growing global market share and business model diversification are the main drivers of BABA’s recovery and sustainable growth.

The article covers the following subjects:

Major Takeaways

- The current price of BABA stands at $120.68 as of 26.05.2025.

- The highest BABA price of $319.32 was reached on 27.10.2020, while the all-time low of $57.2 was set on 29.09.2015.

- Alibaba’s share price is influenced by domestic demand, the expansion of cloud solutions, increased competition in e-commerce, and geopolitics. The BABA share price is also affected by regulatory developments in China, US export restrictions, and the overall state of the global economy.

- Forecasts for 2025 remain widely divergent. Optimistic estimates suggest that the price will climb to $147–$156. More cautious projections point to a decline to $70–$90.

- Long-term projections for 2026–2030 vary widely. Paisakit expects the asset to surge to $383, while CoinPriceForecast anticipates a jump to $319. However, StockScan predicts a plunge to $47. Some experts foresee a significant slump to $16, while other analysts envision a rapid increase to $500. This diverse outlook highlights the volatility of the asset and the need to conduct a fundamental analysis before making investment decisions.

BABA Real-Time Market Status

BABA is trading at $120.68 as of 26.05.2025.

To assess Alibaba’s current performance, investors should monitor key metrics such as market capitalization, trading volume, and dividends. These metrics help determine investor interest in the asset, its actual value, risk tolerance, and upside potential.

|

Indicators |

Values |

|

Market cap |

$290.38 billion |

|

24-hour trading volume |

$22.9 million |

|

All-time high |

$319.32 |

|

Price change over the last 12 months |

+52.7% |

|

Shares outstanding |

2.39 billion BABA |

|

Dividend yield |

0.83% |

BABA Stock Forecast for 2025 Based on Technical Analysis

The daily chart of Alibaba (#BABA) shows a consolidation just below the resistance of $126, which has repeatedly triggered bearish price reversals, as highlighted by the blue marks below. Recently, the asset tested the support of $115 before bouncing higher.

Technical indicators point to market uncertainty. The RSI value of 49.8 is close to the neutral zone, and the MACD indicator is forming a potential bearish crossover. The EMA and SMA lines are converging, signaling a possible momentum shift. The Bollinger Bands are narrowing, suggesting that the price may break through the current trading range. In case of a breakout above $127, the price may continue to climb to $134 and $144. If the stock falls below $115, it is advisable to refrain from long trades.

The table below shows the forecast for the BABA exchange rate for the remainder of 2025.

|

Month |

Minimum, $ |

Maximum, $ |

|

June |

115 |

128 |

|

July |

113 |

130 |

|

August |

110 |

127 |

|

September |

108 |

125 |

|

October |

105 |

128 |

|

November |

110 |

133 |

|

December |

114 |

140 |

Long-Term Trading Plan for #BABA for 2025

The main strategy suggests trading within the range of $115–$126. Long trades can be opened near $115–118 once the rebound is confirmed. You can also open long trades if the price breaks through and settles above the $127 level. Profit targets are $134 and $144.

If the price plunges below $112, avoid opening long trades. Long positions can be opened at the $105 level, once a bullish signal is confirmed by technical indicators. The RSI value above 55 and a bullish MACD crossover are effective signals to initiate long trades.

This trading strategy requires flexibility. Besides, it is crucial to monitor market volatility and keep up with the news.

Analysts’ BABA Stock Price Projections for 2025

Analysts’ forecasts for Alibaba shares in 2025 vary widely. Some experts anticipate a significant recovery amid China’s economic growth, while others expect increased volatility.

StockScan

Price range: $98.73–$234.1 (as of 22.05.2025).

StockScan forecasts significant fluctuations in the BABA exchange rate, with the highest price anticipated in December at $234.1. The growth is expected to be uneven and characterized by varying activity levels. This volatility may stem from shifts in demand, geopolitical risks, and uncertain expectations regarding China’s macroeconomy.

|

Month |

Average, $ |

Minimum, $ |

Maximum, $ |

|

June |

113.3 |

98.73 |

117.5 |

|

July |

131.1 |

106.6 |

136.9 |

|

August |

172.2 |

122.6 |

179.2 |

|

September |

164.1 |

152.1 |

178.0 |

|

October |

194.3 |

158.3 |

212.0 |

|

November |

207.8 |

178.2 |

208.8 |

|

December |

219.5 |

199.1 |

234.1 |

Paisakit

Price range: $201.02–$224.60 (as of 22.05.2025).

Paisakit anticipates steady progress. The price is expected to more than double due to the recovery of the Chinese economy, international expansion, and strengthening positions in the cloud and AI segments. The average price of $212.81 indicates a smooth but consistent movement.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2025 |

201.02 |

212.81 |

224.60 |

CoinPriceForecast

Price range: $128–$172 (as of 22.05.2025).

CoinPriceForecast expects BABA shares to strengthen gradually, climbing to $172 by December amid a recovery in operating margins and an improvement in domestic consumption in China. The momentum is expected to be moderate, with no sharp spikes or slumps.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2025 |

128 |

172 |

Analysts’ BABA Stock Price Projections for 2026

Views on 2026 remain sharply divided. Some analysts see BABA steadily climbing above $280, while others warn the stock may lose more than half its value.

StockScan

Price range: $69.62–$226.50 (as of 22.05.2025).

StockScan projects elevated volatility for BABA in 2026, with the stock expected to trade in a downtrend. The forecast points to a December low of $69.62, a steep drop that signals growing instability, likely tied to geopolitical tensions, tighter tech regulation in China, or declining profitability.

|

Month |

Average, $ |

Minimum, $ |

Maximum, $ |

|

January |

192.1 |

168.0 |

226.5 |

|

February |

176.4 |

168.7 |

187.3 |

|

March |

160.7 |

127.9 |

177.1 |

|

April |

181.9 |

164.4 |

192.5 |

|

May |

158.7 |

144.6 |

177.9 |

|

June |

143.1 |

139.6 |

160.3 |

|

July |

130.3 |

125.2 |

165.7 |

|

August |

133.3 |

129.9 |

144.6 |

|

September |

128.6 |

120.9 |

153.1 |

|

October |

119.9 |

102.9 |

139.4 |

|

November |

91.23 |

76.84 |

122.1 |

|

December |

73.33 |

69.62 |

102.6 |

Paisakit

Price range: $262.45–$284.72 (as of 22.05.2025).

Paisakit maintains its bullish outlook for Alibaba shares. The asset is expected to hit a high of $284.72, driven by expanding influence in foreign markets and investments in infrastructure and the technology sector. Moreover, analysts still consider the shares to be undervalued.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

262.45 |

273.58 |

284.72 |

CoinPriceForecast

Price range: $195–$217 (as of 22.05.2025).

CoinPriceForecast predicts moderate and sustainable appreciation. The price is expected to soar to $217 by December, buoyed by increased revenue.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2026 |

195 |

217 |

Analysts’ BABA Stock Price Projections for 2027

Estimates for 2027 are mixed. Some experts anticipate a decline below $5, while others predict gains toward $310. Such a discrepancy indicates significant uncertainty regarding Alibaba’s future.

StockScan

Price range: $4.14–$108.10 (as of 22.05.2025).

StockScan offers an extremely pessimistic forecast, predicting BABA’s share price to tumble to $4.14 by June. Experts point to a dramatic loss of investor confidence due to sanctions pressure, restructuring, or corporate management issues.

|

Month |

Average, $ |

Minimum, $ |

Maximum, $ |

|

January |

103.8 |

64.08 |

108.1 |

|

February |

67.19 |

66.85 |

104.5 |

|

March |

49.95 |

36.15 |

67.75 |

|

April |

60.23 |

38.63 |

67.36 |

|

May |

51.68 |

39.12 |

65.61 |

|

June |

31.06 |

29.79 |

59.26 |

|

July |

40.06 |

4.14 |

55.17 |

|

August |

18.56 |

17.47 |

50.41 |

|

September |

26.48 |

10.68 |

35.79 |

|

October |

36.33 |

25.35 |

54.72 |

|

November |

55.66 |

37.15 |

60.51 |

|

December |

30.45 |

23.47 |

50.45 |

Paisakit

Price range: $297.29–$309.86 (as of 22.05.2025).

Paisakit believes that #BABA shares will recover to their highs. The average price is estimated at $303.57. The recovery will be supported by the company’s dominance in the e-commerce segment and its expansion into new markets. According to the platform, the company will remain a technology giant capable of innovating its business.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

297.29 |

303.57 |

309.86 |

CoinPriceForecast

Price range: $256–$259 (as of 22.05.2025).

CoinPriceForecast anticipates that the BABA price will steadily increase without any abrupt jumps. This optimistic outlook is based on the potential increase in the company’s revenue due to its expansion into new markets.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2027 |

256 |

259 |

Analysts’ BABA Stock Price Projections for 2028

Estimates for 2028 diverge significantly. Some experts believe that Alibaba will soar to new heights, while others predict that the price may plummet to almost zero. Thus, investors should carefully study the fundamental factors before making any decisions.

StockScan

Price range: $69.62–$226.5 (as of 22.05.2025).

StockScan gives a pessimistic outlook. In March, the price may plummet to $1.50 but then begin to recover. This forecast assumes a complete collapse of confidence in the company, possibly linked to geopolitical events. The likelihood of such a scenario is extremely low, but analysts do not rule it out.

|

Month |

Average, $ |

Minimum, $ |

Maximum, $ |

|

January |

28.28 |

22.79 |

40.93 |

|

February |

17.27 |

13.56 |

31.72 |

|

March |

1.86 |

1.50 |

23.77 |

|

April |

14.58 |

1.88 |

24.56 |

|

May |

25.74 |

13.97 |

34.87 |

|

June |

60.75 |

26.50 |

60.95 |

|

July |

45.34 |

44.48 |

62.39 |

|

August |

25.65 |

25.02 |

48.24 |

|

September |

46.24 |

22.58 |

48.35 |

|

October |

27.52 |

24.79 |

46.53 |

|

November |

29.57 |

22.87 |

36.13 |

|

December |

29.45 |

28.74 |

39.99 |

Paisakit

Price range: $320.18–$338.50 (as of 22.05.2025).

Paisakit expects BABA shares to grow steadily in 2028. The average price is expected to be $329.34. Experts anticipate the stable expansion of the company, the implementation of cloud technologies in its business, and the conclusion of international partnerships. Alibaba is expected to regain investor confidence and solidify its position in global trade.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

320.18 |

329.34 |

338.50 |

CoinPriceForecast

Price range: $262–$267 (as of 22.05.2025).

CoinPriceForecast presents an upbeat outlook, anticipating the price to surge to $267, bolstered by the company’s robust revenue stream and diversification strategy.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2028 |

262 |

267 |

Analysts’ BABA Stock Price Projections for 2029

Forecasts for 2029 are also different, reflecting deep uncertainty around BABA’s long-term outlook. Analysts’ estimates range from a drop to $19 to a potential rally toward $355, highlighting just how divided expert opinions remain.

StockScan

Price range: $19.55–$49.61 (as of 22.05.2025).

StockScan believes that BABA will continue to slide due to potential legal restrictions and pressure on technology companies.

|

Month |

Average, $ |

Minimum, $ |

Maximum, $ |

|

January |

49.27 |

28.94 |

49.61 |

|

February |

37.73 |

34.57 |

49.35 |

|

March |

35.78 |

35.53 |

44.99 |

|

April |

33.53 |

31.76 |

38.31 |

|

May |

33.27 |

28.93 |

37.24 |

|

June |

25.31 |

23.44 |

38.55 |

|

July |

29.63 |

21.80 |

29.91 |

|

August |

25.29 |

19.55 |

29.01 |

|

September |

29.89 |

23.52 |

31.86 |

|

October |

27.06 |

25.57 |

32.18 |

|

November |

24.80 |

24.09 |

30.96 |

|

December |

26.92 |

25.05 |

32.86 |

Paisakit

Price range: $346.73–$355.28 (as of 22.05.2025).

Paisakit maintains its bullish stance, estimating potential appreciation to $355 in light of market expansion and technological upgrades. Experts anticipate that Alibaba’s profits will also increase.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

346.73 |

351.00 |

355.28 |

CoinPriceForecast

Price range: $275–$293 (as of 22.05.2025).

CoinPriceForecast expects moderate but solid gains towards $293. The forecast takes into account the company’s high market capitalization. Besides, no sharp price movements are expected.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2029 |

275 |

293 |

Analysts’ BABA Stock Price Projections for 2030

Estimates for 2030 vary widely. Some experts predict that the share price will fall to $2, while others anticipate a surge above $380.

StockScan

Price range: $1.05–$47.15 (as of 22.05.2025).

StockScan offers a negative outlook for BABA shares in 2030. According to experts, the price will plunge to $1.05 by December. The company is expected to lose a large share of the global market because of stricter regulations, sanctions, and technological stagnation.

|

Month |

Average, $ |

Minimum, $ |

Maximum, $ |

|

January |

44.60 |

35.68 |

47.15 |

|

February |

31.97 |

28.81 |

32.02 |

|

March |

29.01 |

24.63 |

38.46 |

|

April |

34.21 |

23.74 |

35.39 |

|

May |

21.28 |

19.54 |

29.29 |

|

June |

25.10 |

19.81 |

25.54 |

|

July |

5.88 |

11.37 |

14.39 |

|

August |

21.81 |

1.77 |

23.16 |

|

September |

34.04 |

20.72 |

36.74 |

|

October |

31.95 |

11.49 |

42.31 |

|

November |

6.66 |

1.68 |

36.74 |

|

December |

2.05 |

1.05 |

12.37 |

Paisakit

Price range: $366.10–$383.25 (as of 22.05.2025).

Paisakit is most optimistic about BABA’s stock performance. Experts anticipate the company’s capitalization to exceed $1 trillion. Alibaba is considered a global technology leader with multi-billion-dollar revenues and sustained growth. Such a bullish scenario requires significant achievements by the company and the confidence of global markets.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

366.10 |

374.67 |

383.25 |

CoinPriceForecast

Price range: $317–$319 (as of 22.05.2025).

CoinPriceForecast predicts an increase to $319 amid the successful implementation of Alibaba’s expansion, innovation, and competitive advantage strategies.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2030 |

317 |

319 |

Analysts’ BABA Stock Price Projections until 2050

According to Paisakit, #BABA shares may skyrocket to $5,162.37 by 2050, while StockScan expects a more modest increase to $243.30.

Paisakit expects Alibaba to steadily expand in international e-commerce, cloud technology, and artificial intelligence. This growth can be underpinned by a significant increase in profits and global market capitalization, comparable to that of the world’s largest corporations.

At the same time, StockScan anticipates limited gains to $243 by 2050, possibly due to global economic and political challenges.

|

Year |

Paisakit, $ |

StockScan, $ |

|

2030 |

374.67 |

47.15 |

|

2035 |

721.66 |

– |

|

2040 |

1,389.37 |

79.22 |

|

2050 |

5,162.37 |

243.3 |

Forecasts for 2050 vary widely, with some suggesting a moderate recovery while others envision explosive growth. This range highlights the high degree of uncertainty in expert assessments. Thus, investors should consider both scenarios and monitor the company’s fundamentals and macroeconomic trends.

Market Sentiment for BABA (Alibaba) on Social Media

Media sentiment significantly influences short-term price movements and affects the expectations of retail and institutional investors. In the case of #BABA stocks, cautious optimism prevails.

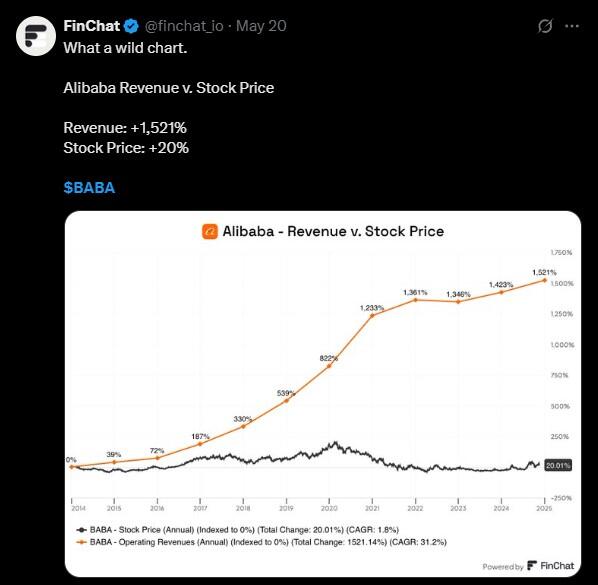

User FinChat points to a clear imbalance, stating that since 2014, Alibaba’s revenue has increased by 1,521%, while its shares have only risen by 20%. This has caused confusion among investors and created expectations of an upward correction.

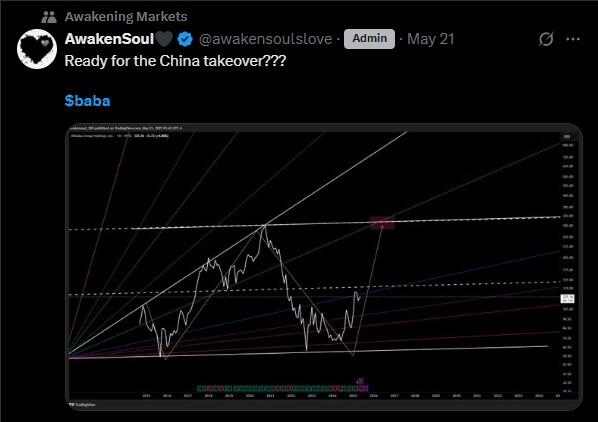

AwakenSoul posts a chart with an ambitious target and the caption “Ready for the China takeover?” hinting at a reversal and rally to all-time highs.

Sentiment towards BABA is predominantly bullish. Investors emphasize that the asset is undervalued and anticipate rapid gains as the Chinese stock market recovers.

BABA Price History

The highest BABA price of $319.32 was recorded on 27.10.2020. The lowest price of 57.2 was set on 29.09.2015.

Alibaba (BABA) stocks continue to exhibit high volatility on the Nasdaq exchange due to regulatory factors. In 2022, the asset plummeted by 25.84% amid inflationary concerns and a weak financial forecast. However, the long-term perspective remains cautiously optimistic thanks to analysts’ estimates from platforms like TipRanks, emphasizing the stock’s upside potential based on moving averages and earnings projections.

Alibaba shares rose 35% in the first half of 2024, buoyed by a rebound in Chinese exports, easing regulatory pressures, and a brighter macroeconomic outlook. However, gains lost momentum in the second half as competition in e-commerce intensified and the company’s cautious forecasts.

As of the first half of 2025, BABA shares remain in a correction phase. Even though the company has seen remarkable revenue growth, boasting a staggering 1,521% increase since 2014, according to FinChat, its market capitalization has only advanced modestly by less than 20% during the same time frame. This situation strengthens the perception of #BABA as an undervalued asset.

The key factors fueling long-term growth include the development of cloud technologies, AI integration, improved logistics, and international expansion. However, risks related to geopolitics, regulation, and slowing domestic demand in China continue to limit the company’s short-term potential.

Alibaba Fundamental Analysis

Fundamental analysis of Alibaba’s stock helps investors understand the key factors affecting its price, including macroeconomic conditions, the state of the Chinese economy, the development of the company’s technology and strategy, and the competitive landscape. Analyzing financial reports, investments in cloud technology, and global demand trends helps assess the company’s prospects and determine its attractiveness for long-term investments.

What Factors Affect the Alibaba Stock?

The Alibaba stock price is determined by many fundamental factors that must be taken into account to analyze its performance:

- Economic situation in China. GDP, inflation rate, and macroeconomic stability significantly affect the company’s operations.

- Global trade relations. Political and economic ties between China and other countries affect the demand for Alibaba’s goods and services.

- Cloud technology development. Investments in cloud computing and its success impact the company’s long-term growth.

- Financial performance of the company. Revenue, earnings, profitability, and debt load determine the stock price.

- Competition. Competition with companies such as JD.com and Amazon puts pressure on the stock price.

- Regulation in China. Government decisions related to data control and anti-monopoly measures often affect market capitalization.

- Innovation and diversification. Business expansion and development of new segments, such as fintech and logistics, bolster the stock.

- Consumer trends. Changes in online consumption affect the company’s revenues.

More Facts About Alibaba

Alibaba Group Holding Limited is China’s largest e-commerce company, founded in 1999 by Jack Ma. Founded as an online marketplace for small businesses, it is now a diversified conglomerate operating in cloud technology, digital payments, logistics, media, and entertainment.

The company’s value growth is driven by its successful development of online commerce, domestic market dominance, and strategic expansion into international markets. Alibaba is actively investing in innovations such as cloud computing through the Alibaba Cloud platform and the development of artificial intelligence, which strengthens its position in the technology sector.

The popularity of the Alibaba stock among traders is attributed to its high liquidity, impressive growth rate, and prospects in China’s rapidly developing economy. Investors see the company as an opportunity to capitalize on the steady trend of digitalization and increasing demand for online services both in Asia and around the world.

Advantages and Disadvantages of Investing in Alibaba

Alibaba has attracted the attention of many investors due to its growth prospects in global e-commerce and a wide range of businesses, including cloud technology and logistics. However, like any large corporation, investing in Alibaba poses risks, including competition, changes in legislative policy, and possible fluctuations in market value.

Advantages of Investing in Alibaba Stocks

- Leadership in e-commerce. Alibaba holds a dominant position in online commerce, controlling most of the Chinese market and expanding actively internationally.

- Business diversification. In addition to e-commerce, the company is developing cloud technologies (Alibaba Cloud), logistics (Cainiao), digital payments (Alipay), and media. This reduces the company’s dependence on a single sector and increases its sustainability.

- Innovation and technological development. Continuous investments in artificial intelligence, big data, and cloud technologies strengthen the company’s competitiveness in the global market.

- China’s economy. Alibaba benefits from a rising middle class and increased consumption in China, the largest e-commerce market.

- High growth potential. The company’s global expansion and technological innovation create prospects for long-term stock price appreciation.

Disadvantages of Investing in Alibaba Stocks

- Regulatory risks. The Chinese government’s strict control, including restrictions on the activities of technology giants, could negatively affect the stock price.

- Dependence on the Chinese economy. Despite its international presence, most of the company’s revenue comes from the Chinese market, which is prone to economic downturns.

- Stock volatility. Significant price fluctuations due to regulatory volatility and market sentiment make Alibaba’s stock risky for short-term investments.

- Strong competition. Alibaba faces intense competition in the domestic market from JD.com and Pinduoduo, and in the international market from Amazon and other players.

- Global tensions. Trade wars and political disagreements between China and other countries may affect the company’s operations and investor interest.

Investing in Alibaba suits those who prioritize long-term prospects and are prepared to embrace the associated risks.

How We Make Forecasts

Our forecasts are based on a thorough analysis of various factors affecting Alibaba’s stock price.

- To make short-term forecasts, we use technical indicators such as moving averages (SMA, EMA), the RSI, and MACD, along with chart trends.

- Medium-term forecasts are based on fundamental analysis. We review Alibaba’s financial reports, changes in revenue, earnings, operating expenses, and the impact of external factors such as regulatory policies in China and the global economy.

- Long-term forecasts rely on the company’s strategic outlook. We assess technological innovations, business diversification plans, growth potential in international markets, and investments in promising technologies such as cloud solutions and artificial intelligence.

A comprehensive approach combining technical, fundamental, and strategic analysis enhances the accuracy of our forecasts. However, it is impossible to predict all the factors that will influence the price in the future. Therefore, traders should not neglect to conduct their own analysis before making decisions.

Conclusion: Is BABA a Good Investment?

Alibaba remains one of China’s largest companies, backed by a robust ecosystem and high revenue growth rates. However, its market valuation stays relatively low due to regulatory risks and global instability.

BABA may be an appealing opportunity for long-term investors seeking returns. However, it is crucial to conduct a thorough analysis and diversify your investment portfolio.

Alibaba Stock Prediction FAQ

The current price of BABA stands at $120.68 as of 26.05.2025.

Predictions vary, with Paisakit expecting a surge to $284.72 and CoinPriceForecast predicting a rise to $217. At the same time, StockScan anticipates a decline to $69.62. The trajectory will depend on regulatory policy, the macroeconomic situation, and the company’s revenue.

Many analysts believe that #BABA is an undervalued asset, especially given its revenue growth. If you are focused on long-term investments and are prepared for volatility, you can open long trades at current prices while ensuring that you follow risk management rules.

Some forecasts, like StockScan’s, predict a drop, especially given the regulatory pressure. However, most analysts expect the asset to strengthen thanks to global expansion and the development of cloud solutions.

As of the first half of 2025, Alibaba shares have recovered moderately. Although returns have remained volatile over the past 12 months, analysts note steady gains of 20–35%, depending on market phases.

Investing in Alibaba can be profitable for long-term investors, given its scalability, innovation, and leadership in key segments. However, it is important to consider the risks associated with volatility and regulatory changes.

The decline in stock prices is related to regulatory uncertainty in China, weakening economic growth, and strong competition, putting pressure on the market and creating additional risks for short-term investors.

Yes, the Alibaba stock may recover due to strong fundamentals and strategic initiatives. However, the recovery will depend on lifting regulatory constraints and the improvement of market conditions.

Alibaba’s stock price hinges on multiple factors. The asset is mostly influenced by the macroeconomic situation in China, regulatory policies, revenue and profit margins, competition in the sector, and global investment trends.

Alibaba is actively investing in new technologies, expanding its international presence, and diversifying its business, allowing it to remain competitive even in a volatile market.

Price chart of BABA in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.