The availability of inexpensive liquidity from the Fed and other central banks has influenced the perception of gold as an investment vehicle. Previously, gold was purchased as a means of diversifying investment portfolios. The recent rally in the XAUUSD is attracting new investors. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Highlights and key points

- The increase in geopolitical risks put pressure on gold.

- The precious metal grew due to hopes for the Fed’s aggressive move.

- The return of a strong US dollar will hit XAUUSD.

- Gold falling below $2,625 per ounce will increase the risks of a pullback.

Weekly fundamental forecast for gold

For decades, gold has been regarded as a safe-haven asset, offering a degree of stability in turbulent times. However, the precious metal’s reaction to the escalation of the geopolitical conflict in the Middle East calls into question the resilience of this perception. As is typical of risky assets, the XAUUSD quotes collapsed along with the US stock indices.

The 2008-2009 economic crisis and the recession caused by the global pandemic resulted in a flood of inexpensive liquidity into the global financial system. Initially, gold was used as a defensive investment strategy, but the armed conflict in Ukraine and the associated de-dollarization have prompted a shift in focus towards the precious metal as a potential source of growth. The FOMO strategy, or “fear of missing out,” enabled XAUUSD quotes to reach above $2,600 per ounce.

This represents a significant increase from the levels seen a year ago. The correlation between gold and oil also provides evidence that gold is now considered a risky rather than a haven asset. Prior to Iran’s missile attacks on Israel, gold reached its highest level since 2021, reflecting the unusual link between global risk appetite and the state of the world economy. Oil is an indicator of the global economy’s health.

Gold-oil ratio

Source: Bloomberg.

The precious metal reached record highs due to the presence of excess liquidity in the market. The expectation that the cost of capital would decline further as a result of the Federal Reserve’s aggressive monetary expansion was a positive factor for the XAUUSD.

However, when the US economy is performing well, the Fed may not be required to cut the rate from 5% to 3%. A significant monetary policy easing could result in an increase in the risk of high inflation. It is probable that the central bank will reduce the rate, which will rekindle investor interest in the US dollar and drive 10-year Treasury yields above 4%. The headwinds facing gold are returning, and it is unclear whether it will be able to overcome them as successfully as it did in 2022-2023.

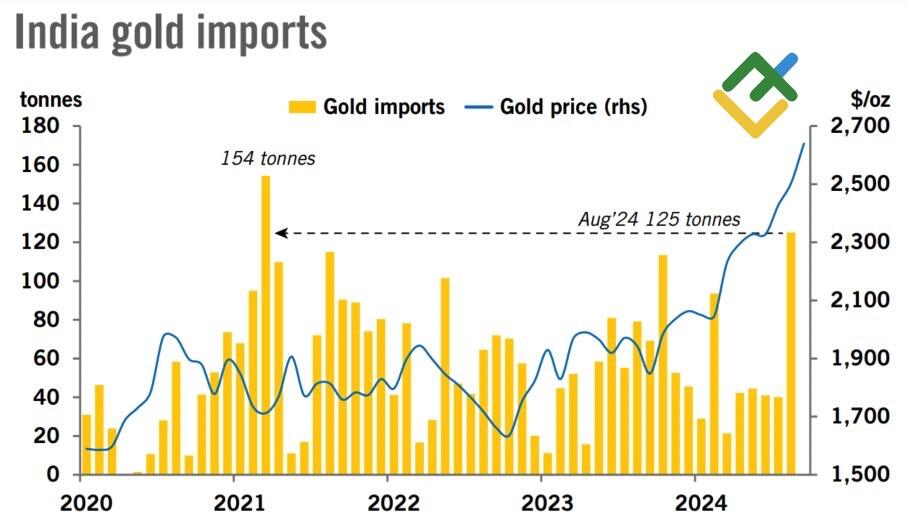

The XAUUSD was previously supported by China’s insatiable appetite. Until May, the People’s Bank of China purchased gold for 18 consecutive months, increasing reserves to 72.8 million ounces. However, the purchases have since been suspended. India has seized the opportunity to become a major player in the market, reducing import duties and increasing its precious metal imports to 125 tons in August, a 212% increase over the past year.

India’s gold imports

Source: Bloomberg.

Weekly trading plan for gold

It is unlikely that the current level of excitement in India will drive the XAUUSD to a new all-time high. Rather, such a reason will be the de-escalation of the geopolitical conflict in the Middle East. Conversely, the conflict between Israel and Iran, or further strengthening of the US dollar on the background of a decrease in the expected scale of the Fed’s monetary expansion, will increase the risk of a correction in the gold market. One may consider short-term short trades if the quotes fall below $2,625 per ounce.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.