If the BoJ does not raise rates until the end of 2024, the yen will once again be used as a funding currency in carry trade transactions. With an elevated global risk appetite, the USDJPY pair’s trend may reverse. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Japanese government believes that the national economy is not ready for a rate hike.

- The yen returns to the carry trade as a funding currency.

- Strong US macro statistics strengthen the US dollar.

- Long trades on the USDJPY pair can be opened on a pullback to 147.35.

Weekly fundamental forecast for Japanese yen

Japan’s new prime minister has the hedge funds in an uproar. Shigeru Ishiba sparked a rapid USDJPY rally by stating that the economy was not ready for an interest rate hike. For the first time since August, net long speculators have been shocked by rumors that the BoJ will follow the government’s directive and halt monetary policy normalization.

Net long speculative positions on Japanese yen

Source: Bloomberg.

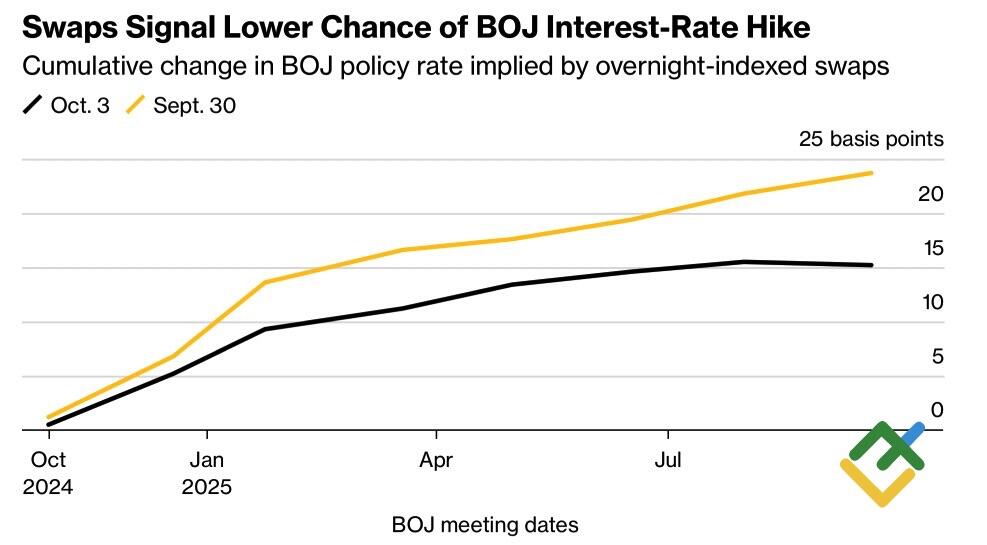

The odds of a December overnight rate hike fell to 22% from 29%, while the odds of the BoJ making such a move in the next 12 months fell to 78% from 87%. After meeting with the prime minister, Kazuo Ueda said the BoJ would adjust monetary policy and had time to observe how the economy reacted to higher interest rates. Economy Minister Ryosei Akazawa said all the BoJ’s next steps should be in line with the government’s goal of ending deflation.

Market expectations on BoJ overnight rate

Source: Bloomberg.

If the regulator does not increase the overnight rate, the Japanese yen can once again be used as the main funding currency in carry trade operations. The period of its weakness will return, as it did in January-June when the yen was the main outsider among its G10 counterparts. The transformation from the ugly duckling to the beautiful swan was made possible by the BoJ’s monetary tightening on the one hand and expectations of a large-scale monetary expansion by the Fed on the other. Now, both of these advantages are no longer relevant for USDJPY bears.

RBC Capital Markets and Mizuho Securities see the pair rising to the 150-155 area, and their forecasts are looking more and more reasonable against the backdrop of the acceleration in US employment to 254K in September. So far, the futures market has almost completely discounted the possibility of a 50bp cut in the fed funds rate in November, but if the US economy continues to perform well, the market will talk about a pause in the cycle, which will support the US dollar.

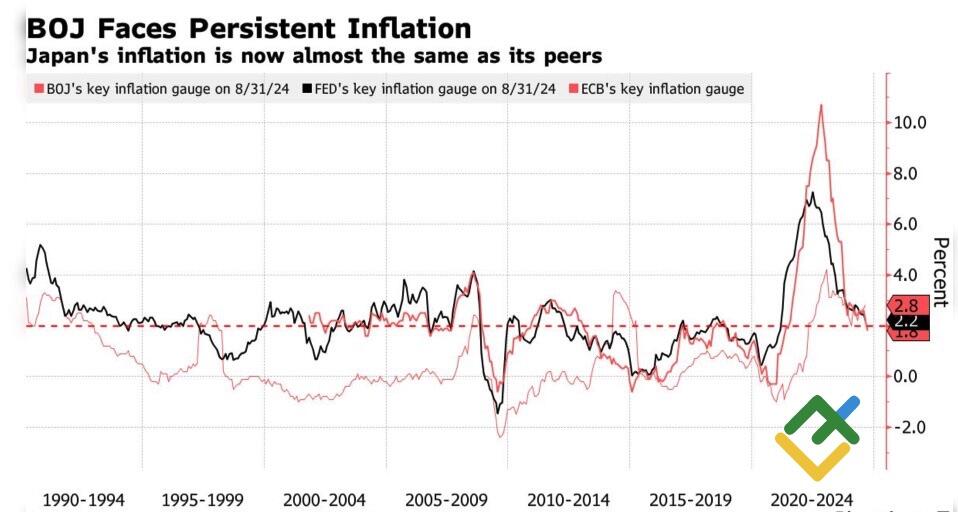

The USDJPY pair has already reversed in 2024; why wouldn’t it do so again? On the other hand, the Bank of Japan is an independent institution, and it should not be guided by what the government says. With inflation remaining above the 2% target for a long time, Kazuo Ueda has reasons to raise the overnight rate, regardless of how much the prime minister and his team would like not to.

Inflation in Japan, US, and EU

Source: Bloomberg.

Weekly USDJPY trading plan

It is unlikely that the US economy will continue to strengthen. In addition, the slowdown in US inflation to 2.3% y/y in September may support USDJPY bears. As for now, long trades can be opened on a pullback to 147.35, or one can open more long positions at this level, adding them to the existing ones.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.