I welcome my fellow traders! I have made a price forecast for the USCrude, XAUUSD, and EURUSD using a combination of margin zones methodology and technical analysis. Based on the market analysis, I suggest entry signals for intraday traders.

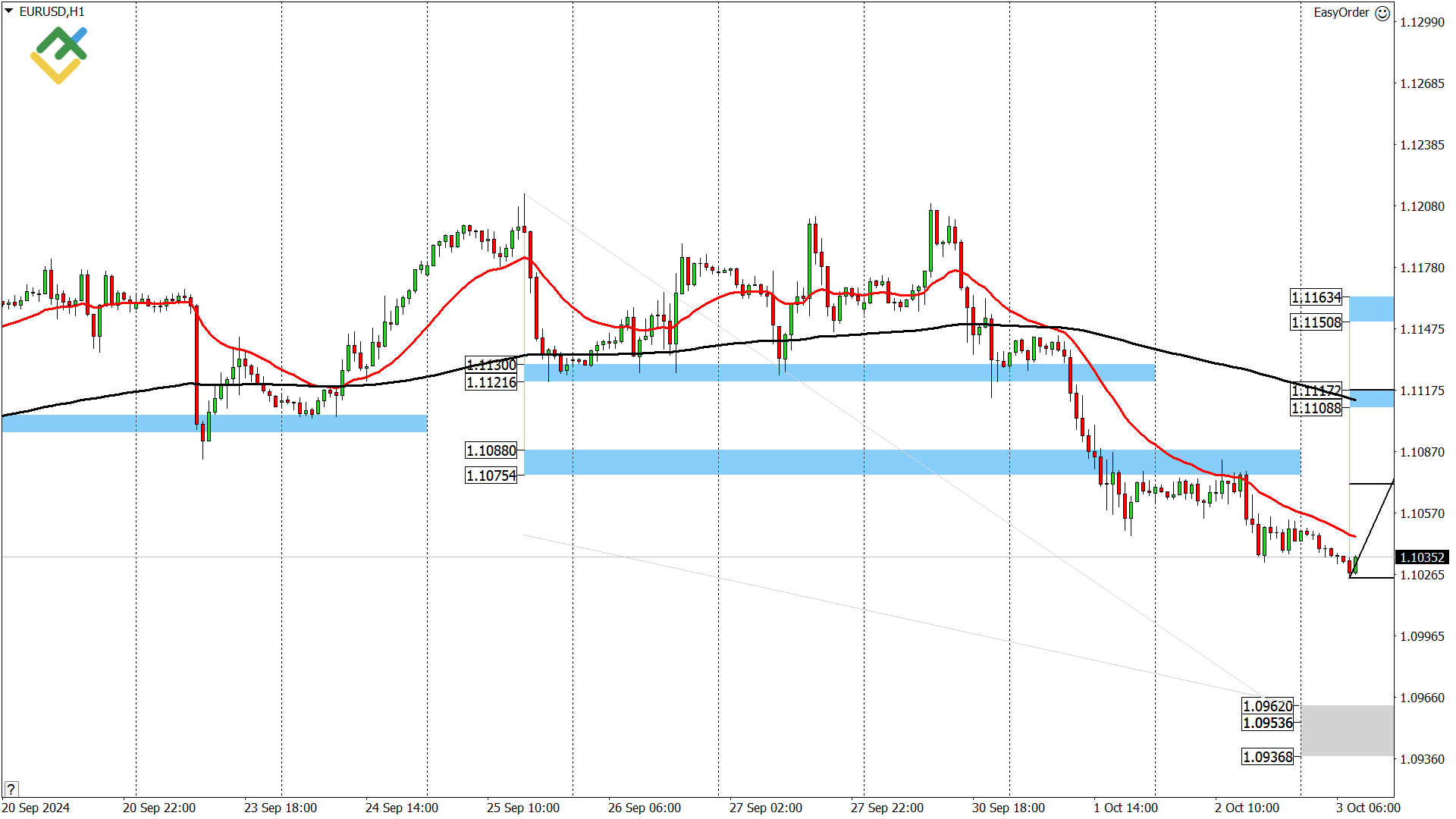

Yesterday, the euro’s short-term uptrend reversed.

The article covers the following subjects:

Highlights and key points

-

USCrude: yesterday, oil reached its second bullish target after hitting the support (B) 67.74 – 67.30.

-

XAUUSD: gold is trading in a correction within the short-term uptrend.

-

EURUSD: the euro’s short-term uptrend has reversed. The main bearish target is the lower Target Zone 1.0962 – 1.0936.

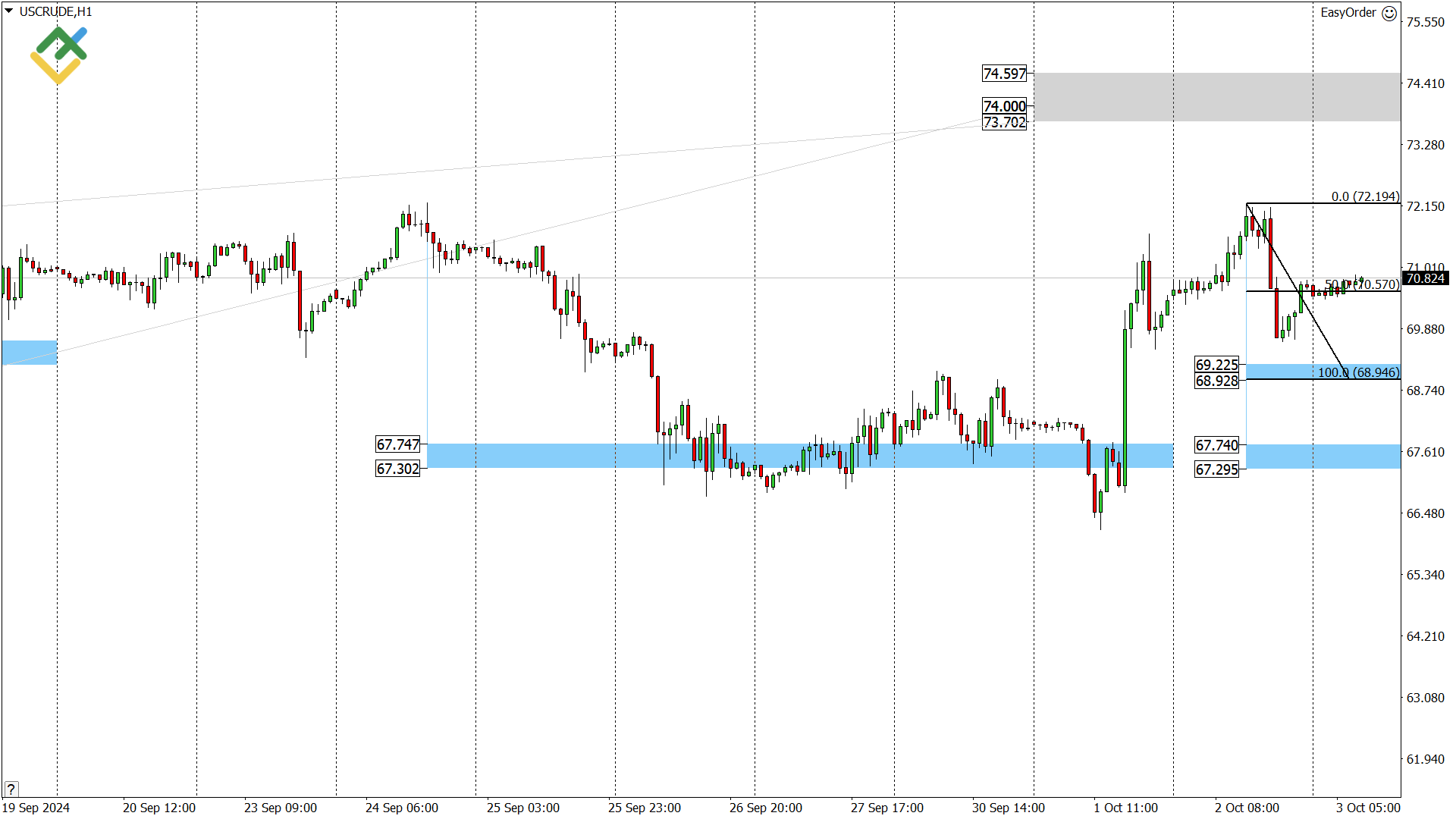

Oil price forecast for today: USCrude analysis

Yesterday, oil maintained its short-term uptrend. As a result, the price has reached the second bullish target near 72.20. Currently, a correction is developing. If the asset touches the support (A) 69.22 – 68.92 during the correction, one may consider long trades near this zone with the first target near 70.57 and the second one near 72.20. If the price continues to grow and consolidates above 72.20, the next target within the short-term uptrend will be the upper Target Zone 74.59 – 73.70.

The trend’s boundary is shifting to 67.74 – 67.29. Consider long trades as long as the price is trading above this area.

USCrude trading ideas for today:

Buy at support (A) 69.22 – 68.92. TakeProfit: 70.57, 72.20. StopLoss: 68.35.

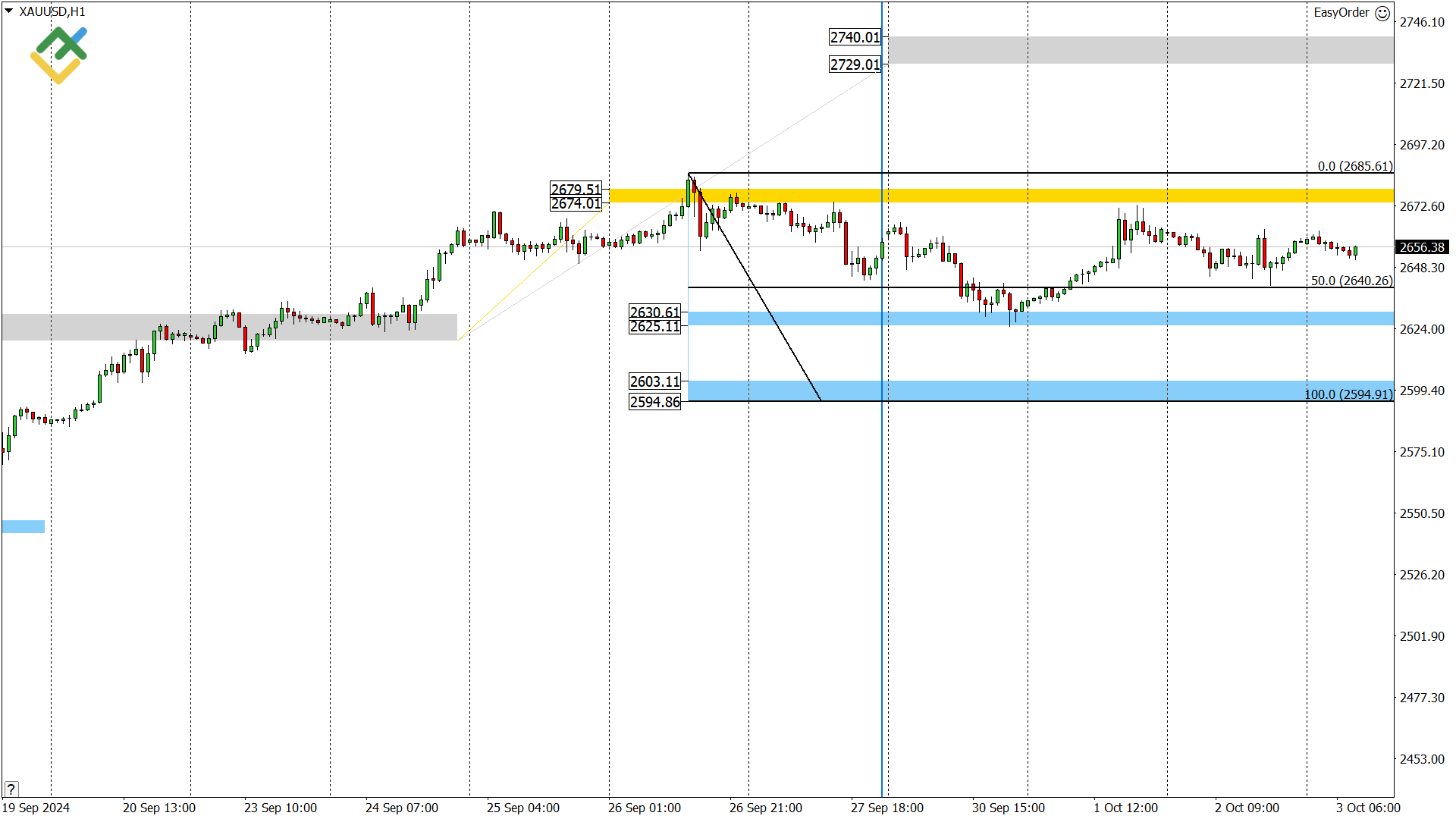

Gold forecast for today: XAUUSD analysis

Gold is trading in a short-term uptrend. The second bullish target is 2685. If the price consolidates above this mark, the next target will be the Target Zone 2740 – 2729.

Consider holding long trades initiated at the support (A) 2630 – 2625 open, shifting them to the breakeven point. Once the deeper correction ends and the price hits the support (B) 2603 – 2594, one may consider long trades again. In this case, the first target will be 2640, and the second will be 2685.

XAUUSD trading ideas for today:

-

Hold up long trades opened at support (A) 2633 – 2627. TakeProfit: 2685. StopLoss: at the breakeven.

-

Buy at support (B) 2603 – 2594. TakeProfit: 2640, 2684. StopLoss: 2578.

Euro/Dollar forecast for today: EURUSD analysis

Yesterday, the euro‘s short-term uptrend reversed once the price broke through the support (B) 1.1088 – 1.1075. Now, the main bearish target is the lower Target Zone 1.0962 – 1.0936.

Consider short trades on a correction at the resistance (A) 1.1117 – 1.1108 and the resistance (B) 1.1163 – 1.1150. Once any of these zones is reached and a sell pattern appears, one may consider short trades. The price should pierce and consolidate above the 1.1163 level to reverse the downtrend.

EURUSD trading ideas for today:

Sell at resistance (A) 1.1117 – 1.1108. TakeProfit: 1.1071, 1.1024. StopLoss: 1.1135.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you” 🙂

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.