Central banks employ a range of strategies to steer the economy, tame inflation, and facilitate GDP growth. Monetary policy represents the most effective means of achieving this objective. It oversees the regulation of interest rates, the money supply, credit terms, household and business expenditures, and incomes. Monetary policy can be approached in two distinct ways: hawkish and dovish. Central banks, such as the US Federal Reserve, must decide between hawkish or dovish policy stances, representing tight inflation control, a strategy favored by conventional hawks, and a soft policy to support economic growth, a stance often advocated by doves.

This approach is crucial for managing economic cycles and stabilizing the macroeconomy. This article explains how these policies affect the economy and why inflation, unemployment, and interest rates are cornerstones of economic decision-making.

The article covers the following subjects:

Key Takeaways

-

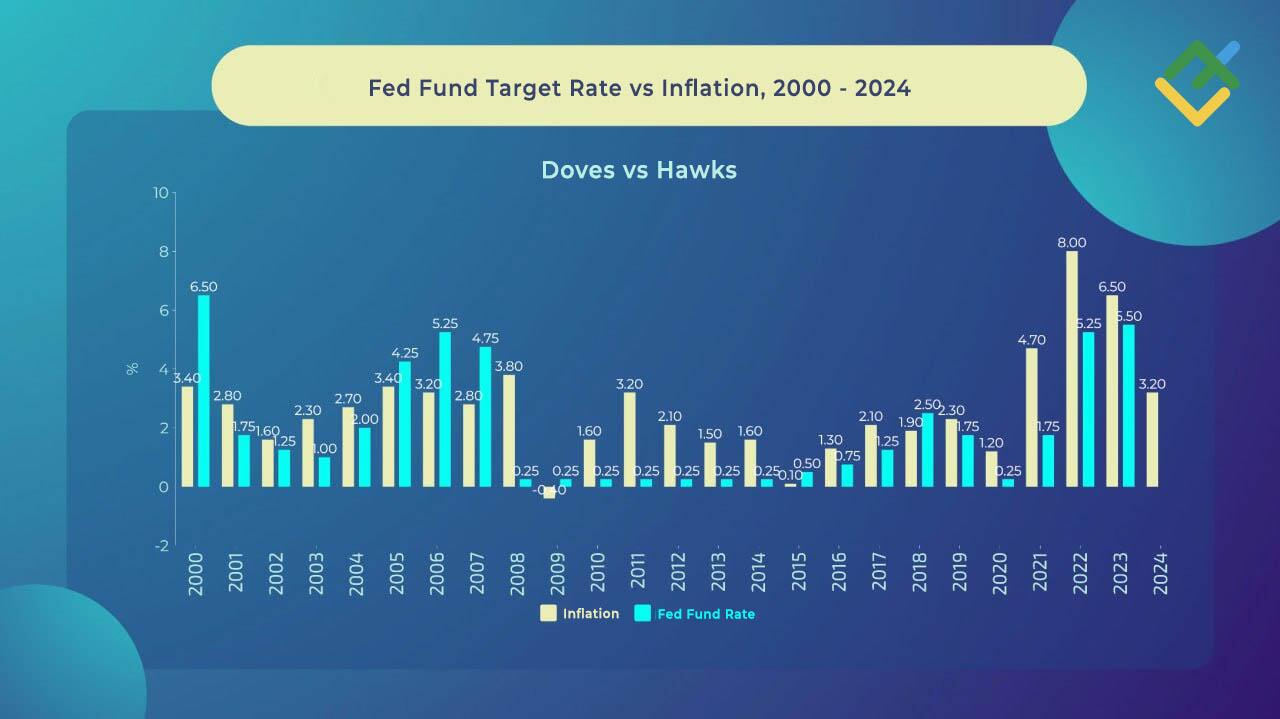

Hawkish policy is designed to control inflation, which typically requires high interest rates. This results in a deceleration of price growth as the cost of credit for businesses and consumers rises. Consequently, individuals and businesses are inclined to borrow less, which alleviates the pressure on inflation. This approach is particularly pertinent during periods of economic expansion, when excess demand can result in higher prices for goods and services. The primary objective of this policy is to maintain price stability and prevent the economy from overheating.

-

Dovish policy aims to stimulate economic growth through the implementation of low interest rates. This provides greater access to credit, which in turn increases spending and investment by consumers and businesses. The primary goal of monetary policy is to support the economy during periods of a recession and economic downturns, when there is a decline in consumption and investment, and unemployment rises. The primary objective of these policies is to facilitate economic growth and job creation.

-

The US Federal Reserve plays a pivotal role in the planning and execution of monetary policy in the United States. Decisions made by the members of the Federal Open Market Committee (FOMC) and other key decision-makers and economic policy advisors directly impact the economy through adjustments in borrowing conditions and the key interest rate. Timely decision-making allows the members of the Fed to regulate economic cycles and maintain control of inflation, while also stimulating growth when necessary.

Defining Hawks and Doves

Hawkish monetary policy is defined as a tightening of monetary conditions with the objective of combating inflation. Hawks employ higher interest rates to keep prices stable. This policy is implemented by reducing the money supply and tightening credit conditions.

Alan Greenspan is a prime example of a hawk. As Fed Chairman, he kept interest rates elevated to fight inflation in the 1980s and 1990s. This strategy safeguarded the value of the US currency and maintained stability in macroeconomic indicators.

In contrast, dovish policy emphasizes easing borrowing costs and lowering interest rates, while promoting economic growth, reducing unemployment, and increasing the money supply through buying government securities or lowering reserve requirements for banks. This approach includes quantitative easing and is designed to promote investment growth. The dovish policy is particularly beneficial during economic downturns when economic activity slows and demand needs to be supported. Policymakers Janet Yellen and Jerome Powell are among the most renowned doves, advocating dovish monetary and fiscal policies that stimulate economic activity and ensure stability in the labor market.

What are the Differences between Hawkish and Dovish Monetary Policies?

The primary distinction between hawks and doves lies in their respective priorities. The hawkish policies tend to decrease the inflation rate, with an emphasis on the potential of raising interest rates and other contractionary measures in achieving this goal. Hawks generally believe that rising prices are the primary threat to economic stability, as they can erode savings and undermine the value of a nation’s currency. Raising rates, according to the hawks, limits the amount of available money in the economy, reduces borrowing, and prevents prices from rising.

On the other hand, doves are committed to maintaining low lending rates and prioritize supporting economic growth and reducing unemployment. This is accomplished by lowering interest rates and easing credit conditions. This approach aims to stimulate domestic demand and support business activity, especially in times of crisis. Both approaches play an important role in economic policy. Central bankers should react in a timely manner to changes in the economy and choose an appropriate strategy depending on current conditions.

Hawkish Monetary Policy

-

High interest rates to keep inflation in check.

-

Restricting access to credit for businesses and consumers.

-

Reducing the prices of government securities, which limits investment in these assets.

-

Shrinking the money supply to control price hikes.

-

The main priority is to maintain inflation control, even though this may slow economic growth and increase recession risks.

-

Long-term hawkish policies may stabilize the currency and preserve purchasing power, but reduce the potential for economic growth.

Dovish Monetary Policy

-

Low interest rates stimulate economic growth and increase demand for borrowing.

-

Facilitating access to loans for businesses and consumers.

-

Quantitative easing programs to maintain liquidity in the markets.

-

Expanding the money supply and stimulating investment and spending add more jobs and promote low unemployment.

-

The main objective is to support economic growth and stability.

-

Dovish policies can lead to short-term positive results in the form of increased demand and manufacturing activity. However, in the long term, there is an inflation risk, as well as financial bubbles, and the risk of devaluation of the national currency.

Economic Impact of Dovish and Hawkish Stance

Both policies have a substantial impact on the economy and on consumers, investors, manufacturers, and financial institutions. Fluctuations in interest rates and credit conditions have a direct impact on savings, incomes, and investment activity.

The tendency to save is a result of elevated interest rates, which are indicative of a hawkish approach. Deposits become more profitable. A shift in consumer behavior from spending to saving leads to a reduction in overall consumption. Financial institutions benefit from this by attracting new depositors. However, high borrowing costs hinder access to credit and dampen market activity.

Low interest rates and dovish policies encourage spending and investment, making credit more affordable. This supports demand for housing, cars, and other goods, and provides companies with greater opportunities to expand and invest. For banks, a dovish policy translates to increased lending activity, although lower rates have an adverse effect on profitability.

Monetary policy shifts also prompt reactions from manufacturers and investors. High interest rates act as a deterrent to investment in capital-intensive industries, whereas low rates provide the impetus for growth. Financial markets react to the availability of capital, which has a positive impact on stock and debt markets.

Consequently, alterations in credit conditions influence all economic actors and determine the extent of investment, borrowing and spending, as well as the rate of economic growth.

For Depositors

A hawkish stance and higher interest rates increase the return on deposits. Commercial banks also raise deposit rates when the central bank makes a rate hike, making savings accounts more attractive to those seeking secure avenues for their capital. In an inflationary environment, savings are essential for protecting purchasing power and offsetting losses from rising prices.

Conversely, a dovish approach tends to reduce returns on deposits, prompting savers to explore alternative investment avenues such as stocks and government bonds. Lower interest rates make people refrain from putting their money in a low-interest savings account, while encouraging investment in riskier assets with potentially higher returns.

For Consumers

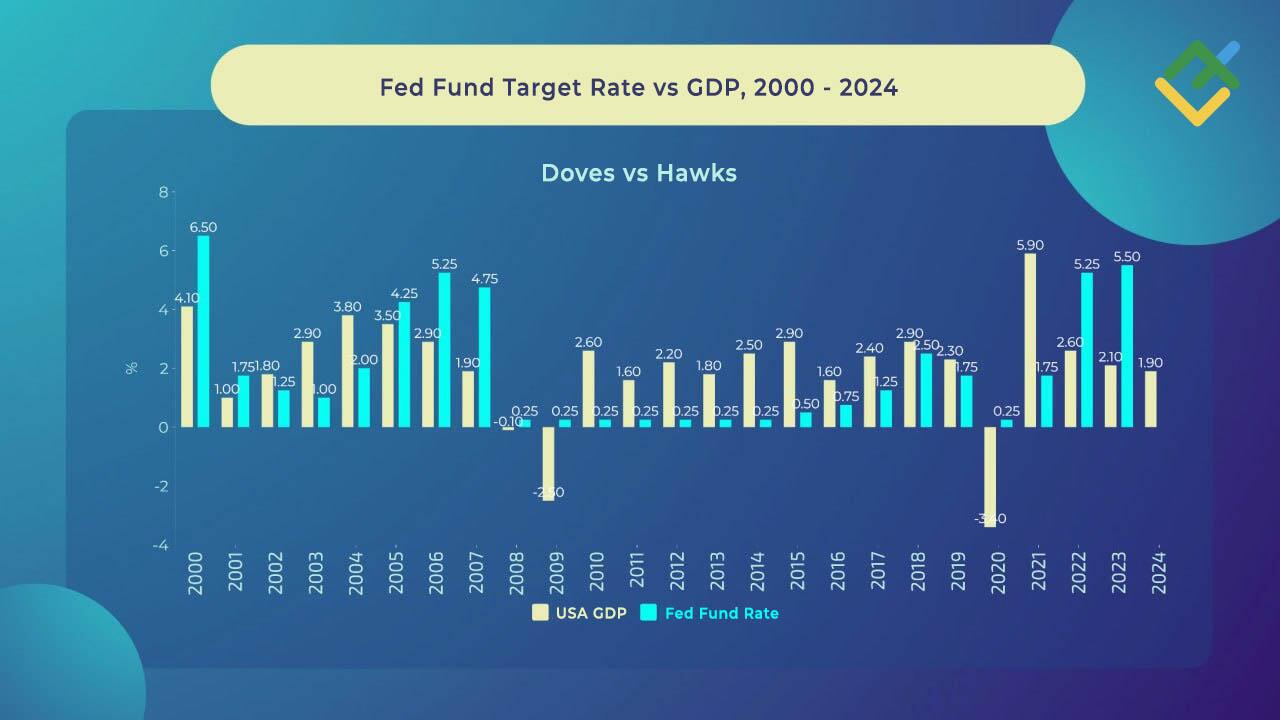

Dovish policy benefits consumers by reducing interest rates and making credit more affordable, including mortgages, car loans, etc. Lower rates reduce monthly payments, making it easier for consumers to access credit and stimulate demand for real estate and cars. This supports growth in key sectors of the economy as well as boosts GDP growth.

In contrast, a hawkish stance increases the cost of borrowing, which in turn, reduces consumer spending. The consequence of higher rates is that credit becomes less available, particularly in heavily leveraged sectors such as real estate and automotive.

For Investors

Investors seek to capitalize on a loose monetary policy as it facilitates market growth through the implementation of low interest rates and enhanced capital accessibility. This encourages a greater level of investment in a variety of asset classes, including stocks, bonds, and other financial instruments.

Low interest rates make credit more affordable, which encourages companies to expand their operations and increases consumer spending, boosting the economy and corporate earnings. As a result, stock markets also post gain. Lower costs enable companies to finance new projects and invest in innovation on a more competitive basis.

Low interest rates reduce the returns on traditional savings instruments, compelling investors to pursue higher-yielding assets such as stocks and corporate bonds. This increases investors’ appetite for risk, leading to higher stock prices.

A dovish policy stance can reduce debt servicing costs, allowing companies to pay more dividends and repurchase shares, thereby increasing their value. Consequently, investors enjoy the dual benefit of higher asset prices and higher returns on their portfolios. In periods of economic turbulence, a dovish policy attracts investors to risk assets.

In contrast, hawkish policies create a more stable but less profitable investment environment, as elevated interest rates restrict access to capital at a low cost. When interest rates are high, the cost of borrowing increases, making credit less attractive to businesses and consumers. For investors, this translates to reduced liquidity and lower levels of investment, particularly in high-risk assets such as emerging sector stocks or technology startups.

As a result, investors may opt for more conservative instruments such as bonds, although this may limit long-term returns.

Therefore, an aggressive monetary policy tends to dampen liquidity in the stock market and make short-term investments less appealing, which curtails speculation. However, for long-term investors, such a policy can foster a stable and predictable environment, as it mitigates inflationary risks and preserves price stability. This may ultimately reinforce the resilience of financial institutions and the broader economy.

For Business

In response to shifts in interest rates, manufacturers take proactive measures. In a dovish policy environment, low rates make credit cost-effective, enabling companies to invest in expansion, equipment modernization, and innovation—particularly in capital-intensive sectors such as manufacturing and energy. This stimulates economic growth, creates jobs, and increases consumer demand.

In addition, reduced interest rates facilitate access to working capital, enabling companies to maintain current operations and cope with fluctuations in demand. Such investments ultimately enhance product quality, boost output, and reduce production costs.

On the other hand, a tight policy restricts these opportunities as higher borrowing costs reduce the availability of capital. This impedes modernization, development, and investment in research, particularly in high-tech sectors. The strengthening of the national currency makes exports less competitive, reducing companies’ revenues and deterring expansion. Consequently, companies may delay or cancel projects, negatively affecting production activity and economic growth.

Pros and Cons of Hawkish and Dovish Monetary Policies

A hawkish policy has both advantages and disadvantages. The primary benefit is the ability to control inflation and prices. Higher interest rates decelerate inflation and reduce the availability of credit, curbing consumer spending and investment while maintaining purchasing power. However, high key rates can impede economic growth as businesses and consumers reduce borrowing due to rising borrowing costs. This is of particular importance for sectors that rely on debt financing, such as real estate and the automotive industry.

In contrast, a dovish stance can stimulate economic growth, but there is a risk of inflationary pressures if interest rates remain low for an extended period. Accessible credit encourages investment and spurs spending, facilitating economic recovery. However, lower-for-longer rates can lead to overheating and inflation.

Central banks must navigate these strategies to align with economic conditions. A hawkish policy is beneficial when inflationary pressures are elevated, whereas a dovish policy is advantageous for stimulating the economy during a downturn. Central banks should adjust their monetary policy in a timely manner to maintain stability and growth, while avoiding excessive inflation or recession.

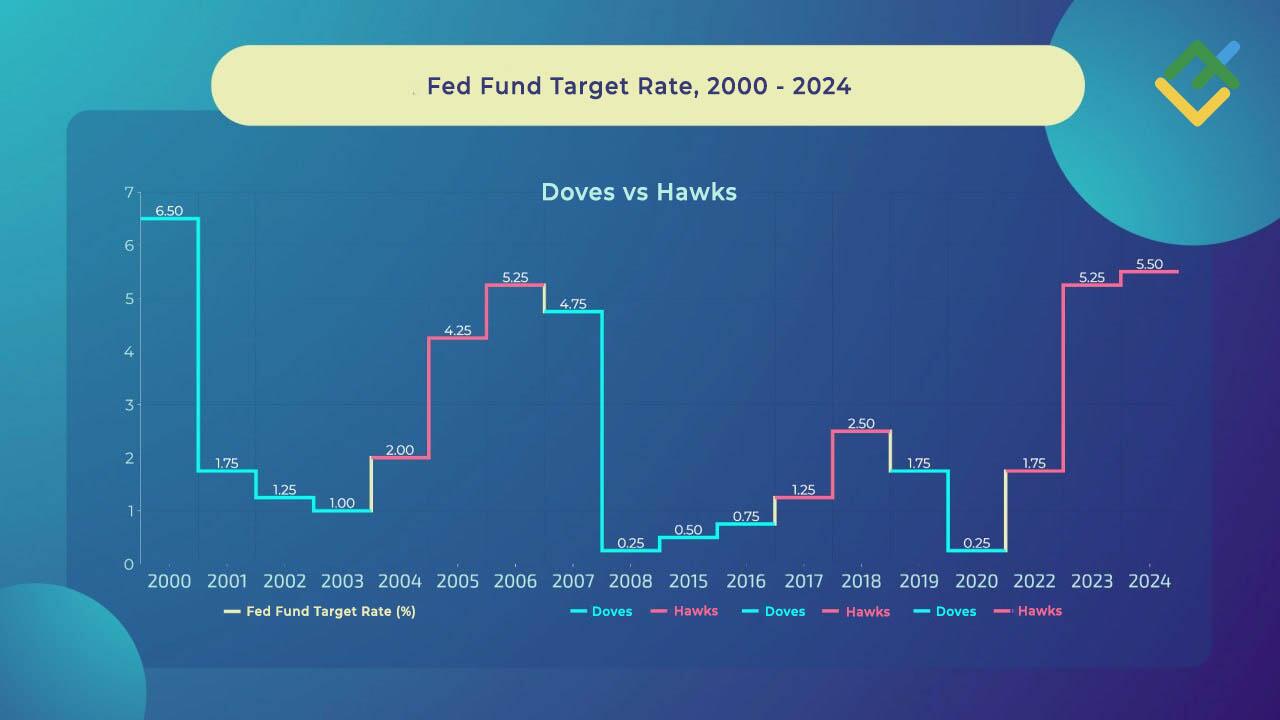

Shifts Between Hawkish and Dovish Stances

Central banks, such as the US Federal Reserve, can change their approach depending on the economic situation. Their primary goal is to maintain economic stability, control inflation, and stimulate economic growth. When inflation threatens stability, interest rates are raised to cool the economy and reduce pressure on prices. This makes loans more expensive, reduces borrowing and savings, which brings down inflation indicators. Additionally, rate hikes strengthen the national currency and help stabilize prices.

In a period of recession or low inflation, banks tend to adopt a dovish policy stance. In order to facilitate economic growth, banks reduce their interest rates. Lower interest rates make credit more affordable, which in turn supports consumer spending and business investment. This stimulates economic growth and reduces unemployment. In exceptional conditions, central banks may implement measures such as quantitative easing to enhance liquidity and bolster financial markets during periods of crisis.

Monetary policy shifts help avoid extremes such as hyperinflation or a deep recession, striking a balance between financial stability and economic growth.

Conclusion

Hawkish and dovish policies represent two distinct approaches to economic management and inflation targeting. Those with a hawkish outlook tend to prioritize the use of higher interest rates as a means of combating inflationary pressures and moderating economic activity. This has the effect of reducing borrowing and lowering consumer spending, which serves to stabilize prices. However, this approach may have the unintended consequence of slowing economic growth and increasing unemployment. A dovish policy is designed to stimulate economic growth and reduce unemployment by lowering interest rates, making borrowing more affordable and encouraging investment and consumer spending. However, extended application of low rates can pose inflationary risks.

Central banks play a pivotal role in determining the optimal timing for policy adjustments. They must adapt to economic shifts by monitoring key indicators such as inflation, employment, and economic growth. In periods of accelerating inflation, a hawkish approach is necessary, while in recessionary or low-inflation environments, a dovish stance is warranted. A balanced approach is crucial for maintaining economic stability and preventing overheating or recession.

FAQs on Hawkish vs Dovish Monetary Policy

It is a strategy employed by central banks to curb inflation by raising interest rates and reducing the money supply.

Dovish policy focuses on supporting economic growth by lowering interest rates and stimulating consumer demand.

Inflation is controlled using a hawkish policy, which implies higher interest rates.

The dovish stance helps to reduce unemployment by stimulating economic growth through low interest rates and easier access to credit. Thus, it is profitable for companies to borrow, expand their business, and invest in innovation. Thus, new jobs are created.

Hawkish monetary policy may limit financial market activity as high interest rates deter investment opportunities and slow asset appreciation.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.