The likelihood of an ECB deposit rate cut in October, the intensification of geopolitical conflict in the Middle East, and the ongoing political crisis in France contributed to the decline of the EURUSD currency pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The drop in European inflation to 1.8% put pressure on the euro.

- Iran’s missile attacks on Israel increased demand for the US dollar.

- Political risks are growing again in France.

- The EURUSD pair may continue declining if it breaks through the support level of 1.1045.

Weekly fundamental forecast for euro

Following statements from Jerome Powell indicating that the Fed was not in a hurry and Christine Lagarde expressing confidence in beating inflation, the EURUSD changed direction. Investors were focused on the ECB’s decision to cut its deposit rate in October. Iran’s missile attacks on Israel have contributed to heightened geopolitical tensions in the Middle East, which in turn has bolstered the US dollar as a safe-haven asset.

Eurozone money markets estimate the scale of ECB monetary expansion until the end of the year at 51 bps, which is equivalent to 50 bps in FOMC forecasts for the federal funds rate. However, the European Central Bank is likely to act more promptly. Following Christine Lagarde’s speech and the currency bloc’s first dip in inflation below the 2% target in three years, an October monetary policy easing has become the most probable scenario.

EU inflation change

Source: Financial Times.

The decline in the eurozone’s consumer price index (CPI) to 1.8% prompted a surge in demand for German bonds. Two-year yields have reached a new low since late 2022, dropping below 2% for the first time. Meanwhile, ten-year rates saw a significant decline of 11 bps, reaching 2.01%. Morgan Stanley forecasts that rates could reach 1.8-1.9% by the end of the year. The firm anticipates a series of reductions in the ECB’s borrowing costs from October to March 2025, followed by a gradual approach to adjustments on a quarterly basis. Consequently, the deposit rate will decline to 1.75% by the end of next year. SEB projects a decline from 3.5% to 2% by June.

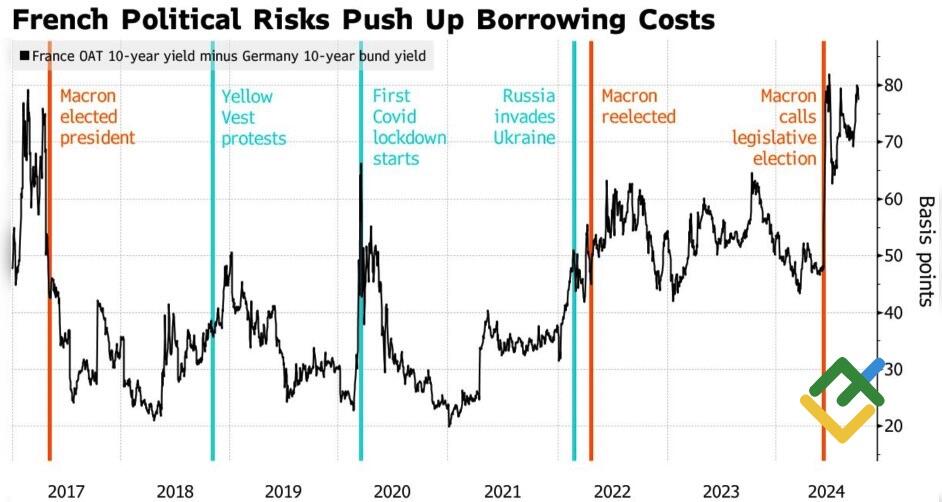

In addition, the EURUSD was pressured by the inaugural confrontation between the minority government and the parliament in France. Prime Minister Michel Barnier plans to reduce the budget deficit to the EU’s required 3% of GDP by 2029 by raising taxes on the wealthy and corporations, as well as cutting spending. Dissatisfaction with the right or left in the National Assembly could result in a vote of no confidence. The widening yield differential between French and German bonds indicates that markets are taking this scenario into account.

Spread between French and German bond yields

Source: Bloomberg.

The escalation of geopolitical tensions in the Middle East fueled the EURUSD pair’s plunge. Israel launched a ground offensive into southern Lebanon, and Iran responded to the assassination of the Hezbollah leader with a large-scale missile attack. Now, investors are awaiting Jerusalem’s retaliation, selling off stocks and fleeing to safe-haven assets. The fall in stock indices has forced investors to turn to the US dollar.

Weekly trading plan for EURUSD

The ECB’s outstripping speed compared to the Fed, the growth of political risks in France, and the increased geopolitical tension in the Middle East have returned the initiative to EURUSD bears. The major currency pair has plummeted below 1.11 and shows no signs of stopping. Should the pair plunge below the support of 1.1045, one may open short trades, adding them to short positions initiated above 1.12.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.