Investing.com – The Federal Reserve has started its rate-cutting cycle, and Bank of America Securities continues to expect modest US dollar downside going into 2025.

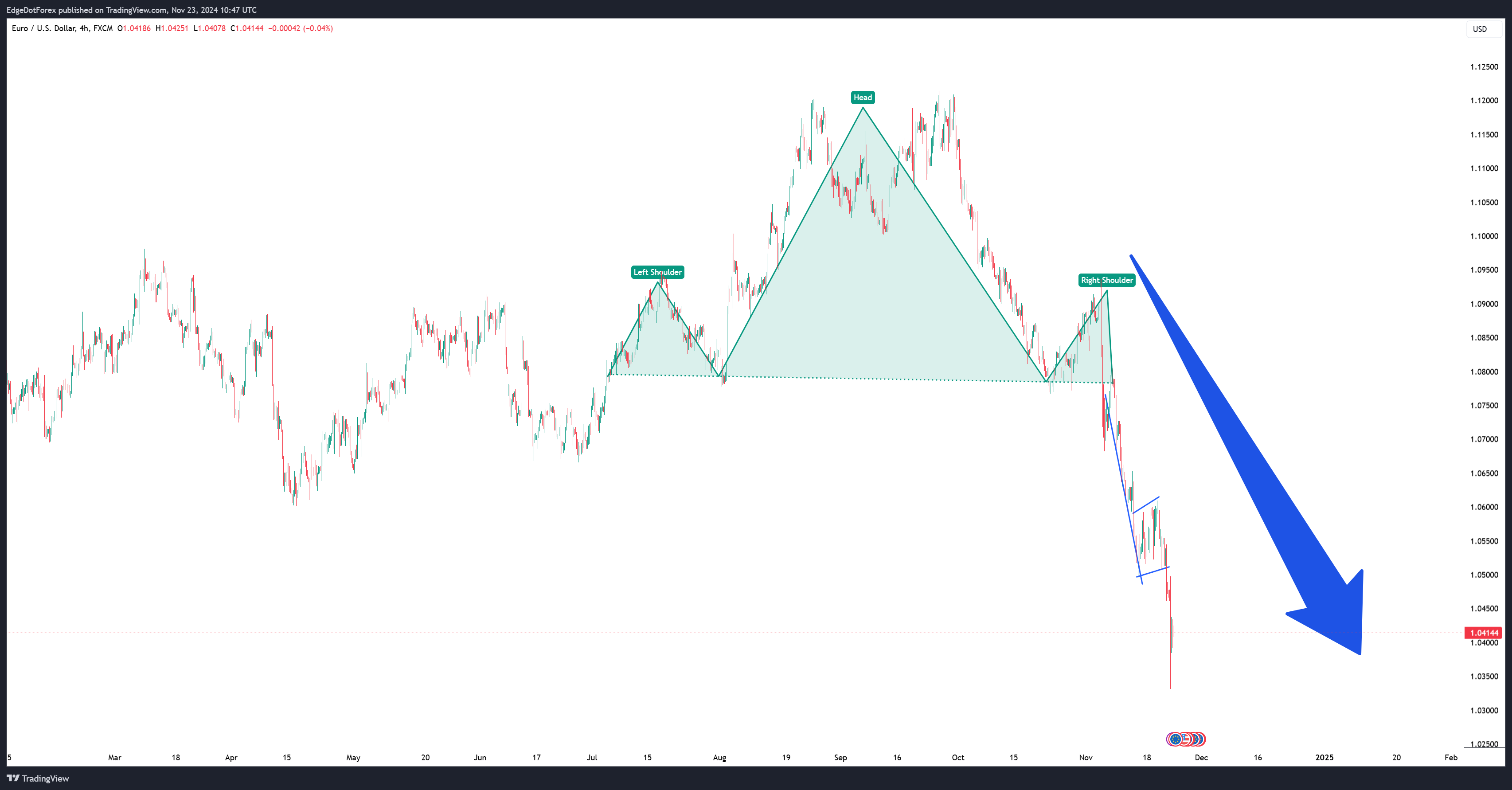

“Although the Fed modestly surprised markets with a 50 bps cut last week, we see core FX dynamics largely unchanged in G10, with EUR/USD continuing to drift higher,” analysts at Bank of America Securities said, in a note dated Sept. 26.

The bank sees the US dollar as moderately overvalued, but the Fed rate cutting cycle would likely help further attenuate this overvaluation over the medium term, including our outlook for a rising EUR/USD.

“We look for EUR/USD to build on recent gains, with our unrevised forecast profile of end-2024 at 1.12 and end-2025 at 1.17,” BoA said.

USD downside is more likely to continue, the bank said, as disinflationary trends and a softening labor market support the Fed in a modestly more accelerated rate-cutting pace.

BoA expects another 50 bps cut at their November meeting and a 25 bps reduction in December.

At 10:00 ET (14:00 GMT), EUR/USD traded 0.1% higher at 1.1142, up around 1% year-to-date.

This post is originally published on INVESTING.