Investing.com – The U.S. dollar edged lower Thursday, consolidating after a sharp rebound overnight ahead of more speeches from key Federal Reserve policymakers.

At 04:40 ET (08:40 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% lower to 100.565, following a near 0.6% jump on Wednesday, its biggest one-day gain since June 7.

Dollar looks to Fed officials

The U.S. dollar has stabilized Thursday after rebounding strongly overnight as traders reassessed just how aggressive future U.S. rate reductions would be in the wake of the Federal Reserve starting its rate-cutting cycle with a hefty 50 basis-point reduction earlier this month.

There are a series of Fed officials due to speak later Thursday, and traders will be looking for more clues as the message following the last Fed meeting has been a little inconsistent.

Fed Governor Adriana Kugler said she “strongly supported” the decision to cut rates by half a point to kick off the easing cycle, but Fed Governor Michelle Bowman cautioning against steep rate reductions and Atlanta Fed President Raphael Bostic said the central bank need not go on a “mad dash” to lower rates.

“On the Fedspeak side, Chair Powell will give pre-recorded opening remarks, and there is a long list of other speakers: Collins, Bowman, Williams, Barr, Cook and Kashkari. There should be some extra color on each member’s Dot Plot submission,” said analysts at ING, in a note.

The economic data slate is also full Thursday, with the likes of the latest second-quarter GDP print, weekly jobless claims and August’s durable goods orders release due.

Euro remains at elevated level

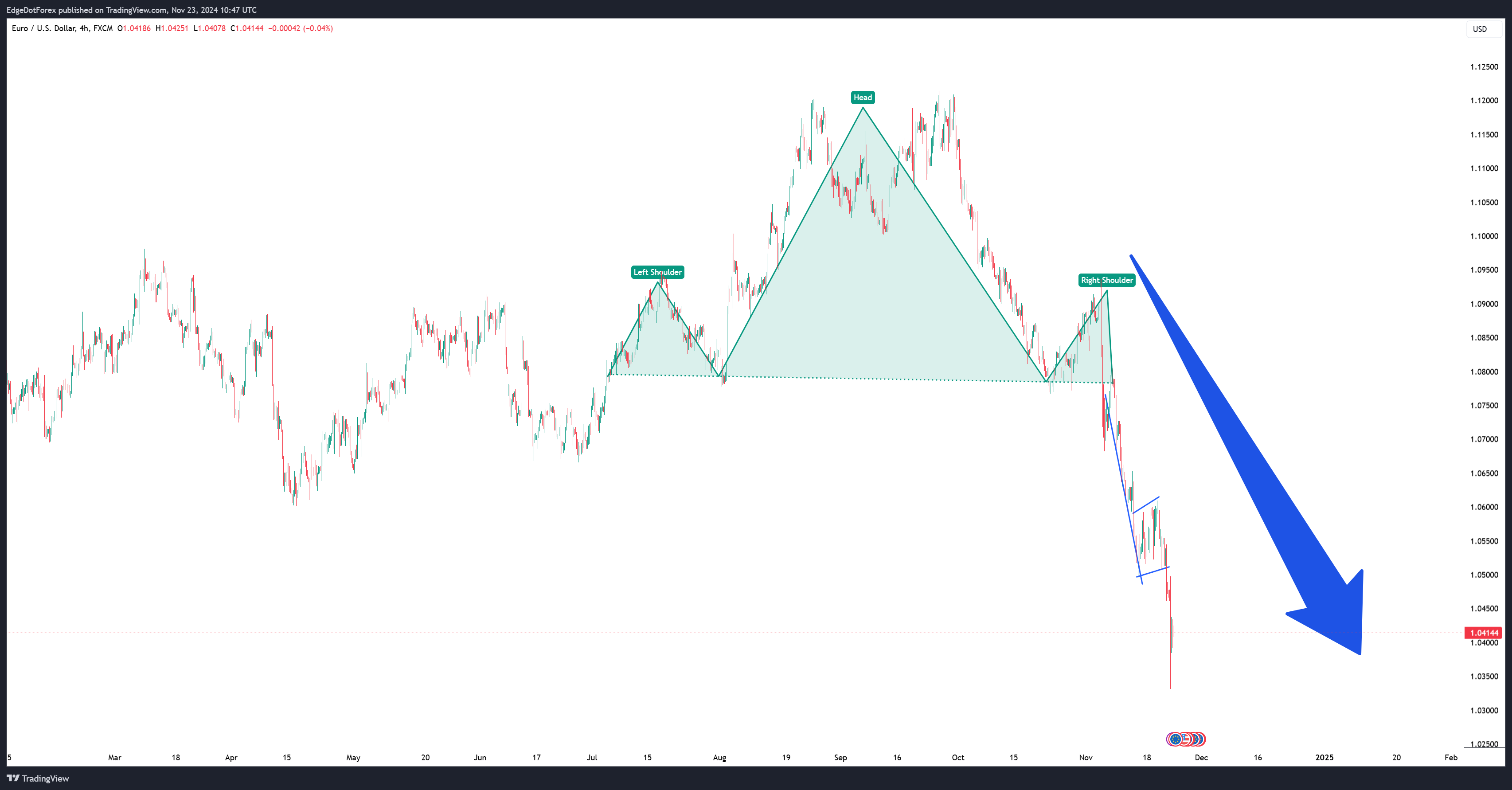

In Europe, EUR/USD edged slightly higher to 1.1132, after pulling back sharply from 1.1214, a high not seen since July of last year with the eurozone data calendar quiet.

“We will likely see a bit more range-bound swings around the 1.110-1.120 area in the near term unless US data offers clearer direction to markets. A 2-year EUR:USD swap rate gap tighter than -100bp (now at -95bp) is still arguing against a major correction in the pair,” said ING.

GBP/USD traded 0.1% higher to 1.3342, after climbing to 1.3430 on Wednesday for the first time since February 2022.

USD/CHF fell 0.2% to 0.8488 after the Swiss National Bank cut its benchmark interest rate by 25 basis points earlier Thursday.

While this move was largely expected, and is the third consecutive such reduction, there had been some looking for an even bigger cut as the country’s inflation rate came in at 1.1% last month, the slowest pace among G10 economies and nearly in the midpoint of the SNB’s 0%-2% target range.

Yuan benefits from Chinese stimulus

USD/CNY traded 0.2% lower to 7.0187, near its lowest level since May 2023 after Beijing unveiled a string of major stimulus measures aimed at shoring up growth.

USD/JPY rose 0.1% to 144.87, moving further away from its 2024 lows before the LDP elections on Friday, which are set to determine the country’s next Prime Minister.

Analysts expect a leadership change in Japan to stymie the Bank of Japan’s plans to raise interest rates in the near-term.

This post is originally published on INVESTING.