While the weakening of the Fed’s monetary policy, India’s insatiable demand, capital inflows into ETFs, geopolitical factors, and rising default risks in the US are significant contributors to the XAUUSD rally, there are other factors that investors should consider. Let’s discuss this topic and make a trading plan for gold.

The article covers the following subjects:

Highlights and key points

- The Fed’s aggressive start created a tailwind for XAUUSD.

- Escalating conflict in the Middle East supports gold prices.

- Indian imports of precious metal set records.

- One can buy gold with the target of $2,800 per ounce.

Quarterly fundamental forecast for gold

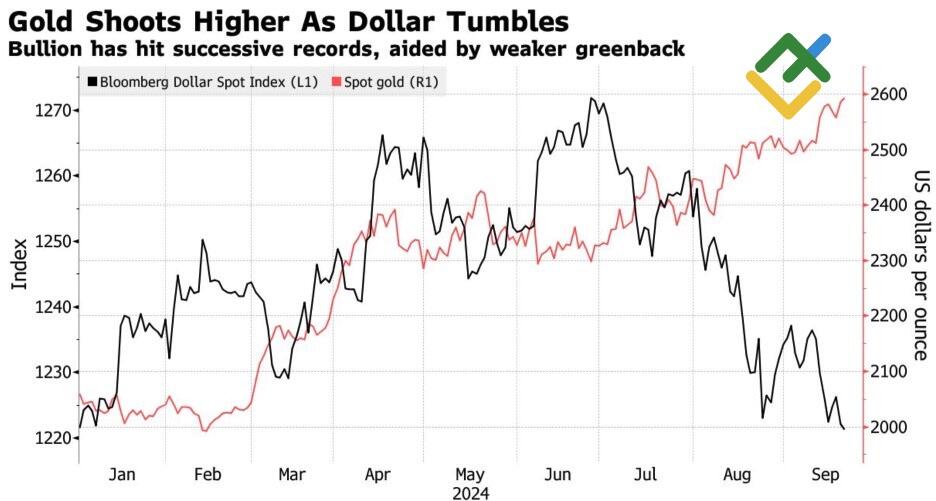

It would be unwise to bet against gold. Short trades on the XAUUSD are out of consideration now, particularly given that bulls are taking advantage of the Fed’s actions. The rapid monetary expansion enabled the precious metal to reach a price of over $2,600 per ounce for the first time in history, while the intensification of the conflict in the Middle East and the unstoppable demand in India provided additional support. Therefore, gold bears are better off sitting on the fence now.

In August, India’s gold imports reached a new record high of over $10 billion. This represents the sixth-largest result in history, with 131 tons of gold. In light of the precious metal’s unwavering record-breaking performance and the waning interest in neighboring China, the current frenzied demand seems anomalous. The primary factor driving this surge in demand is the reduction of import duties, which has significantly increased the purchasing power of Indian consumers.

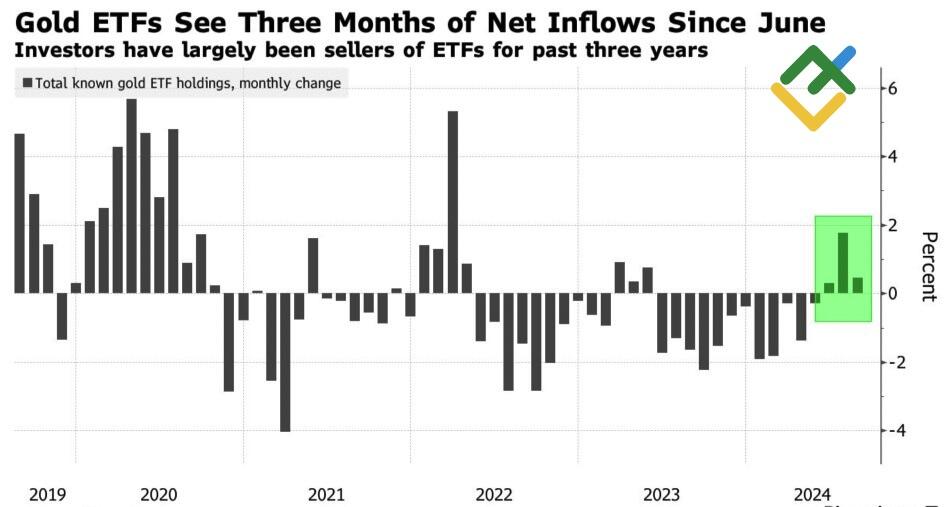

The situation in the West is not significantly different. Following 18 months of capital outflow from specialized exchange-traded funds, there has been a three-month inflow. The reason was the start of the Fed’s monetary expansion cycle. According to Chicago Fed President Austan Goolsbee, the central bank has a long way to go before it makes the rate neutral. The derivatives market estimates the magnitude of its cut at 175 bps in the cycle, which adds to the risks of a weaker US dollar and greenlights a gold rally.

Capital flows into gold ETFs

Source: Bloomberg.

Gold price and US dollar performance

Source: Bloomberg.

The Fed’s primary objective is to achieve a soft landing for the US economy. However, before the economy improves, there is a possibility that it will experience a temporary decline. The delayed effect of aggressive rate hikes in 2022-2023 will contribute to this outcome. This will continue to exert downward pressure on US Treasury yields, stimulate capital inflows into ETFs, and spur XAUUSD‘s quotes.

Geopolitical factors and the associated de-dollarization and central bank purchases of gold remain significant factors. In addition, there are risks of further escalation of the conflict in the Middle East, which strengthens the demand for the precious metal as a safe-haven asset.

Notably, the reluctance of US presidential candidates to pursue fiscal consolidation policies. The introduction of further fiscal stimulus will result in an increase in the already considerable national debt, an elevated risk of defaults, and a subsequent loss of confidence in the US dollar.

Therefore, all of XAUUSD’s key advantages remain in place. Despite the record speculative net longs in gold since 2020, positions do not appear to be overly stretched in light of the Fed’s approach to financial markets. The precious metal continues to be purchased at a rapid pace, and Goldman Sachs’ forecast of $2,700 per ounce by the end of 2024 seems conservative. Citigroup’s $3,000 by mid-2025 represents a more ambitious outlook.

Quarterly trading plan for gold

There are no preconditions for a significant pullback in the XAUUSD rate. Therefore, one can purchase gold on any slight declines in quotes. The target of $2,800 per ounce remains relevant.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.