Investing.com — Gold’s rally of more than 5% so far in September has been “unseasonably strong,” defying its historical behavior during the month over the past 10 years, according to investors at UBS.

In a note to clients, the analysts said “recent conversations with various market participants” suggest that views towards the yellow metal are growing “ever stronger,” although they have yet to be “fully backed by positions.”

“Many keep waiting for pullbacks to build exposure, but the lack of opportunities has likely amplified these sharp moves up as investors chase prices higher,” the UBS analysts said.

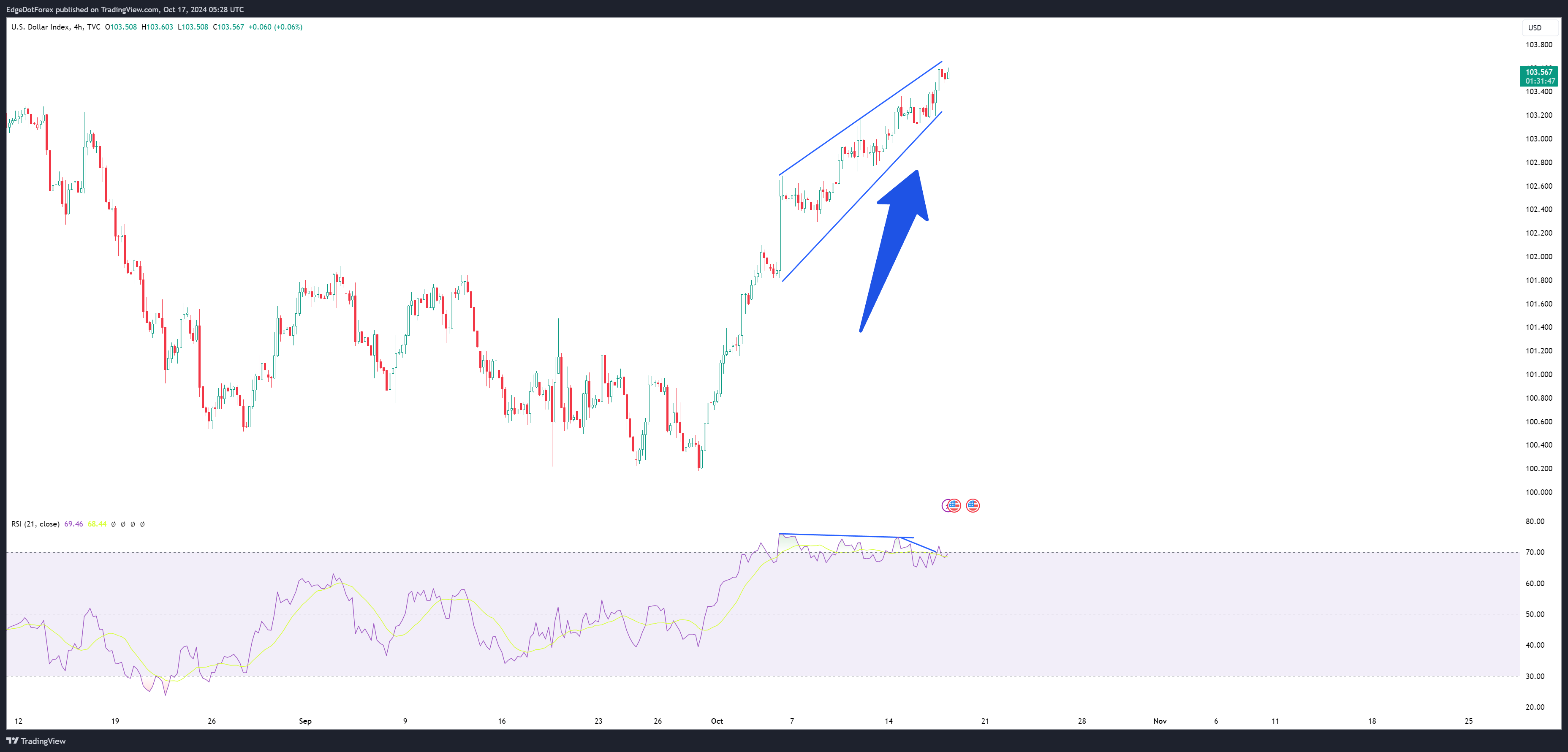

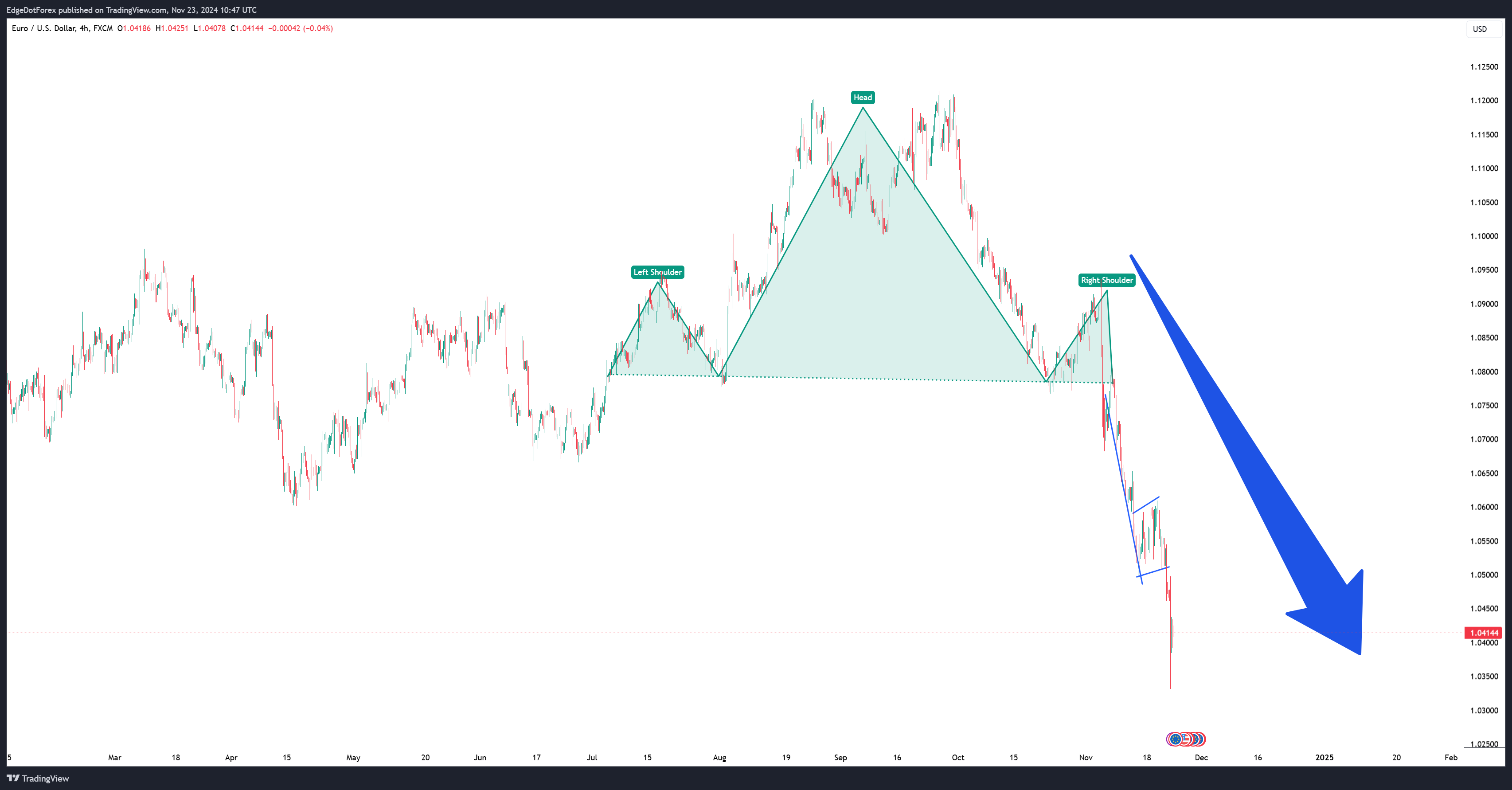

They added that traders are generally anticipating that a cooling in gold’s returns “may be in the cards,” particularly if a re-acceleration in US growth leads the Federal Reserve to take a “hawkish pivot” that could keep interest rates elevated and bolster the dollar. However, they predicted that any downside would likely be “limited.”

“The market could use a breather,” the UBS analysts said. “[A] period of consolidation at this juncture would be healthy for the market, especially if it allows some weak longs to be flushed out and for long-term investors to jump in at better levels.”

Gold surged to record highs in Asian trade on Tuesday, extending a recent run of gains sparked by a bumper rate cut by the Fed last week. Sentiment has also been buoyed by the prospect of further reductions to borrowing costs later this year.

Several Fed officials said on Monday that they supported the central bank’s 50 basis point cut, but expected its pace of drawdowns to slow in the coming months. Analysts at Citi said they expect at least 125 basis points of cuts by the end of the year.

Lower rates bode well for gold, given that they reduce the opportunity cost of investing in non-yielding assets. The dollar and Treasury yields sank after the Fed’s decision, enabling more gains in gold.

This post is originally published on INVESTING.