The Fed’s new approach to saving the economy from recession with an aggressive move contrasts with the cautious stance of the ECB and other central banks, which allows the EURUSD pair to increase. Let’s talk about this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The derivatives market is demanding the Fed to cut rates by 70 bps by the end of 2024.

- The Fed is ready to accelerate as inflation is falling fast.

- The ECB talks about the volatile nature of consumer prices.

- The EU PMI weakness will create a buying opportunity for the EURUSD pair.

Weekly US dollar fundamental forecast

Why is the US dollar falling? It is not because the Fed has decided to do everything to combat the cooling of the US economy. The latter, according to Jerome Powell, is in good shape, and the decision to cut interest rates by 50 basis points is aimed at keeping it that way. Indeed, the aggressive start to monetary expansion suggests that the central bank has come to believe that inflation has been defeated. At the same time, the ECB continues to talk about its volatile nature and maintains its emphasis on caution. Against this backdrop, the EURUSD pair is soaring.

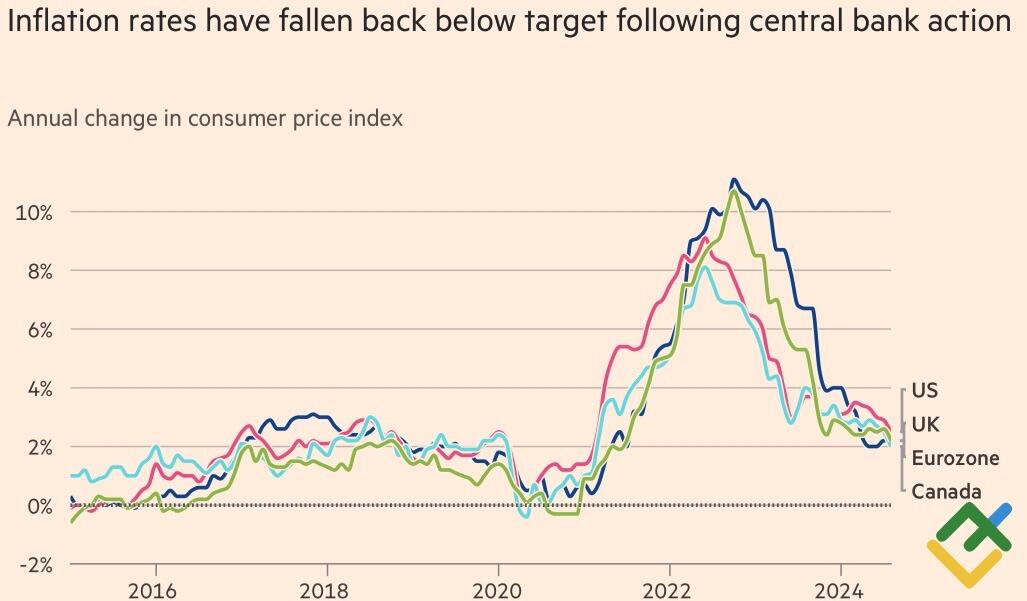

At first glance, the Fed’s stance is correct. The Personal Consumption Expenditure Index is expected to slow to 2.3% in August, the smallest annual increase since 2021. However, inflation in the UK already hit its target in May, and the eurozone’s CPI is closer to the target than that of the US. The currency bloc’s economy is clearly weaker than the US, but the ECB prefers to be reassuring, arguing that the market is pricing in one or two acts of monetary expansion before the end of 2024.

Inflation rates

Source: Financial Times.

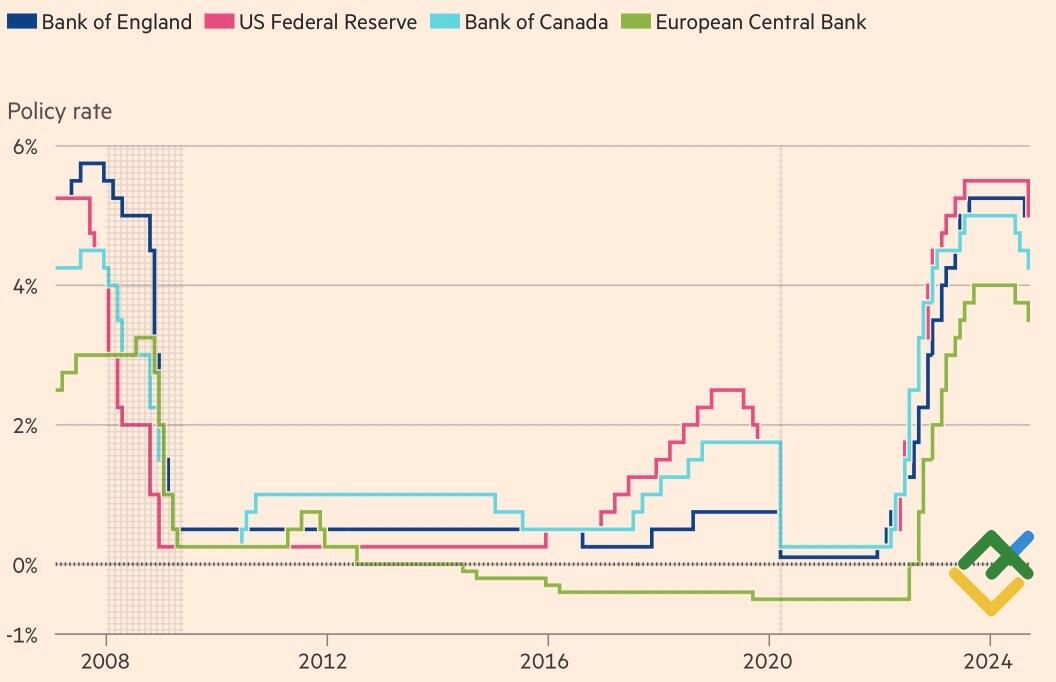

The futures market expects the Fed to cut rates by as much as 70 basis points this year. By the end of 2025, borrowing costs should fall to 3%. This is a more aggressive monetary expansion than the FOMC is projecting. However, Christopher Waller is prepared to speed it up if the economy continues to cool. According to the official, the abrupt start is due to inflation slowing faster than expected.

Not everyone agrees with him. Michelle Bowman, who voted for a smaller cut, says the Fed’s final decision could be interpreted as a victory over high prices. A slower pace of rate cuts would help avoid unnecessarily stoking demand. Indeed, the PCE index is slowing, but the target has not yet been reached.

Major central bank’s interest rates

Source: Financial Times.

Christine Lagarde also addressed the volatile nature of inflation. She stated that the global economy was facing a triple challenge: the worst pandemic since the 1920s, the worst armed conflict since the 1940s, and the worst energy crisis since the 1970s. Given that supply shocks are not yet over, central banks must remain vigilant.

The ECB’s cautious stance contrasts with the Fed’s aggressive approach. For EURUSD traders, this is a buy signal. The US dollar had hoped that the Fed would prefer caution and not go along with the market demanding aggressive reduction of borrowing costs. However, it turned out to be different.

Weekly EURUSD trading plan

EURUSD bears may benefit from the US presidential election or positive US economic data. However, until these developments occur, the euro’s rally may continue. The pair may eventually breach the 1.118 resistance level. In addition, the pair’s decline in response to weak European PMI data could also offer an opportunity for purchases.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.