It would appear that there is no better investment than gold in 2024. The precious metals sector leader set new records, but in the autumn, it ceded the top spot to silver, its main rival. Let’s discuss this topic and make a trading plan for the XAGUSD.

The article covers the following subjects:

Highlights and key points

- Silver gained the upper hand over gold in the precious metals market and became the market leader.

- XAGUSD bulls were able to capitalize on the 50-basis-point rate cut by the Fed.

- Silver may grow to $32.7 and $36 per ounce.

Monthly fundamental forecast for silver

For the greater part of the year, gold held a dominant position in the precious metals market, with silver playing a less prominent role. Not only did XAUUSD quotes hit new all-time highs, while XAGUSD did not, but the precious metals sector leader also grew at a faster rate than the rest of the market. However, thanks to the September surge, silver outperformed its main competitor following the Fed’s decision to cut the federal funds rate by 50 basis points.

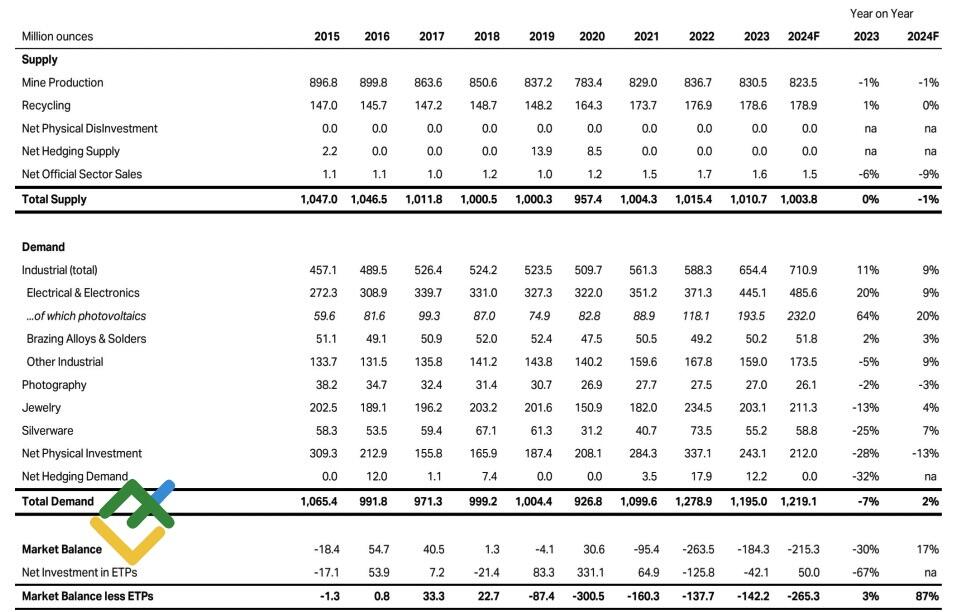

Gold has a number of advantages over its competitors, including the potential for de-dollarization and the active buying of central banks. Conversely, the global economic slowdown, led by the US and China, is limiting the enthusiasm of XAGUSD buyers, even with the second-ever deficit in the physical metal market.

Silver supply and demand

Source: Silver Institute.

A recent report from Capital Economics suggests that silver will lag behind gold as the slowdown in the Chinese economy has negative implications for most metals. Given the high weight of industrial use, it is unlikely that XAGUSD quotes will outperform XAUUSD.

In practice, this is not the case. The aggressive launch of monetary expansion by the Fed has led to accelerated growth in white metal prices. Since the beginning of the year, prices have increased by 29.5%, including a 5% rise over the past month. As for gold, the figures are 25.8% and 3.3%.

It would appear that a 50-basis-point reduction in the federal funds rate to 5% should have provided substantial support for an asset with a high proportion of investment demand. Indeed, the magnitude of the adjustment was widely expected, and the manner in which Jerome Powell executed it proved advantageous for the XAGUSD. The Fed chief reassured investors that the US economy was stable and that a recession was not imminent. Earlier, market speculation about a potential recession put downward pressure on silver prices during the summer and fall. Given the current market conditions, should investors refrain from purchasing precious metals?

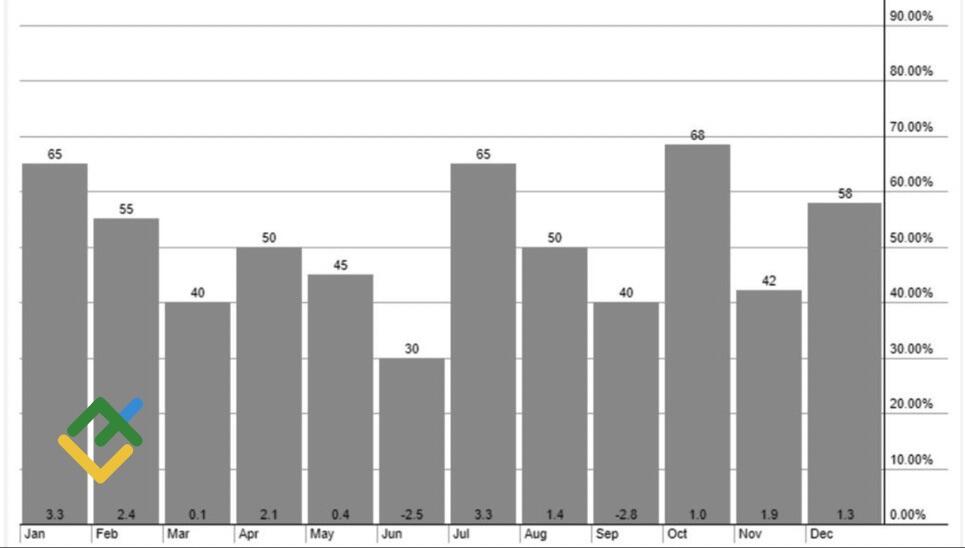

Despite these concerns, investors rushed into the precious metal market. Historically, January and October have been favorable periods for silver, particularly between 2005 and 2024. When considering the seasonal factor, the XAGUSD rally will likely continue.

Seasonal trends in silver prices

Source: Kitco.

The recession fears that depressed the price of the white metal have now evaporated, allowing it to surpass gold. Meanwhile, the weakening of the US dollar and the decline in US Treasury bond yields create a favorable background for the XAGUSD, contributing to capital inflows into ETFs.

Monthly trading plan for silver

The bullish trend in silver is robust. Therefore, consider keeping long positions formed above $29.35 per ounce open and initiate more long trades on pullbacks. The quotes are approaching the first of two targets at $31.4 and $32.7 per ounce, and it makes sense to shift bullish targets to $32.7 and $36.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.