The aggressive start of the Fed’s monetary expansion has left other central banks indifferent. They have chosen not to declare victory over inflation, which is a negative development for the US dollar. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Central banks have not followed the Fed’s lead.

- The rising global risk appetite is putting pressure on the US dollar.

- Markets are demanding more from the Fed.

- Long trades can be considered if the EURUSD pair breaks through 1.118.

Weekly US dollar fundamental forecast

Central banks have not followed the example set by the US Fed, which, when coupled with an improvement in global risk appetite, has significantly undermined the value of the US dollar. The market response to the 50-basis-point reduction in the federal funds rate to 5% was not timely. The S&P 500 reached record highs, and the EURUSD pair climbed to 1.12. Jerome Powell’s rhetoric initially caused risky assets to decline but then inspired investors to take further action the following day. They viewed the Fed chairman’s statements as a Goldilocks scenario.

The Bank of England will exercise caution to ensure that monetary policy is neither eased excessively nor too rapidly, as it is crucial to maintain low inflation. In a move that was widely anticipated, the Bank of England opted to leave interest rates unchanged. Similarly, the central banks of Norway, Taiwan, Turkey, and Japan also chose to maintain their current monetary policies. Brazil even increased borrowing costs. In light of the Fed’s significant reductions, this enabled EURUSD bulls to push the quotes higher. At the same time, bears had hoped that regulators would follow the Fed, but this did not occur.

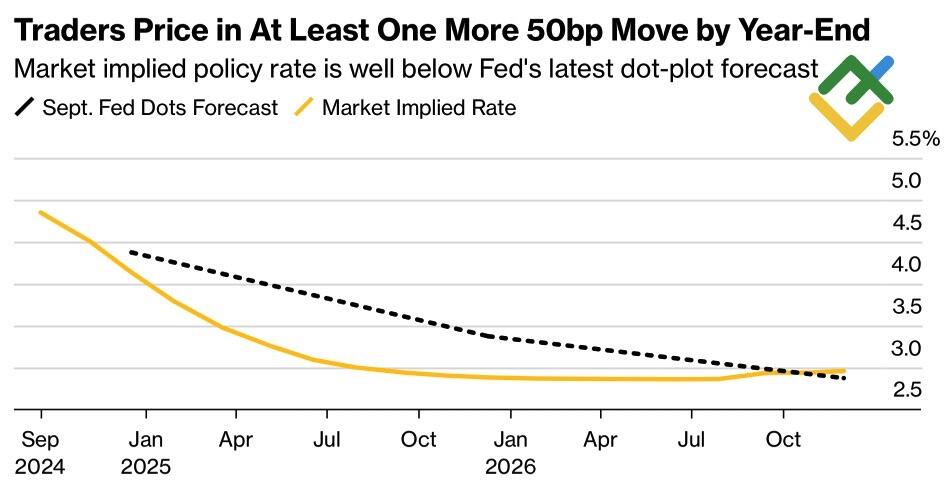

The varying speeds of monetary expansion and occasional divergence in policy, as seen in Japan and Brazil, provide compelling reasons to sell the US dollar against major global currencies. Furthermore, the improvement in global risk appetite is affecting the demand for safe havens. The Fed delivered the market response that was anticipated, and investors began to demand more. They are now seeking a 70 bp cut in the federal funds rate by the end of 2024, which is more than the half-point cut that the FOMC previously forecasted.

Market expectations and Fed forecasts on interest rate

Source: Bloomberg.

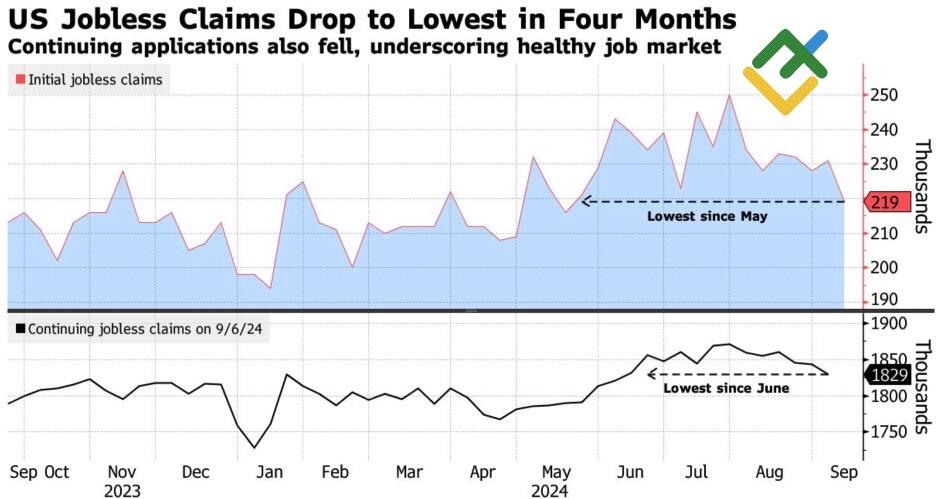

Goldman Sachs projects a 25-basis-point reduction in borrowing costs at each Fed meeting from November to June. JP Morgan suggests the possibility of a 50-basis-point cut in November. The Fed’s revised estimates indicate a slight increase in the unemployment rate, suggesting that the central bank has succeeded in controlling inflation but is now focusing its efforts on addressing the cooling labor market.

Employment figures may present unexpected developments, as evidenced by the decline in jobless claims to their lowest levels since May.

Initial jobless claims

Source: Bloomberg.

The Fed is committed to achieving a soft landing, although a more precise description would be a return of the US economy from overheating to a state of equilibrium. When GDP growth decelerates but remains above trend, inflation returns to the 2% target, and unemployment stabilizes at a low level. The only unusual aspect of this strategy was the level of the federal funds rate, which was set at 5.25%. The Fed took the appropriate action by adjusting it.

Weekly EURUSD trading plan

Central banks’ reluctance to follow the US regulator and improving global risk appetite allows traders to buy the EURUSD pair once it pierces the level of 1.118. The quotes may see growth before moving lower.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.