The cooling labor market, falling inflation to the target, and GDP growth twice as slow as the Bank of Canada forecasts leave USDCAD bears no chance. Only the Fed can throw them a lifeline. Let’s talk about this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

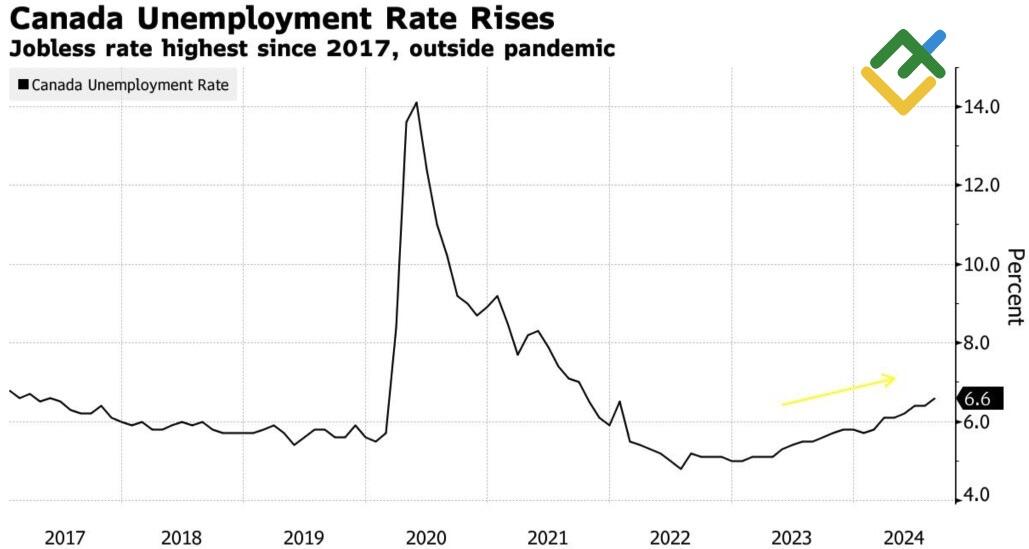

- Unemployment in Canada jumped to 6.6%.

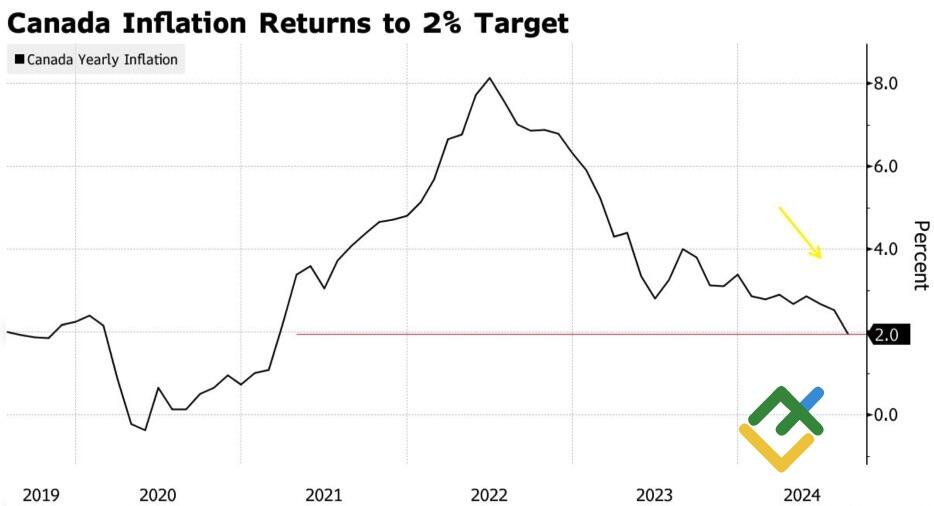

- Inflation fell to 2% from 8.1% in June 2022.

- Banks are demanding a 50 bp rate cut from the BoC.

- The Fed’s slow start will allow traders to open long trades on the USDCAD pair with targets of 1.37 and 1.38.

Monthly Canadian dollar fundamental forecast

Will the Fed’s aggressive start to monetary expansion save USDCAD bears? The Canadian dollar is sliding amid a cooling labor market and the first dip in inflation to the 2% target since 2021. It is losing against most of the G10 currencies except for the Norwegian krone, and even a massive sell-off in the US dollar is not helping the loonie. Will the Fed be able to lend a helping hand to the Canadian dollar?

In August, unemployment in Canada climbed to 6.6%, higher than Bloomberg experts predicted. Employment grew by 22.1 K for the first time in three months. However, the positive momentum was based on growth in part-time employment.

Unemployment rate in Canada

Source: Bloomberg.

The cooling labor market is weighing on the overall economy. According to Bloomberg experts, the economy will grow twice as slowly in the third quarter than the Bank of Canada previously forecast.

Tiff Macklem is concerned that a further drop in oil prices will further slow GDP and hurt the labor market. The IEA forecasts that global crude oil demand will grow by 900K bpd in 2024. This is significantly lower than JP Morgan’s +1.3 mln bpd and Citigroup’s +1.5 mln bpd. Along with the increase in supply from non-OPEC+ countries, the risks of a resumption of the bearish trend in Brent are growing. This is bad news for Canada, which is an oil export-oriented country, and its currency.

The Bank of Canada needs to act aggressively to avoid a recession. It has already been proactive, cutting the overnight rate three times since the cycle began in June, from 5% to 4.25%. Is it time for more decisive action? CIBC expects the BoC to cut borrowing costs by half a point at each of its December and January meetings, reducing them to 2.25% by June 2025. The National Bank of Canada also projects that the central bank will cut rates at one of its meetings before the end of the year.

Notably, the first drop in inflation to the 2% target since 2021 in August allows Tiff Macklem and his colleagues to take more decisive action. Although Bank of Canada Senior Deputy Governor Carolyn Rogers says it is too early to declare victory over high prices, the BoC still has work to do to anchor it, and market attention is shifting to the state of the economy as the yield curve is no longer inverted, signaling an approaching recession.

Canada’s inflation rate

Source: Bloomberg.

Canada’s yield curve

Source: Bloomberg.

Monthly USDCAD trading plan

The cooling economy has made the loonie the main underdog among the G10 currencies. However, an aggressive start to the Fed’s tightening cycle may help the currency stay afloat. At the same time, Jerome Powell will not shock the financial markets and will likely start with a 25 bp cut. Against this backdrop, traders can consider opening long trades on the USDCAD pair, adding them to the ones formed at 1.3475 and shifting the bullish target from 1.364 to 1.37 and 1.38.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.