By Tom Westbrook

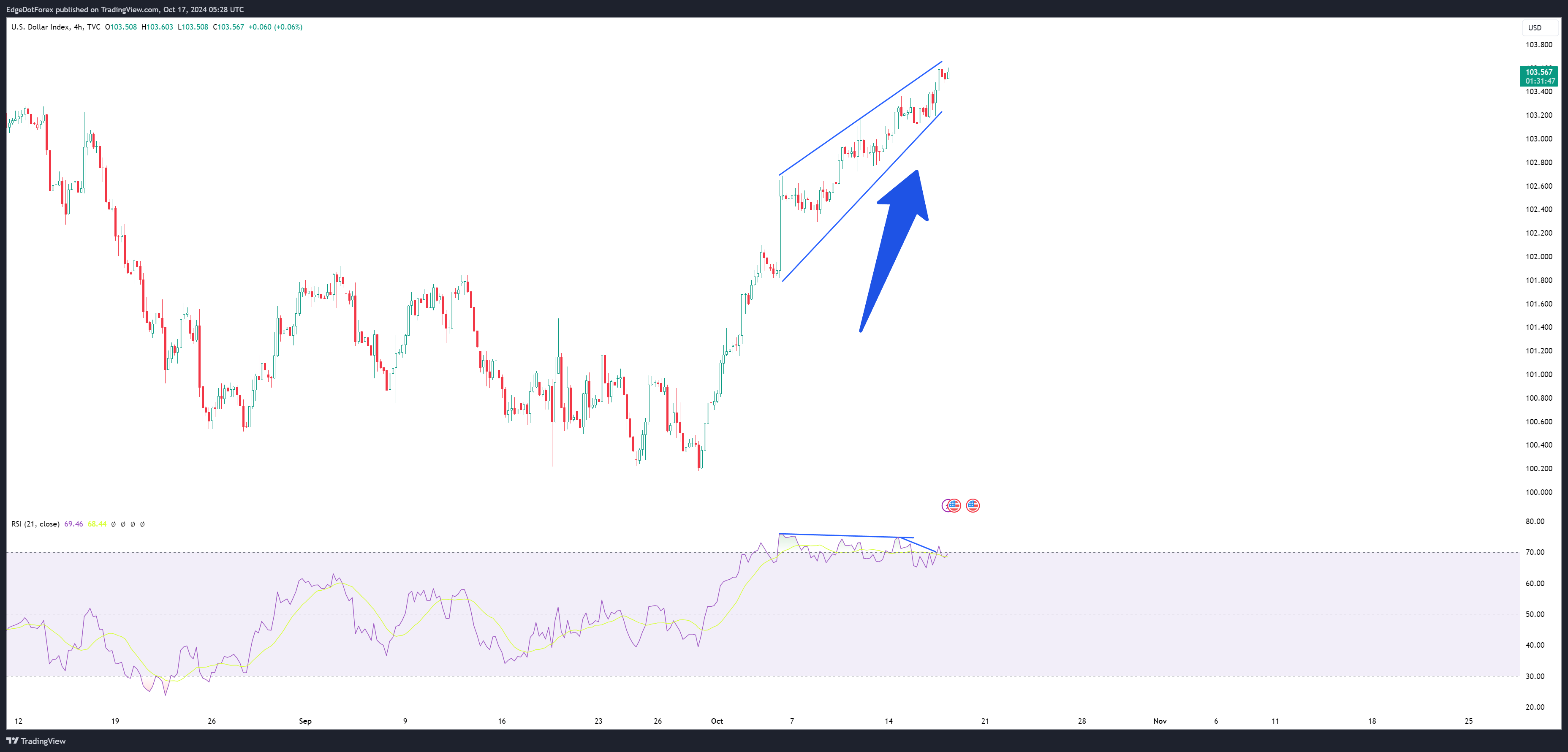

London (Reuters) -The dollar shed some of its overnight gains against the yen on Wednesday, as investors made last-minute tweaks to positions ahead of a policy meeting expected to initiate a U.S. easing cycle.

The Federal Reserve is expected to make its first interest rate cut in more than four years at 1800 GMT, with markets pricing a 61% probability of a 50 basis point cut.

The dollar has fallen along with U.S. yields since July and at $1.1129 per euro is not far from the year’s low at $1.1201 in anticipation of U.S. easing at a clip, with more than 100 basis points of rate cuts priced in by Christmas.

The yen, up more than 12% since July, has been surging because the Bank of Japan – which sets policy on Friday – has been hiking rates at the same time as the Fed prepares to cut.

It rose about 0.4% to 141.80 per dollar on Wednesday, recouping about a third of an overnight drop. The yen was down 0.3% to 157.84 per euro.

Elsewhere, the Australian dollar traded at a two-week top at $0.6778, while a rise in milk prices supported the New Zealand dollar at $0.62155, though moves were tentative ahead of the Fed’s meeting. [AUD/]

“I think markets really struggle to find much sense of direction today before the FOMC,” said ING currency strategist Francesco Pesole, referring to the Federal Open Market Committee.

Traders say the Fed’s tone as well as the size of the rate cut will drive the reaction in the foreign exchange market.

“A dovish Fed on a substantial easing path should generally lead to a weaker dollar,” said Nathan Swami, head of currency trading at Citi in Singapore.

But an extremely dovish Fed, Swami said, could end up spooking markets if it seems it anticipates a more ominous downturn in the economy than is expected, and in that case risk-sensitive and emerging market currencies may face headwinds.

On the other hand, the dollar will get a relief rally in case of a 25bp cut, Pesole said.

But “the move over the next few days and weeks into the U.S. jobs report will depend much more on the press conference and the overall tone,” Pesole noted, with markets remaining quite reluctant to jump back into dollar longs or trim dollars short substantially if the Fed signals they are open to a 50bp cut later in the year.

U.S. retail sales unexpectedly rose 0.1% in August, data showed overnight, against forecasts for a 0.2% contraction and the Atlanta Fed’s closely-followed GDPNow estimate was raised to 3% from 2.5%, supporting perhaps a case for a smaller Fed cut.

China’s markets resumed trade on Wednesday after the mid-autumn festival break, with the yuan’s trading band fixed at its strongest since January. The currency was steady at 7.0897 per dollar. [CNY/]

Sterling, the best performing G10 currency of the year, gained slightly at $1.3204 with its rally being driven by signs of a steadying economy and sticky inflation. British inflation stood at an annual rate of 2.2% in August, unchanged from July, but price growth in the services sector – closely watched by the Bank of England – picked up, official figures showed.

Final European inflation figures are also due, however, they are not expected to deviate much from preliminary August figures and so all eyes will be on the Fed.

“With markets wagering on 41bp of cuts, which is a long way from either realistic contender (25bp or 50bp), volatility seems almost assured,” analysts at ANZ Bank said in a note to clients.

This post is originally published on INVESTING.