As we navigate the stock market landscape, Nvidia (NVDA) emerges as a critical player worthy of attention for its future stock price movements. The pivotal question many are asking is, “Are Nvidia stock prices expected to go up or down?” Delving into the current trends and data, there’s a leaning toward a bullish perspective on NVDA’s stock. This fact makes it an intriguing option for investors and traders.

In this article, readers will gain an in-depth understanding of Nvidia’s (NVDA) stock price forecast, exploring various factors influencing its market performance, including technical analysis, financial health, and expert insights.

The article covers the following subjects:

Highlights and Key Points: Nvidia Stock Forecast 2024-2030

- On 17.09.2024, Nvidia Corporation stock is trading at $117.46.

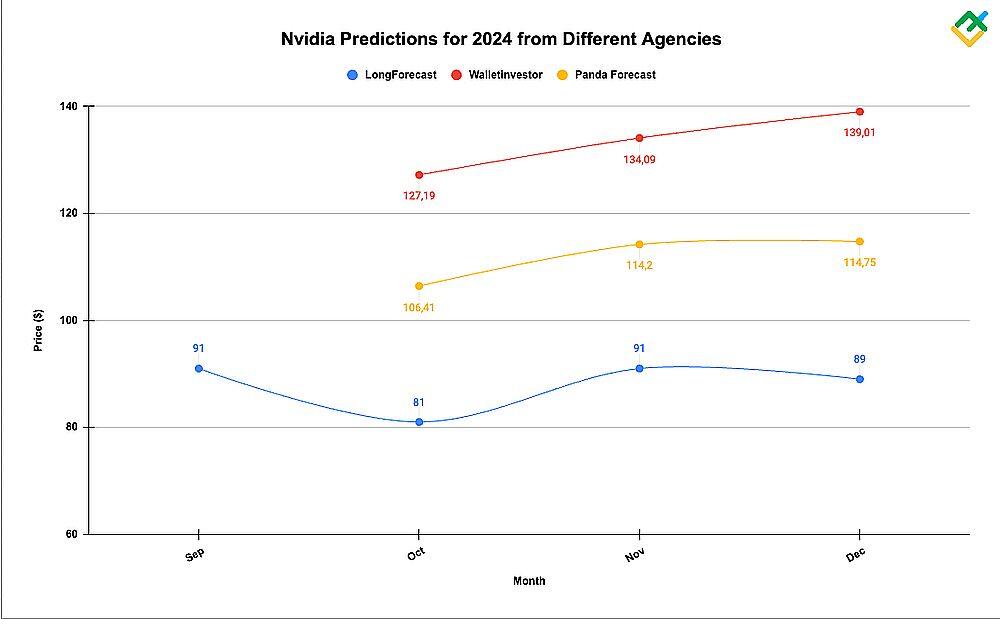

- Nvidia stock forecasts for 2024 include a range of estimates from leading stock market experts. Most analytical agencies project that NVDA will reach values between $114.52 and $139.01, despite the recent $280 billion decline in the company’s market cap. Negative forecasts indicate a moderate decline in the company’s price to $82.17–$96.47 by the end of the year. Analysts at CoinCodex do not rule out a decline in the share price to $70.53.

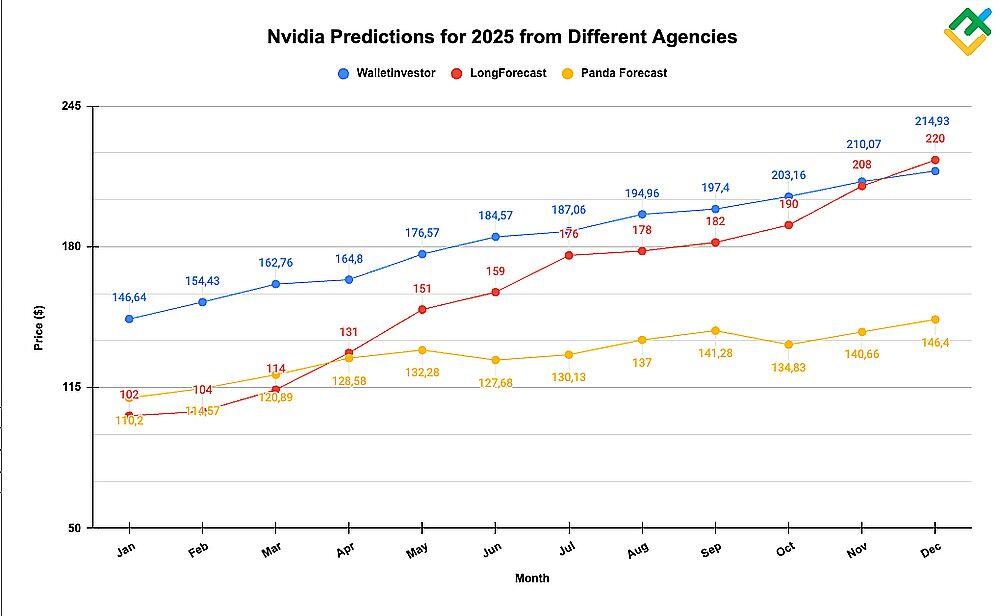

- Analysts anticipate that Nvidia securities will reach a value of $156.90–$185.40 per share in 2025. More optimistic forecasts suggest an increase in value to the levels of $214.93–$220.77. More conservative forecasts project that NVDA will experience moderate growth, reaching $146.40 per share in 2025.

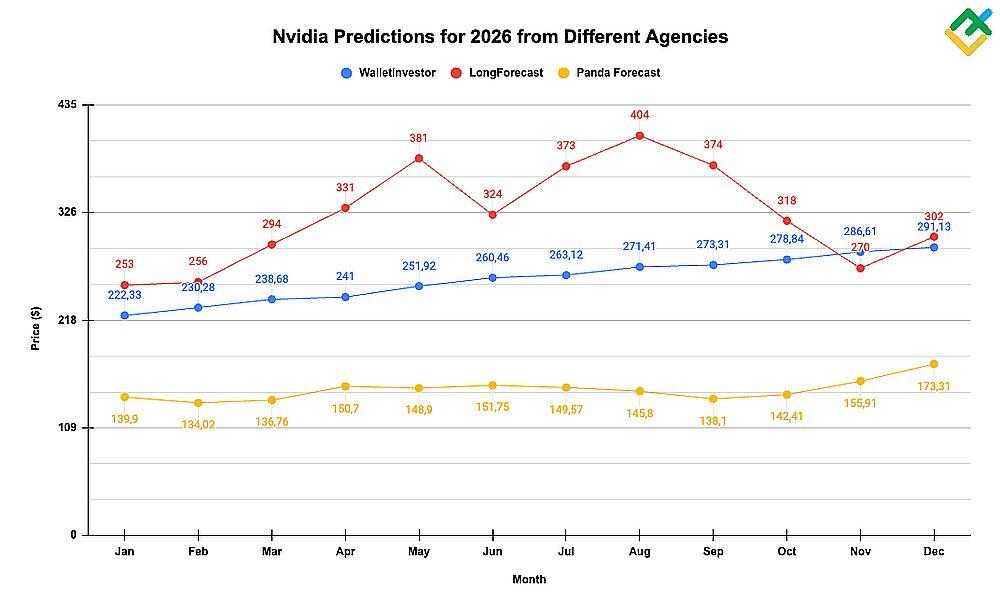

- Analysts estimate that the target range for 2026 will be between $217.82 and $291.13. A number of experts predict that the value of the company’s shares will experience significant growth, reaching $334.15–$437.34 per share in 2026. More moderate forecasts indicate an anticipated increase in Nvidia’s share price to $173.31.

- Forecasts for Nvidia stock prices for the 2027–2030 period vary. Some experts predict that the NVDA rate will surge to $1,030.00–$3,525.80 per share. At the same time, some analysts give more conservative forecasts and expect growth to the range of $421.21–$499.33 per share by 2030.

Nvidia Stock Price Today Coming Days and Week

When forecasting Nvidia’s stock, focus on upcoming product launches and technological advancements in GPUs and AI. Monitor earnings reports for financial health and future projections. Keep an eye on tech sector trends and supply chain updates, especially regarding chip shortages. Utilize technical analysis tools like Moving Averages, the RSI, and the MACD indicator to assess market sentiment and predict price movements. These factors collectively provide insights into Nvidia’s short-term stock price behavior.

Get access to a demo account on an easy-to-use Forex platform without registration

Analysts’ Nvidia Stock Projections for 2024

Let’s take a look at expert forecasts for the NVDA rate in 2024.

Trading Economics

Price range in 2024: $116.15–$118.48 (as of September 8, 2024).

Analysts at the Trading Economics portal, who base their forecasts on global macro models and insights from stock market analysts, project that the Nvidia stock could reach a value of $118.48 per share by the end of the current quarter. By the end of 2024, analysts expect that the price will stabilize at $116.15.

Longforecast

Price range in 2024: $75.00–$122.00 (as of September 8, 2024).

Experts at LongForecast suggest that Nvidia’s stock price will range between $75.00 and $122.00 over the next few months, with a projected decline to $89.00 per share by the end of the year, representing a loss of over 25% from the stock’s current valuation.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| September | 119.00 | 79.00–122.00 | 91.00 | -23.5% |

| October | 91.00 | 75.00–120.00 | 81.00 | -31.9% |

| November | 81.00 | 81.00–98.00 | 91.00 | -23.5% |

| December | 91.00 | 82.00–96.00 | 89.00 | -25.2% |

TipRanks

Price range in 2024: $90.00–$200.00 (as of September 8, 2024).

According to the analytical portal TipRanks, the share price of Nvidia will rise to $151.79. The consensus forecast of 43 experts surveyed reveals that 39 analysts give a “buy” recommendation, while the rest of them maintain a “hold” stance. The lowest and highest price targets for the stock are $90.00 and $200.00, respectively.

| Year | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| 2024 | 90.00 | 151.79 | 200.00 |

WalletInvestor

Price range in 2024: $121.56–$139.01 (as of September 8, 2024).

According to analysts from WalletInvestor, NVDA quotes will trade in a narrow range of $121.56-139.01 per share within the next four months. By the end of the year, experts estimate that the share price of the AI giant will increase to $139.01.

| Month | Open, $ | Close, $ | Minimum, $ | Maximum, $ | Change, % |

|---|---|---|---|---|---|

| October | 121.56 | 127.19 | 121.56 | 127.19 | 4.43% |

| November | 127.50 | 134.09 | 127.50 | 134.09 | 4.92% |

| December | 134.67 | 139.01 | 134.59 | 139.01 | 3.12% |

Coin Price Forecast

Price range in 2024: $83.00–$127.00 (as of September 8, 2024).

Experts at Coin Price Forecast suggest the asset’s price will rise to $127.00 per share by the end of 2024, reflecting a 24% gain.

| Year | Year-End, $ | Change, % |

|---|---|---|

| 2024 | 127.00 | 24% |

GovCapital

Price range in 2024: $105.68–$114.52 (as of September 8, 2024).

According to GovCapital, the average Nvidia stock price could increase to $114.52 per share by the end of 2024. At the same time, the lowest possible price could be $89.82 and the highest possible price may reach $131.70 per share.

| Date | Average price, $ | Least possible price, $ | Best possible price, $ |

|---|---|---|---|

| October 1, 2024 | 105.68 | 89.82 | 121.53 |

| October 31, 2024 | 107.64 | 91.49 | 123.78 |

| November 1, 2024 | 108.39 | 92.13 | 124.65 |

| November 30, 2024 | 114.18 | 97.05 | 131.31 |

| December 1, 2024 | 113.77 | 96.71 | 130.84 |

| December 31, 2024 | 114.52 | 97.34 | 131.70 |

CoinCodex

Price range in 2024: $70.53–$100.92 (as of September 8, 2024).

Analysts at CoinCodex are cautious about the future outlook for Nvidia’s share price, anticipating a decline of 34.18% by the end of 2024, with the NVDA price reaching $70.53.

| Year | Average price, $ | Change, % |

|---|---|---|

| 2024 | 70.53 | -34.18% |

30Rates

Price range in 2024: $75.27–$121.75 (as of September 8, 2024).

30Rates projects price fluctuations through the end of 2024, with a projected range of $75.27 to $121.75 per share. The market analysts expect a decline in trading instrument quotes, with an anticipated value of $89.32 by the end of December.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| September | 119.37 | 79.75–121.75 | 91.72 | -23.2% |

| October | 91.72 | 75.27–119.98 | 81.81 | -31.5% |

| November | 81.81 | 81.81–98.78 | 91.46 | -23.4% |

| December | 91.46 | 82.17–96.47 | 89.32 | -25.2% |

Stock Analysis

Price range in 2024: $65.00–$200.00 (as of 02.09.2024).

Based on the data provided by the Stock Analysis analytical portal, the price of the trading instrument will increase to a target of $144.79 per share. Of the 39 analysts surveyed, 16 gave a “buy” recommendation, 20 awarded NVDA shares a “strong buy” rating, three assigned a “hold,” and none suggested “sell” or “strong sell.”

| Year | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| 2024 | 65.00 | 144.79 | 200.00 |

Panda Forecast

Price range in 2024: $97.34–$125.76 (as of September 8, 2024).

According to experts at Panda Forecast, the asset’s value will reach a high of $125.76, with a projected closing price of $114.75 in December 2024.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| October | 106.41 | 97.34 | 110.11 |

| November | 114.20 | 108.31 | 122.83 |

| December | 114.75 | 105.11 | 125.76 |

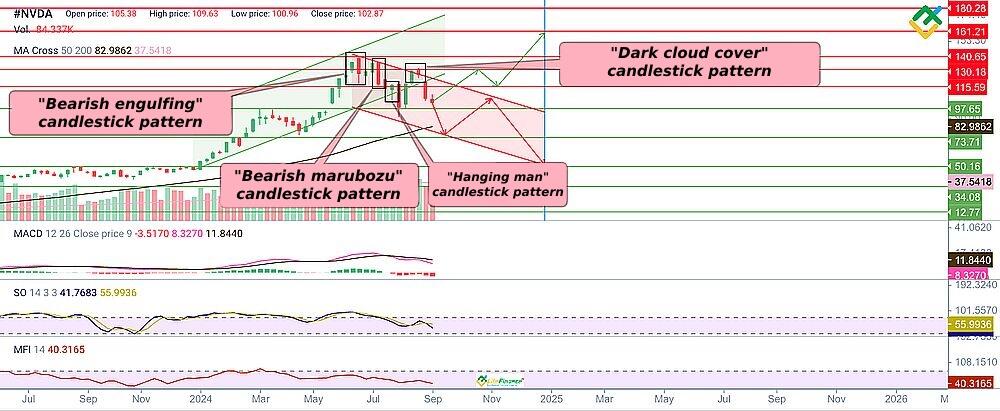

Nvidia (NVDA) Stock Technical Analysis

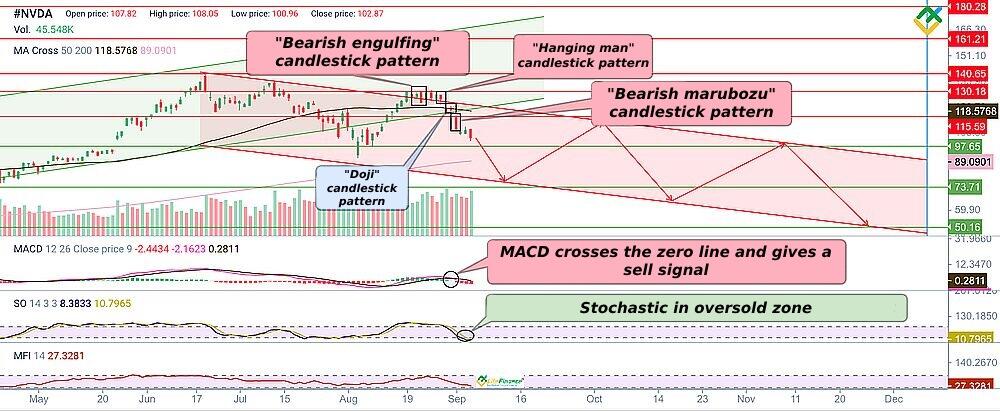

To ascertain the present market conditions and future trajectory of Nvidia stock prices until the end of 2024, we will use H4, D1, W1, and MN time frames. The Stochastic, MACD, MFI, MA Cross indicators, as well as tick volumes will facilitate a more precise and comprehensive examination of the NVDA price on the chosen time frames. These technical analysis tools help assess the dynamics of cash flows in the asset, determine overbought and oversold zones, as well as the strength of the current trend.

In addition, it is suggested that you use candlestick and chart pattern analysis. These analytical techniques will enable more exact determination of key support and resistance levels, trend reversals, and optimal entry points.

The most common patterns observed on the #NVDA charts include “Hammer” and “Hanging man” reversal candlesticks, “Morning star” and “Evening star” candlesticks, as well as the “Head and shoulders” pattern.

Let’s analyze the monthly chart to gain insight into the current price of the trading instrument.

Since October 2022, the trading instrument has demonstrated a clear upward trajectory, currently trading at $102.87. Notably, the “Hanging man” reversal candlestick has appeared on the chart, signaling that the asset has reached the area of high prices and indicates a possible reversal of an uptrend.

The MACD indicator values are trending downward in the positive zone, indicating waning bullish strength. The Stochastic indicator has been in the overbought zone since April 2023 and has crossed the upper boundary from above, leaving the overbought zone. This is a bearish signal indicating a potential trend reversal to the downside. According to the MFI, there is an outflow of liquidity from the asset, which also points to bearish pressure.

A preliminary analysis of the monthly chart indicates that the asset is overheated. Currently, the trading instrument’s price is turning downward, which may signal the onset of a bearish trend or downward correction.

blog

Promo code

#NVDA Stock Analysis For Next Three Months

Let’s assess the H4 and D1 time frames to gain insight into the stock performance over three months.

On the 4-hour chart, the asset has broken through the uptrend’s lower boundary of $119.75 and begun to develop a bearish trend.

The Stochastic indicator is giving bullish reversal signals, hovering in the oversold zone. MACD values are gradually recovering to the zero boundary in the negative zone, still signaling the beginning of a bearish trend or a prolonged downward correction. The MFI points to an outflow of funds from the asset, warning market participants about the probable continuation of the decline in the value of the asset in the near future.

The market price is located below MA50 and MA200, which act as resistance levels. The breakout of these levels triggered an increase in short positions on the trading instrument.

On the daily time frame, there is a discrepancy between the signals provided by the indicators and the candlestick patterns. The asset price has breached the lower boundary of the uptrend. In addition, the chart shows the formation of “Bearish engulfing,” “Hanging man,” and “Bearish marubozu” reversal candlesticks, as well as a “Doji” candlestick within the key price range of $130.18–$115.59. The latter candlestick pattern shows that neither buyers or sellers prevail in the market.

The MACD indicator values have crossed the zero boundary and are trending downward in negative territory. The Stochastic indicator values have reached the oversold zone, showing neutral dynamics. In addition, the MFI is pointing to an outflow of liquidity, which is a negative indicator for Nvidia shares. The market price is below the MA50, indicating fading bullish strength in the market.

Against this backdrop, the asset value will likely decline to the key support level of $97.65. Should this level be surpassed, a downward trend will start, with prices potentially reaching the $73.71-50.16 range over the next three months.

An alternative scenario is likely if market volumes increase and the price is able to break out of the short-term correction, consolidating above the resistance level of $115.59. In this scenario, the Nvidia price will recover to the range of $130.18–$180.28.

Long-Term Nvidia Shares Technical Analysis for 2024

Let’s conduct technical analysis on the weekly time frame to ascertain the future trajectory of Nvidia shares until the end of 2024.

On the weekly time frame, the price has formed a series of reversal patterns at its peaks: “Bearish engulfing,” “Bearish marubozu,” “Hanging man,” and “Dark cloud cover” within the $130.18–$140.65 range. The patterns point to waning bullish strength and a trend reversal to the downside.

Following a brief period of stabilization in the downward trajectory of the MACD indicator values, the decline resumed with renewed intensity. This also highlights bearish pressure.

The Stochastic indicator is declining, signaling a further decline in the value of the asset. The MFI values have begun to demonstrate a net outflow of liquidity from the asset, following a brief period of upward movement. The current market sentiment is bearish. This indicates that current decline is likely to persist in the near future.

Should the price settle below the key support level of $97.65, it will reinforce the bearish trend and provide an opportunity to open short positions with targets in the area of $73.71–$34.08 over the next six months.

The bullish scenario for Nvidia Corporation shares requires bulls pushing the price to the $115.59–$130.18 range. Subsequently, the asset may hit the targets in the area of $140.65–$180.28. Nevertheless, the probability of this outcome is low.

The table below displays forecasted lows and highs of the Nvidia stock price for the remainder of 2024.

| Month | Nvidia Corporation (#NVDA) Projected Price Values | |

| Minimum, $ | Maximum, $ | |

| September | 77.11 | 109.63 |

| October | 74.59 | 97.75 |

| November | 84.69 | 106.17 |

| December | 55.64 | 87.64 |

Long-Term Trading Plan for Nvidia Corporation (#NVDA)

The analysis of asset price charts indicated a high risk of continued decline in the share price of Nvidia Corporation in the near term. The technical analysis identified the key support and resistance levels, which can be used in a trading strategy for the next six months.

Trading strategy for three months

The trading strategy for the next few months is as follows:

- The daily chart of the asset indicates a significant number of bearish signals that could potentially result in a downward price reversal. In particular, the “Bearish engulfing,” “Hanging man,” “Bearish marubozu,” and “Doji” candlesticks indicate that prices may reach an area of high prices and reverse to the downside;

- Short positions on the trading instrument can be opened below the key support level of $97 with the target in the area of $73.71–$50.16;

- Long positions can be considered above the resistance level of $115.59 with the target between $130.18 and $180.28.

- The key support levels are $97.65, $89.09, $73.71, $50.16;

- The key resistance levels are $115.59, $118.57, $130.18, $140.65, $161.21, $180.28.

Trading strategy for 2024

The following is a trading strategy based on technical analysis for the remainder of 2024:

- The weekly time frame also indicates that the trading instrument is likely to experience a downtrend in the near future. In particular, this is signaled by the formation of “Bearish engulfing,” “Hanging man,” “Dark cloud cover,” and “Bearish marubozu” candlesticks.

- A breakout of the support level of $97.65 on increased trading volumes will likely intensify bearish sentiment and push the price lower. Against this backdrop, the value of securities may plunge to the range of $73.71–$34.08.

- The key support levels are $97.65, $82.98, $73.71, $50.16, $37.54, $34.08, $12.77;

- The key resistance levels are $115.59, $130.18, $140.65, $161.21, $180.28.

Analysts’ Nvidia Stock Projections for 2025

Let’s take a look at expert forecasts for the NVDA rate in 2025.

WalletInvestor

Price range in 2025: $139.05–$214.93 (as of September 8, 2024).

Analysts from WalletInvestor offer optimistic forecasts for Nvidia shares in 2025. In the first half of the year, analysts expect that the trading instrument’s price will fluctuate within a range of $139.05 to $184.57 per share. The bullish trend will continue in the second half of the year, closing at $214.93 by the year-end.

| Month | Open, $ | Close, $ | Minimum, $ | Maximum, $ | Change, % |

|---|---|---|---|---|---|

| January | 139.05 | 146.64 | 139.05 | 146.64 | 5.17% |

| February | 147.93 | 154.43 | 147.93 | 154.43 | 4.21% |

| March | 155.35 | 162.76 | 155.35 | 162.76 | 4.55% |

| April | 162.65 | 164.80 | 162.54 | 164.80 | 1.3% |

| May | 165.12 | 176.57 | 165.12 | 176.57 | 6.49% |

| June | 178.56 | 184.57 | 178.56 | 184.57 | 3.26% |

| July | 184.60 | 187.06 | 184.60 | 187.92 | 1.31% |

| August | 187.01 | 194.96 | 187.01 | 194.96 | 4.08% |

| September | 195.31 | 197.40 | 194.47 | 197.40 | 1.06% |

| October | 197.47 | 203.16 | 197.47 | 203.16 | 2.8% |

| November | 204.49 | 210.07 | 204.49 | 210.07 | 2.66% |

| December | 210.64 | 214.93 | 210.55 | 214.93 | 2% |

CoinCodex

Price range in 2025: $35.82–$185.40 (as of September 8, 2024).

CoinCodex projects that Nvidia’s stock price will appreciate by 80.23% from its current value to reach $185.40 per share in 2025.

| Year | Average price, $ | Change, % |

|---|---|---|

| 2025 | 185.40 | 80.23% |

LongForecast

Price range in 2025: $89.00–$238.00 (as of September 8, 2024).

According to LongForecast, Nvidia may plunge to $89.00 per share by early 2025. In the first half of the year, the asset will likely trade within a range of $89.00 to $172.00, with a projected closing price of $159.00 in June. In the second half of 2025, analysts anticipate that the Nvidia stock price will continue to increase, reaching $220.00 by the end of the year.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| January | 89.00 | 89.00–110.00 | 102.00 | -14.3% |

| February | 102.00 | 96.00–112.00 | 104.00 | -12.6% |

| March | 104.00 | 104.00–123.00 | 114.00 | -4.2% |

| April | 114.00 | 114.00–141.00 | 131.00 | 10.1% |

| May | 131.00 | 131.00–163.00 | 151.00 | 26.9% |

| June | 151.00 | 146.00–172.00 | 159.00 | 33.6% |

| July | 159.00 | 159.00–190.00 | 176.00 | 47.9% |

| August | 176.00 | 164.00–192.00 | 178.00 | 49.6% |

| September | 178.00 | 167.00–197.00 | 182.00 | 52.9% |

| October | 182.00 | 175.00–205.00 | 190.00 | 59.7% |

| November | 190.00 | 190.00–225.00 | 208.00 | 74.8% |

| December | 208.00 | 202.00–238.00 | 220.00 | 84.9% |

Coin Price Forecast

Price range in 2025: $163.00–$164.00 (as of September 8, 2024).

Analysts at Coin Price Forecast predict that the value of Nvidia shares will reach $163.00 by mid-2025. By the end of the year, the stock is forecast to post a 59% gain, soaring to $164.00 per share.

| Year | Mid-Year, $ | Year-End, $ | Change, % |

|---|---|---|---|

| 2025 | 163.00 | 164.00 | 59% |

GovCapital

Price range in 2025: $114.63–$156.90 (as of September 8, 2024).

GovCapital assumes that the average price of Nvidia shares will fluctuate in the range of $114.63–$156.90 and reach $156.90 by the end of the year. The least possible price is $97.44, and the best possible price is $180.44 per share.

| Date | Average price, $ | Least possible price, $ | Best possible price, $ |

|---|---|---|---|

| January 1, 2025 | 114.63 | 97.44 | 131.83 |

| January 31, 2025 | 119.47 | 101.55 | 137.39 |

| February 1, 2025 | 120.42 | 102.36 | 138.49 |

| February 28, 2025 | 127.01 | 107.95 | 146.06 |

| March 1, 2025 | 128.01 | 108.81 | 147.21 |

| March 31, 2025 | 134.78 | 114.56 | 155.00 |

| April 1, 2025 | 134.84 | 114.61 | 155.06 |

| April 30, 2025 | 131.83 | 112.05 | 151.60 |

| May 1, 2025 | 130.78 | 111.16 | 150.39 |

| May 31, 2025 | 143.70 | 122.14 | 165.26 |

| June 1, 2025 | 144.14 | 122.52 | 165.77 |

| June 30, 2025 | 149.77 | 127.31 | 172.24 |

| July 1, 2025 | 150.07 | 127.56 | 172.58 |

| July 31, 2025 | 151.04 | 128.38 | 173.69 |

| August 1, 2025 | 148.49 | 126.21 | 170.76 |

| August 31, 2025 | 152.63 | 129.74 | 175.53 |

| September 1, 2025 | 152.21 | 129.38 | 175.04 |

| September 30, 2025 | 147.86 | 125.68 | 170.04 |

| October 1, 2025 | 147.99 | 125.79 | 170.19 |

| October 31, 2025 | 148.84 | 126.51 | 171.17 |

| November 1, 2025 | 149.68 | 127.23 | 172.14 |

| November 30, 2025 | 155.08 | 131.82 | 178.35 |

| December 1 2025 | 155.27 | 131.97 | 178.56 |

| December 31, 2025 | 156.90 | 133.37 | 180.44 |

Panda Forecast

Price range in 2025: $99.89–$153.25 (as of September 8, 2024).

Experts from Panda Forecast give more moderate forecasts regarding Nvidia shares’ performance in 2025. Thus, according to experts, the average price will trade at $127.68 by the middle of the year and reach $146.40 by the year-end.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| January | 110.20 | 99.89 | 116.15 |

| February | 114.57 | 111.54 | 122.54 |

| March | 120.89 | 114.65 | 130.75 |

| April | 128.58 | 118.09 | 133.36 |

| May | 132.28 | 126.88 | 142.28 |

| June | 127.68 | 116.03 | 134.73 |

| July | 130.13 | 119.98 | 141.69 |

| August | 137.00 | 128.45 | 144.89 |

| September | 141.28 | 131.95 | 151.28 |

| October | 134.83 | 131.44 | 140.50 |

| November | 140.66 | 127.83 | 147.75 |

| December | 146.40 | 139.55 | 153.25 |

30Rates

Price range in 2025: $89.32–$238.43 (as of September 8, 2024).

The 30Rates analytical portal provides highly optimistic forecasts for the value of Nvidia shares in 2025. Thus, according to analysts, the NVDA price will reach $160.03 per share by the end of June. The stock will soar by 84.9% and hit the $220.77 mark by the end of the year.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| January | 89.32 | 89.32–110.94 | 102.72 | -13.9% |

| February | 102.72 | 96.39–113.15 | 104.77 | -12.2% |

| March | 104.77 | 104.77–123.87 | 114.69 | -3.9% |

| April | 114.69 | 114.69–142.44 | 131.89 | 10.5% |

| May | 131.89 | 131.89–163.80 | 151.67 | 27.1% |

| June | 151.67 | 147.23–172.83 | 160.03 | 34.1% |

| July | 160.03 | 160.03–190.84 | 176.70 | 48.0% |

| August | 176.70 | 164.17–192.73 | 178.45 | 49.5% |

| September | 178.45 | 167.67–196.83 | 182.25 | 52.7% |

| October | 182.25 | 175.02–205.46 | 190.24 | 59.4% |

| November | 190.24 | 190.24–225.27 | 208.58 | 74.7% |

| December | 208.58 | 203.11–238.43 | 220.77 | 84.9% |

Analysts’ Nvidia Stock Projections for 2026

Let’s take a look at expert forecasts for the NVDA rate in 2026.

30Rates

Price range in 2026: $220.77–$437.34 (as of September 8, 2024).

According to 30Rates, the asset price will continue to rise in 2026. In the first half of the year, the value of NVDA shares is expected to fluctuate in the range of $220.77 to $412.75, reaching $324.85 by the end of June. In the second half of 2026, the trading instrument is projected to continue its upward trajectory, reaching $375.26 per share by the end of September.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| January | 220.77 | 220.77–274.20 | 253.89 | 113% |

| February | 253.89 | 236.36–277.46 | 256.91 | 115% |

| March | 256.91 | 256.91–319.09 | 295.45 | 148% |

| April | 295.45 | 295.45–358.92 | 332.33 | 178% |

| May | 332.33 | 332.33–412.75 | 382.18 | 220% |

| June | 382.18 | 298.86–382.18 | 324.85 | 172% |

| July | 324.85 | 324.85–403.47 | 373.58 | 213% |

| August | 373.58 | 372.54–437.34 | 404.94 | 239% |

| September | 404.94 | 345.24–405.28 | 375.26 | 214% |

WalletInvestor

Price range in 2026: $215.26–$291.13 (as of September 8, 2024).

WalletInvestor expects Nvidia’s stock price to continue to rise in 2026, trading between $215.26 and $291.13 per share. By the end of the year, analysts forecast the stock price to increase to the $291.13 level.

| Month | Open, $ | Close, $ | Minimum, $ | Maximum, $ | Change, % |

|---|---|---|---|---|---|

| January | 215.26 | 222.33 | 215.26 | 222.33 | 3.18% |

| February | 223.60 | 230.28 | 223.60 | 230.28 | 2.9% |

| March | 231.17 | 238.68 | 231.17 | 238.77 | 3.15% |

| April | 238.60 | 241.00 | 238.60 | 241.00 | 1% |

| May | 241.13 | 251.92 | 241.13 | 251.92 | 4.28% |

| June | 253.96 | 260.46 | 253.96 | 260.46 | 2.5% |

| July | 260.51 | 263.12 | 260.51 | 264.08 | 0.99% |

| August | 263.45 | 271.41 | 263.36 | 271.41 | 2.93% |

| September | 271.25 | 273.31 | 270.62 | 273.31 | 0.75% |

| October | 273.67 | 278.84 | 273.67 | 278.84 | 1.86% |

| November | 280.14 | 286.61 | 280.14 | 286.61 | 2.26% |

| December | 286.55 | 291.13 | 286.52 | 291.13 | 1.57% |

CoinCodex

Price range in 2026: $190.00–$334.15 (as of September 8, 2024).

According to analytics portal CoinCodex, the average price of Nvidia shares will hover near $334.15 per share in 2026.

| Year | Average price, $ | Change, % |

|---|---|---|

| 2026 | 334.15 | 224.83% |

GovCapital

Price range in 2026: $156.59–$217.82 (as of September 8, 2024).

Analysts from GovCapital also anticipate continued upward movement in Nvidia share prices in 2026. Based on expert projections, the NVDA price is expected to reach $208.74 by the end of June, with an estimated increase to $217.82 by the end of the year.

| Date | Average price, $ | Least possible price, $ | Best possible price, $ |

|---|---|---|---|

| January 1, 2026 | 156.59 | 133.10 | 180.07 |

| January 31, 2026 | 164.90 | 140.16 | 189.63 |

| February 1, 2026 | 166.08 | 141.17 | 191.00 |

| February 28, 2026 | 174.97 | 148.73 | 201.22 |

| March 1, 2026 | 176.59 | 150.10 | 203.07 |

| March 31, 2026 | 184.71 | 157.00 | 212.41 |

| April 1, 2026 | 184.89 | 157.16 | 212.63 |

| April 30, 2026 | 183.11 | 155.64 | 210.58 |

| May 1, 2026 | 182.03 | 154.72 | 209.33 |

| May 31, 2026 | 199.10 | 169.23 | 228.96 |

| June 1, 2026 | 200.13 | 170.11 | 230.15 |

| June 30, 2026 | 208.74 | 177.43 | 240.05 |

| July 1, 2026 | 209.26 | 177.87 | 240.65 |

| July 31, 2026 | 209.17 | 177.79 | 240.55 |

| August 1, 2026 | 205.58 | 174.74 | 236.42 |

| August 31, 2026 | 212.53 | 180.65 | 244.41 |

| September 1, 2026 | 212.40 | 180.54 | 244.26 |

| September 30, 2026 | 207.11 | 176.04 | 238.18 |

| October 1, 2026 | 206.77 | 175.76 | 237.79 |

| October 31, 2026 | 207.70 | 176.55 | 238.86 |

| November 1, 2026 | 208.77 | 177.45 | 240.09 |

| November 30, 2026 | 215.19 | 182.91 | 247.47 |

| December 1, 2026 | 215.41 | 183.10 | 247.72 |

| December 31, 2026 | 217.82 | 185.15 | 250.50 |

Panda Forecast

Price range in 2026: $122.28–$187.87 (as of September 8, 2024).

Panda Forecast estimates that the average value of Nvidia will reach $151.75 by the end of the first half of 2026 and $173.31 per share by the end of the year.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| January | 139.90 | 126.97 | 151.82 |

| February | 134.02 | 122.28 | 141.26 |

| March | 136.76 | 125.76 | 148.24 |

| April | 150.70 | 138.41 | 161.74 |

| May | 148.90 | 143.54 | 160.69 |

| June | 151.75 | 147.20 | 165.23 |

| July | 149.57 | 144.90 | 153.16 |

| August | 145.80 | 142.13 | 155.07 |

| September | 138.10 | 124.84 | 148.87 |

| October | 142.41 | 137.11 | 154.37 |

| November | 155.91 | 145.62 | 163.58 |

| December | 173.31 | 156.67 | 187.87 |

LongForecast

Price range in 2026: $220.00–$436.00 (as of September 8, 2024).

According to LongForecast, NVDA quotes may reach $220.00 per share at the beginning of 2026. After that, they will likely see a gradual increase to $381.00 in May. Starting from June, the Nvidia stock will demonstrate mixed trading. By the end of 2026, the share price will reach $302.00.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| January | 220.00 | 220.00–273.00 | 253.00 | 113% |

| February | 253.00 | 236.00–276.00 | 256.00 | 115% |

| March | 256.00 | 256.00–318.00 | 294.00 | 147% |

| April | 294.00 | 294.00–357.00 | 331.00 | 178% |

| May | 331.00 | 331.00–411.00 | 381.00 | 220% |

| June | 381.00 | 298.00–381.00 | 324.00 | 172% |

| July | 324.00 | 324.00–403.00 | 373.00 | 213% |

| August | 373.00 | 372.00–436.00 | 404.00 | 240% |

| September | 404.00 | 344.00–404.00 | 374.00 | 214% |

| October | 374.00 | 293.00–374.00 | 318.00 | 167% |

| November | 318.00 | 248.00–318.00 | 270.00 | 127% |

| December | 270.00 | 270.00–326.00 | 302.00 | 154% |

Coin Price Forecast

Price range in 2026: $201.00–$234.00 (as of September 8, 2024).

Analysts at Coin Price Forecast predict that NVDA’s stock price will reach $201.00 per share by mid-2026 and $234.00 by the end of the year.

| Year | Mid-Year, $ | Year-End, $ | Change, % |

|---|---|---|---|

| 2026 | 201.00 | 234.00 | 128% |

Recent Price History of the NVDA Stock

The NVDA stock has experienced a remarkable journey over the past two decades. In 2000, the stock was modestly priced around $2.0155, showing a modest annual increase. The early 2000s witnessed fluctuating fortunes, with a peak in 2001 at $5.1206, followed by a dramatic plunge in 2002 to $0.8810. However, a resilient recovery started in 2003, with the stock gradually climbing to $5.6655 by 2006, doubling its value.

The late 2000s were turbulent, marked by a sharp fall in 2008 to $1.8530. Despite this, NVDA rebounded strongly, reaching $7.8117 by 2007 and then $4.2893 in 2009, reflecting a significant recovery. The early 2010s showed modest growth, but it was the mid-2010s when NVDA soared, jumping from $8.0540 in 2015 to an impressive $26.3317 by 2016, showcasing a staggering 226.94% increase.

This upward trajectory continued, with the stock reaching new heights annually, culminating in a peak of $333.2936 in 2021, an astonishing rise from its humble beginnings.

Throughout 2022, the value of NVDA shares was in the accumulation phase, fluctuating in a narrow price range. From the beginning of 2023, an uptrend began, and the shares added more than 250% during the year. Since the beginning of 2024, the value of the company’s shares has continued to grow, adding another 132%.

In May 2024, management announced a 10-for-1 stock split. The company completed it during its quarterly results presentation after the market close on June 7. From mid-June 2024 to the end of the summer, the price fluctuated in the range of $140.65–$97.65, trading near $102.87.

In early September, quotes of the asset collapsed to a monthly low of $100.96 per share, losing more than 14% of its value. This occurred after the US Department of Justice had served Nvidia CEO Jensen Huang with a subpoena as part of its ongoing investigation into alleged antitrust violations. As a result, the company saw nearly $280 billion wiped off, posting the largest one-day loss in US history.

Below is a summary of the allegations:

- The US Department of Justice finds that ordinary users are suffering as Nvidia ramps up its profits in the overheated chip market.

- The company’s graphics card performance growth has slowed down, while their cost, on the contrary, continues to rise.

- Jensen Huang ignored the Justice Department’s attempts to settle with him and sold the company’s stock at its peak.

- This led to legal inquiries demanding disclosure of internal company information.

Long-Term (NVDA) Nvidia Stock Forecast for 2027-2030

The long-term forecast for NVIDIA (NVDA) stock from 2027 to 2030, as projected by some experts, paints a bullish picture.

LongForecast

According to experts from LongForecast, the value of Nvidia shares will grow in 2027–2028. Thus, the average price may grow to $530.00 per share by the end of 2027. In 2028, NVDA quotes may hit a yearly high of $1,030.00 and reach $955.00 by the end of October.

| Month | Open, $ | Min–Max, $ | Close, $ | Change, % |

|---|---|---|---|---|

| 2027 | ||||

| January | 302.00 | 271.00–319.00 | 295.00 | 148% |

| February | 295.00 | 295.00–366.00 | 339.00 | 185% |

| March | 339.00 | 287.00–339.00 | 312.00 | 162% |

| April | 312.00 | 312.00–369.00 | 342.00 | 187% |

| May | 342.00 | 342.00–424.00 | 393.00 | 230% |

| June | 393.00 | 393.00–488.00 | 452.00 | 280% |

| July | 452.00 | 439.00–515.00 | 477.00 | 301% |

| August | 477.00 | 477.00–569.00 | 527.00 | 343% |

| September | 527.00 | 466.00–546.00 | 506.00 | 325% |

| October | 506.00 | 426.00–506.00 | 463.00 | 289% |

| November | 463.00 | 444.00–522.00 | 483.00 | 306% |

| December | 483.00 | 483.00–572.00 | 530.00 | 345% |

| 2028 | ||||

| January | 530.00 | 516.00–606.00 | 561.00 | 371% |

| February | 561.00 | 561.00–697.00 | 645.00 | 442% |

| March | 645.00 | 601.00–705.00 | 653.00 | 449% |

| April | 653.00 | 653.00–811.00 | 751.00 | 531% |

| May | 751.00 | 751.00–913.00 | 845.00 | 610% |

| June | 845.00 | 845.00–1,050.00 | 972.00 | 717% |

| July | 972.00 | 760.00–972.00 | 826.00 | 594% |

| August | 826.00 | 826.00–1,026.00 | 950.00 | 698% |

| September | 950.00 | 948.00–1,112.00 | 1030.00 | 766% |

| October | 1,030.00 | 879.00–1,031.00 | 955.00 | 703% |

Coin Price Forecast

Coin Price Forecast projects that the value of Nvidia may grow to $423.00 by the end of 2030. Experts also forecast that the uptrend will continue, and the NVDA share price may reach $557.00 by the end of 2036.

| Year | Mid-Year, $ | Year-End, $ | Change, % |

|---|---|---|---|

| 2027 | 248.00 | 280.00 | 172% |

| 2028 | 312.00 | 343.00 | 234% |

| 2029 | 374.00 | 394.00 | 283% |

| 2030 | 396.00 | 423.00 | 311% |

| 2031 | 432.00 | 441.00 | 329% |

| 2032 | 450.00 | 460.00 | 347% |

| 2033 | 470.00 | 481.00 | 368% |

| 2034 | 492.00 | 504.00 | 390% |

| 2035 | 516.00 | 529.00 | 414% |

| 2036 | 543.00 | 557.00 | 442% |

WalletInvestor

WalletInvestor experts anticipate robust growth in Nvidia shares between 2027 and 2029. By the end of 2027, the company’s shares will reach $367.15, and by the end of 2028, the stock price is expected to climb to $443.03. At the beginning of 2029, analysts project that the asset will trade at $443.83 and reach $499.33 by the end of August 2029.

| Month | Open, $ | Close, $ | Minimum, $ | Maximum, $ | Change, % |

|---|---|---|---|---|---|

| 2027 | |||||

| January | 291.27 | 298.02 | 291.27 | 298.02 | 2.26% |

| February | 299.28 | 306.14 | 299.28 | 306.14 | 2.24% |

| March | 307.00 | 314.63 | 307.00 | 314.75 | 2.42% |

| April | 314.83 | 317.02 | 314.82 | 317.02 | 0.69% |

| May | 317.81 | 329.34 | 317.81 | 329.34 | 3.5% |

| June | 329.76 | 336.38 | 329.76 | 336.38 | 1.97% |

| July | 336.71 | 339.28 | 336.71 | 340.20 | 0.76% |

| August | 339.49 | 347.34 | 339.31 | 347.46 | 2.26% |

| September | 347.22 | 349.51 | 346.66 | 349.51 | 0.65% |

| October | 349.68 | 354.54 | 349.68 | 354.54 | 1.37% |

| November | 355.81 | 362.52 | 355.81 | 362.58 | 1.85% |

| December | 362.49 | 367.15 | 362.49 | 367.15 | 1.27% |

| 2028 | |||||

| January | 367.96 | 374.96 | 367.96 | 374.96 | 1.87% |

| February | 375.13 | 382.89 | 375.13 | 382.89 | 2.03% |

| March | 382.96 | 390.88 | 382.96 | 390.88 | 2.03% |

| April | 391.24 | 392.91 | 390.94 | 392.91 | 0.42% |

| May | 393.69 | 405.58 | 393.69 | 405.58 | 2.93% |

| June | 406.30 | 412.72 | 406.30 | 412.72 | 1.56% |

| July | 413.62 | 415.58 | 413.62 | 416.28 | 0.47% |

| August | 415.42 | 423.46 | 415.32 | 423.46 | 1.9% |

| September | 423.41 | 425.51 | 422.74 | 425.51 | 0.49% |

| October | 426.39 | 431.66 | 426.39 | 431.66 | 1.22% |

| November | 431.87 | 438.71 | 431.87 | 438.71 | 1.56% |

| December | 438.77 | 443.03 | 438.77 | 443.03 | 0.96% |

| 2029 | |||||

| January | 443.83 | 451.01 | 443.83 | 451.01 | 1.59% |

| February | 451.49 | 458.80 | 451.49 | 458.80 | 1.59% |

| March | 459.15 | 466.90 | 459.15 | 466.90 | 1.66% |

| April | 467.32 | 469.57 | 467.04 | 469.57 | 0.48% |

| May | 469.58 | 481.68 | 469.58 | 481.68 | 2.51% |

| June | 482.21 | 488.61 | 482.21 | 488.61 | 1.31% |

| July | 489.44 | 491.52 | 489.44 | 492.31 | 0.42% |

| August | 491.38 | 499.33 | 491.38 | 499.41 | 1.59% |

CoinCodex

According to experts from CoinCodex, the average price of the Nvidia stock will grow in 2027–2030. Thus, according to analysts’ forecasts, quotes of the trading instrument may soar to $3,525.80 per share by 2030.

| Year | Average price, $ | Change, % |

|---|---|---|

| 2027 | 602.25 | 485.44% |

| 2028 | 1,085.43 | 955.15% |

| 2029 | 1,956.28 | 1,801.70% |

| 2030 | 3,525.80 | 3,327.44% |

GovCapital

Experts from GovCapital are also optimistic about the future of Nvidia stock and predict the asset’s value to soar to $421.21 per share by September 2029.

| Date | Average price, $ | Least possible price, $ | Best possible price, $ |

|---|---|---|---|

| January 1, 2027 | 217.75 | 185.09 | 250.42 |

| December 31, 2027 | 287.77 | 244.60 | 330.94 |

| January 1, 2028 | 287.56 | 244.42 | 330.69 |

| December 31, 2028 | 357.87 | 304.19 | 411.55 |

| January 1, 2029 | 357.97 | 304.27 | 411.67 |

| September 7, 2029 | 421.21 | 358.02 | 484.39 |

Which Factors Impact Nvidia Stock Price?

Nvidia’s share price is influenced by numerous factors that could change the future trajectory of the price:

- AI and Gaming Industries: Nvidia’s strong presence in artificial intelligence (AI) and gaming sectors, which are highly popular and growing, significantly impacts its stock price.

- High P/E Ratio: Nvidia’s Price-to-Earnings (P/E) ratio is high, reflecting its status as a growth-oriented tech stock and the market’s expectation of its future performance.

- Growing Demand for AI Chips: Steady demand for AI chips supports stable revenue growth and positive investor sentiment.

- Geopolitical Factors: US policy decisions and tensions in key semiconductor production regions like Taiwan could impact Nvidia’s operations and stock price.

- Expansion into CPU Market: Nvidia’s entry into the CPU market with ARM technology, slated for 2025, represents a significant growth opportunity.

Conclusion: Is Nvidia a Good Investment?

The majority of analysts and stock market experts anticipate a continued upward trajectory for Nvidia shares in 2024. The provided projections indicate that the value of the technology giant’s securities may reach $114.52–$139.01 per share by the end of 2024, despite the recent decline in the company’s share price and market capitalization.

Analysts’ forecasts regarding the future trajectory of Nvidia’s share price over the next three to five years are also very promising. Based on a range of estimates, the trading instrument is expected to reach prices between $421.21 and $499.33 over the forecast period. The most optimistic forecasts indicate that the asset price may exceed $1,000.00 per share by 2030.

The company’s developments in artificial intelligence, gaming industry, and its venture into the Acorn RISC Machine (ARM) computer processor market in 2025 make its stock an attractive long-term investment.

Nvidia’s strong financial performance and dominant market position instill confidence among many investors. Nevertheless, the company’s allegations of market monopolization by the US Department of Justice have led to a re-evaluation of Nvidia’s position in the market.

Proceedings with the company’s CEO, Jensen Huang, resulted in a 14% decline in the company’s shares, reaching $102.87 per share. This led to a $280 billion reduction in the company’s capitalization over a single day, setting a new record in stock market history. Technical analysis indicates that the decline has not yet reached its conclusion and that the purchase of shares at more advantageous prices may be a viable strategy.

These factors underscore the inherent risks associated with investing. Therefore, it is essential to assess the factors that directly or indirectly influence the IT giant’s growth before making investment decisions regarding Nvidia shares. It is crucial to consider potential risks and market volatility due to market uncertainty.

Nvidia Price Prediction FAQs

As of today, 17.09.2024, NVIDIA’s stock is trading at $117.46.

A total of 43 independent analysts have provided estimates, with 39 recommending a “buy” position and 4 suggesting a “hold” stance. Currently, the NVDA share price is trending downwards, suggesting that short-term investments present unfavorable opportunities. However, over the long term, the company’s shares may offer a profitable investment prospect.

Currently, most experts are predicting that the target for the Nvidia stock is at $151.79 per share over the next 12 months.

There is a consensus among many experts that the trading instrument will reach a price range of $114.52–$139.01 by the end of 2024. However, it is important to consider that an increasing number of specialists are predicting a downward shift in the financial outlook for the instrument, with a potential decline in value to $82.17–$96.47 per share.

Analysts anticipate that Nvidia securities will maintain their upward trajectory in 2025, reaching a valuation of $156.90–$185.40 per share. The most optimistic forecasts project that the trading instrument could reach $214.93–$220.77 by the end of 2025.

In the next three to five years, the value of Nvidia shares has the potential to reach $421.21–$499.33. Some experts believe that the price could skyrocket to $1,030.00–$3,525.80 per share.

Analysts forecast that the Nvidia stock will reach a price range of $421.21–$499.33 by 2030. More optimistic projections suggest that the stock price may climb to $1,030.00–$3,525.80 per share.

The NVDA stock is a promising long-term investment despite short-term challenges to the asset value. The company is experiencing growth and expansion into new markets while driving innovation in the field of artificial intelligence.

Price chart of NVDA in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.