Investors are optimistic about the beginning of the Fed’s monetary policy easing cycle but are uncertain about the specific step the central bank will take first. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Investors believe in a 50 bp Fed rate cut, but things could change.

- Retail sales will trigger an increase in market volatility.

- The size of the Fed’s first move will affect the FOMC’s rate forecasts.

- The EURUSD pair risks soaring to 1.1155 or collapsing from current levels.

Daily US dollar fundamental forecast

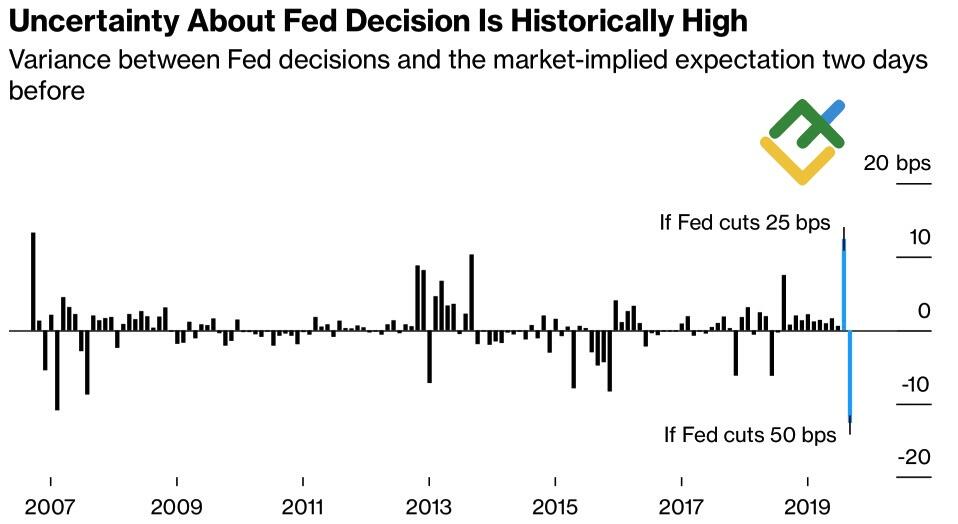

The Fed will cut the interest rate by half a point or a quarter. Financial markets have not been so divided over the size of the change in the Fed funds rate since 2007. The odds of a 50bp cut to 5% at the September 17-18 FOMC meeting have risen from 17% to 69%, allowing the EURUSD pair to move towards 1.114. However, US retail sales data for August could trigger a change of direction. Against this backdrop, investors are on tenterhooks.

Difference between market expectations two days before Fed decision

Source: Bloomberg.

In a recent report, NatAlliance stated that the Fed should have reduced borrowing costs as early as June or July and anticipated a further cut of 0.5% in September. Furthermore, disappointing retail sales figures will prompt the central bank to start the monetary expansion cycle in a robust manner. In contrast, Barclays anticipates that the actual figure will exceed the projected 0.2%, necessitating a 25-basis-point loosening. Consequently, the USD index is expected to increase by 1%.

Markets shift their focus to retail sales. The data is not only a factor in the Fed’s monetary policy but also provides insight into the strength of consumer demand in the US. The state of the economy is the underlying factor in the FOMC’s discussion on the size of the initial cut.

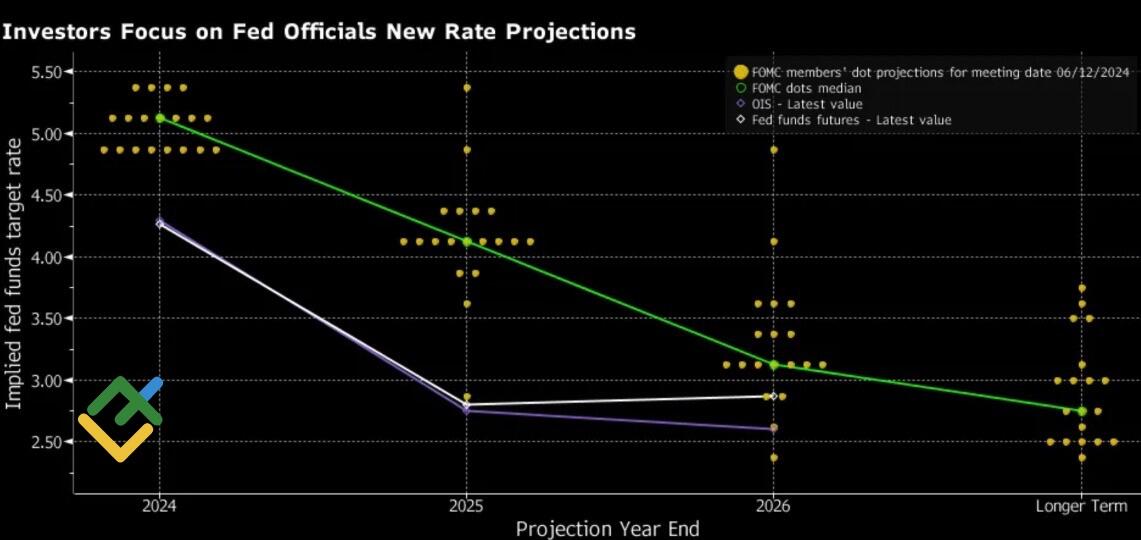

The key objective for the September meeting is to maintain a sense of balance. If the majority of central bank officials believe that inflation is defeated and will continue to move toward the target, and the labor market is cooling rapidly, they will cut borrowing costs by 50 basis points. If the majority of FOMC members are confident that the economy is stable and the risks of a PCE unwind remain, we should anticipate a 25 bp rate cut to 5.25%.

This scenario suggests that the FOMC’s revised projections will include an additional 50 basis points before the end of the year. This is below the market’s anticipated 75 basis points, excluding the September cut. In this case, we can expect a more dovish tone from Jerome Powell. For instance, he may indicate that the Fed is prepared to accelerate if necessary.

July FOMC forecasts for federal funds rate

Source: Bloomberg.

Conversely, if the Fed allows the doves to prevail and reduces rates by 50 basis points, the new FOMC consensus estimate will align with market expectations. This will necessitate the Fed chief to issue a statement to restrain EURUSD bulls. In both scenarios, there is a high probability the major currency pair will experience excessive volatility.

Daily EURUSD trading plan

However, the markets will digest the release of retail sales data. The market has fully absorbed the message that the Fed is dependent on macro statistics and has overlooked the fact that the central bank will not react to a single data point. Investors are awaiting indications of the extent of the September cut so that they can prepare a robust response. Weak statistics could drive the EURUSD pair towards 1.1155, but a failure to maintain that level would provide an opportunity to sell. Conversely, strong data will create an environment to open short trades.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.