By Nicole Jao

NEW YORK (Reuters) -Oil prices rose more than 1% on Monday as the ongoing impact of Hurricane Francine on output in the U.S. Gulf of Mexico offset persistent Chinese demand concerns.

Brent crude futures for November were up 92 cents, or 1.28%, at $72.53 a barrel by 12:15 p.m. EDT (1535 GMT). U.S. crude futures for October rose $1.12, or 1.63%, to $69.77.

Nearly a fifth of crude oil production and 28% of natural gas output in the Gulf of Mexico remains offline after Hurricane Francine.

“We’ve still got the remnants of the storm,” said Matt Smith, lead oil analyst at Kpler. “The impact is more on the production side than on refining. Therefore, it leans a little bit bullish.”

Overall, however, the market remains cautious ahead of the Federal Reserve’s interest rate decision on Wednesday.

“For the next two and a half days, the markets will be collectively holding their breath,” said Tim Snyder, chief economist at Matador Economics.

Traders are increasingly betting on a Fed rate cut of 50 bps rather than 25 bps, as shown by the CME FedWatch tool that tracks Fed fund futures.

Lower interest rates typically reduce the cost of borrowing, which can boost economic activity and lift demand for oil.

But a cut of 50 bps could also signal weakness in the U.S. economy, which could raise concerns over oil demand, said OANDA analyst Kelvin Wong.

Weaker Chinese economic data over the weekend dampened market sentiment, with the low-for-longer growth outlook in the world’s second-largest economy reinforcing doubts over oil demand, IG market strategist Yeap Jun Rong said in an email.

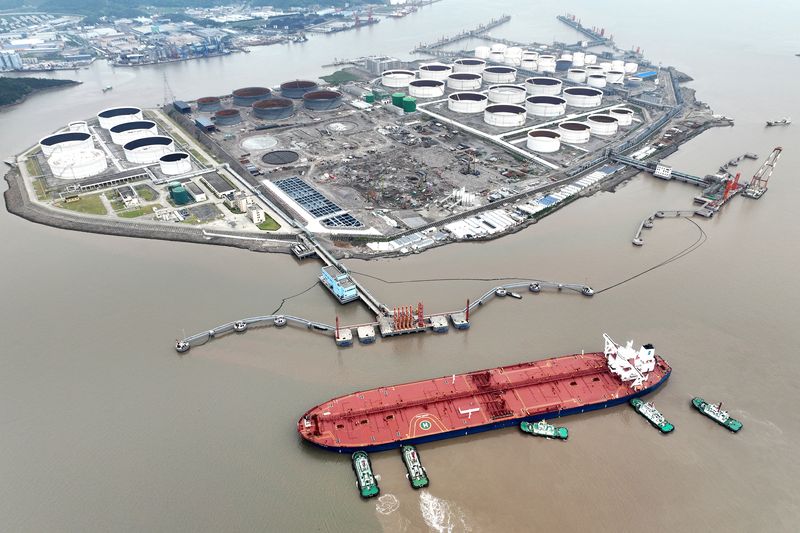

Industrial output growth in China, the world’s top oil importer, slowed to a five-month low in August while retail sales and new home prices weakened further.

China’s oil refinery output also fell for a fifth month as weak fuel demand and export margins curbed production.

Brent and WTI each gained about 1% last week but remain comfortably below their August averages of $78.88 and $75.43 a barrel respectively after a price slide around the start of this month driven in part by demand concerns.

This post is originally published on INVESTING.