The financial markets are awaiting the Fed’s decision on the start of the monetary policy easing cycle and the scale of monetary expansion. The outcome will depend on the state of the US economy. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The futures market is expecting a recession and demanding the Fed to aggressively cut rates.

- The stock market is set for a soft landing.

- The less the Fed does, the better for the US dollar.

- Short trades on the EURUSD pair on growth with a rebound from 1.1115-1.1125 remain relevant.

Weekly US dollar fundamental forecast

Ahead of the first federal funds rate cut since 2020, there is a divergence of opinion among derivatives market participants and Bloomberg experts as to the extent of the cut. The derivatives market indicates a 59% probability of a half-point loosening of monetary policy, while the consensus forecast of economists is for a less aggressive adjustment of 25 basis points. The EURUSD exchange rate is rising on investor confidence.

Sometimes, markets tend to exaggerate the situation or underestimate it. Derivatives are anticipating a 250-basis-point decline in borrowing costs to 3% by the end of 2025. Such a rate decline typically signals an impending recession in the US economy. Stock indices are exhibiting a high level of optimism. Following several drawdowns, including one in September, the S&P 500 index has increased by 18% year-to-date and is approaching a record high. Stocks are confident of a soft landing. Notably, the economy is performing even better than it did in 1995 when that level was reached.

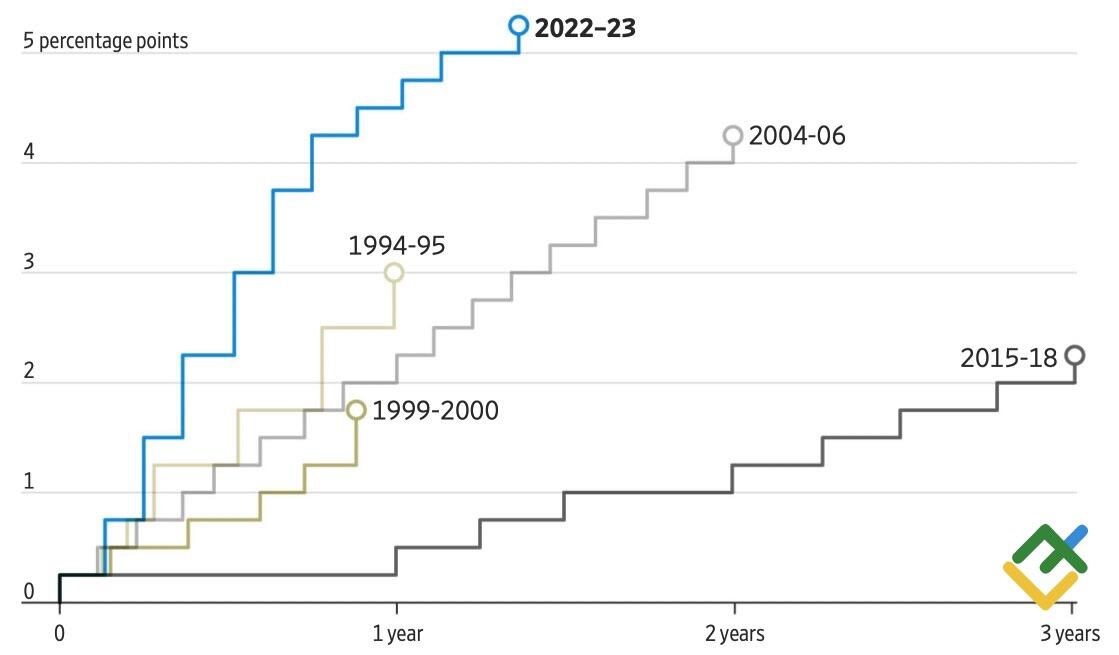

Fed monetary tightening cycles

Source: Wall Street Journal.

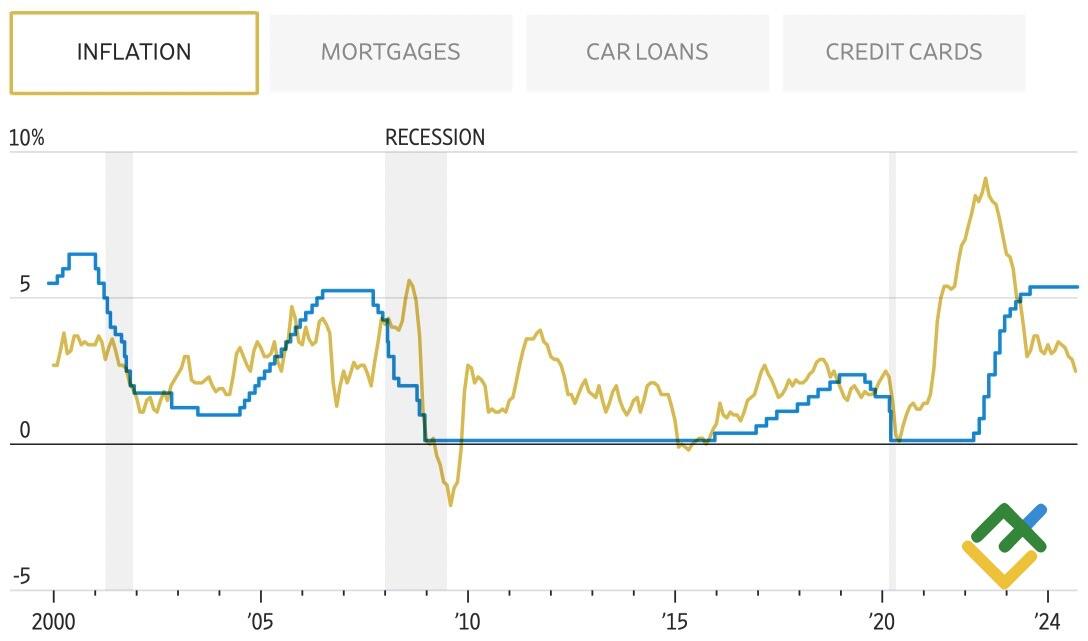

In contrast, Milton Friedman likened the Fed’s monetary policy to a water faucet that is abruptly turned off, resulting in a gradual release of water over a period of 6, 12, and 18 months. Since 2022, the Fed has increased interest rates 11 times, resulting in a current range of 5.25-5.5%, the highest since 2001. Over the past year, consumer prices have decelerated from 3.2% to 2.5%, while core inflation has slowed from 4.2% to 2.7%. The current level of real rates is significantly higher than previously, which is having a cooling effect on the economy and pushing it towards a recession.

Fed funds rate and US inflation

Source: Wall Street Journal.

Financial Times experts concur with the prevailing view on the stock market. They anticipate a soft landing with a gradual and controlled economic decline. GDP is forecast to expand by 2.3% in 2024 and 2% in 2025. Inflation, as measured by the personal consumption expenditure index, is expected to decline from 2.6% to 2.2% by the end of this year. Unemployment is projected to increase from 4.2% to 4.5%.

In the absence of a recession, the appetite of the derivatives market for the magnitude of monetary expansion in 2024 appears excessive. A 100-basis point reduction in the federal funds rate to 4.5% is unlikely. If the Fed makes this clear at the September 17-18 meeting, investors will experience a sense of déjà vu. Earlier in the year, derivatives also demanded six to seven acts of monetary expansion from the Fed, which it did not provide, resulting in disappointment and a rally in the USD index.

Weekly EURUSD trading plan

The September FOMC forecast for the federal funds rate represents a significant risk factor for the EURUSD pair. There is a high probability that officials will raise their estimates from one to two or three acts of monetary expansion in 2024. However, this is below the four or five that the derivatives market expects. Therefore, one may sell the pair during its upward movement to 1.1115 and 1.1140 or refrain from trading until the outcome of the Fed meeting is announced.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.