In the Forex market, mirror trading represents an approach that enables investors to automatically replicate the trades and strategies of experienced traders. The investor subscribes to the trader’s account and earns profits together with the trader. The trader receives a commission of up to 20% of the investor’s profit. The broker earns on the spread. The mirror trades investment strategy is suitable for beginners who can gain hands-on experience by following the decisions of professional traders.

This article will help you understand the principles of mirror trading as well as its advantages and disadvantages. You will learn about the possibilities of trade copying and the potential risks.

The article covers the following subjects:

What is Mirror Trading?

Mirror trading is pretty much the same as copy trading as you open and close trades, but there the similarity ends.

Copying trades is a type of passive investing that can be performed manually or automatically:

-

Manual copy trading. The investor monitors the trader’s trading activity and repeats the trader’s actions. The only problem is that few traders post their trades online. At best, the investor receives signals with a delay.

-

Automated copy trading. The investor links their account directly to the trader’s account. The trader’s operations are automatically copied to the investor’s account at a speed of up to 0.1 seconds. If the investor starts losing money, they can terminate copy trading at any time. The investor pays a commission to the trader from the received profits. The commission can be up to 20% on average. The broker is responsible for assessing the trader’s performance and ensuring the smooth operation of the copy trading platform.

Mirror trading resembles copy trading in many ways. The only difference is that the investor does not just copy trading signals. They follow the trader’s performance and learn to copy their trading strategy. When the investor learns how to open trades, place stop-loss and take-profit orders, they do not just copy trades but grasp the essential trading principles.

It is important to distinguish legitimate mirror trading from fraudulent schemes. As an example, let’s consider mirror trades and Deutsche Bank. In 2017, US and UK financial regulators accused Germany’s Deutsche Bank of mirror trading in the market.

The essence of the mirror-trading scheme was as follows:

-

Deutsche Bank’s division in Russia bought shares in the market for rubles.

-

The purchased assets were transferred to the balance sheet of the bank’s division in Europe.

-

In Europe, the shares were sold for foreign currency. The transactions made no economic sense; their purpose was to launder money to circumvent sanctions.

In the stock market, such a scheme of international mirror trading does exist. However, financial regulators determine such transactions as fraudulent if they are exploited to transfer money abroad. These schemes have nothing to do with legal mirror trading in the Forex market. Legal mirror trading assumes that a person duplicates another person’s trading strategy.

This is what you should know about how mirror trading works:

-

Mirror trading does not require a separate or special account. Any trading account a broker offers can be used for copy trading and mirror trading. You can open trades manually or use automated trading software if your deposit has enough funds.

-

Experienced traders can use automated software for trading. In this case, you will copy the signals of his expert advisor. This method offers an alternative to buying paid software.

-

It is better to use your broker’s platform for mirror trading. Traders and investors pay the same spread and have the same execution speed, provided that the account types are also the same. In addition, the quotes do not diverge, and the swap/triple swap conditions are similar.

-

Traders’ mirror accounts can be investors’ accounts (multi-level copying) if it is technically possible. Initially, you can act as an investor. You will have positive trading statistics when you copy trades of different traders during their best trading periods. Therefore, other investors can copy trades from your account. Your strategy is to copy the trades of a few successful traders and allow other investors to copy trades performed on your account.

Mirror trading can be more than an automated trading service for copying trades. It is an additional tool on which a separate trading system can be built.

What’s the difference between mirror trading and social trading?

Different sources have different approaches to these definitions:

-

Social trading is a concept that involves the exchange of ideas, discussion of trading strategies, and their optimization through social networks, forums, groups, and messenger channels. It does not imply any automation. It is a discussion, in the process of which everyone decides how to apply the obtained information.

For example, you can find groups and forums such as “Useful indicators” or “Swing trading strategies” on the Internet. In these communities, professional traders share their thoughts and trading ideas, and novice traders gain experience and hone their trading skills using them. It does not mean that you just duplicate trades. The main idea is to share knowledge and experience.

Mirror trading implies full or partial copying of the trading strategy manually or using software for automated trading.

Meanwhile, most sources define “mirror trading” and “social trading” as synonyms.

What’s the difference between mirror trading and copy trading?

As mentioned above, different sources have varying approaches to the definition of these concepts.

-

Copy-trading implies direct copying of trades from the trader’s account to your account. Every trade that the trader opens or closes is copied to your account with a maximum delay of 0.1 seconds.

- Mirror trading is a more general concept. You do not just copy trades but analyze the trading principle of their opening and closing, as well as explore risk management fundamentals. In other words, you copy the essence of proper Forex trading, customizing the trading strategy to your goals and risk appetite.

In most sources, “mirror trading” and “copy trading” are synonyms.

How Mirror Trading Works

1. Mirror trading as a trading strategy copying method.

The idea of this method is to copy the trader’s trading strategy. You track how the trader identifies signals and what tools they use for this purpose, how they open and close trades, set pending, stop-loss and take-profit orders. You can select the best trading practices and apply them to your strategy.

Here is how it works:

-

You analyze each parameter of the trading statistics. According to them, you can recreate the trader’s trading strategy.

- Activate automated trade copying on a demo account, if possible. Next, follow every action of the trader, understand how to open and close trades, especially when chart patterns appear.

2. Mirror trading as a method of automated copy trading, as most sources define it.

In this model, the investor copies trades automatically through independent mirror trading and broker services. For example, ZuluTrade and MQL5 are available via the MT4/MT5 platforms. They connect traders and investors from different brokers. The second type of mirror trading represents a broker’s service. In this case, the broker is responsible for its technical maintenance and support.о

It works like this:

-

A broker makes a rating of the most high-performing traders.

-

Each trader’s profile contains key trading statistics: the account’s lifetime, the number of trades made and their profit/loss ratio, equity, maximum drawdown, a series of profitable and losing trades, the number of subscribed investors, etc. This data determines the risk level and its correlation with profitability.

-

The investor activates copy trading in the trader’s profile and specifies copying parameters. For example, you can apply full-size copying 1 to 1. However, if the trader has a deposit of $1,000, and you have $100, this option is not applicable. It is better to choose a predefined % of each trade.

-

Once copying is activated, all trades performed on the trader’s account will be duplicated on the investor’s account.

-

At any moment, the investor can deactivate copy trading.

The investor should find a trader who will consistently generate profits. However, this involves a lot of effort. You need to be good at analyzing trading strategies and make adjustments to them, as even experienced traders make mistakes.

Mirror trading tips

Tips for investors on applying mirror trading:

-

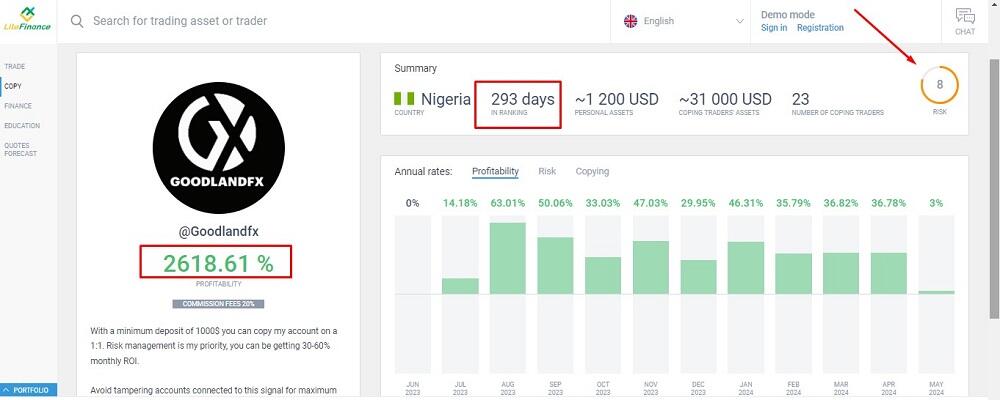

It is crucial not to be swayed by high numbers. Remember, higher returns often come with higher risks. While the trader may be able to handle them, as an investor, it is important to carefully consider if you are ready to take on such risks.

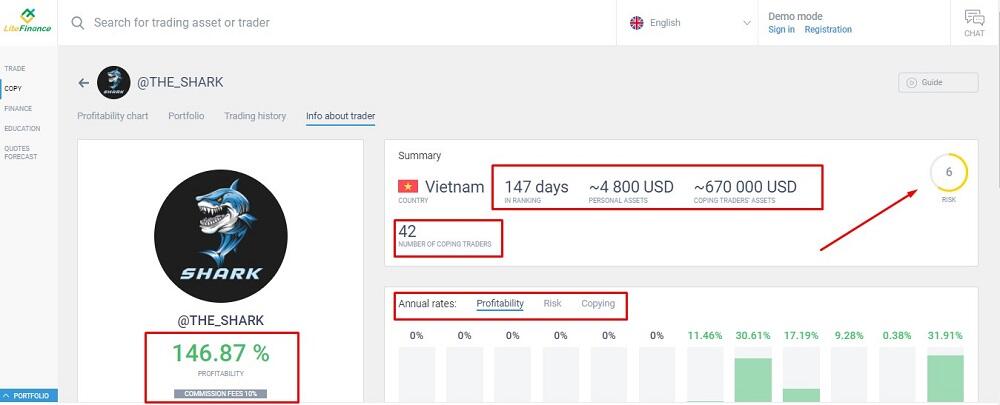

This trader achieved an impressive profitability of 2,618.61% in less than a year. With 1 to 1 copying, an investor’s account could have had the same profitability.

This chart shows the account’s equity on the H4 time frame. It reflects frequent deep drawdowns, eating up to 25-35% or more of the trader’s funds. At some point, the trader will not be able to recover from another drawdown, it is just a matter of time. Deciding to trade using the signals of such a trader carries a high risk of losing the entire investment capital within a single transaction.

-

Learn to analyze trading statistics in the trader’s profile. Remember that a trader can plan to earn on commission, putting their account’s profitability on the sidelines. You should understand what each backtest parameter means.

-

Do not risk the entire deposit. Copy-trading is not “easy profit in a few clicks”. Mistakes in setting copy-trading parameters and on the trader’s part can completely drain the investor’s deposit.

-

Do not subscribe to several traders simultaneously if you are unsure that your deposit can withstand the drawdown and maintain a sufficient margin level. Otherwise, your trades can be closed after a stop out level is reached.

-

Keep an eye on the account. A trader’s strategy and risk profile may unexpectedly change.

-

Pay attention to assets as they represent another risk factor. For example, if a trader has 80% of transactions with cryptocurrencies, it means a high level of risk regardless of profitability.

Try to keep track of trader’s actions. You can copy trades and close them at your discretion if you think the trader is taking too much risk or delaying the exit from the financial market.

How to Mirror Trade?

After analyzing the trader’s statistics, the second key parameter is the choice of copying parameters.

Copy trading types that LiteFinance offers are the following:

-

Full-size copying 1 to 1. If a trader opens a trade with 0.5 lot volume, the same volume will be opened on your account. This type suits those who have the same amount as the trader owns or more.

-

Copying a fixed size of each trade. Only the volume in lots you set will be copied. Set the minimum volume to 0.01 lots and test the system.

-

Copying a predefined % of each trade. For example, 10%. A trader opens a trade with the volume of 1 lot, you open a trade with the volume of 0.1 lot. It is convenient if you have a much smaller deposit than the trader, but you also want to copy the trading strategy.

-

Copying a fixed share of investor’s equity. If the trader has a deposit of $1,000 and opens a trade with 0.1 lot volume, while the investor’s deposit is $100, the trade of 0.01 lot is copied. It is the best type in terms of risk management.

Coefficients in the settings also allow you to set a larger copy volume than the trader’s volume. You can also turn on automatic copy trading disabling if the drawdown/loss is greater than you can afford. In this case, all trades made on the trader’s account stop duplicating on the investor’s account.

Is Mirror Trading Profitable?

It depends on you and your experience. A trader aims to earn money and attract investors from whom they earn commission. However, there are many nuances, ranging from trader and investor mistakes to technical glitches. Mirror trading on Forex can be profitable if you create an effective investment strategy and test it on a demo and cent accounts using minimum funds.

Pros Of Mirror Trading

-

Make money with basic knowledge. It is enough to know about risk management to analyze trading strategies. Basic knowledge of technical and fundamental analysis is also required.

-

Gain experience. Observing the principle of opening trades and trying to understand successful trading systems is also a kind of training. It also brings income when copying trades.

-

Personal money management. Money is not transferred to third parties as in the case of PAMM accounts or trust management. They are fully controlled by the investor.

-

Save time. Trades are copied automatically without the investor’s participation. The investor is required to perform only periodic monitoring without spending time analyzing the Forex market. Instead, checking the account from time to time would be enough.

-

Emotionless trading. Greed, excitement, and the desire to recover losses are classic mistakes of beginners. In mirror trading, another person manages the transactions – a professional who knows how to control emotions.

The advantages of this type of investment include a high probability with a relatively low level of risk. For an investor, mirror trading is a passive income. For a trader, it is an opportunity to earn a commission.

Cons Of Mirror Trading

-

Risk of error in analysis. The higher a trader’s profit is, the higher they are ranked. At the same time, the higher the profit is, the higher the risk is likely to be. For example, judging by the equity drawdown one can determine that a trader uses the Martingale strategy. If an investor ignores this fact, they may lose their deposit.

-

Errors in selecting copying parameters. These include different leverage or deposit amounts. The trader’s deposit may withstand a temporary drawdown, while the investor’s trades can be forcibly closed after hitting a stop out level.

-

Technical risks. It is better to copy trades within one broker. For example, the MT4 and MT5 platform also offer copy trading, but traders will represent different brokers. Here technical risks appear such as speed of trade execution, spread, and slippages. They can affect the trading performance. In this case, the trader may get profits from a trade, while the investor will likely lose money from the copied trade.

-

Risk of fraud. The trader may turn out to be non-existent, created by the broker to drain the investors’ deposit. Therefore, a broker should be reliable and select traders carefully to include them in the rating, controlling them at the same time.

The disadvantages of mirror trading on Forex are reduced to the loss of the deposit for various reasons, and the investor will most often be to blame.

Conclusion

-

Mirror trading is practically the same as social trading and copy trading. In most sources, these are equivalent concepts, but there are some differences. Copy trading involves automated copying of trades only. Mirror trading implies copying of the whole investment strategy: from the principle of identifying trading signals to opening trades and placing pending orders.

-

Automated copy trading is possible on separate trading platforms that connect traders from different brokers. It can also be a specific broker’s service.

-

For a trader, mirror trading is an opportunity to get an additional commission from the investor’s profit.

-

For an investor, mirror trading is an opportunity to earn passive income. The investor (mirror trader) subscribes to the trader’s account, and all trades are opened and closed automatically online on the investor’s account. You can disable this at any time.

-

Secrets of successful mirror trading are deep analysis of trader’s trading statistics and risk assessment, selection of copying parameters according to your deposit and risk appetite.

Do not risk large sums. First, you should understand how copy trading services work and learn how to adjust to the results of individual traders. When you start to get stable profits, you can try to increase the trading volume.

Mirror Trading FAQ

Yes, provided that the trading activities do not violate the law. No authorized body prohibits duplication of trades; it is not fraud, unfair competition, or any violation of financial legislation. However, if there are restrictions on trading, then both trading and copy trading will violate the law.

A broker provides a copy trading service with traders’ ratings. You check traders’ statistics, performance, and other parameters and choose whose trades you want to copy. You customize the copying parameters and subscribe to a trader. The trades that the trader will open and close will be automatically opened and closed online on your account.

Mirror stock trading implies copying trades and trading strategies in manual or automatic mode from another trader. The trader buys or sells shares, the same actions are repeated on your account. You can copy the trader’s actions in full or in part, for example, with a proportionally less volume and risk level. You can fully copy the trader’s strategy or some of its elements.

Copy trading settings depend on the trading platform used, broker’s conditions, etc. For example, LiteFinance’s copy trading service offers several parameters: full-size copying 1 to 1; copying a fixed size of each trade; copying a predefined percentage of each trade; copying a fixed share of copy trader’s equity.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.