Following the debate, markets appeared to favor Kamala Harris, which prompted a retreat in the US dollar. Investors are now focusing on the release of US inflation data and the ECB meeting. Let’s discuss these topics and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The odds of a Democratic victory have increased.

- Markets expect the Fed to cut the interest rate by 150 bp by the end of January.

- Exaggerated expectations may result in the strengthening of the US dollar.

- The EURUSD’s rally to 1.1065 and 1.109 can be used to sell the pair.

Weekly US dollar fundamental forecast

Some believed that the US presidential election would be advantageous for the US dollar. However, the debate between Donald Trump and Kamala Harris demonstrated that this was unlikely to be the case. Following the debate, the probability of a Democratic victory rose to 56% from 53%, with the Japanese yen and Swiss franc experiencing the greatest increase in value. The EURUSD pair demonstrated a recovery from the 1.1015 support level discussed in the previous analysis.

Despite Donald Trump’s assertions regarding the necessity of weakening the US dollar to enhance the competitiveness of American manufacturers, the Republican Party’s policy stance is protectionist and pro-inflationary. The introduction of new tariffs on imports and the prospect of trade wars will have a detrimental impact on global GDP, which will have a negative effect on pro-cyclical currencies, including the euro. A resumption of rising prices will prompt the Fed to reconsider its current monetary expansion strategy. In light of this, the upward movement of the EURUSD pair following Kamala Harris’ debate victory appears to be a valid assessment.

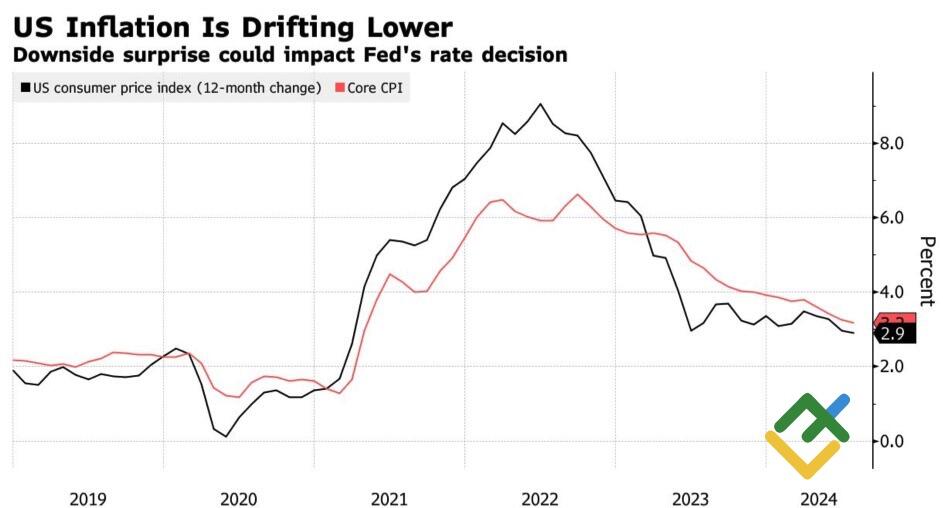

While Donald Trump has criticized Democrats for high inflation, it is important to recognize that external factors, including supply chain disruptions, have contributed to soaring prices. As these factors recede, prices usually begin to stabilize. Bloomberg experts anticipate a deceleration in CPI to 2.6% from 2.9% in August, with core inflation remaining at 3.2%.

US inflation change

Source: Bloomberg.

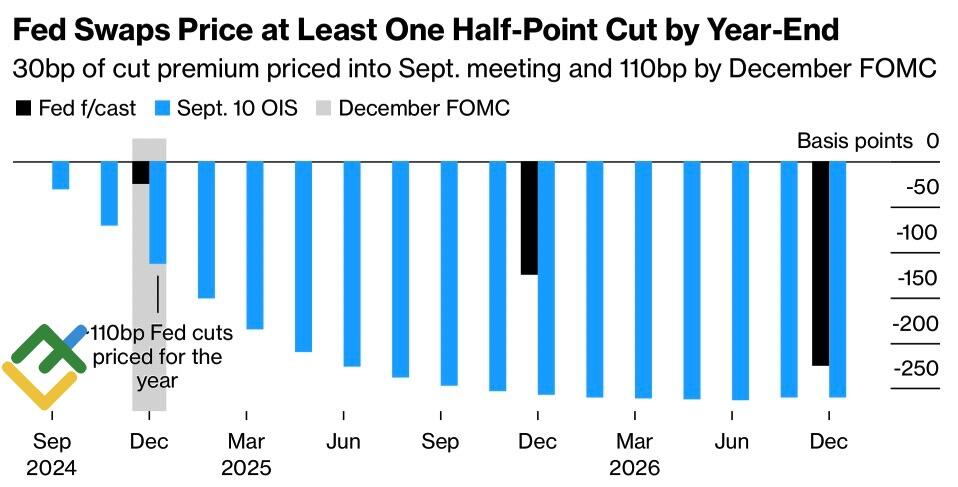

These figures are unlikely to provide insight into the potential scale of the fed funds rate cut in September. However, when viewed alongside US employment statistics, they may indicate the possibility of a 50 bp cut. The futures market anticipates that the magnitude of the monetary expansion between September and January will be 150 basis points. In other words, two of the four FOMC meetings scheduled for that period will result in a 50-basis-point reduction in borrowing costs.

Is this an excessive level of pessimism? This aggressive loosening of monetary policy creates a sense that a recession is imminent. If the Fed proceeds with this course of action, it could potentially trigger a panic in the financial markets. Is this the most prudent course of action for the central bank? It is unclear if such an action is necessary.

US Fed interest rate expectations

Source: Bloomberg.

The US economy is demonstrating resilience in the face of challenges posed by the military conflict in Ukraine and the energy crisis, while the European economy is facing headwinds. According to Morgan Stanley, the ECB has a stronger case for a more aggressive cycle of monetary expansion than the Fed. The bank predicts a 100 bp cut in the deposit rate during three meetings of the European Central Bank, including the September meeting. As a result, the EURUSD pair will collapse to 1.02 by the end of the year. This is significantly lower than the Bloomberg experts’ consensus estimate of 1.11.

Goldman Sachs also anticipates a decline in the major currency pair, as the synchronization of monetary policy easing cycles is typically advantageous for the US dollar.

Weekly EURUSD trading plan

The recent reassessment of the Fed’s intentions has created an opportunity to sell the EURUSD pair on a pullback from the 1.1065 and 1.109 levels.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.