The precious metal has lost support from Asia, as evidenced by the People’s Bank of China’s reluctance to buy it. However, gold will benefit from lower federal funds rate. Let’s discuss these topics and make a trading plan for the XAUUSD.

The article covers the following subjects:

Highlights and key points

- The People’s Bank of China does not buy gold for the fourth consecutive month.

- The XAUUSD’s reaction to US employment data reduces the chances of a pullback.

- Inflation and the US presidential debate may offer insight into gold’s future trajectory.

- One can trade gold on a breakout of the $2,472 – $2,525 range.

Weekly fundamental forecast for gold

Is it possible for the value of gold to plummet? Why did the People’s Bank of China stop buying the asset? These two questions are causing concern in the precious metal market. Gold has demonstrated resilience in the face of recent market challenges such as the data on US employment for August. As investors turn their attention to the presidential debate and inflation statistics in the US, gold is well-positioned to navigate these developments. The price of gold is currently hovering near $2,500 per ounce, with ING forecasting that the XAUUSD rally is just beginning.

China has not purchased gold to replenish its reserves for the fourth consecutive month. The figure remained at 72.8 million ounces in August, while the value increased from $176.6 billion to $183 billion, reflecting an appreciation in the precious metal’s value. The People’s Bank of China established the foundation for an upward trajectory in the XAUUSD during the 18-month span of purchases up until May, but then opted to pause. What is the rationale behind this decision?

SIA Wealth Management anticipates that the People’s Bank of China will eventually cease its current policy of purchasing gold. The central bank has reached its limits. Conversely, Capital Economics asserts that the most favorable conditions are yet to come. Rising global geopolitical tensions, economic uncertainty, and efforts to move away from the US dollar will result in a resurgence of interest in gold in Beijing. However, for that to occur, the XAUUSD price should first undergo a correction.

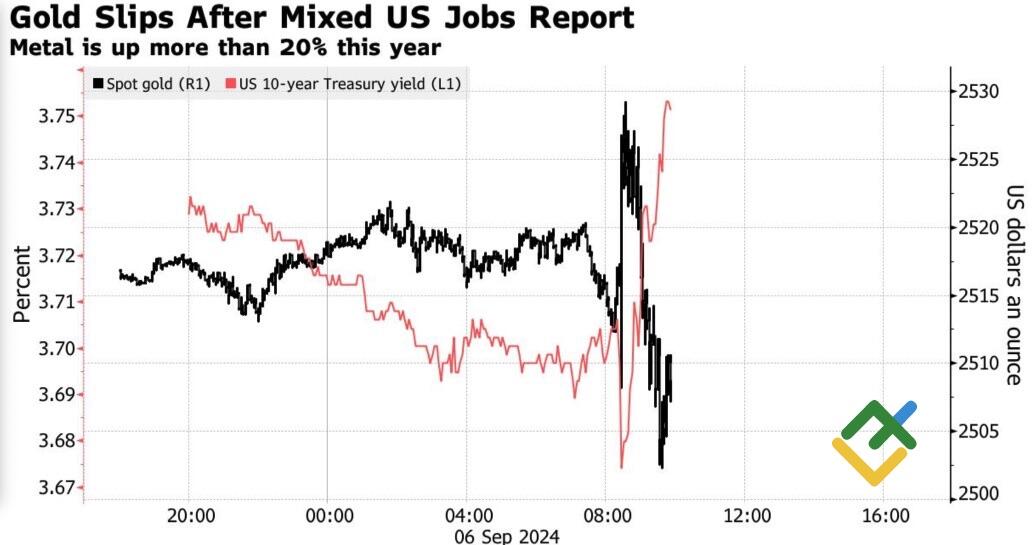

Based on the precious metal’s response to the US labor market data, a pullback may prove challenging to achieve. Disappointing employment data only temporarily boosted gold prices due to the growing likelihood of aggressive monetary policy easing by the Fed in September. However, these odds subsequently declined, pushing the XAUUSD down.

Gold and US Treasury yield reaction to US employment data

Source: Bloomberg.

Gold demonstrates heightened sensitivity to the magnitude of the initial reduction in the federal funds rate and to the extent of the Fed’s anticipated monetary expansion in 2024, as reflected in derivatives market expectations. A reduction in the cost of borrowing will result in a lower opportunity cost of holding bullion. As anticipated, stocks of gold-oriented ETFs have begun to increase following several months of decline.

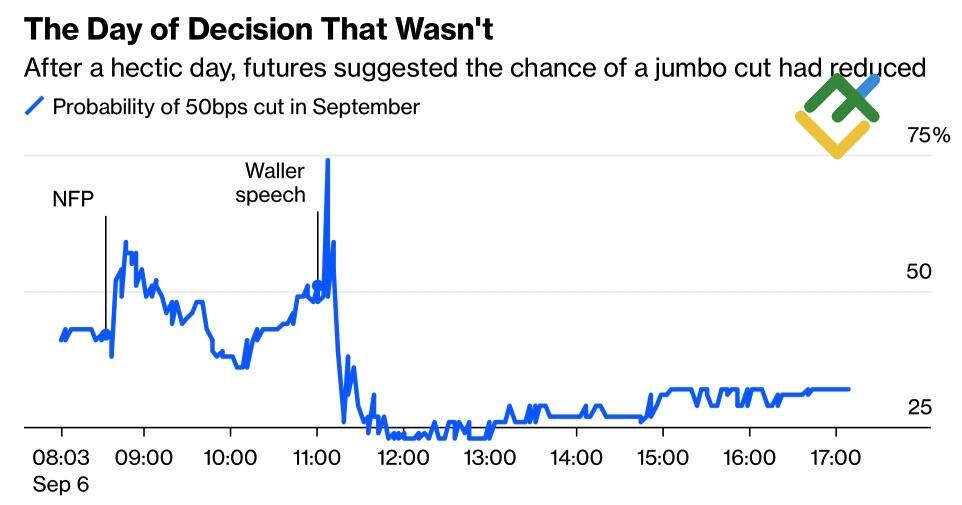

Kinesis expects that if the August inflation rate in the US decelerates by more than 2.6%, as projected by Bloomberg experts, the probability of a 0.5% reduction in the federal funds rate in September will increase significantly, leading to a surge in gold prices to record highs. Nevertheless, even if the final figures align with estimates or exceed them slightly, the precious metal is unlikely to decline. The anticipation of the commencement of the Fed’s monetary policy easing cycle is creating a favorable environment for the XAUUSD.

Probability of 50 bp Fed rate cut in September

Source: Bloomberg.

Weekly trading plan for gold

Meanwhile, one should not ignore the potential impact of the US presidential debates on the gold market, given the possibility of a resurgence in the Trump trade. Currently, the precious metal is consolidating. Thus, one can buy gold once the resistance level of $2,525 per ounce is broken through. A test of the $2,484 and $2,472 support levels may trigger a pullback.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.