The markets are overestimating the pace of the Federal Reserve’s rate cuts and underestimating the extent of the Bank of England’s monetary expansion. The future trajectory of the GBPUSD pair will be determined by fiscal policy in the US and the UK. Let’s discuss these factors and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Restrained fiscal policy could significantly slow inflation in the UK.

- The Bank of England will be forced to shift from a cautious approach to a more decisive one.

- A faster repo rate cut than markets expect will likely weaken the pound.

- The GBPUSD pair risks slipping to 1.3025 and 1.295 against robust US employment data.

Weekly fundamental forecast for pound sterling

The economy is characterized by cyclical patterns. A downturn is typically followed by a recovery, while a period of economic growth is often followed by a recession. In business, as in nature, there is a natural progression from one state to another. In contrast to the US, where economic activity is slowing, the UK economy is blooming, recovering from the pandemic, Brexit, and the scandals associated with the Boris Johnson and Liz Truss governments. As anticipated, GBPUSD quotes have increased by 21% since the fall of 2022. The pound has become the leader among the G10 currencies in 2024.

The appreciation of the British pound against the US dollar is not solely attributable to a narrowing of the divergence in economic growth. The derivatives market participants anticipate that the Bank of England will proceed more cautiously in pursuing monetary expansion than its US counterpart. The market projects a 75-basis-point reduction in the repo rate over the next six months. Over the same period, the federal funds rate risks declining by 125 basis points.

Against a more favorable economic outlook, the political landscape is also improving. The Labour Party’s victory has brought stability to the UK. The Keir Starmer government has embarked on a course of fiscal consolidation and is addressing the budgetary shortfall inherited from the previous administration. However, this may pose challenges for the British currency.

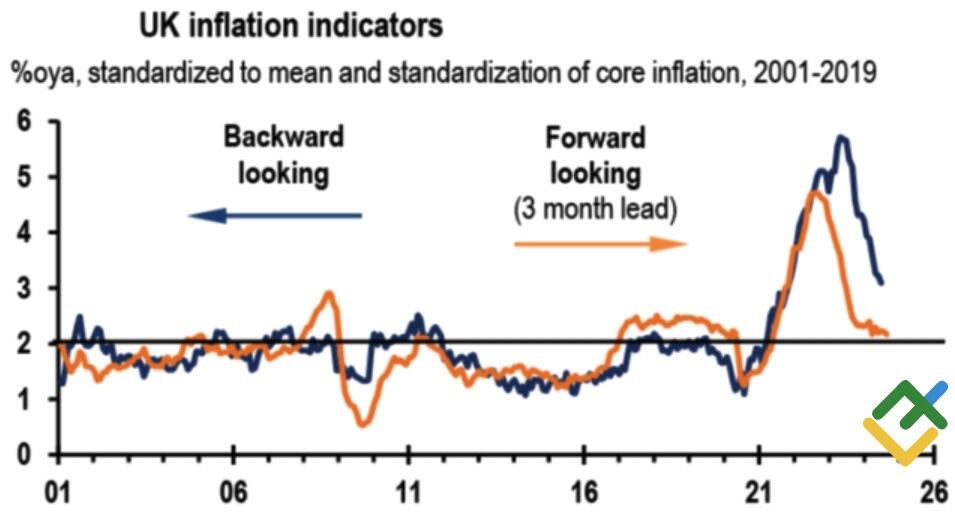

UK inflation change

Source: Financial Times.

According to Oxford Economics, if the Bank of England were to prioritize inflation and wage growth, it would likely reduce the repo rate from 5% to a neutral level of 3.25-3.5% over the next 18-24 months. However, with the government pursuing a restrained fiscal policy, the risks of a return of the era of low prices are high, especially at rates like those in the country.

This suggests that inflation may soon fall below the target, making it challenging to raise it to 2%. In addition, the current level of real debt rates in the UK represents a risk to economic growth. It is possible that the Bank of England may reduce borrowing costs quicker than the markets currently expect. If this occurs, the GBPUSD exchange rate will likely slump dramatically.

Despite the slowing economy, the US maintains a relatively loose fiscal policy, which carries the risk of keeping inflation above the target for an extended period. If the Fed cuts rates as fast as the derivatives market expects, the likelihood of further risk exposure will increase.

Weekly trading plan for GBPUSD

The market is overly optimistic about the Fed’s plans and underestimates the speed of BoE monetary expansion. It is a miscalculation that could result in a significant correction to the GBPUSD‘s uptrend. Short trades opened at 1.316 have brought profits, but the pound recovered thanks to positive British PMI statistics. A strong US labor market report for August will allow traders to open short trades with targets of 1.302 and 1.295.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.