In September, stock indices tend to fall while US Treasury bond yields increase, creating a favorable backdrop for the US dollar. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Historically, September has been a challenging month for US stocks and bonds.

- The seasonal factor offers a favorable outlook for the US dollar.

- ECB officials have differing views on the future of the deposit rate.

- One can sell the EURUSD pair with the target of 1.1.

Weekly US dollar fundamental forecast

The autumn season is already here, bringing us a general sense of decline. However, the seasonal change is not limited to falling foliage from trees. Historically, stocks and bonds have experienced losses in September as investors reassess their portfolios following summer vacations. The S&P 500 index has declined four out of the last four years through the first month of fall, while Treasuries have fallen eight out of the last 10 times. The decline in stock indices and rising US Treasury yields create a perfect environment for EURUSD bears, particularly when the market overestimates the Fed’s monetary expansion scale.

Seasonal global equity market trend

Source: Bloomberg.

In light of these circumstances, the US jobs report for August may prove pivotal in determining the trajectory of the US dollar against other currencies for the remainder of the year. If the statistics are disappointing, investors will maintain their confidence in the Fed’s decision to cut rates by 100 basis points in 2024. This will have a positive impact on stocks, bonds, and the EURUSD exchange rate.

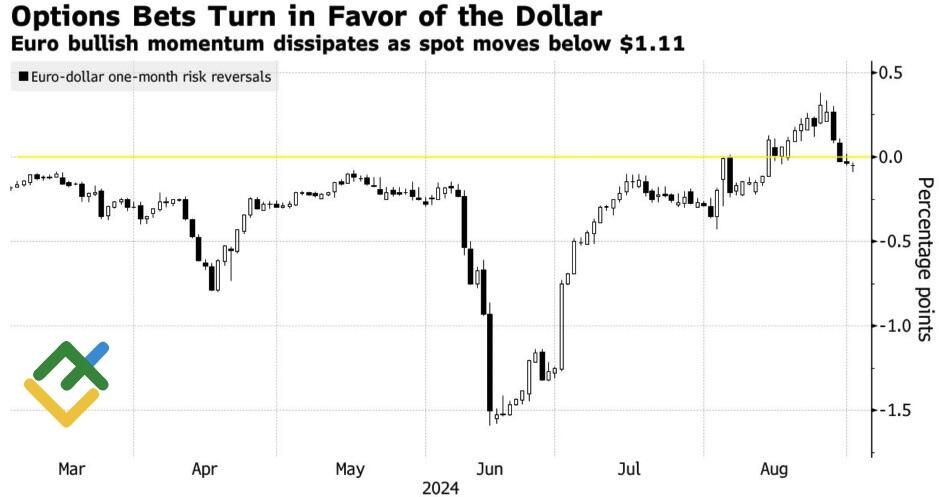

Markets seem to believe more in the second scenario. The fall of the euro risk reversals below zero indicates an increased demand for call options. Against this backdrop, Deutsche Bank recommends selling the EURUSD pair on upward pullbacks.

Euro risk reversals

Source: Bloomberg.

Following Isabel Schnabel’s hawkish rhetoric, the derivatives market reduced the anticipated scope of the ECB’s monetary expansion from 67 bp to 59 bp immediately after the release of German consumer price data. Schnabel stressed that the low inflation figure concealed more significant challenges facing the eurozone economy.

Those with a centrist viewpoint have observed that recent macroeconomic statistics have outperformed expectations, which may suggest that the economy is more robust than anticipated. In this context, there is an increased risk of a resurgence in inflationary pressures. This is particularly the case given the continued strength of wage growth. With regard to the weakness of German industry, this is a fundamental issue that monetary policy is unable to influence.

In contrast, those who favor a more accommodating approach believe that a recession is likely. If the current cycle of monetary expansion is not continued, the eurozone will return to deflation. As the experience of ultra-low rates and QE shows, it is more challenging to beat deflation than higher prices. Both camps agree that monetary policy should be loosened once again in September, but further ECB verdicts will depend on the data.

Weekly EURUSD trading plan

In addition to the meetings of the Federal Reserve and the European Central Bank, investors will be monitoring the US presidential election. The debate between Donald Trump and Kamala Harris is scheduled for September 10th. Meanwhile, the markets are awaiting the release of US employment data. Thus, consider short trades with a target of 1.1 on the EURUSD pair’s upward pullbacks.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.