The BoJ claims that the USDJPY‘s collapse is rooted in the events in North America. In fact, the pair is showing increased sensitivity to the Fed’s monetary policy and changes in US Treasury yield. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Sharp fluctuations in the yen exchange rate harm the Japanese economy.

- Slow BoJ normalization makes the USDJPY dependent on events in the US.

- The release of US labor market data will determine the yen’s future.

- As long as USDJPY is trading above 146.3, one may continue buying the pair.

Weekly fundamental forecast for Japanese yen

The Bank of Japan has stated that an overly rapid USDJPY rally is detrimental to the economy, hindering companies’ ability to forecast and manage currency risks effectively. However, an equally problematic scenario is when the yen appreciates too rapidly. Foreign exchange analysts offer a range of predictions regarding the future value of the US dollar, with some suggesting a potential decline to ¥140 and even ¥135. Such a decline would impact exporters and the more than 9,000 businesses that quoted a rate of ¥144.77 in the latest Bank of Japan survey.

Despite Kazuo Ueda’s assertion that the sharp decline in the USDJPY pair was due to developments in the US, the BoJ’s role in this event was not as significant as he implied. The decision to raise the overnight rate to 0.25% was unexpected and accompanied by a shift towards a more hawkish stance and cuts to QE.

As a result, the BoJ is facing a challenging situation and is attempting to navigate it in a way that benefits the institution. The deputy central bank governors have stated that the overnight rate will not be increased further if market turbulence persists. They have also indicated that monetary policy will continue normalizing if data align with the Policy Board forecasts.

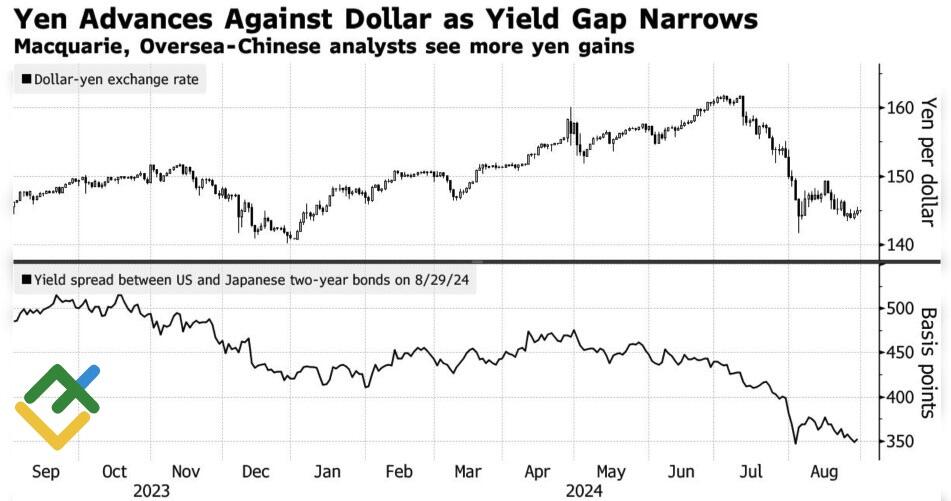

Investors are currently uncertain whether the BoJ will raise rates again this year and are monitoring developments in North America. This is a sound strategy given the yen’s heightened sensitivity to the US Treasury bond market.

USDJPY rate and US-Japan bond yield spread

Source: Bloomberg.

The stabilization of financial markets after Black Monday and the acceleration of Tokyo consumer prices, a leading indicator for national inflation, from 2.2% to 2.4% in August, provide a compelling rationale for the BoJ to maintain its normalization cycle through 2024. Nevertheless, it is unlikely that the central bank will make more than one act in 2024. The slow pace reinforces the USDJPY‘s dependence on US statistics.

Suppose the Fed does not adopt a more aggressive stance than anticipated by the markets and does not cut borrowing costs by 100 basis points. In that case, investors will continue to focus on the significant differential between the central bank rates and will likely buy the USDJPY. Conversely, if the Fed acts in accordance with market expectations, the downtrend will persist, and the bearish forecasts of Macquarie and Standard Chartered Bank will come true. Macquarie anticipates the pair will reach 135 by the end of 2024, while Standard Chartered Bank projects it will decline to 140 and 136 by the end of December and March, respectively.

Weekly USDJPY trading plan

Kazuo Ueda’s assessment of the impact of US events on the yen’s appreciation is arguably accurate. Investors are awaiting August labor market statistics from the US. In the meantime, optimistic forecasts from Bloomberg experts on employment and unemployment are pushing USDJPY quotes higher. As long as the pair is trading above 146.3, long trades can be opened.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.