I welcome my fellow traders! I have made a price forecast for the USCrude, XAUUSD, and EURUSD using a combination of margin zones methodology and technical analysis. Based on the market analysis, I suggest entry signals for intraday traders.

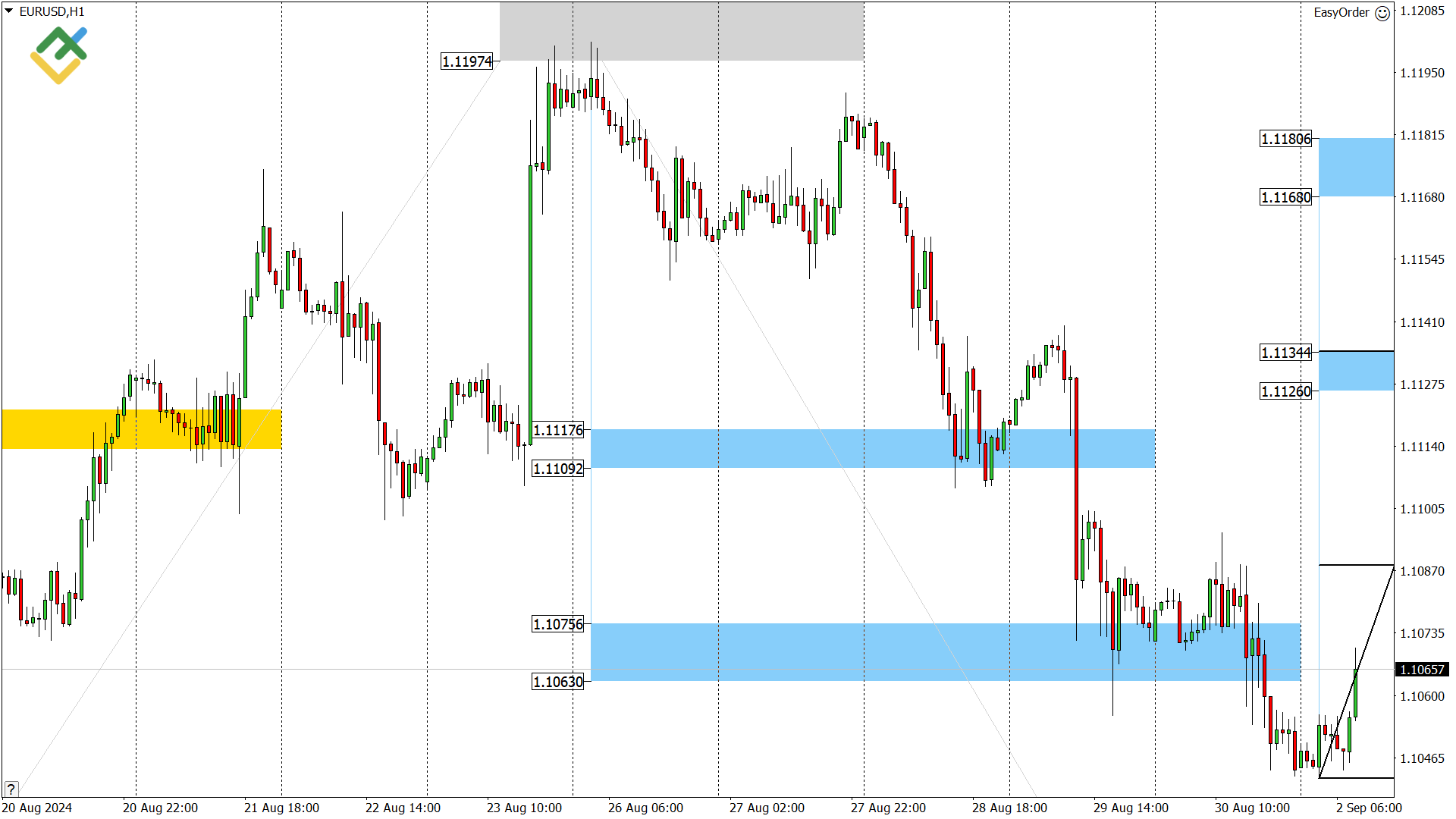

The euro’s short-term uptrend has reversed.

The article covers the following subjects:

Highlights and key points

-

USCrude: oil continues to decline after hitting the short-term downtrend’s key resistance 76.79 – 76.30. The bearish target is at 71.35.

-

XAUUSD: gold is trading in a downward correction within the short-term uptrend. The potential correction target is the support (B) 2452 – 2445.

-

EURUSD: the euro’s short-term uptrend has reversed. Now, the main bearish target is the lower Target Zone 1.0949 – 1.0924.

Oil price forecast for today: USCrude analysis

Oil continues to trade in a short-term downtrend after touching the key resistance 76.79 – 76.30. Last week, the asset hit the first bearish target near 74.07. The second target is the 71.35 level. If the price breaks through and consolidates below this level, the slide may continue to the target in the lower Target Zone 68.85 – 67.86.

The price should breach the 76.79 level to allow traders to open long trades and reverse the trend.

USCrude trading ideas for today:

Hold up sales opened at resistance (B) 76.79 – 76.30. TakeProfit: 71.35. StopLoss: 76.30.

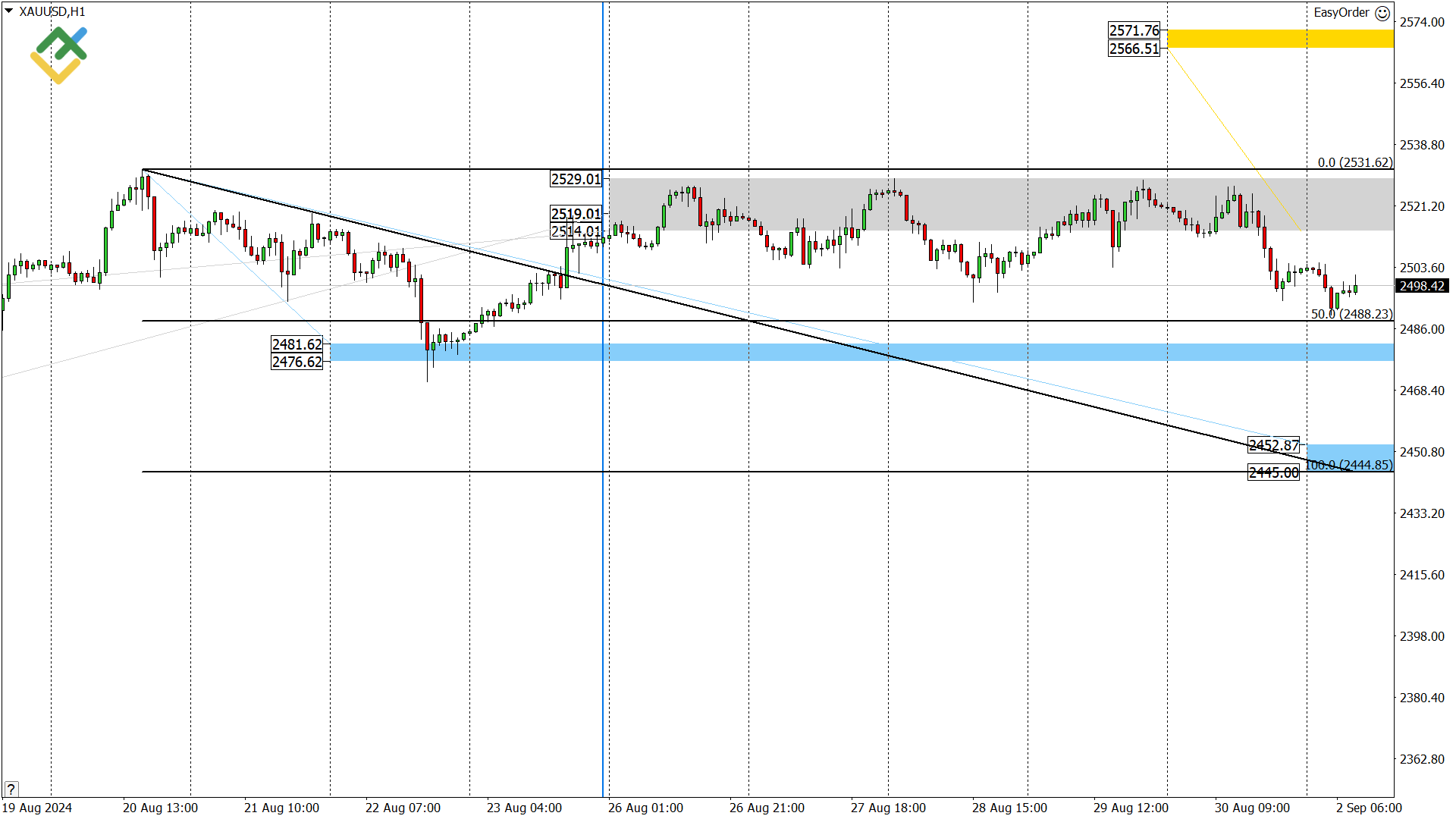

Gold forecast for today: XAUUSD analysis

Gold is developing a correction within the short-term uptrend, approaching the support (A) 2481 – 2476. If the asset remains above this zone, the growth will continue to the target of 2531. In case the price pierces the support (A) from above, the next correction target will be near the support (B) 2452 – 2445.

The support B is the trend’s boundary. Thus, consider long trades once gold tests this zone. The second target will be the August high near 2531.

XAUUSD trading ideas for today:

Buy at support (B) 2456 – 2449. TakeProfit: 2488, 2531. StopLoss: 2428.

Euro/Dollar forecast for today: EURUSD analysis

On Friday, the euro‘s short-term uptrend reversed, and the asset breached the key support 1.1057 – 1.1063. Therefore, the bearish target now is the lower Target Zone 1.0949 – 1.0924.

The price is trading in an upward correction. If the correction continues, the quotes may reach the resistance (A) 1.1134 – 1.1126. After testing the resistance, one may consider short trades with the main target at today’s low. The trend’s boundary is the 1.1180 – 1.1168 level.

EURUSD trading ideas for today:

Sell at resistance (A) 1.1134 – 1.1126. TakeProfit: 1.1088, 1.1042. StopLoss: 1.1151.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you” 🙂

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.